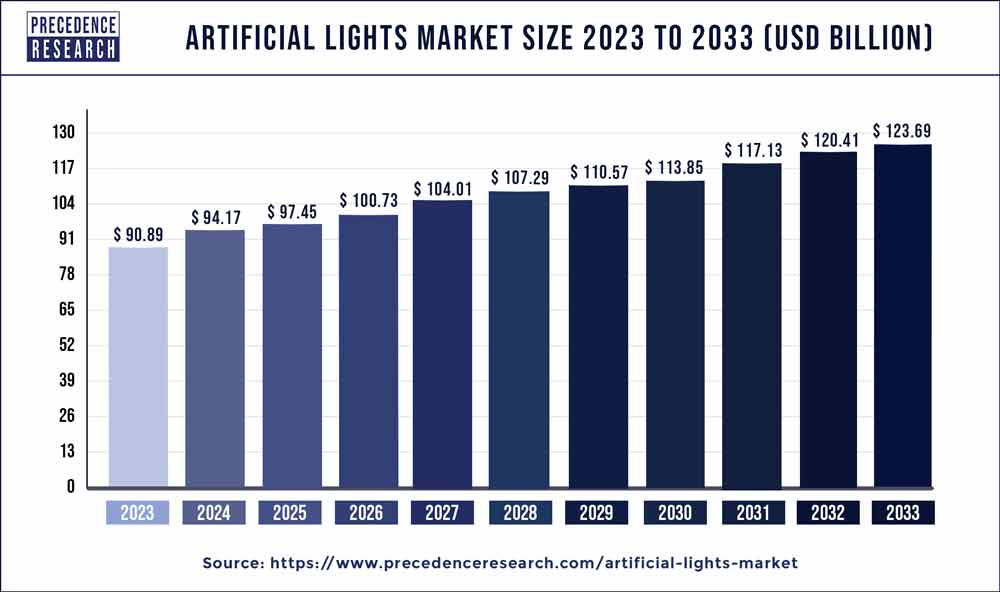

Artificial Lights Market Size to Attain USD 123.69 Bn by 2033

The global artificial lights market size was estimated at USD 90.89 billion in 2023 and is projected to touch around USD 123.69 billion by 2033, growing at a CAGR of 3.08% from 2024 to 2033.

Key Takeaways

- Asia Pacific held the dominating share of the market of 47% in 2023.

- North America is observed to expand at a CAGR of 5.7% during the forecast period.

- By type, the LED lighting segment led the market with 32% of market share in 2023.

- By type, the halogen lighting segment is expected to witness a rapid growth with a CAGR of 4.9% over the forecast period.

- By application, the general lighting segment dominated the market with 41% of market share in 2023.

- By application, the automotive segment is expected to witness a significant growth rate of 5.6% during the forecast period.

- By end user, the residential segment held the dominating share of 54% in 2023.

- On the other hand, the commercial segment is expected to witness the fastest rate of growth at 3.9% during the forecast period.

The artificial lights market has witnessed significant growth in recent years, driven by advancements in lighting technology, increasing demand for energy-efficient lighting solutions, and the growing adoption of smart lighting systems. Artificial lights encompass a wide range of lighting products, including light-emitting diodes (LEDs), compact fluorescent lamps (CFLs), halogen lamps, and high-intensity discharge (HID) lamps, among others. These lighting solutions find applications across various sectors, including residential, commercial, industrial, and outdoor lighting. The market is characterized by intense competition among key players striving to innovate and offer cost-effective, sustainable lighting solutions to meet evolving consumer needs and regulatory requirements.

Get a Sample: https://www.precedenceresearch.com/sample/3756

Growth Factors:

Several factors contribute to the growth of the artificial lights market. Firstly, technological advancements have led to the development of more energy-efficient and durable lighting solutions. LED technology, in particular, has gained widespread acceptance due to its long lifespan, low energy consumption, and superior performance compared to traditional lighting sources. Additionally, the increasing emphasis on sustainability and environmental conservation has driven the demand for energy-efficient lighting solutions, as businesses and consumers seek to reduce their carbon footprint and energy costs.

Moreover, the rapid urbanization and industrialization observed globally have fueled the demand for artificial lighting in urban infrastructure, commercial buildings, manufacturing facilities, and public spaces. As cities expand and populations grow, there is a greater need for efficient and reliable lighting systems to ensure safety, security, and productivity. Furthermore, the emergence of smart lighting solutions, enabled by IoT (Internet of Things) technology, has transformed the way lighting is managed and controlled. Smart lighting systems offer features such as remote monitoring, automated scheduling, and customization options, enhancing convenience and energy savings for users.

