Aircraft Health Monitoring System Market Size, Trends, Report by 2033

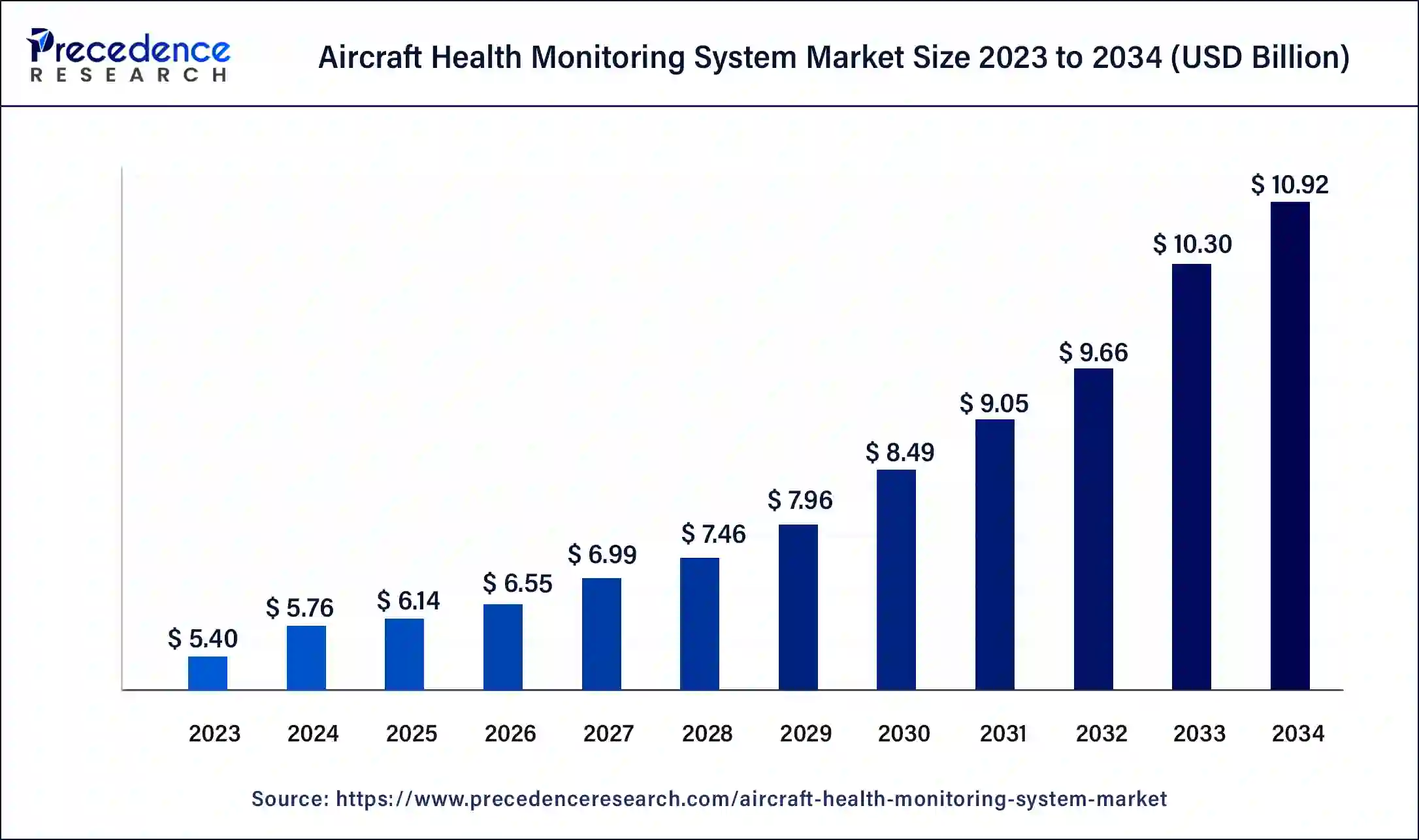

The global aircraft health monitoring system market size surpassed USD 5.40 billion in 2023 and is expected to worth be around USD 10.30 billion by 2033, growing at a CAGR of 6.67% from 2024 to 2033.

