The Banking Encryption Software market is characterized by robust growth driven by increasing cybersecurity concerns within the financial sector. This software plays a crucial role in safeguarding sensitive financial data, transactions, and communications against unauthorized access and cyber threats. Key drivers include stringent regulatory requirements mandating data protection, rising digital banking adoption, and the escalating frequency and sophistication of cyberattacks targeting financial institutions. The market is segmented by deployment (cloud-based and on-premises), encryption type (file/folder encryption, disk encryption, and communication encryption), and end-user (banks, credit unions, and other financial institutions). As banks worldwide prioritize data security to maintain customer trust and regulatory compliance, the demand for advanced encryption solutions is expected to continue growing significantly.

Download the Sample Report ( Including Full TOC, List of Table & Figures, Chart): https://www.precedenceresearch.com/sample/4574

Banking Encryption Software Market Companies

- McAfee, LLC

- Microsoft

- Sophos Ltd.

- Broadcom

- ESET North America

- IBM Corporation

- Intel Corporation

- Thales Group

- Trend Micro Incorporated

- WinMagic

Banking Encryption Software Market Scope

| Report Coverage | Details |

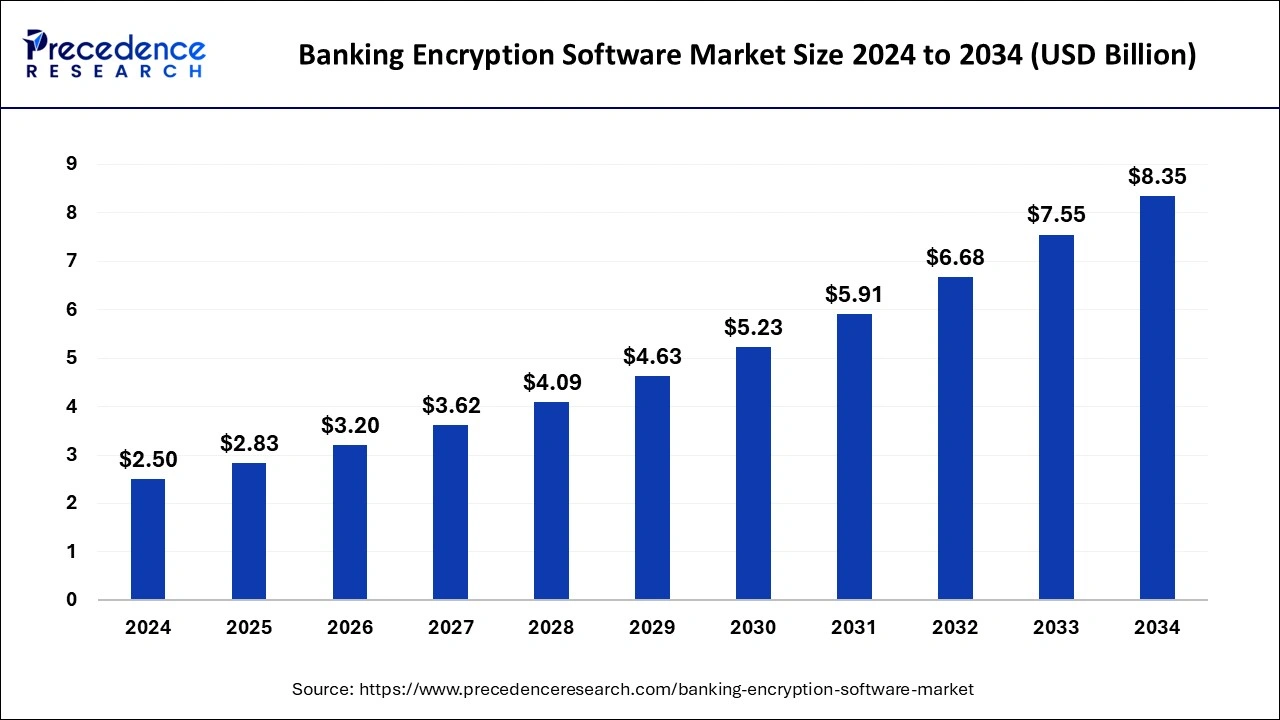

| Market Size by 2033 | USD 7.55 Billion |

| Market Size in 2023 | USD 2.22 Billion |

| Market Size in 2024 | USD 2.50 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 13.05% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Component, Deployment, Enterprise, Function, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Component Insights

This segment encompasses the fundamental building blocks of encryption software, such as encryption algorithms (e.g., AES, RSA), key management systems, secure sockets layer (SSL), and hardware security modules (HSMs). Encryption algorithms form the core of data protection, while key management systems ensure secure key storage and distribution. SSL and HSMs enhance security by encrypting data in transit and protecting cryptographic keys, respectively.

