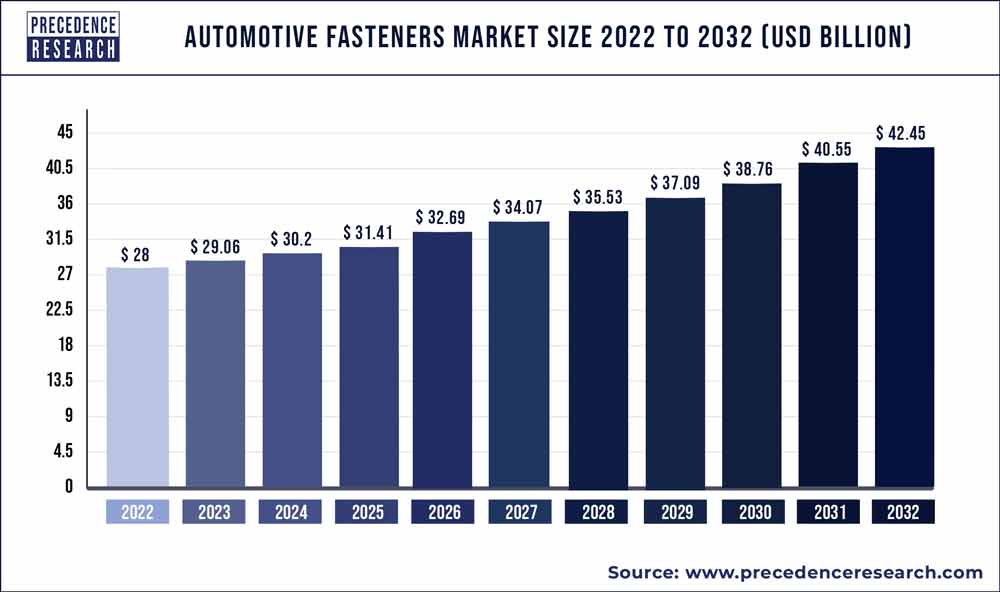

The automotive fasteners market size was valued approximately at US$ 27.2 billion in 2021 and is projected to reach US$ 38.95 billion by 2030, registering a CAGR of 4.1%.

The base year for the study has been considered 2021, the historic year 2017 and 2020, the forecast period considered is from 2022 to 2030. The Automotive Fasteners market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

Download a FREE Sample Copy (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1611

A fastener is a mechanical device that connects or holds more than two things together in a non-permanent joint. The automotive fasteners are used to hold parts together, increase vehicle performance, and prevent leaks. The stainless steel and plastic are commonly used and while plastic fasteners are not as strong as steel fasteners, they have a good vibration resistance. The tiny engine parts, door panels, airbag housing, and many other parts of the automobile use steel fasteners. The retainers, nuts, screws, and washers are examples of automotive fasteners.

The automotive fasteners market will develop due to the expanding automobile sector and the critical importance of fasteners in various automobiles. The mechanical developments and improvements in the quality of fasteners are also factors driving market demand. The ease with fasteners may be replaced on automobiles makes it considerably easier for end users to obtain fasteners for their vehicles. Furthermore, the rising desire for lighter vehicles with greater stability will increase the preference for automotive fasteners over welding, allowing the market to expand.

Automotive Fasteners Market Scope

| Report Coverage | Details |

| Market Size by 2030 | USD 38.95 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 4.1% |

| Largest Market | Asia Pacifc |

| Fastest Growing Market | North America |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

Automotive Fasteners Market Report Highlights

- Based on the material, the stainless-steel segment is the fastest growing segment in the global automotive fasteners market. Due to their high tensile strength and rust resistance, stainless steel fasteners have a substantial market share in the automobile industry.

- Based on the product, the threaded segment is the fastest growing segment in the global automotive fasteners market. The threaded fasteners are used in a variety of applications including the assembly and disassembly of many sections and components of the automobiles.

- Based on the application, the wire harnessing segment is the fastest growing segment in the global automotive fasteners market. This is attributed to an increase in the use of fastening wire bundles which in turn is contributing to the global automotive fasteners market’s overall expansion.

Automotive Fasteners Market : Regional Snapshot

North America is the fastest growing region in the automotive fasteners market. The government regulatory framework for lightweight automobiles has resulted in technological improvements in the region’s development of lightweight and durable items.