Key Points

- North America is expected to lead the global aircraft health monitoring system market in 2023 with revenue share of 34%.

- Asia Pacific is witnessing notable growth during the forecast period 2024 to 2033.

- By Fit, the line fit segment has captured highest revenue share of around 85% in 2023.

- By system, the software segment has dominated the market in 2023 with revenue share of 51% in 2023.

- By platform, the narrow body aircraft segment has dominated the market in 2023 with revenue share of 33.8%.

The Aircraft Health Monitoring System (AHMS) market plays a critical role in enhancing the safety, efficiency, and reliability of aircraft operations. AHMS encompasses a range of technologies and solutions designed to monitor, analyze, and manage the health and performance of aircraft systems in real-time. With the increasing focus on predictive maintenance, condition-based monitoring, and data-driven decision-making in the aviation industry, the AHMS market is experiencing significant growth worldwide.

Get a Sample: https://www.precedenceresearch.com/sample/4060

Growth Factors

Several factors are driving the growth of the Aircraft Health Monitoring System market. Firstly, the increasing adoption of AHMS by airlines, maintenance, repair, and overhaul (MRO) providers, and aircraft manufacturers is driven by the need to improve operational efficiency, reduce maintenance costs, and enhance safety. AHMS enables proactive maintenance, allowing operators to detect potential issues before they escalate into critical failures, thereby minimizing downtime and disruptions.

Furthermore, advancements in sensor technology, data analytics, and connectivity solutions are expanding the capabilities of AHMS, enabling more comprehensive monitoring of aircraft systems and components. The integration of artificial intelligence (AI) and machine learning algorithms enhances predictive capabilities, enabling AHMS to identify patterns, anomalies, and trends in aircraft data to predict failures and optimize maintenance schedules.

Region Insights:

The Aircraft Health Monitoring System market exhibits regional variations influenced by factors such as regulatory frameworks, market maturity, fleet size, and technological adoption.

In North America, the United States dominates the AHMS market, driven by the presence of major aircraft manufacturers, airlines, and technology providers. The region’s emphasis on safety, regulatory compliance, and operational efficiency fuels the demand for AHMS solutions across commercial, military, and business aviation sectors.

In Europe, countries like the United Kingdom, France, and Germany are leading adopters of AHMS technologies, supported by the region’s strong aerospace industry, regulatory standards, and focus on innovation. European airlines and MRO providers prioritize AHMS to optimize maintenance practices, enhance fleet reliability, and comply with stringent safety regulations.

In Asia-Pacific, emerging economies such as China, India, and Southeast Asian countries are witnessing rapid growth in aviation demand, driving the adoption of AHMS solutions to support fleet expansion, improve operational efficiency, and ensure airworthiness. Government initiatives, investments in infrastructure, and partnerships with international aerospace companies contribute to the growth of the AHMS market in the region.

Aircraft Health Monitoring System Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.67% |

| Global Market Size in 2023 | USD 5.40 Billion |

| Global Market Size in 2024 | USD 5.76 Billion |

| Global Market Size by 2033 | USD 10.30 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Platform, By Fit, By System, and By Operation |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Aircraft Health Monitoring System Market Dynamics

Drivers:

Several drivers propel the growth of the Aircraft Health Monitoring System market. Firstly, the increasing emphasis on aviation safety and regulatory compliance mandates the implementation of advanced monitoring and diagnostic systems to ensure the airworthiness of aircraft fleets. AHMS enables operators to comply with regulatory requirements, minimize safety risks, and maintain high levels of operational integrity.

Moreover, the growing complexity of modern aircraft systems, including advanced avionics, propulsion systems, and onboard electronics, necessitates sophisticated monitoring solutions to manage performance, detect faults, and optimize maintenance activities. AHMS provides operators with real-time insights into the health and status of critical components, enabling timely maintenance actions to prevent unplanned downtime and improve asset utilization.

