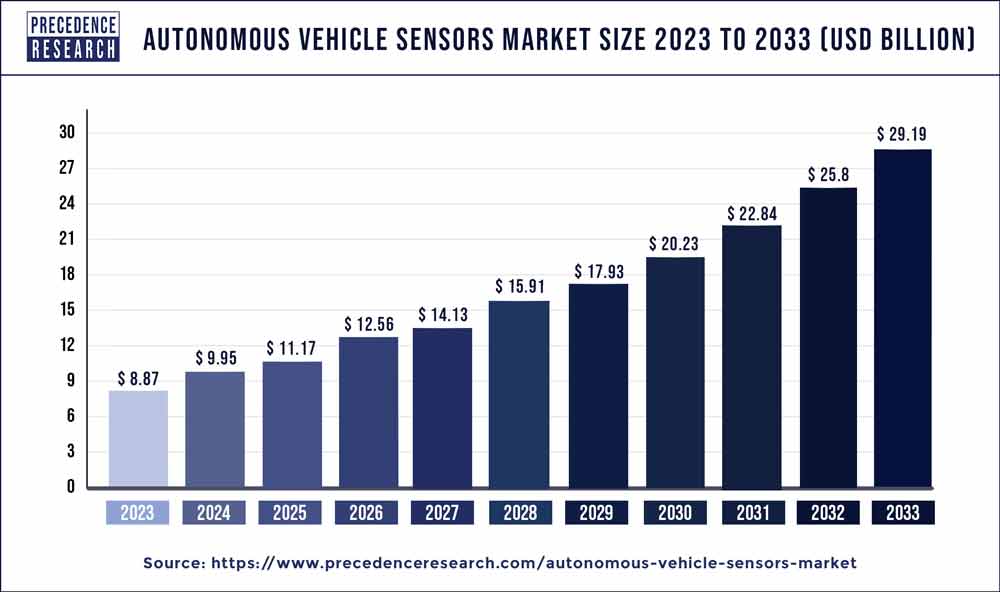

Autonomous Vehicle Sensors Market Size Will be USD 29.19 Bn by 2033

The global autonomous vehicle sensors market size reached USD 8.87 billion in 2023 and is projected to be worth around USD 29.19 billion by 2033, notable at a CAGR of 12.70% from 2024 to 2033.

Key Points

- By type of sensor, the LiDAR segment held the largest share of the market in 2023.

- By vehicle type, the passenger segment is expected to capture a prominent market share during the forecast period.

- By level of automation, the Level 3 segment is expected to capture a substantial market share over the forecast period.

- By application, the obstacle detection segment held the largest share of the market in 2023.

- By region, Europe is expected to hold a prominent market share during the forecast period.

The autonomous vehicle sensors market is witnessing significant growth driven by advancements in sensor technologies and the increasing demand for self-driving vehicles. These sensors play a crucial role in enabling autonomous vehicles to perceive and navigate their surroundings safely and efficiently. With the rapid development of artificial intelligence and machine learning algorithms, autonomous vehicle sensors are becoming more sophisticated, offering enhanced capabilities in perception, decision-making, and control.

Growth Factors

Several factors contribute to the growth of the autonomous vehicle sensors market. Firstly, the escalating investments in research and development activities aimed at improving sensor technologies are driving innovation and pushing the boundaries of autonomous driving capabilities. Additionally, the growing emphasis on safety and regulatory compliance in the automotive industry is fueling the adoption of advanced sensor systems to mitigate the risks associated with autonomous driving. Moreover, the rising consumer acceptance of autonomous vehicles, coupled with the increasing integration of sensor-based features in modern vehicles, is further bolstering market growth.

Get a Sample: https://www.precedenceresearch.com/sample/3766

Autonomous Vehicle Sensors Market Scope

List of Contents

Toggle| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 12.70% |

| Global Market Size in 2023 | USD 8.87 Billion |

| Global Market Size by 2033 | USD 29.19 Billion |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type of Sensor, By Vehicle Type, By Level of Automation, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Autonomous Vehicle Sensors Market Dynamics

Drivers

Key drivers propelling the autonomous vehicle sensors market include the continuous advancements in sensor technology, which are enhancing the accuracy, reliability, and performance of sensor systems in autonomous vehicles. Furthermore, the surging demand for enhanced driving experiences, improved road safety, and reduced traffic congestion is incentivizing automotive manufacturers to integrate a diverse range of sensors into their autonomous vehicle platforms. Moreover, government initiatives promoting the development and deployment of autonomous driving technologies, along with the increasing adoption of electric and connected vehicles, are driving the demand for sensor-based solutions.