Asia-Pacific region is the largest segment for automotive fasteners market in terms of region. This is attributed increased vehicle sales and consumer tastes from standard to customizable automobile parts and rising per capita income of consumers in the region.

Automotive Fasteners Market Dynamics

Drivers

Rising penetration of battery powered trains

The fasteners are essential components for battery powered trains. The battery powered trains are being utilized on large scale due to the rising energy expense. The automotive fasteners help to enhance the efficiency of trains. The battery powered trains effectiveness is also increasing due to the implementation of automotive fasteners. Thus, the rising penetration of battery powered trains is boosting the growth of the global automotive fasteners market over the projected period.

Restraints

High capital investments

The automobiles have intricated mechanical and electrical systems. They have hundreds of moving parts, making development and maintenance difficult and expensive. For increased seasonal performance and operation, automotive fasteners ensure that the auto vehicle is in one state without any disbalances in distinct linked parts. The manufacturing of automobile fasteners is expensive and time-consuming, as well as risky, as many things might go wrong if the component is not built correctly. The vehicle fasteners have a substantially higher research and development expense than other automotive components. Thus, this factor is restricting the market growth.

Read Also: Pulmonary Drug Delivery Systems Market Size to Touch $ 92.4 Bn By 2030

Opportunities

Surge in sales of electric vehicles

The electric vehicle sector is quickly growing around the world. Electric vehicles, like any other transformational disruptive technology, trigger a flurry of new economic development, difficulties, and opportunities. Increased vehicle range, increased charging infrastructure availability, and proactive participation by automobile original equipment manufacturers are driving global electric car sales. Furthermore, as governments become more concerned about environmental issues, demand for zero-emission vehicles has surged, encouraging the expansion of the electric vehicle industry. Electric vehicles are being actively promoted in industrialized countries to minimize pollution, which has resulted in increased sales of electric vehicles. Thus, the surge in sales of electric vehicles is creating lucrative opportunities for the growth of the automotive fasteners market during the forecast period.

Challenges

Difficulty of refastening

The capacity to fasten and then refasten automotive fasteners is a benefit. This can be sometimes be a disadvantage, especially with automotive mechanical fasteners. Engines, for example, are densely packed with bolts that take a long time to remove and retorque. Other automotive fasteners such as ski boot buckles can speed up fastening and refastening. Thus, the difficulty of refastening is creating a major challenge for the growth of the automotive fasteners market.

Some of the prominent players in the global automotive fasteners market include:

- Bulten AB

- KAMAX

- Sundram Fasteners

- Stanley Black & Decker

- Shanghai Prime Machinery Company

- SFS Group

- Lisi Group

- The Philips Screw Company

- KOVA Fasteners Private Limited

- Westfield Fasteners Limited

Segments Covered in the Report

By Product

- Threaded

- Nuts Screws

- Rivets

- Studs

- Non-threaded

- Snap rings

- Clip

By Application

- Engine

- Chassis

- Transmission

- Steering

- Front/rear Axle

- Interior Trim

- Wire Harnessing

- Others

By Characteristics

- Removable Fasteners

- Permanent Fasteners

- Semi-permanent Fasteners

By Material

- Stainless Steel

- Bronze

- Iron

- Nickel

- Aluminum

- Brass

- Plastic

By Electric Vehicle Type

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

By Vehicle Type

- Passenger Car

- Hatchback

- Sedan

- Luxury

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Distribution

- Automotive OEM

- Aftermarket

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Automotive Fasteners Market, By Product

7.1. Automotive Fasteners Market, by Product, 2022-2030

7.1.1. Threaded

7.1.1.1. Market Revenue and Forecast (2017-2030)

7.1.2. Non-threaded

7.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 8. Global Automotive Fasteners Market, By Application

8.1. Automotive Fasteners Market, by Application, 2022-2030

8.1.1. Engine

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Chassis

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Transmission

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Steering

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Front/rear Axle

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Interior Trim

8.1.6.1. Market Revenue and Forecast (2017-2030)

8.1.7. Wire Harnessing

8.1.7.1. Market Revenue and Forecast (2017-2030)

8.1.8. Others

8.1.8.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Automotive Fasteners Market, By Characteristics

9.1. Automotive Fasteners Market, by Characteristics, 2022-2030

9.1.1. Removable Fasteners

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Permanent Fasteners

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Semi-permanent Fasteners

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Automotive Fasteners Market, By Material

