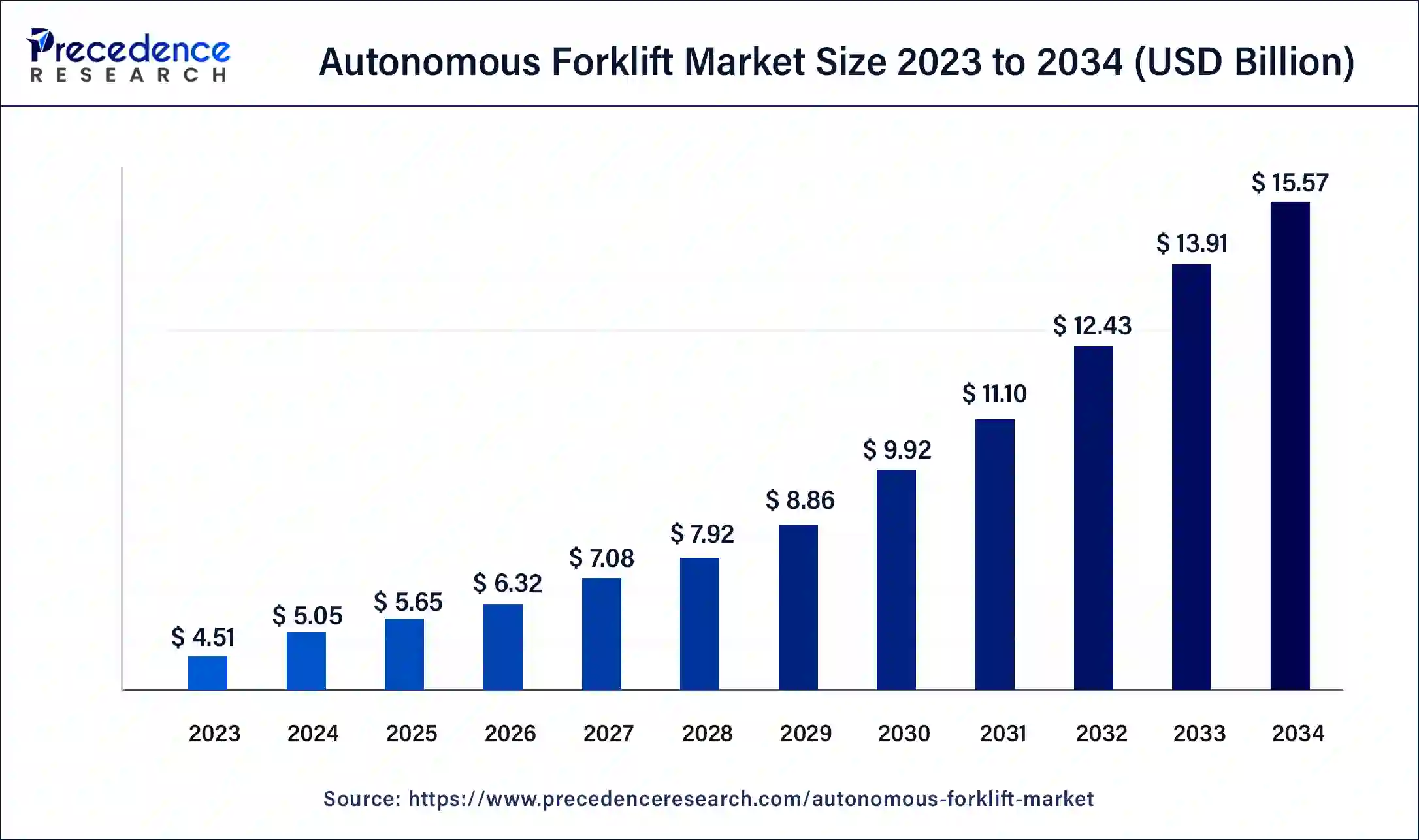

Autonomous Forklift Market Size to Cross USD 13.91 Billion by 2033

The global autonomous forklift market size is expected to increase USD 13.91 billion by 2033 from USD 4.51 billion in 2023 with a CAGR of 11.92% between 2024 and 2033.

Key Points

- Asia Pacific dominated the autonomous forklift market in 2023.

- North America is expected to show significant growth in the market over the forecast period.

- By tonnage, the above 10 tonnes segment dominated the market in 2023.

- By tonnage, the below 5-10 segment is expected to grow at the fastest rate in the market during the forecast period.

- By navigation technology, the laser segment dominated the market in 2023.

- By navigation technology, the vision segment is expected to grow at a notable rate in the market over the forecast period.

- By end use, the retail & wholesale segments dominated the market in 2023.

- By end use, the logistics segment is expected to grow rapidly in the market over the forecast period.

- By application, the indoor segment dominated the market in 2023.

The autonomous forklift market has witnessed substantial growth in recent years, driven by the increasing demand for automation in material handling operations across various industries. Autonomous forklifts, equipped with advanced technologies such as sensors, cameras, and artificial intelligence, can navigate warehouses and distribution centers without human intervention, enhancing efficiency and safety. These forklifts offer benefits such as reduced labor costs, improved productivity, and optimized warehouse space utilization, making them a preferred choice for modern logistics and manufacturing facilities.

