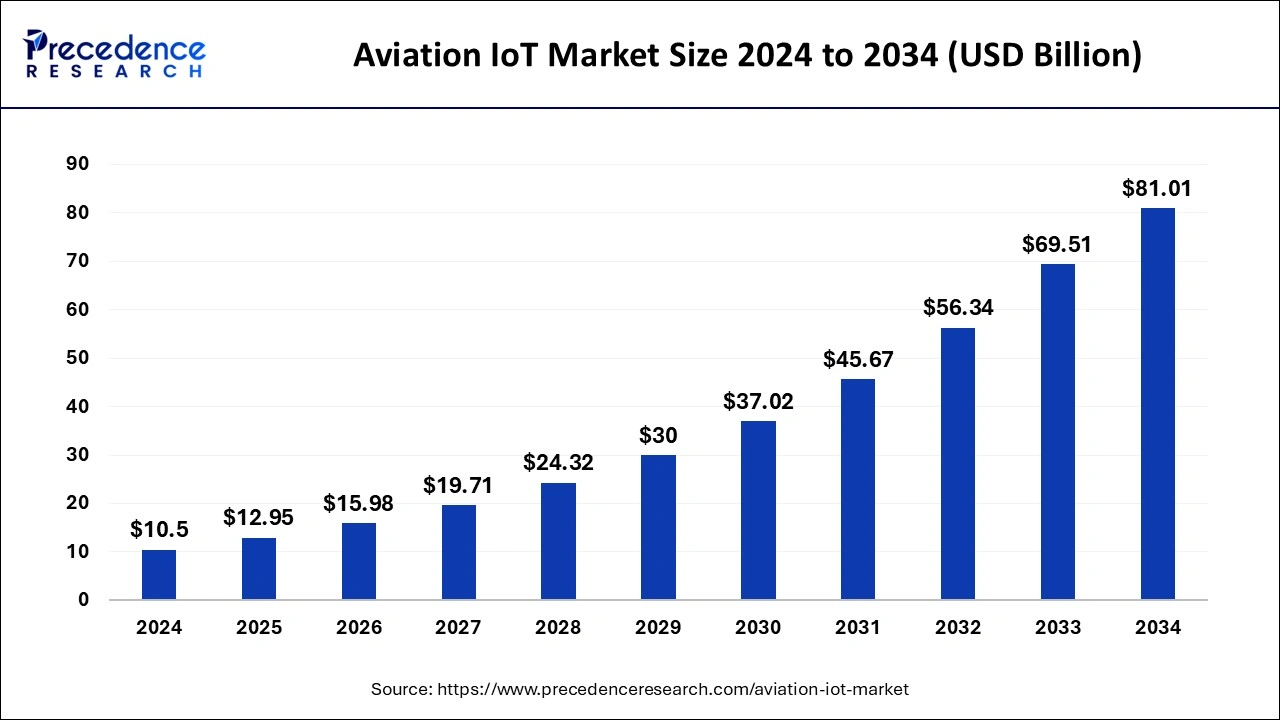

The global aviation IoT market size surpassed USD 8.51 billion in 2023 and is projected to rake around USD 69.51 billion by 2033, expanding at a CAGR of 23.37% from 2024 to 2033.

Key Points

- North America has contributed more than 36% of market share in 2023.

- By application, the asset management segment has held a substantial market share of 31% in 2023.

- By component, the hardware segment has recorded the largest market share of 51% in 2023.

- By end-use, the airport segment has accounted the biggest market share of 36% in 2023.

The Aviation Internet of Things (IoT) market represents a paradigm shift in the aviation industry, leveraging connectivity and data analytics to enhance safety, efficiency, and passenger experience. IoT technologies enable aircraft and ground systems to communicate, collect, and analyze vast amounts of data in real-time, revolutionizing operations, maintenance, and customer service across the aviation ecosystem.

Get a Sample: https://www.precedenceresearch.com/sample/3984

Growth Factors

Several key factors drive the growth of the Aviation IoT market. Firstly, increasing demand for air travel, coupled with the need for operational efficiency and cost optimization, motivates airlines and aviation stakeholders to adopt IoT solutions. Moreover, regulatory initiatives promoting the implementation of connected technologies for enhanced safety and compliance further accelerate market growth. Additionally, advancements in sensor technology, cloud computing, and artificial intelligence empower IoT solutions to deliver actionable insights and predictive analytics, driving their adoption across the aviation sector.

