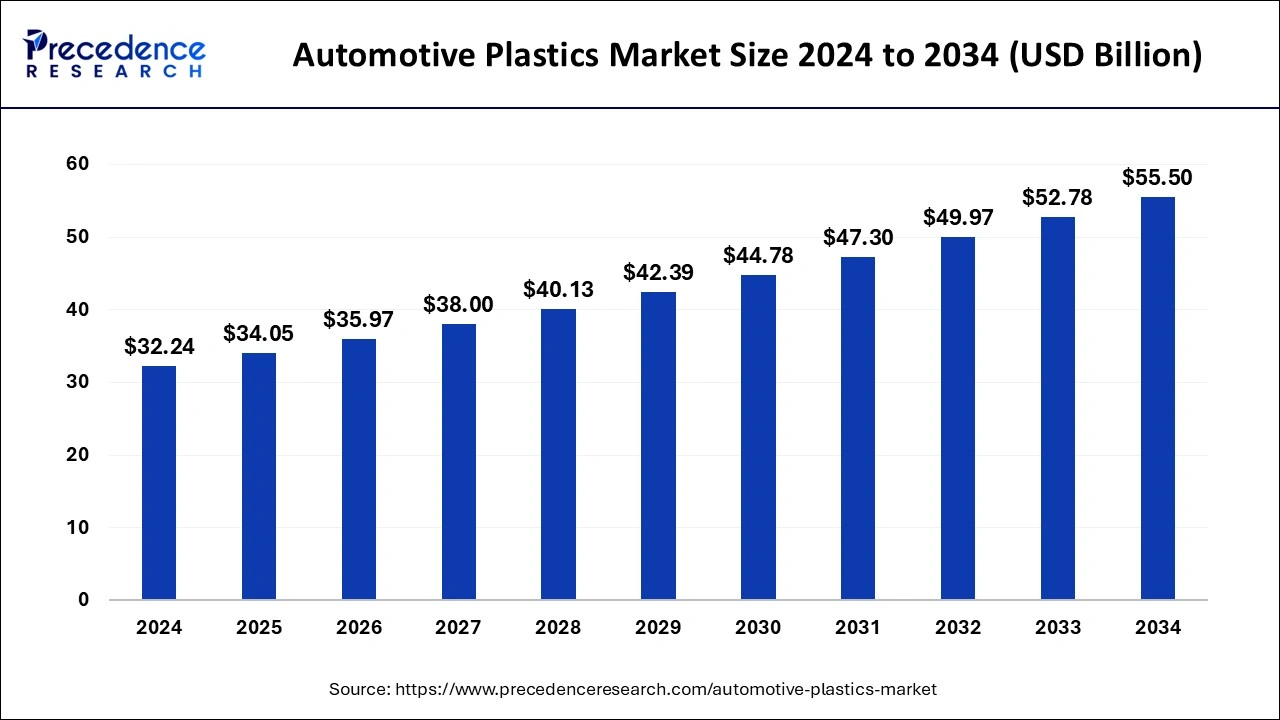

Automotive Plastics Market Size to Surpass USD 52.78 Bn By 2033

The global automotive plastics market is expected to increase USD 52.78 billion by 2033 from USD 30.52 billion in 2023 with a CAGR of 5.63% between 2024 and 2033.

Key Points

- Asia Pacific dominated the market with the largest revenue share of 47% in 2023.

- Europe is projected to host the fastest-growing market during the forecast period of 2024–2033.

- By product, the polypropylene (PP) segment has held a major revenue share of 33% in 2023.

- By product, the polyvinyl chloride (PVC) segment is projected to grow at the fastest CAGR of 18.02% during the forecast period.

- By process, the injection molding segment has contributed more than 57% of revenue share in 2023.

- By application, the interior furnishing segment has held a largest revenue share of 45% in 2023.

- By application, the electrical components segment will grow at the fastest rate in the market during the forecast period.

- By application, the exterior furnishing segment will grow significantly during the forecast period.

- By vehicle, the passenger cars segment dominated the market in 2023.

The automotive plastics market has witnessed significant growth over the past few decades, driven by the increasing demand for lightweight materials in the automotive industry. Plastics have become integral in modern vehicle design, replacing traditional materials like metals due to their superior properties such as weight reduction, design flexibility, and cost-effectiveness. These materials find extensive applications in interior, exterior, under-the-hood components, and structural elements of vehicles, contributing to enhanced fuel efficiency, safety, and aesthetics.

Get a Sample: https://www.precedenceresearch.com/sample/4444

Growth Factors

Several factors contribute to the growth of the automotive plastics market. Firstly, stringent government regulations regarding emissions and fuel efficiency have compelled automakers to adopt lightweight materials like plastics to meet regulatory standards. Additionally, consumer preferences for more fuel-efficient vehicles have further propelled the demand for lightweight materials in automotive manufacturing. Moreover, advancements in plastic technologies, such as the development of high-performance engineering plastics and bioplastics, have expanded the application scope of plastics in the automotive sector.

