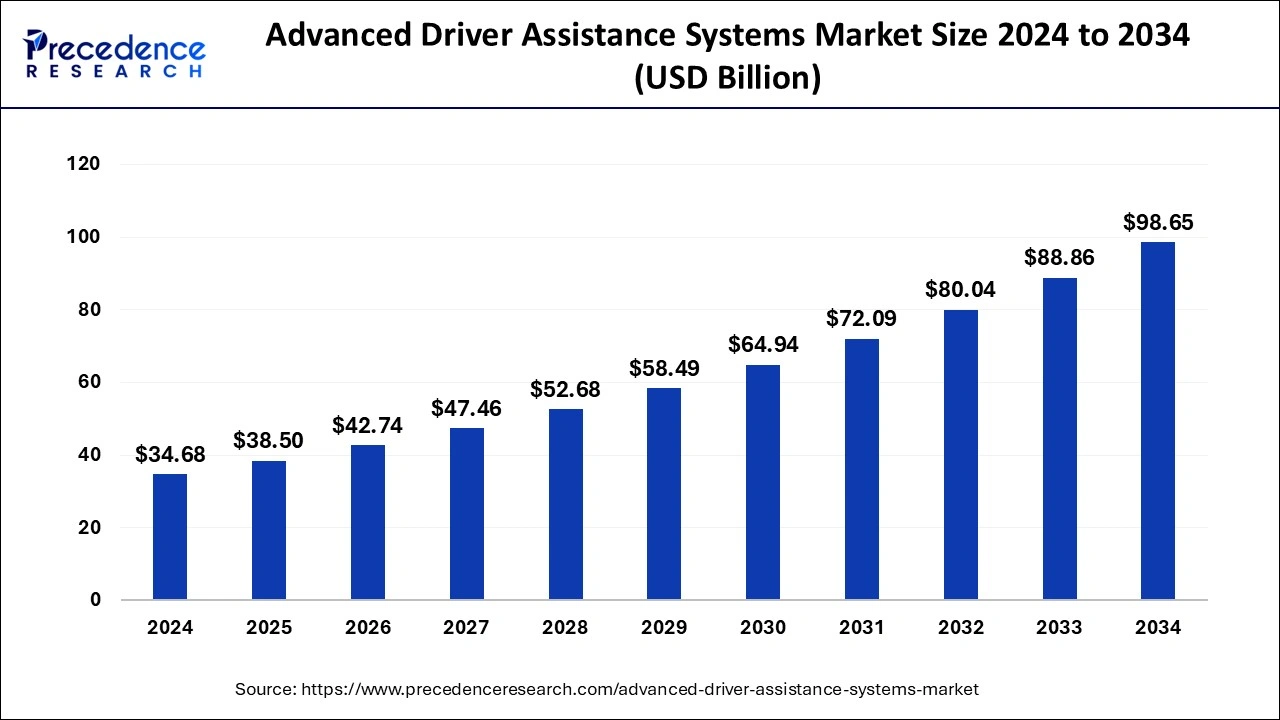

ADAS Market to Reach USD 98.65 Billion by 2034.

Advanced Driver Assistance Systems (ADAS) Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 38.50 Billion |

| Market Size in 2034 | USD 98.65 Billion |

| Growth Rate | CAGR of 11.02% from 2025 to 2034 |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | System Type, Vehicle Type, Sensor Type, Electric Vehicle, Level of Autonomy, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

The ADAS market is driven by several key factors, including the increasing demand for enhanced vehicle safety and convenience features. As traffic-related accidents and fatalities continue to raise concerns, both consumers and governments are pushing for advanced safety solutions in vehicles. Government regulations, such as mandatory safety features in vehicles, are also playing a significant role in driving the adoption of ADAS technologies. Additionally, advancements in sensor technologies, including lidar and cameras, as well as software innovations, are improving the capabilities of ADAS systems, making them more accessible and effective. The growing trend of electrification and the rise of autonomous vehicles are further contributing to the market’s expansion, as these technologies require advanced driver assistance features to function safely. Increased consumer awareness and demand for better driving experiences are also accelerating the integration of ADAS in both commercial and passenger.

Opportunities

- Growing demand for autonomous vehicles driving ADAS adoption.

- Integration of ADAS technologies in electric vehicles as part of sustainability goals.

- Increasing consumer preference for enhanced safety features in vehicles.

- Technological advancements in lidar, radar, and camera systems improving ADAS capabilities.

- Expansion of ADAS into emerging markets with rising vehicle ownership.

- Partnerships between automakers and tech companies to enhance ADAS features

Challenges

- High cost of advanced ADAS components, limiting affordability for some consumers.

- Integration complexity with existing vehicle infrastructure.

- Data security and privacy concerns related to ADAS data collection.

- Regulatory challenges across different regions regarding ADAS standards.

- Limited consumer awareness and understanding of ADAS capabilities.

- Dependence on high-quality sensor data, which can be affected by environmental factors like weather.

Regional Insights

The ADAS market is experiencing varied growth across different regions. North America holds a significant share of the market due to the high demand for vehicle safety features, regulatory mandates for advanced safety systems, and the increasing adoption of autonomous vehicle technology. Europe is also a key player, driven by stringent safety regulations, as well as growing interest in electric vehicles and autonomous driving technologies, which often come equipped with ADAS features.

In the Asia Pacific region, countries like China, Japan, and South Korea are seeing rapid growth in ADAS adoption due to the rising demand for advanced automotive technologies, increasing vehicle production, and government initiatives to enhance road safety. The growing middle class and urbanization in emerging markets are contributing to a rise in vehicle sales, further boosting the demand for ADAS in regions like Latin America and the Middle East. While the market is still developing in Africa, there is potential for growth as vehicle ownership increases and safety standards improve.

Read Also: Electric Vehicle Charging as a Service Market Size Analysis 2022 To 2030

Market Companies

- Nidec Corporation

- Hella

- Texas Instruments

- Infineon Technologies AG

- Hitachi Automotive

- Renesas Electronics Corporation

Recent Developments

Recent developments in the ADAS market highlight significant advancements in both technology and adoption. Major automakers are increasingly integrating ADAS features into their vehicle models, with some automakers offering these technologies as standard rather than optional. In terms of technological advancements, lidar, radar, and camera systems are becoming more sophisticated, improving the accuracy and reliability of ADAS features. The software component is evolving as well, with companies focusing on enhancing the capabilities of ADAS systems through artificial intelligence and machine learning for better decision-making and situational awareness.

Furthermore, partnerships between automakers and tech companies are on the rise, leading to the development of cutting-edge ADAS solutions. Additionally, the market is seeing growth in the autonomous emergency braking segment, with many manufacturers enhancing this feature as part of their commitment to improving vehicle safety. Government regulations are also evolving to require advanced safety systems in new vehicles, further accelerating the adoption of ADAS globally. The push toward electric vehicles is also creating synergies with ADAS, as these vehicles often come equipped with a variety of automated features.