10.1. Automotive Fasteners Market, by Material, 2022-2030

10.1.1. Stainless Steel

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Bronze

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Iron

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Nickel

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Aluminum

10.1.5.1. Market Revenue and Forecast (2017-2030)

10.1.6. Brass

10.1.6.1. Market Revenue and Forecast (2017-2030)

10.1.7. Plastic

10.1.7.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Automotive Fasteners Market, By Electric Vehicle

11.1. Automotive Fasteners Market, by Electric Vehicle, 2022-2030

11.1.1. Battery Electric Vehicle (BEV)

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Hybrid Electric Vehicle (HEV)

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Plug-in Hybrid Electric Vehicle (PHEV)

11.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Automotive Fasteners Market, By Vehicle

12.1. Automotive Fasteners Market, by Vehicle, 2022-2030

12.1.1. Passenger Car

12.1.1.1. Market Revenue and Forecast (2017-2030)

12.1.2. Light Commercial Vehicle

12.1.2.1. Market Revenue and Forecast (2017-2030)

12.1.3. Heavy Commercial Vehicle

12.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 13. Global Automotive Fasteners Market, By Distribution

13.1. Automotive Fasteners Market, by Distribution, 2022-2030

13.1.1. Automotive OEM

13.1.1.1. Market Revenue and Forecast (2017-2030)

13.1.2. Aftermarket

13.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 14. Global Automotive Fasteners Market, Regional Estimates and Trend Forecast

14.1. North America

14.1.1. Market Revenue and Forecast, by Product (2017-2030)

14.1.2. Market Revenue and Forecast, by Application (2017-2030)

14.1.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.1.4. Market Revenue and Forecast, by Material (2017-2030)

14.1.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.1.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.1.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.1.8. U.S.

14.1.8.1. Market Revenue and Forecast, by Product (2017-2030)

14.1.8.2. Market Revenue and Forecast, by Application (2017-2030)

14.1.8.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.1.8.4. Market Revenue and Forecast, by Material (2017-2030)

14.1.8.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.1.8.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.1.8.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.1.9. Rest of North America

14.1.9.1. Market Revenue and Forecast, by Product (2017-2030)

14.1.9.2. Market Revenue and Forecast, by Application (2017-2030)

14.1.9.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.1.9.4. Market Revenue and Forecast, by Material (2017-2030)

14.1.9.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.1.9.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.1.9.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.2. Europe

14.2.1. Market Revenue and Forecast, by Product (2017-2030)

14.2.2. Market Revenue and Forecast, by Application (2017-2030)

14.2.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.2.4. Market Revenue and Forecast, by Material (2017-2030)

14.2.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.2.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.2.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.2.8. UK

14.2.8.1. Market Revenue and Forecast, by Product (2017-2030)

14.2.8.2. Market Revenue and Forecast, by Application (2017-2030)

14.2.8.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.2.8.4. Market Revenue and Forecast, by Material (2017-2030)

14.2.8.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.2.8.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.2.8.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.2.9. Germany

14.2.9.1. Market Revenue and Forecast, by Product (2017-2030)

14.2.9.2. Market Revenue and Forecast, by Application (2017-2030)

14.2.9.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.2.9.4. Market Revenue and Forecast, by Material (2017-2030)

14.2.9.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.2.9.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.2.9.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.2.10. France

14.2.10.1. Market Revenue and Forecast, by Product (2017-2030)

14.2.10.2. Market Revenue and Forecast, by Application (2017-2030)

14.2.10.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.2.10.4. Market Revenue and Forecast, by Material (2017-2030)

14.2.10.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.2.10.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.2.10.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.2.11. Rest of Europe

14.2.11.1. Market Revenue and Forecast, by Product (2017-2030)

14.2.11.2. Market Revenue and Forecast, by Application (2017-2030)

14.2.11.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.2.11.4. Market Revenue and Forecast, by Material (2017-2030)

14.2.11.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.2.11.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.2.11.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.3. APAC

14.3.1. Market Revenue and Forecast, by Product (2017-2030)

14.3.2. Market Revenue and Forecast, by Application (2017-2030)

14.3.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.3.4. Market Revenue and Forecast, by Material (2017-2030)

14.3.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.3.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.3.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.3.8. India

14.3.8.1. Market Revenue and Forecast, by Product (2017-2030)

14.3.8.2. Market Revenue and Forecast, by Application (2017-2030)

14.3.8.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.3.8.4. Market Revenue and Forecast, by Material (2017-2030)