Get a Sample: https://www.precedenceresearch.com/sample/4363

Growth Factors:

Several factors contribute to the growth of the autonomous forklift market. The rising adoption of Industry 4.0 principles and the need for efficient supply chain management drive demand for automation solutions like autonomous forklifts. Additionally, advancements in sensor technology, artificial intelligence, and machine learning algorithms have enhanced the capabilities of autonomous forklifts, enabling them to operate in complex and dynamic warehouse environments. Moreover, the growing emphasis on workplace safety and the need to mitigate labor shortages further accelerate the adoption of autonomous forklifts.

Regional Insights:

The autonomous forklift market exhibits significant regional variations driven by factors such as industrialization, technological advancements, and infrastructure development. North America and Europe lead the market, owing to the presence of established manufacturing and logistics industries, coupled with early adoption of automation technologies. Asia Pacific emerges as a lucrative region for market players, fueled by rapid industrialization in countries like China and India, along with increasing investments in smart manufacturing and warehouse automation initiatives.

Autonomous Forklift Market Scope

| Report Coverage | Details |

| Autonomous Forklift Market Size in 2023 | USD 4.51 Billion |

| Autonomous Forklift Market Size in 2024 | USD 5.05 Billion |

| Autonomous Forklift Market Size by 2033 | USD 13.91 Billion |

| Autonomous Forklift Market Growth Rate | CAGR of 11.92% from 2024 to 2033 |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Tonnes, Navigation Technology, End-use, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Autonomous Forklift Market Dynamics

Drivers:

Several drivers propel the growth of the autonomous forklift market. The need for optimizing warehouse operations and reducing labor costs drives the adoption of autonomous forklifts among enterprises. Additionally, the integration of Internet of Things (IoT) technology with forklifts enables real-time tracking and monitoring of inventory, contributing to operational efficiency. Furthermore, stringent safety regulations and the focus on minimizing workplace accidents create opportunities for autonomous forklifts, as they offer enhanced safety features and reduce the risk of human errors.

Opportunities:

The autonomous forklift market presents promising opportunities for innovation and market expansion. Continued advancements in technology, such as the integration of LiDAR and advanced robotics, can further enhance the capabilities of autonomous forklifts, enabling them to operate in diverse environments with higher precision and efficiency. Moreover, the increasing adoption of cloud-based fleet management solutions and predictive maintenance algorithms offers opportunities for service providers to offer value-added services and differentiate themselves in the market.

Challenges:

Despite significant growth prospects, the autonomous forklift market faces several challenges. High initial investment costs associated with deploying autonomous forklifts may deter small and medium-sized enterprises from adopting this technology. Moreover, concerns related to cybersecurity and data privacy pose challenges to the widespread adoption of autonomous forklifts, as they rely on interconnected systems and data sharing for operation. Additionally, regulatory barriers and compliance requirements vary across regions, creating complexities for market players in terms of product standardization and certification. Addressing these challenges requires collaborative efforts from industry stakeholders, including technology providers, regulatory bodies, and end-users, to foster a conducive environment for the adoption of autonomous forklifts.

Read Also: Wireless Connectivity Market Size to Cross USD 335.38 Bn by 2033

Autonomous Forklift Market Recent Developments

- In February 2024, Seegrid Corporation announced the launch of an autonomous lift truck, the Palion Lift CR1 model, to address evolving challenges in autonomous material handling for warehousing, manufacturing, and logistics customers. The Palion Lift CR1 boasts an impressive 15’ lift height and a robust 4,000lb payload capacity. Further, the company stated that the new model is equipped with its own proprietary state-of-the-art navigation technology.

- In August 2023, Cyngn Inc., a developer of AI-powered autonomous driving solutions for industrial applications, announced a paid pre-order agreement with Arauco, a global company of sustainable forestry products, pulp, and engineered wood that is a supplier to the furniture and construction industries, to supply 100 autonomous electric DriveMod-enabled forklifts. The agreement aims to enhance Arauco’s operations and drive efficiency in its material handling processes.

- In September 2022, Toyota Material Handling Japan (“TMHJ”), a branch of Toyota Industries Corporation, developed an autonomous lift truck with world-first*1AI-based technology that automatically recognizes truck and load location and position and produces automated travel paths to complete loading operations.

Autonomous Forklift Market Companies

- Toyota Industries Corporation

- Kion Group AG

- Mitsubishi Logisnext Co Ltd

- Jungheinrich AG

- Hyster-Yale Materials Handling

- Hangcha Group Co, Ltd

- Agilox Services GMBH

- Komatsu Ltd.

- Doosan Corporation

- Anhui Yufeng Equipment Co., Ltd.

- Anhui Heli Co., Ltd.

- Crown Equipment Corporation

- MLE B.V.

Segments Covered in the Report

By Tonnes

- Below 5 Tons

- 5 to 10 Tons

- Above 10 Tons

By Navigation Technology

- Laser

- Vision

- Optical Tape

- Magnetic

- Inductive Guidance

By End-use

- Retail and Wholesale

- Logistics

- Automotive

- Food Industry

- Others

By Application

- Indoor

- Outdoor

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/