AI in Fraud Management Market Size to Worth USD 57.32 Bn by 2033

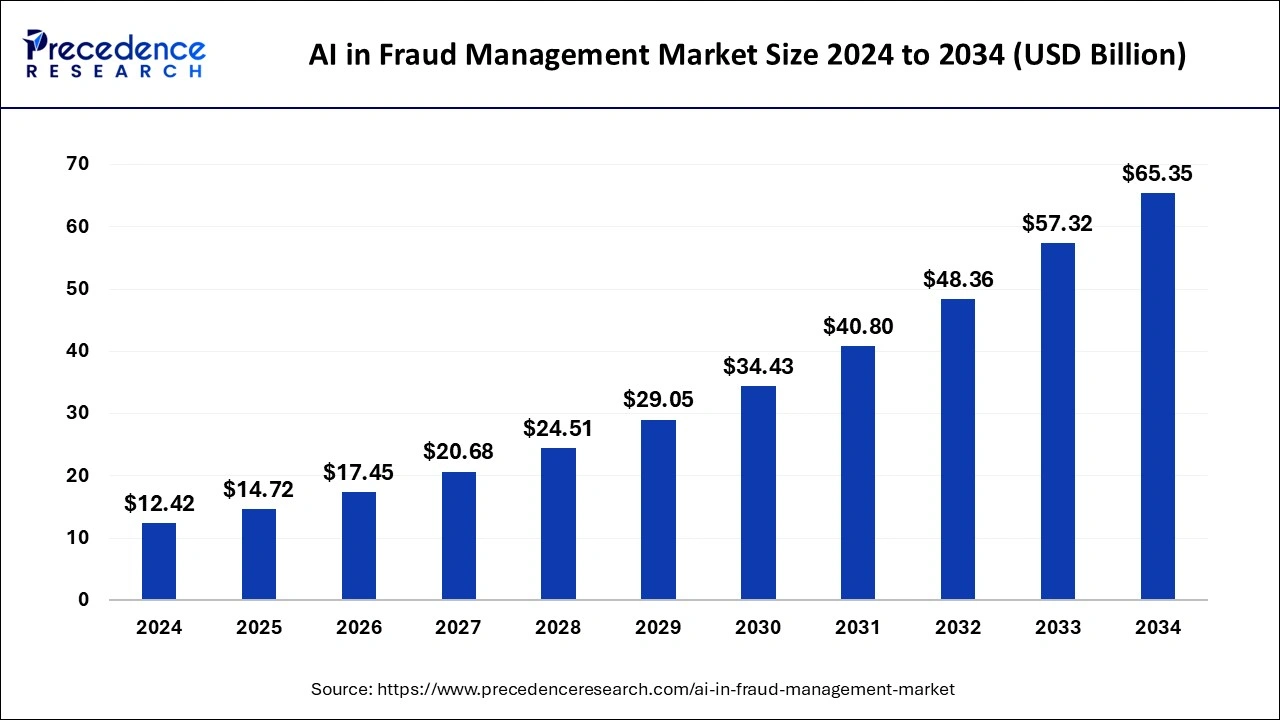

The global AI in fraud management market size is expected to increase USD 57.32 billion by 2033 from USD 10.48 billion in 2023 with a CAGR of 18.52% between 2024 and 2033.

AI in Fraud Management Market Key Points

- The North America AI in fraud management market size reached USD 3.56 billion in 2023 and is expected to attain around USD 19.78 billion by 2033, poised to grow at a CAGR of 18.70% between 2024 and 2033.

- North America led the global AI in fraud management market with the largest revenue share of 34% in 2023.

- Asia Pacific is expected to witness the fastest growth in the market during the forecast period.

- By solution, the AI-powered fraud prevention software segment has held a major revenue share of 75% in 2023.

- By application, the identity theft protection segment was estimated to account for the highest share of the market in 2023.

- By enterprises, the large enterprises segment has contributed more than 65% in 2023.

- By industry, the BFSI segment has recorded more than 27% of revenue share in 2023.

