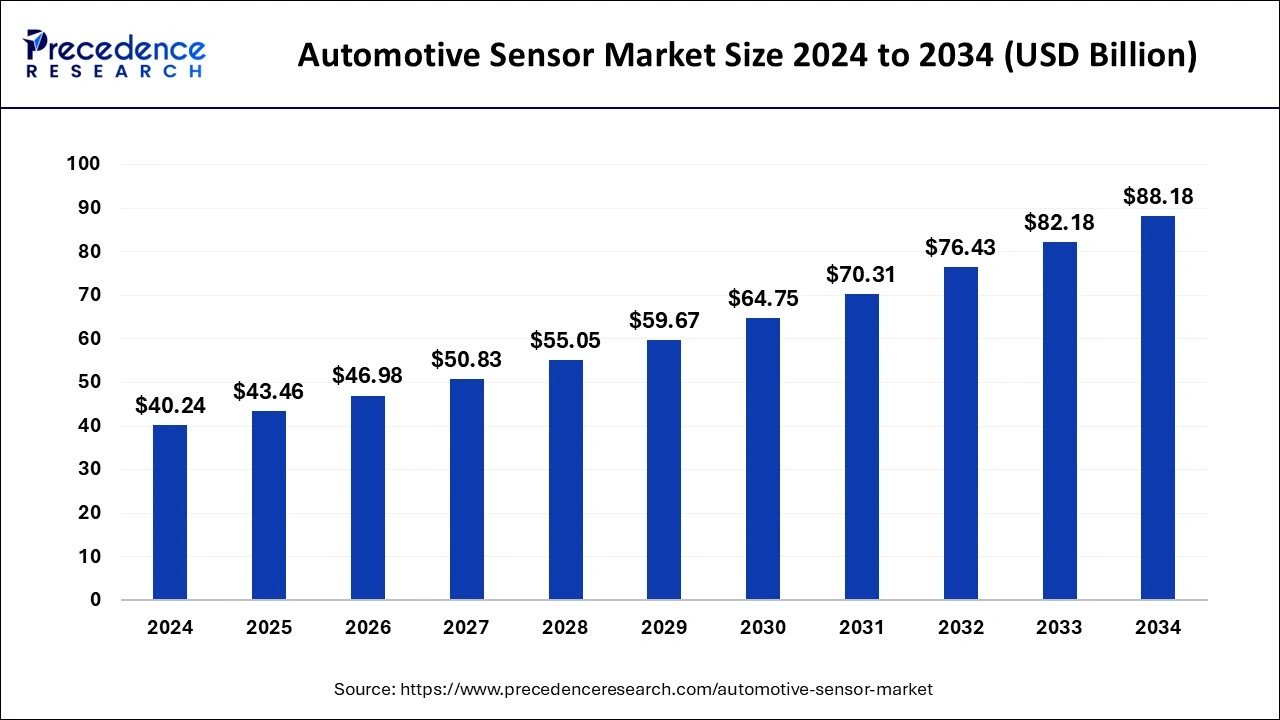

Automotive sensor market to reach USD 88.18B by 2034, growing at 8.16% CAGR.

The global automotive sensor market is experiencing substantial growth, driven by advancements in vehicle safety and automation. In 2024, Asia Pacific dominated the market with a significant revenue share of 56.11%, reflecting the region’s strong automotive industry. A key factor in this growth is the increasing adoption of Advanced Driver Assistance Systems (ADAS) and safety technologies, which contributed 42% of the market share. Additionally, the passenger vehicle segment remains the dominant contributor, making up 86% of the overall revenue. Within sensor types, image sensors play a crucial role, holding a 17% share, as they are integral to various safety and driver-assist features, such as cameras and autonomous driving systems. This market’s growth is also fueled by the rising demand for more intelligent and connected vehicles, which rely heavily on sensors for enhanced performance, safety, and efficiency.

Automotive Sensor Market Key Insights

- Asia Pacific region captured 56.11% of the total revenue share in 2024.

- The ADAS & safety system segment held 42% of the revenue share in 2024.

- The passenger vehicle segment generated 86% of the total revenue share in 2024.

- The image sensor segment accounted for 17% of the revenue share in 2024.

Automotive Sensor Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 43.46 Billion |

| Market Size by 2034 | USD 88.18 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.16% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Sales Channel, Vehicle, Engine, by Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Drivers

The automotive sensor market is driven by several key factors. The increasing adoption of Advanced Driver Assistance Systems (ADAS) and safety features is a significant driver, as sensors are integral to enabling these technologies, improving vehicle safety, and enhancing the driving experience. The growing demand for autonomous vehicles is another major contributor, as self-driving cars rely heavily on sensors for navigation, perception, and decision-making processes. Additionally, the rising focus on electric vehicles (EVs) is spurring the need for advanced sensors to support the integration of electric drivetrains, battery management systems, and energy-efficient technologies. Increased consumer demand for vehicle connectivity, smart features, and infotainment systems is also propelling the market, as automotive sensors play a pivotal role in these innovations. Furthermore, stricter government regulations related to vehicle safety and environmental standards are prompting automakers to incorporate more sensors into their vehicles to meet these requirements.

Opportunities

- Increasing demand for autonomous and electric vehicles, driving the need for advanced sensors.

- Growth of ADAS and safety systems, offering opportunities for sensor integration in vehicles.

- Expansion of the Internet of Things (IoT) and connectivity, enabling smarter and more efficient sensors.

- Rising adoption of electric vehicles (EVs), creating demand for sensors in battery management and energy efficiency.

- Technological advancements in sensor miniaturization and cost reduction, making them more affordable for mass adoption.

Challenges

- High development costs and complex integration of sensors into vehicles, especially for autonomous driving.

- Issues related to sensor reliability, especially in harsh environmental conditions such as extreme temperatures.

- Potential cybersecurity risks associated with connected sensors in vehicles.

- Challenges in standardization and regulation across different regions and vehicle models.

- Limited infrastructure for supporting advanced sensor-based technologies, especially in emerging markets.

Regional Insights

The automotive sensor market is witnessing significant growth across different regions, with Asia Pacific leading the market, holding a substantial share of 56.11% in 2024. This growth is largely driven by the region’s strong automotive manufacturing base, particularly in countries like China, Japan, and South Korea, which are home to major automotive manufacturers and are rapidly adopting advanced technologies such as ADAS and electric vehicles.

North America and Europe are also experiencing notable growth, particularly driven by the increasing demand for advanced driver-assistance systems (ADAS) and safety technologies. The automotive sensor market in these regions is expanding due to the rising adoption of electric and autonomous vehicles, with stringent safety regulations further pushing the demand for sensors.