Restraints

Despite the promising growth prospects, the autonomous vehicle sensors market faces certain restraints. One significant challenge is the high cost associated with developing and deploying advanced sensor systems, which could limit their adoption, particularly in price-sensitive market segments. Additionally, concerns regarding data privacy and cybersecurity pose significant hurdles to widespread acceptance and deployment of autonomous vehicles. Furthermore, regulatory complexities and uncertainties surrounding liability issues in the event of accidents involving autonomous vehicles remain key obstacles to market expansion.

Opportunities

Despite the challenges, the autonomous vehicle sensors market presents numerous opportunities for growth and innovation. One such opportunity lies in the development of cost-effective sensor solutions capable of meeting the stringent performance requirements of autonomous driving applications. Furthermore, the increasing focus on environmental sustainability and energy efficiency is driving the demand for sensor technologies that enable more efficient and eco-friendly transportation solutions. Additionally, the emergence of new business models and partnerships within the automotive ecosystem, including collaborations between technology companies, automakers, and regulatory bodies, presents opportunities for market players to capitalize on the growing demand for autonomous vehicle sensors.

Read Also: Tumor Ablation Market Size to Attain USD 6.06 Billion by 2033

Recent Developments

- In September 2023, a new collaboration between Mobileye and Valeo is set to provide software-defined, best-in-class imaging radars for automated driving and next-generation driver assistance capabilities. By working together, Valeo and Mobileye can swiftly provide a promising new technology that allows for more intelligent automobiles to automakers throughout the globe. Imaging radar, a crucial component of automated driving sensing systems, will make it possible to implement more sophisticated hands-off ADAS systems and eyes-off automated driving features on highways and city streets.

- In August 2023, the cutting-edge lidar sensors from Hesai Technology, a pioneer in the industry, will be integrated into the NVIDIA DRIVE and NVIDIA Omniverse ecosystems owing to a partnership with NVIDIA. Through the integration of Hesai’s leading-edge lidar sensor technology with NVIDIA’s AI, simulation, and software development platforms, the partnership will open up new avenues for the autonomous driving industry.

- In July 2023, the cutting-edge LeddarVisionTM software from LeddarTech®, an automotive software company that offers patented disruptive low-level sensor fusion and perception software technology for ADAS and AD, announced that it has successfully integrated with Ficosa’s state-of-the-art surround-view camera system, as well as other sensors like radars, IMUs, and GPS. Ficosa is a preeminent international business devoted to the study, creation, manufacturing, and distribution of cutting-edge vision, safety, and efficiency solutions for the vehicle industry. The strategic partnership between Ficosa and LeddarVision to integrate the software into Ficosa’s advanced driving assistance systems (ADAS) for parking was announced in December 2022, and this noteworthy milestone represents a significant step forward in that relationship. Using unprocessed data from sensor systems, LeddarVision is a high-performance software stack for sensor fusion and perception that creates remarkably realistic 3D reconstructions of the environment around the automobile. The full potential of this program to allow Ficosa’s smart parking assistant for ADAS and AD is unlocked by integrating it with Ficosa’s well-known vision technology.

Autonomous Vehicle Sensors Market Companies

- BorgWarner Inc.

- Fujitsu

- NXP Semiconductors

- Asahi Kasei Corporation

- Lumentum Operations LLC

- Valeo

- Continental AG

- Brigade Electronics

- Navtech Radar

- Teledyne Geospatial

Segments Covered in the Report

By Type of Sensor

- RADAR

- LiDAR

- Ultrasound

- Camera

- Others

By Vehicle Type

- Passenger

- Commercial

By Level of Automation

- Level 1

- Level 2

- Level 3

- Level 4

- Level 5

By Application

- Obstacle Detection

- Navigation

- Collision Avoidance

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/