The AI in Fraud Management Market is experiencing rapid growth due to the increasing sophistication of fraud techniques and the need for advanced technologies to combat these threats. Artificial Intelligence (AI) in fraud management involves the use of machine learning, deep learning, natural language processing, and other AI technologies to detect and prevent fraudulent activities in real-time. The market encompasses various applications, including banking, insurance, e-commerce, government, and other sectors that are prone to fraud.

AI-based fraud management solutions offer significant advantages over traditional methods by providing real-time analysis, high accuracy, and the ability to handle large volumes of transactions. These solutions can identify patterns and anomalies that may indicate fraudulent activities, thereby enabling organizations to take proactive measures to mitigate risks. The increasing digitalization of services, rise in online transactions, and the proliferation of digital payment methods have further fueled the demand for AI in fraud management solutions.

Get a Sample: https://www.precedenceresearch.com/sample/4584

Growth Factors

- Increasing Digital Transactions: The surge in digital transactions, particularly in the banking and e-commerce sectors, has led to a corresponding increase in fraud attempts. AI-powered fraud management solutions are essential for monitoring and analyzing these transactions to detect and prevent fraudulent activities in real-time.

- Advancements in AI and Machine Learning: Continuous advancements in AI and machine learning technologies have significantly enhanced the capabilities of fraud detection and prevention systems. These technologies enable the development of more sophisticated algorithms that can accurately identify fraudulent patterns and adapt to evolving fraud tactics.

- Regulatory Compliance: Stringent regulatory requirements for fraud detection and prevention across various industries, particularly in banking and finance, are driving the adoption of AI-based fraud management solutions. Compliance with regulations such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS) necessitates robust fraud management systems.

- Cost Efficiency: AI-powered fraud management solutions can significantly reduce the costs associated with manual fraud detection and investigation processes. By automating these tasks, organizations can allocate resources more efficiently and improve overall operational efficiency.

- Rising Cybersecurity Threats: The increasing prevalence of cyber threats and sophisticated hacking techniques necessitates advanced fraud management solutions. AI-driven systems can provide enhanced security by continuously monitoring for suspicious activities and responding swiftly to potential threats.

Region Insights

North America is expected to dominate the AI in Fraud Management Market due to the presence of major technology companies and a high adoption rate of advanced technologies. The region’s robust financial infrastructure and stringent regulatory landscape also contribute to the growth of the market. Additionally, the increasing number of cyber-attacks and data breaches in the region drives the demand for AI-based fraud management solutions.

Europe is another significant market for AI in fraud management, driven by the region’s strong regulatory framework and high adoption of digital banking services. Countries such as the United Kingdom, Germany, and France are leading in the implementation of AI-based fraud detection systems. The General Data Protection Regulation (GDPR) has also played a crucial role in promoting the adoption of advanced fraud management technologies in the region.

The Asia-Pacific region is witnessing rapid growth in the AI in Fraud Management Market, primarily due to the increasing digitalization of services and the rising number of online transactions. Countries like China, India, and Japan are at the forefront of adopting AI technologies for fraud detection and prevention. The growing e-commerce sector and the proliferation of mobile payment systems are key drivers of market growth in this region.

AI in Fraud Management Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 57.32 Billion |

| Market Size in 2023 | USD 10.48 Billion |

| Market Size in 2024 | USD 12.42 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 18.52% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Solution, Application, Enterprises, Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

AI in Fraud Management Market Dynamics

Drivers

Real-time Fraud Detection: One of the primary drivers of the AI in Fraud Management Market is the need for real-time fraud detection. Traditional fraud detection methods are often reactive and unable to keep up with the fast-paced nature of modern transactions. AI-powered solutions can analyze vast amounts of data in real-time, identifying fraudulent activities as they occur and enabling organizations to take immediate action.

Data-Driven Insights: AI in fraud management leverages data-driven insights to identify patterns and anomalies that may indicate fraudulent behavior. Machine learning algorithms can process and analyze large datasets to uncover hidden patterns and trends, providing organizations with valuable insights for fraud prevention.

