5G Optical Transceiver Market Size to Worth USD 25.27 Bn by 2033

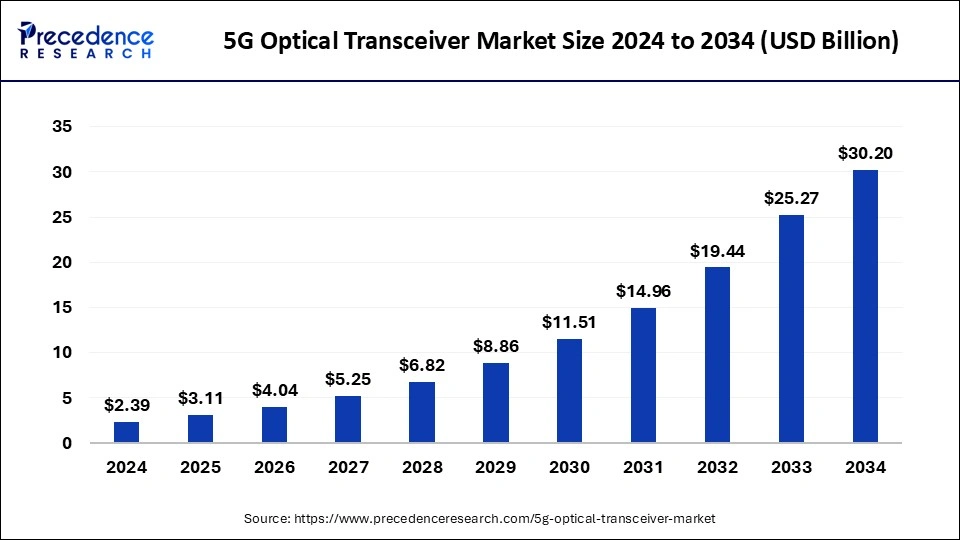

The global 5G optical transceiver market size is expected to increase USD 25.27 billion by 2033 from USD 1.84 billion in 2023 with a CAGR of 29.95% between 2024 and 2033.

Key Points

- The North America 5G optical transceiver market size reached USD 660 million in 2023 and is expected to attain around USD 9.22 million by 2033, poised to grow at a CAGR of 30.17% between 2024 and 2033.

- North America has held a largest revenue share of 36% in 2023.

- Asia Pacific is anticipated to showcase significant growth with the highest CAGR in the market in the upcoming period.

- By type, the 25G transceivers segment has contributed more than 32% of revenue share in 2023.

- By type, the 400G transceivers segment is expected to grow significantly in the market over the forecast period.

- By form factor, the SFP56 form factor segment has recorded the highest revenue share of 30% in 2023.

- By form factor, the QSFP28 segment is anticipated to grow significantly during the forecast period in the market.

- By wavelength, the 1310 nm band segment has generated more than 45% of revenue share in 2023.

- By wavelength, the 850 nm band segment is estimated to grow significantly over the forecast period.

- By 5G infrastructure, the 5G fronthaul segment dominated the market with a major revenue share of 74% in 2023.

- By 5G infrastructure, the 5G midhaul/backhaul segment is projected to show substantial growth in the market during the projected period.

The 5G optical transceiver market is experiencing rapid growth driven by the increasing demand for high-speed and reliable communication networks. Optical transceivers play a critical role in 5G infrastructure by enabling high-capacity data transmission over optical fibers. These devices are essential for converting electrical signals into optical signals and vice versa, facilitating seamless data transfer across networks.

Get a Sample: https://www.precedenceresearch.com/sample/4551

Growth Factors

Several factors contribute to the growth of the 5G optical transceiver market. Key drivers include the surge in mobile data traffic, advancements in network infrastructure for higher bandwidth capabilities, and the proliferation of Internet of Things (IoT) devices requiring robust connectivity. Additionally, the transition towards 5G technology worldwide is fueling the demand for optical transceivers capable of supporting higher data rates and low latency.

Regional Insights

The market for 5G optical transceivers is globally distributed, with significant growth observed across regions. North America and Asia Pacific lead in adoption, driven by extensive investments in 5G infrastructure by telecom operators and government initiatives promoting digital transformation. Europe follows closely, leveraging optical transceivers to enhance broadband connectivity and support industrial automation applications.

Trends in the Market

Current trends in the 5G optical transceiver market include the development of compact and power-efficient transceiver modules to meet the space and energy constraints of 5G network deployments. Innovations in coherent optical communication technologies and the integration of artificial intelligence for network optimization are also shaping the market landscape.

5G Optical Transceiver Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 25.27 Billion |

| Market Size in 2023 | USD 1.84 Billion |

| Market Size in 2024 | USD 2.39 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 29.95% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Form Factor, Wavelength, Distance, 5G Infrastructure, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

5G Optical Transceiver Market Dynamics

Drivers of Market Growth

The primary drivers propelling the 5G optical transceiver market forward include the increasing demand for ultra-fast and reliable connectivity, driven by applications such as video streaming, cloud computing, and virtual reality. Moreover, the need for improved network capacity and coverage in urban and rural areas is boosting investments in advanced optical transceiver solutions.

Opportunities and Challenges

Opportunities in the 5G optical transceiver market abound in emerging economies where infrastructure modernization and expansion projects are accelerating. Collaborations between telecom companies and technology providers are creating avenues for innovation in transceiver design and functionality. However, challenges such as high initial deployment costs, spectrum allocation issues, and regulatory complexities pose potential hurdles to market growth, necessitating strategic planning and industry collaboration.

Read Also: Smart Home Appliances Market Size to Worth USD 75.20 Bn by 2033

5G Optical Transceiver Market Companies

- II-VI Coherent Corp.

- INNOLIGHT

- HiSilicon Optoelectronics Co., Ltd.

- Cisco Acacia Communications, Inc.

- Hisense Broadband, Inc.

- Broadcom.

- Source Photonics

- Juniper Networks, Inc.

- Eoptolink Technology Inc.

- Molex, LLC

- Accelink Technology Co. Ltd

- Fujitsu Optical Components Limited

Recent Developments

- In March 2024, Nokia is introducing a new line of optical transport solutions specifically designed for metro edge deployments, catering to Communication Service Providers (CSPs), webscale companies, and Enterprise customers.

- In March 2022, Lumentum, a global optical transceiver company headquartered in the U.S., established a strategic collaboration agreement with Ayar Labs Inc. The collaboration aimed to deliver high-volume continuous-wave wavelength division multiplexing multi-source agreement (CW-WDM MSA)-compliant external laser sources.

- In October 2023, Aker Solutions and Subsea7 reported the completion of their joint venture, officially closing the deal. The newly formed entity is operating under the name OneSubsea and intends to revolutionize subsea production by fostering innovation and enhancing efficiency

Segments Covered in the Report

By Type

- 25G Transceivers

- 50G Transceivers

- 100G Transceivers

- 200G Transceivers

- 400G Transceivers

By Form Factor

- SFP28

- SFP56

- QSFP28

- Others (QSFP56, CFP2, CFP8)

By Wavelength

- 850 nm Band

- 1310 nm Band

- Others (CWDM, DWDM, LWDM, 1270nm, 1330 nm)

By Distance

- 1 to 10 Km

- 10 to 100 Km

- More than 100 Km

By 5G Infrastructure

- 5G Fronthaul

- 5G Midhaul/Backhaul

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/