Deployment Insights

The deployment segment includes various models tailored to meet diverse operational needs and security requirements. Options typically include on-premises solutions, where software is installed and managed locally within the financial institution’s infrastructure. Cloud-based deployments leverage remote servers managed by third-party providers, offering scalability, flexibility, and reduced operational costs. Hybrid deployments combine on-premises and cloud solutions, allowing institutions to balance security concerns with the benefits of cloud computing.

Enterprise Size Insights

This segment categorizes users based on their organizational size, including small and medium-sized enterprises (SMEs) and large enterprises. SMEs often seek cost-effective encryption solutions that offer essential data protection capabilities without requiring extensive IT resources. Large enterprises prioritize scalability, integration capabilities with existing systems, and advanced security features to manage vast volumes of financial transactions and customer data securely.

Function Insights

The functional segment defines the specific purposes for which encryption software is employed within banking and financial services. Functions include data encryption to protect sensitive information stored in databases and applications, secure communications to safeguard electronic communications and transactions, and compliance with regulatory standards (e.g., GDPR, PCI DSS) to ensure data privacy and integrity. Additionally, encryption software may facilitate secure access controls, user authentication, and digital signatures to verify the authenticity of financial transactions and communications.

Regional Insights

The Banking Encryption Software Market is witnessing growth across various regions globally. North America leads the market due to stringent regulatory requirements and high adoption of advanced cybersecurity solutions by financial institutions. In Europe, increasing digitalization in banking services and rising concerns over data security are driving market growth. The Asia-Pacific region is experiencing rapid expansion, driven by increasing investments in IT infrastructure and growing awareness about cybersecurity among banking enterprises. Meanwhile, Latin America and the Middle East & Africa regions are also seeing steady growth as financial institutions prioritize data protection measures amidst evolving cyber threats. Overall, the global banking encryption software market is poised for continuous expansion across all major regions, fueled by the escalating need for secure financial transactions and data protection.

Read Also: Nicotine Replacement Therapy Market Size, Report by 2033

Banking Encryption Software Market Dynamics

Market Drivers

The Banking Encryption Software Market is primarily driven by the accelerating adoption of digital banking solutions worldwide. As financial institutions transition to digital platforms for transactions and customer interactions, the demand for robust encryption software increases. This software plays a crucial role in securing sensitive financial data such as account information and transactions from unauthorized access and cyber threats. Moreover, stringent regulatory requirements imposed by authorities like GDPR in Europe and various financial regulatory bodies globally mandate the implementation of encryption software. These regulations compel banks to ensure data protection and privacy, thereby driving the market growth.

Opportunities

Opportunities in the Banking Encryption Software Market are abundant, particularly with the rapid growth of mobile banking and fintech innovations. The popularity of mobile banking apps and digital wallets among consumers necessitates advanced encryption solutions to secure mobile transactions and data effectively. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) into encryption software presents new avenues for enhancing security measures. AI and ML can help in preemptively identifying potential threats and improving the overall efficacy of encryption technologies in safeguarding financial data.

Challenges

Despite its growth prospects, the Banking Encryption Software Market faces several challenges. One significant challenge is the complexity associated with managing encryption across diverse banking systems and networks. Banks often operate a mix of legacy and modern systems, requiring interoperable encryption solutions that can seamlessly secure data across all environments. Furthermore, the evolving nature of cyber threats poses persistent challenges. Hackers continually develop sophisticated methods to exploit vulnerabilities, necessitating constant updates and enhancements to encryption software to stay ahead of potential security breaches.

Recent Developments

- In 2024, Kurdistan International Bank (KIB) partnered with Azentio Software. The partnership involves the implementation of the latest version of Azentio’s core banking platform as a part of a digital evolution.

- In 2024, FBNBank Ghana launched Finacle 11x, a modern banking software, to enhance customer experience with seamless, secure, and personalized services, reflecting its commitment to banking excellence in Ghana.

- In 2024, Raman Research Institute’s qkdSim software, granted an Indian patent, validates Quantum Key Distribution (QKD) experiments via simulation, aiding in the efficient design and deployment of secure communication systems.

Segments Covered in the Report

By Component

By Deployment

By Enterprise

- Large Enterprise

- Small and Medium Enterprise

By Function

- Disk Encryption

- Communication Encryption

- File/Folder Encryption

- Cloud Encryption

By Regional Outlook

- North America: US, and Rest of North America

- Europe: UK, Germany, France, and Rest of Europe

- Asia Pacific: China, Japan, India, and Rest of Asia Pacific

- Latin America: Brazil, and Rest of Latin America

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4574

Web: https://www.precedenceresearch.com/