Improved Accuracy: AI-based fraud management solutions offer higher accuracy compared to traditional methods. These systems can continuously learn and adapt to new fraud tactics, improving their ability to detect and prevent fraud over time. This increased accuracy reduces the number of false positives and ensures that genuine transactions are not unnecessarily flagged.

Opportunities

Integration with Blockchain Technology: The integration of AI in fraud management with blockchain technology presents significant opportunities for enhancing security and transparency. Blockchain’s decentralized and immutable nature makes it highly resistant to fraud, and combining it with AI can provide a robust and tamper-proof fraud detection system.

Expansion in Emerging Markets: Emerging markets present a vast opportunity for the AI in Fraud Management Market. As these regions continue to undergo digital transformation and experience a rise in online transactions, the demand for advanced fraud detection solutions is expected to grow. Companies can tap into these markets by offering tailored solutions that address the unique challenges and requirements of these regions.

Development of Advanced Algorithms: The continuous development of advanced AI algorithms offers significant opportunities for improving fraud detection and prevention capabilities. Researchers and developers are constantly working on enhancing machine learning models and algorithms to stay ahead of evolving fraud tactics. Investing in research and development can lead to the creation of more sophisticated and effective fraud management solutions.

Challenges

Data Privacy and Security: One of the significant challenges in the AI in Fraud Management Market is ensuring data privacy and security. AI systems require access to large volumes of sensitive data to effectively detect and prevent fraud. However, the handling and storage of this data must comply with stringent privacy regulations, such as GDPR. Organizations need to implement robust security measures to protect customer data and prevent unauthorized access.

Complexity of AI Algorithms: The complexity of AI algorithms can pose challenges in terms of implementation and understanding. Organizations need skilled professionals who can develop, deploy, and maintain AI-based fraud management systems. Additionally, ensuring that these algorithms are transparent and explainable is crucial for building trust and gaining regulatory approval.

Evolving Fraud Tactics: Fraudsters are continuously evolving their tactics to bypass detection systems. AI in fraud management must keep pace with these evolving threats and adapt to new fraud patterns. This requires continuous monitoring, updating, and refining of AI models to stay ahead of fraudsters.

Read Also: Laparoscopic Retrieval Bags Market Size, Share, Report by 2033

AI in Fraud Management Market Companies

- IBM Corporation

- Cognizant

- Temenos AG

- Capgemini SE

- Subex Limited

- JuicyScore

- Hewlett Packard Enterprise

- Maxmind, Inc.

- BAE Systems plc

- Pelican

- SAS Institute, Inc.

- Splunck Inc.

- DataVisor, Inc.

- Matellio, Inc.

- ACTICO Gmbh.

Recent Developments

- In May 2024, Swift announced the introduction of AI-based experiments by partnering with member banks to explore how technology can analyze and fight against cross-border payment fraud and save billions in fraud-related costs.

- In June 2024, CLARA Analytics, a major player in the artificial intelligence (AI) technology for insurance claim optimization, launched the innovatory latest fraud detection product that uses the company’s AI platform and large workers’ compensation datasets to enhance visibility into defective or suspicious claims.

- In May 2024, Mangopay, a flexible and modular payment provider for the platform, launched its new Fraud Prevention solution. The launch possesses integrated and payment processor-agnostic AI-driven cybersecurity solutions for securing against a wide range of threats such as reseller fraud, account takeover by both bots and humans, chargebacks, payment fraud, and return abuse.

Segments Covered in the Report

By Solution

- AI-powered Fraud Prevention Software

- Cloud-bases

- On-premise

- Services

- Risk Assessment Services

- Fraud And Risk Consulting

- Integration & Implementation

- Support & Maintenance

- Managed Services

By Application

- Identity Theft Protection

- Payment Fraud Prevention

- Anti-Money Laundering

- Others

By Enterprises

- Large Enterprises

- Small and Medium Enterprises

By Industry

- BFSI

- IT and Telecom

- Healthcare

- Government

- Education

- Retail and CPG

- Media and Entertainment

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/