Artificial Lights Market Scope

| Report Coverage | Details |

| Global Market Size in 2023 | USD 90.89 Billion |

| Global Market Size by 2033 | USD 123.69 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 3.08% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Artificial Lights Market Dynamics

Drivers:

Several drivers are propelling the growth of the artificial lights market. Firstly, government initiatives and regulations aimed at phasing out inefficient lighting technologies and promoting energy conservation have spurred the adoption of LED lighting solutions. Many countries have implemented energy efficiency standards and incentive programs to encourage the transition to energy-efficient lighting, driving market growth.

Additionally, the increasing focus on sustainable development and green building practices has led to the incorporation of energy-efficient lighting systems in new construction projects and retrofits. Businesses and property owners are increasingly investing in energy-efficient lighting solutions to reduce operating costs and comply with environmental regulations.

Furthermore, the rise of smart cities and the integration of lighting into broader IoT ecosystems have created opportunities for the adoption of connected lighting solutions. Smart lighting systems enable remote monitoring, data analytics, and dynamic lighting control, enhancing energy efficiency, safety, and urban livability.

Restraints:

Despite the numerous growth drivers, the artificial lights market faces certain restraints that may hinder its expansion. One significant challenge is the initial cost associated with upgrading to energy-efficient lighting technologies, such as LEDs. While these solutions offer long-term cost savings through reduced energy consumption and maintenance expenses, the upfront investment can be prohibitive for some consumers and businesses, particularly in emerging economies.

Additionally, the availability of counterfeit and substandard lighting products in the market poses a challenge to the adoption of genuine, high-quality lighting solutions. Counterfeit products not only undermine consumer confidence but also pose safety risks and may fail to deliver the expected energy savings and performance.

Moreover, the complexity of implementing smart lighting systems, including interoperability issues, cybersecurity concerns, and the need for specialized expertise, may deter some users from adopting these advanced technologies. Ensuring seamless integration with existing infrastructure and addressing privacy and security concerns are essential for the widespread adoption of smart lighting solutions.

Opportunities:

Despite the challenges, the artificial lights market presents several opportunities for growth and innovation. One significant opportunity lies in the development of smart lighting solutions tailored to specific applications and industries, such as smart cities, transportation, healthcare, and agriculture. By leveraging IoT technology and data analytics, smart lighting systems can deliver value-added features such as traffic management, indoor navigation, patient monitoring, and crop optimization.

Furthermore, the ongoing research and development efforts aimed at improving the efficiency, performance, and lifespan of LED lighting technology present opportunities for market expansion. Innovations in materials science, semiconductor technology, and manufacturing processes are driving continuous improvements in LED efficacy, color quality, and reliability, making LEDs an increasingly attractive option for a wide range of lighting applications.

Moreover, the increasing focus on circadian lighting, which mimics natural daylight patterns to promote health and well-being, presents opportunities for market differentiation and product innovation. Circadian lighting solutions have applications in healthcare facilities, schools, offices, and residential settings, where they can enhance productivity, mood, and sleep quality.

Read Also: Uterine Fibroid Treatment Devices Market Size To Hit USD 25.43 Bn by 2033

Recent Developments

- In February 2023, OSRAM GmbH (ams OSRAM AG), a prominent provider of optical solutions leveraging edge-emitting lasers (EELs) and vertical-cavity surface-emitting lasers (VCSELs) technology, revealed a collaboration with Cepton to deliver light detection and ranging (LiDAR) solutions for autonomous vehicles.

- In February 2022, GE Current, a US-based lighting firm, acquired Hubbell C&I Lighting, also based in the US, for an undisclosed sum. This acquisition aims to improve both companies’ distribution networks and digital capabilities, enabling them to better address customer requirements with increased speed, efficiency, and convenience. Hubbell C&I Lighting specializes in general lighting solutions.

- In December 2021, Signify N.V. disclosed the acquisition of Fluence, a move aimed at expanding and enriching its agricultural lighting growth platform.

- In January 2021, Ushio Deutschland GmbH, the German branch of Ushio Europe, completed a merger with BLV Licht- und Vakuumtechnik GmbH, its sister company known for manufacturing horticultural lighting systems. Following the merger, the combined entity operates under the name Ushio Germany GmbH. Ushio Europe specializes in producing UV, visible, and infrared lighting solutions, boasting manufacturing and testing facilities.

Artificial Lights Market Companies

- GE Lighting (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Panasonic Corporation (Japan)

- OSRAM Licht AG (Germany)

- Schneider Electric SE (France)

- Cree, Inc. (U.S.)

- CITIZEN ELECTRONICS CO., LTD. (Japan)

- Lumerica (Canada)

- Havells India Ltd. (India)

- LEDtronics, Inc. (U.S.)

- Patriot LED (U.S.)

- Acuity Brands, Inc. (U.S.)

Segments Covered in the Report

By Type

- LED

- CFL

- LFL

- HID

- Halogen

- Incandescent

By Application

- General Lighting

- Automotive Lighting

- Backlighting

- Others

By End User

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/