Region Insights

The adoption of Aviation IoT varies across regions, influenced by factors such as regulatory frameworks, infrastructure development, and market dynamics. Developed regions like North America and Europe lead the adoption curve, driven by robust aviation industries, technological innovation, and regulatory support for IoT integration. Emerging markets in Asia-Pacific, Latin America, and the Middle East show significant potential for growth, fueled by expanding air travel demand, infrastructure investments, and increasing awareness of IoT benefits among aviation stakeholders.

Aviation IoT Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 23.37% |

| Global Market Size in 2023 | USD 8.51 Billion |

| Global Market Size by 2033 | USD 69.51 Billion |

| U.S. Market Size in 2023 | USD 2.14 Billion |

| U.S. Market Size by 2033 | USD 17.64 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Application, By End-Use, and By Component |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Aviation IoT Market Dynamics

Drivers:

Several drivers propel the adoption of IoT in the aviation industry. Enhanced operational efficiency and cost savings through predictive maintenance, fuel optimization, and asset tracking drive airlines and operators to invest in IoT solutions. Improved passenger experience, enabled by personalized services, in-flight connectivity, and entertainment options, enhances customer satisfaction and loyalty. Furthermore, regulatory mandates for aircraft tracking, safety monitoring, and data reporting incentivize the adoption of IoT-enabled systems to ensure compliance and enhance aviation safety standards.

Opportunities:

The Aviation IoT market presents numerous opportunities for stakeholders across the value chain. Aircraft manufacturers can integrate IoT technologies into next-generation aircraft designs to offer advanced monitoring, diagnostics, and maintenance capabilities. Airlines and operators can leverage IoT solutions to optimize fleet operations, improve on-time performance, and reduce operational costs. Service providers can offer innovative IoT platforms and solutions tailored to the specific needs of aviation customers, facilitating seamless connectivity and data exchange across diverse systems and devices.

Challenges

Despite its potential, the Aviation IoT market faces several challenges that need to be addressed for widespread adoption. Security and privacy concerns related to data protection, cyber threats, and regulatory compliance pose significant challenges for IoT implementation in aviation. Interoperability issues between legacy systems and IoT platforms require standardization efforts and integration strategies to ensure seamless connectivity and data exchange. Moreover, the complexity of implementing and managing IoT ecosystems across diverse aircraft fleets and operational environments demands skilled workforce, robust infrastructure, and effective change management processes.

Read Also: Surgical Drainage Devices Market Size to Surpass USD 5.05 Bn by 2033

Recent Developments

- January 2024– Airbus opened a new ZEROe Development Center in Stade to develop revolutionary hydrogen technologies.

- In May 2023, the International Civil Aviation Organization (ICAO) released a new set of guidelines for the use of IoT in the aviation industry. The guidelines address a variety of topics, including data security, privacy, and interoperability.

- In April 2023, Delta Air Lines announced that it had installed a new IoT-powered baggage tracking system at its Atlanta airport hub. The system uses sensors to track the location of baggage in real time. This information is used to help passengers track their baggage and to identify any delays or disruptions in the baggage handling process.

- In March 2023, Airbus announced that it had partnered with Palantir Technologies to develop a new IoT platform for the aviation industry. The platform will collect and analyze data from various sources, including aircraft sensors, weather data, and flight schedules. This data will be used to improve the safety and efficiency of Airbus’s operations.

- In February 2023, Lufthansa Technik announced that it had installed a fleet of 500 connected sensors on its aircraft. The sensors will collect data on engine performance, fuel consumption, and other metrics. This data will be used to improve the efficiency and safety of Lufthansa’s operations.

Aviation IoT Market Companies

- Honeywell International, Inc.

- Tata Communication

- Cisco Systems, Inc.

- Huawei Technologies Co. Ltd.

- IBM Corp.

- Aeris Communication

- Microsoft Corp.

- Tech Mahindra Ltd.

- Wind River Systems, Inc.

- SAP SE

Segments Covered in the Report

By Application

- Ground Operations

- Passenger Experience

- Aircraft Operations

- Asset Management

By End-Use

- Airport

- Airline Operators

- MRO

- Aircraft OEM

By Component

- Hardware

- Software

- Service

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/