14.3.8.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.3.8.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.3.8.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.3.9. China

14.3.9.1. Market Revenue and Forecast, by Product (2017-2030)

14.3.9.2. Market Revenue and Forecast, by Application (2017-2030)

14.3.9.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.3.9.4. Market Revenue and Forecast, by Material (2017-2030)

14.3.9.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.3.9.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.3.9.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.3.10. Japan

14.3.10.1. Market Revenue and Forecast, by Product (2017-2030)

14.3.10.2. Market Revenue and Forecast, by Application (2017-2030)

14.3.10.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.3.10.4. Market Revenue and Forecast, by Material (2017-2030)

14.3.10.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.3.10.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.3.10.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.3.11. Rest of APAC

14.3.11.1. Market Revenue and Forecast, by Product (2017-2030)

14.3.11.2. Market Revenue and Forecast, by Application (2017-2030)

14.3.11.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.3.11.4. Market Revenue and Forecast, by Material (2017-2030)

14.3.11.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.3.11.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.3.11.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.4. MEA

14.4.1. Market Revenue and Forecast, by Product (2017-2030)

14.4.2. Market Revenue and Forecast, by Application (2017-2030)

14.4.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.4.4. Market Revenue and Forecast, by Material (2017-2030)

14.4.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.4.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.4.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.4.8. GCC

14.4.8.1. Market Revenue and Forecast, by Product (2017-2030)

14.4.8.2. Market Revenue and Forecast, by Application (2017-2030)

14.4.8.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.4.8.4. Market Revenue and Forecast, by Material (2017-2030)

14.4.8.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.4.8.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.4.8.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.4.9. North Africa

14.4.9.1. Market Revenue and Forecast, by Product (2017-2030)

14.4.9.2. Market Revenue and Forecast, by Application (2017-2030)

14.4.9.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.4.9.4. Market Revenue and Forecast, by Material (2017-2030)

14.4.9.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.4.9.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.4.9.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.4.10. South Africa

14.4.10.1. Market Revenue and Forecast, by Product (2017-2030)

14.4.10.2. Market Revenue and Forecast, by Application (2017-2030)

14.4.10.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.4.10.4. Market Revenue and Forecast, by Material (2017-2030)

14.4.10.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.4.10.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.4.10.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.4.11. Rest of MEA

14.4.11.1. Market Revenue and Forecast, by Product (2017-2030)

14.4.11.2. Market Revenue and Forecast, by Application (2017-2030)

14.4.11.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.4.11.4. Market Revenue and Forecast, by Material (2017-2030)

14.4.11.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.4.11.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.4.11.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.5. Latin America

14.5.1. Market Revenue and Forecast, by Product (2017-2030)

14.5.2. Market Revenue and Forecast, by Application (2017-2030)

14.5.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.5.4. Market Revenue and Forecast, by Material (2017-2030)

14.5.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.5.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.5.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.5.8. Brazil

14.5.8.1. Market Revenue and Forecast, by Product (2017-2030)

14.5.8.2. Market Revenue and Forecast, by Application (2017-2030)

14.5.8.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.5.8.4. Market Revenue and Forecast, by Material (2017-2030)

14.5.8.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.5.8.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.5.8.7. Market Revenue and Forecast, by Vehicle (2017-2030)

14.5.9. Rest of LATAM

14.5.9.1. Market Revenue and Forecast, by Product (2017-2030)

14.5.9.2. Market Revenue and Forecast, by Application (2017-2030)

14.5.9.3. Market Revenue and Forecast, by Characteristics (2017-2030)

14.5.9.4. Market Revenue and Forecast, by Material (2017-2030)

14.5.9.5. Market Revenue and Forecast, by Electric Vehicle (2017-2030)

14.5.9.6. Market Revenue and Forecast, by Distribution (2017-2030)

14.5.9.7. Market Revenue and Forecast, by Vehicle (2017-2030)

Chapter 15. Company Profiles

15.1. Bulten AB

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. KAMAX

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. Sundram Fasteners

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Stanley Black & Decker

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Shanghai Prime Machinery Company

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. SFS Group

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. Lisi Group

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. The Philips Screw Company

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. KOVA Fasteners Private Limited

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. Westfield Fasteners Limited

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Why Buy this Report?

The purpose of Precedence Research’s Automotive Fasteners market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1611

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://precedenceresearchnews.wordpress.com