Regional Insights

The automotive plastics market exhibits regional variations influenced by factors such as economic development, automotive manufacturing capabilities, and regulatory frameworks. North America and Europe have been early adopters of automotive plastics, driven by stringent emission norms and a strong presence of automotive OEMs. Asia-Pacific, led by countries like China, Japan, and India, has emerged as a dominant region due to the rapid expansion of the automotive industry and increasing production capacities of automotive plastics in the region.

Automotive Plastics Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 30.52 Billion |

| Market Size in 2024 | USD 32.24 Billion |

| Market Size By 2033 | USD 52.78 Billion |

| Market Growth Rate | CAGR of 5.63% from 2024 to 2033 |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Process, Application, Vehicle and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Automotive Plastics Market Dynamics

Drivers

Key drivers of growth in the automotive plastics market include the emphasis on lightweighting to improve fuel efficiency and reduce emissions. Plastics offer significant weight savings compared to metals, thereby enhancing the overall efficiency of vehicles. Additionally, the versatility of plastics allows for complex designs and integration of functionalities such as aerodynamics and safety features, which further drives their adoption in automotive applications. Moreover, the increasing focus on electric and hybrid vehicles has bolstered the demand for lightweight materials like plastics to extend driving range and improve battery efficiency.

Opportunities

The automotive plastics market is poised with several opportunities for growth. Technological advancements in materials science are leading to the development of sustainable and recyclable plastics, addressing environmental concerns and enhancing the lifecycle of automotive components. Furthermore, the rising trend towards connected and autonomous vehicles presents opportunities for innovative plastic solutions that can integrate sensors, electronics, and other advanced functionalities seamlessly into vehicle designs. Moreover, collaborations between automotive OEMs and material suppliers are fostering innovation in lightweight materials, opening new avenues for market expansion.

Challenges

Despite the growth prospects, the automotive plastics market faces several challenges. One significant challenge is the recycling and disposal of plastic components, as end-of-life management remains a concern due to the complexity of automotive plastics and their composite nature. Furthermore, the volatility in raw material prices, particularly for petrochemical-based plastics, can impact the cost competitiveness of automotive plastics compared to traditional materials. Additionally, ensuring the durability and safety of plastic components under extreme conditions, such as high temperatures and mechanical stress, poses challenges for material engineers and manufacturers.

Read Also: Hemodialysis Catheters Market Size, Share, Report by 2033

Automotive Plastics Market Companies

- AkzoNobel N.V.

- Adient plc

- Borealis AG

- BASF SE

- Dow Inc

- Covestro AG

- TEIJIN Limited

- Royal DSM N.V.

- Quadrant AG

- Owens Corning

- Lear Corporation

- Grupo Antolin

- Hanwha Azdel Inc

- SABIC

- Momentive Performance Materials, Inc.

- Evonik Industries AG

- Magna International, Inc

- Saudi Basic Industries Corporation (SABIC)

Recent Developments

- In December 2023, a new recycled ocean plastic or resin made from recovered maritime plastics for automotive applications was launched by LyondellBesell.

- In January 2024, Sonichem launched a project to transform the automotive industry with bio-based plastics. These are used in the production of composites, resins, and plastics.

- In February 2024, a new multi-substrate primer for the plastic automotive exterior was launched by the AkzoNobel. A new 2k solvent-borne primer in conductive and dark grey for automotive OEM exterior plastic parts was developed by AkzoNobel.

- In February 2024, a new range of recycling content thermoplastic elastomer (TPE) products was launched by the KRAIBURG TPE for the automotive series.

Segments Covered in the Report

By Product

- Acrylonitrile Butadiene Styrene (ABS)

- Polypropylene (PP)

- PP LGF 20

- PP LGF 30

- PP LGF 40

- Others

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Rigid PVC

- Flexible PVC

- Polyethylene (PE)

- High-density Polyethylene (HDPE)

- Other PE Grades

- Polybutylene Terephthalate (PBT)

- Polycarbonate (PC)

- Polymethyl Methacrylate (PMMA)

- Polyamide (Nylon 6, Nylon 66)

- Others

By Process

- Injection Molding

- Blow Molding

- Thermoforming

- Others

By Application

- Powertrains

- Electrical Components

- Interior Furnishing

- IMD or IML

- Others

- Exterior Furnishing

- Under the Hood

- Chassis

By Vehicle

- Passenger Cars

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Fuel cell Electric Vehicles (FCEV)

- Light Commercial Vehicles

- Medium & heavy Commercial Vehicles

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/