Furthermore, the shift towards predictive maintenance and condition-based monitoring strategies drives the adoption of AHMS solutions, as operators seek to transition from traditional, calendar-based maintenance practices to data-driven, predictive approaches. AHMS facilitates proactive maintenance interventions based on actual system health and performance data, reducing maintenance costs, and maximizing asset availability.

Opportunities:

The Aircraft Health Monitoring System market presents numerous opportunities for technology providers, aerospace companies, and service providers to capitalize on emerging trends and market demand. Firstly, advancements in sensor technology, wireless connectivity, and data analytics offer opportunities to develop innovative AHMS solutions with enhanced capabilities for remote monitoring, predictive analytics, and prognostics.

Moreover, the expansion of the global aircraft fleet, particularly in emerging markets, creates a growing demand for AHMS solutions to support fleet management, maintenance optimization, and operational efficiency. Airlines, MRO providers, and aircraft OEMs can leverage AHMS to differentiate their offerings, improve customer satisfaction, and gain a competitive edge in the market.

Furthermore, collaborations and partnerships between industry stakeholders, including airlines, OEMs, technology providers, and regulatory agencies, can drive innovation and accelerate the adoption of AHMS solutions. By sharing data, best practices, and expertise, stakeholders can collectively address industry challenges, drive standardization, and promote the widespread adoption of AHMS across the aviation ecosystem.

Challenges:

Despite the opportunities presented by the Aircraft Health Monitoring System market, several challenges must be addressed to realize its full potential. Firstly, interoperability and data integration remain key challenges, as AHMS solutions need to interface with diverse aircraft systems, data sources, and legacy infrastructure. Ensuring seamless data exchange, compatibility, and cybersecurity is essential to maximize the effectiveness of AHMS deployments.

Moreover, the high upfront costs associated with AHMS implementation, including sensor installation, data infrastructure, and software integration, can pose barriers to adoption for some operators, particularly smaller airlines and MRO providers. Addressing cost concerns, demonstrating return on investment, and offering flexible pricing models can help overcome resistance to AHMS adoption and drive market growth.

Furthermore, data privacy and security concerns present challenges for AHMS providers and users, particularly regarding the collection, storage, and sharing of sensitive aircraft data. Compliance with data protection regulations, cybersecurity standards, and industry best practices is essential to build trust and ensure the integrity and confidentiality of aircraft health data.

Read Also: Space Technology Market Size to Surpass USD 916.85 Bn by 2033

Recent Developments

- In June 2023, GE Engine Services LLC (General Electric Company) was selected by Korea Aerospace Industries (KAI) to supply health and usage monitoring systems (HUMS).

- In July 2022, Curtiss-Wright Corporation was awarded a contract by Airbus to provide custom actuation technology. This technology offers improved reliability over legacy systems and incorporates health monitoring functions.

- In April 2022, Lufthansa Technik announced that it had recently enhanced its AVIATAR digital platform with various new digital fleet management applications for the Boeing 737 NG (Next Generation), which are now available to 737 operators around the world.

- In March 2022, Indigo announced that it had become the 55th airline to adopt Skywise Health Monitoring (SHM) as its future fleet performance tool.

Aircraft Health Monitoring System Market Companies

- Airbus SE

- Curtiss-Wright Corporation

- FLYHT Aerospace Solutions Ltd.

- GE Engine Services LLC (General Electric Company)

- Honeywell Aerospace

- Meggitt Plc

- Rolls-Royce Plc

- Safran

- SITA N.V.

- The Boeing Company

Segments Covered in the Report

By Platform

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Aircraft

- Business Jet

- Helicopter

- Fighter Jet

By Fit

- Line Fit

- Retrofit

By System

- Hardware

- Software

- Services

By Operation

- Real-time

- Non-real-time

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/