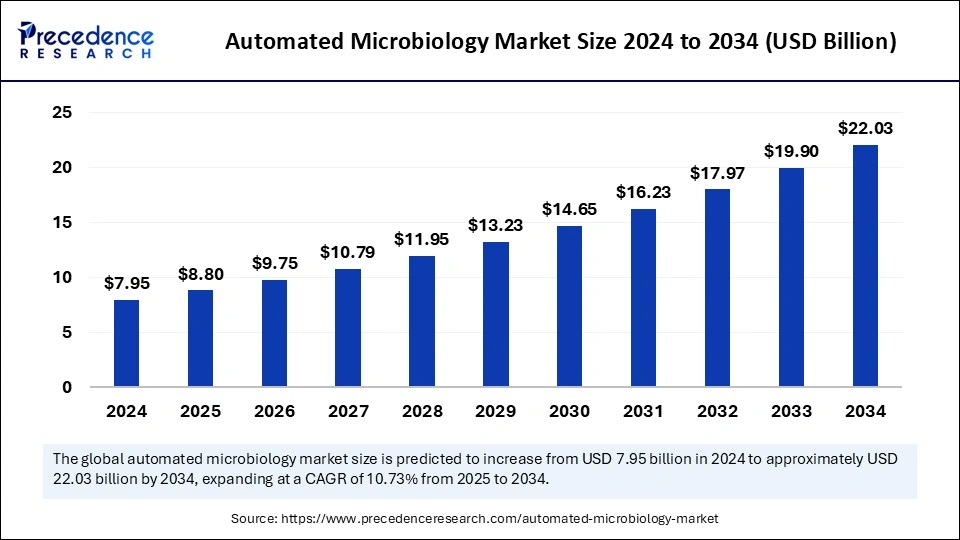

Automated Microbiology Industry is on Track to Achieve a Market Size of USD 22.03 billion by 2034

The automated microbiology industry is set to grow significantly, increasing from USD 7.95 billion in 2024 to around USD 22.03 billion by 2034, at a CAGR of 10.73%.

Automated Microbiology Industry Key Insights

- North America led the market by holding more than 41% of the market share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR over the studied period.

- By product, the reagents and kits segment held the biggest market share of 49% in 2024.

- By product, the instruments segment is anticipated to grow at the fastest CAGR over the forecast period.

- By automation type, the fully automated segment led the market in 2024.

- By application, the clinical diagnostics segment dominated the market in 2024.

- By application, the biopharmaceutical production segment is anticipated to grow at the fastest CAGR over the forecast period.

- By end use, the hospitals and diagnostic laboratories segment held the biggest market share of 45% in 2024.

- By end use, the pharmaceutical and biotechnology companies segment is anticipated to grow at the fastest rate during the projected period.

The automated microbiology market is experiencing rapid expansion, driven by the growing demand for faster, more accurate, and efficient microbial testing solutions across various industries. Automated microbiology involves the use of advanced technology, including robotics, artificial intelligence (AI), and machine learning, to enhance the speed and precision of microbiological testing. It plays a critical role in clinical diagnostics, pharmaceutical research, food safety, and environmental monitoring, enabling the detection and identification of microorganisms with minimal human intervention.

The increasing prevalence of infectious diseases, the rise in antimicrobial resistance, and the need for improved diagnostic capabilities have significantly contributed to the adoption of automated microbiology solutions. Laboratories and healthcare facilities worldwide are integrating automation into their workflows to enhance efficiency, reduce turnaround times, and improve patient outcomes. Additionally, stringent regulatory guidelines for microbial testing in industries such as pharmaceuticals, food and beverage, and biotechnology are further fueling market growth.

With technological advancements such as high-throughput screening, molecular diagnostics, and AI-driven analytical tools, the market is poised for continued expansion. The shift towards personalized medicine and precision diagnostics is also creating new opportunities for automated microbiology systems, allowing for tailored treatments based on rapid and accurate microbial identification.

Sample Link: https://www.precedenceresearch.com/sample/5722

Market Drivers

The rising global burden of infectious diseases and hospital-acquired infections has intensified the need for rapid and reliable microbiology testing. Automated systems enable faster detection and identification of pathogens, reducing delays in diagnosis and treatment. This is particularly crucial in managing outbreaks and preventing the spread of infections in healthcare settings.

Advancements in automation and artificial intelligence are transforming microbiology laboratories by improving accuracy, efficiency, and reproducibility. The integration of AI-powered algorithms in microbiology testing enhances data analysis, minimizes errors, and enables real-time decision-making. These innovations are accelerating the adoption of automated systems in diagnostic and research laboratories.

Stringent regulatory requirements for microbial testing in pharmaceutical manufacturing, food processing, and water quality monitoring are driving the demand for automated microbiology solutions. Regulatory agencies such as the FDA, CDC, and WHO emphasize stringent microbial control measures, necessitating the use of advanced automation to ensure compliance with safety standards.

The increasing adoption of automation in clinical laboratories is addressing the growing workload of microbiologists and laboratory technicians. Automated microbiology systems enhance workflow efficiency, reduce human intervention, and minimize the risk of contamination, making them indispensable in modern diagnostic settings.

Opportunities

The expanding application of automated microbiology in pharmaceutical and biotechnology research presents significant growth opportunities. Automated microbial testing is essential in drug discovery, vaccine development, and clinical trials, where precise microbial analysis is critical for product safety and efficacy. As pharmaceutical companies continue to invest in research and development, the demand for automated microbiology solutions is expected to rise.

Growing concerns about foodborne illnesses and the need for stringent food safety measures are driving the adoption of automated microbiology systems in the food and beverage industry. These systems enable rapid detection of foodborne pathogens, ensuring compliance with food safety regulations and preventing contamination-related outbreaks. The increasing consumer demand for safe and high-quality food products is further boosting market growth.

Advancements in molecular diagnostics and next-generation sequencing (NGS) are opening new avenues for automated microbiology. Molecular testing techniques, such as PCR (Polymerase Chain Reaction) and DNA sequencing, offer precise and high-speed microbial identification. The integration of these technologies with automation is enhancing the capabilities of microbiology laboratories, supporting personalized medicine and precision healthcare.

The growing emphasis on environmental monitoring and water quality assessment is creating new opportunities for automated microbiology solutions. Automated systems facilitate real-time microbial analysis in water treatment plants, ensuring compliance with environmental regulations and safeguarding public health. As concerns about waterborne diseases and pollution rise, automated microbiology is becoming an essential tool for environmental monitoring agencies.

Challenges

High initial costs associated with automated microbiology systems pose a significant challenge, particularly for small and medium-sized laboratories. The investment required for advanced automation equipment, software integration, and staff training can be a barrier to widespread adoption. Although automation enhances efficiency and reduces long-term operational costs, the upfront expenditure remains a concern for budget-constrained healthcare facilities.

Technical complexities related to system integration and maintenance can hinder market growth. Automated microbiology systems require regular calibration, software updates, and skilled personnel for optimal performance. Ensuring compatibility with existing laboratory workflows and electronic medical record (EMR) systems is another challenge that organizations must address when implementing automation solutions.

The shortage of skilled microbiologists and laboratory technicians is a growing concern in the field of microbiology. While automation reduces manual workload, trained professionals are still needed to interpret results, troubleshoot technical issues, and oversee laboratory operations. The lack of adequately trained personnel can slow down the adoption of advanced microbiology systems in some regions.

Regulatory and compliance challenges also impact the market, as different countries have varying standards for microbiological testing. Navigating complex regulatory frameworks, obtaining approvals, and ensuring compliance with international guidelines require significant effort from manufacturers and end-users. Delays in regulatory approvals can affect the commercialization of new automated microbiology solutions.

Regional Insights

North America dominates the automated microbiology market due to the high adoption of advanced diagnostic technologies, well-established healthcare infrastructure, and increasing investments in research and development. The presence of key market players, coupled with strong regulatory frameworks supporting automation in microbiology, has propelled market growth in this region. The United States, in particular, has witnessed a surge in the adoption of automated microbiology systems in hospitals, research laboratories, and pharmaceutical companies.

Europe follows closely, with significant contributions from countries such as Germany, France, and the United Kingdom. The region’s strong focus on healthcare innovation, stringent regulatory standards for microbial testing, and growing demand for precision diagnostics are driving market expansion. The European Union’s emphasis on food safety, environmental monitoring, and pharmaceutical quality control further boosts the adoption of automated microbiology solutions.

Asia-Pacific is emerging as a lucrative market, driven by the rapid development of healthcare infrastructure, increasing investments in biotechnology, and the rising burden of infectious diseases. Countries like China, India, Japan, and South Korea are witnessing growing demand for automated microbiology systems in clinical diagnostics and pharmaceutical research. The expanding food and beverage industry in Asia-Pacific is also fueling the need for advanced microbial testing solutions.

Latin America and the Middle East & Africa are gradually adopting automated microbiology technologies, with growing investments in healthcare and research facilities. While economic constraints and limited infrastructure may slow adoption rates, increasing awareness about infectious disease management and regulatory compliance is expected to drive future market growth. Governments and international organizations are working to improve laboratory capabilities, creating opportunities for automation in microbiology.

Read Also: Autoinjectors Market

Market Companies

- BD

- QIAGEN

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Danaher

- Merck KGaA

- bioMérieux

- Abbott

- DiaSorin S.p.A.

- BioRad Laboratories, Inc.