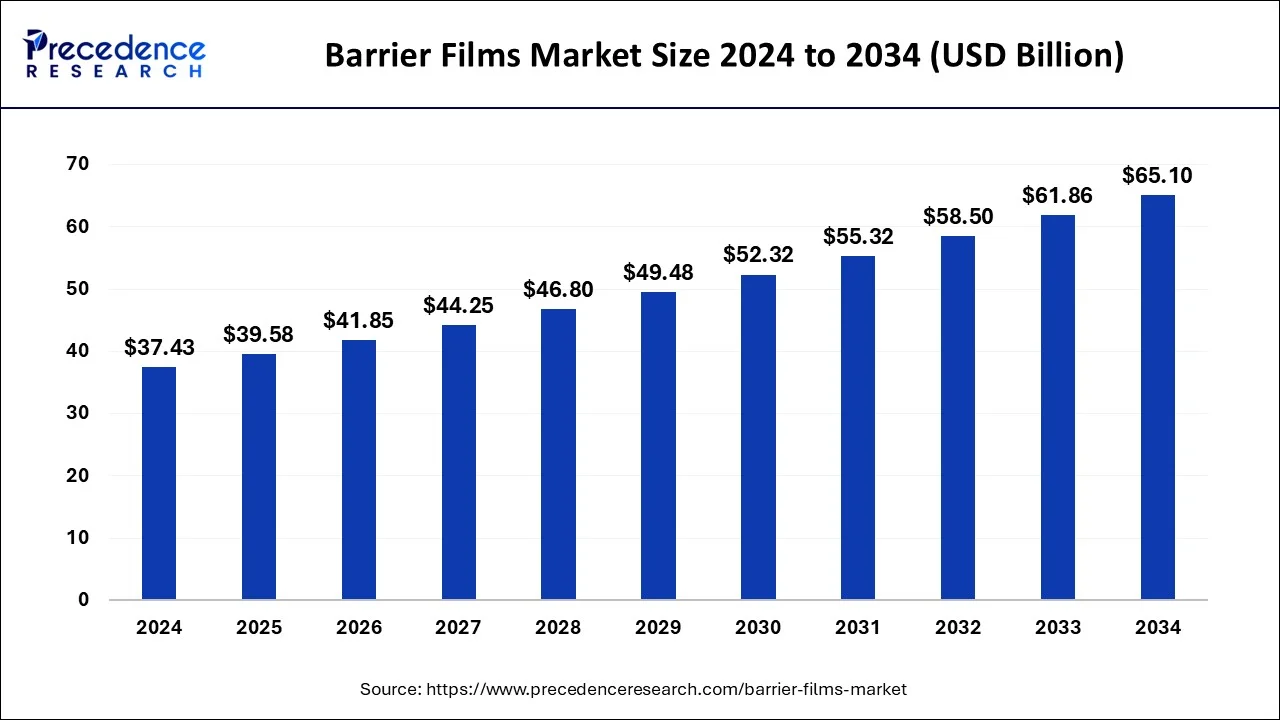

Barrier Films Market Size to Surpass USD 61.86 Billion by 2033

The global barrier films market size surpassed USD 35.40 billion in 2023 and is anticipated to hit around USD 61.86 billion by 2033, growing at a CAGR of 5.74% from 2024 to 2033.

Key Points

- Asia Pacific held the largest share of the barrier films market and is expected to hold the largest share during the forecast period.

- By region, North America is expected to show notable growth during the forecast period.

- By material, the organic coating segment held the largest share of the market.

- By packaging type, the pouches segment had the largest market share in 2023.

- By end use, the agriculture segment held the largest share of the market.

Barrier films are specialized materials designed to protect sensitive products from external factors such as moisture, oxygen, light, and other contaminants. These films find extensive applications across various industries including food packaging, pharmaceuticals, electronics, and agriculture. The barrier films market has witnessed significant growth in recent years due to the increasing demand for longer shelf life, enhanced product protection, and sustainability in packaging solutions.

The global barrier films market is characterized by a diverse range of materials including polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polyvinylidene chloride (PVDC), ethylene vinyl alcohol (EVOH), and others. Each material offers unique barrier properties suitable for different applications and requirements. The market is also driven by advancements in film processing technologies, enabling manufacturers to produce thinner films with improved barrier performance.

Get a Sample: https://www.precedenceresearch.com/sample/4015

Growth Factors:

Several factors contribute to the growth of the barrier films market. Firstly, the rising demand for packaged food and beverages, driven by changing lifestyles and preferences, is fueling the demand for barrier films globally. Additionally, stringent regulations regarding food safety and hygiene further drive the adoption of barrier films in packaging applications. Moreover, increasing awareness among consumers regarding sustainable packaging solutions and the need to reduce food waste has led to the growing demand for recyclable and biodegradable barrier films.

Furthermore, the expanding electronics industry, particularly in emerging economies, is boosting the demand for barrier films used in electronic components packaging to protect sensitive devices from moisture and other environmental factors. Moreover, the pharmaceutical industry’s stringent requirements for packaging sensitive drugs and medical devices also drive the demand for high-barrier films with excellent protective properties.

Region Insights:

The barrier films market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Among these regions, Asia Pacific dominates the market owing to the rapid industrialization, urbanization, and increasing consumer spending on packaged goods in countries like China, India, and Japan. The region is also home to several key manufacturers and suppliers of barrier films, further driving market growth.

North America and Europe also hold significant market shares due to the presence of established packaging industries and stringent regulations regarding food safety and sustainability. Moreover, technological advancements and ongoing research and development activities in barrier film materials and processing techniques contribute to market growth in these regions.

In Latin America and the Middle East and Africa, the barrier films market is witnessing steady growth attributed to the expanding food and beverage industries, increasing disposable incomes, and improving packaging standards. However, challenges such as limited access to advanced technologies and infrastructure constraints hinder market growth in these regions.

Barrier Films Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.74% |

| Global Market Size in 2023 | USD 35.40 Billion |

| Global Market Size by 2033 | USD 61.86 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Material, By Packaging Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Barrier Films Market Dynamics

Drivers:

Several key drivers propel the growth of the barrier films market. One of the primary drivers is the increasing demand for flexible packaging solutions across various end-use industries such as food and beverage, pharmaceuticals, and personal care. Flexible packaging offers several advantages including lightweight, cost-effectiveness, and customization options, driving its adoption and subsequently the demand for barrier films.

Moreover, the growing trend towards convenience packaging, such as single-serve packs and resealable pouches, further boosts the demand for barrier films. These packaging formats enhance product convenience, shelf appeal, and extend shelf life, meeting consumer preferences for on-the-go lifestyles and reducing food wastage.

Additionally, the rising awareness regarding environmental sustainability and the shift towards eco-friendly packaging solutions are driving the demand for bio-based and recyclable barrier films. Manufacturers are increasingly investing in research and development to develop sustainable alternatives to conventional barrier films derived from fossil fuels, thereby reducing carbon footprint and environmental impact.

Opportunities:

The barrier films market presents several opportunities for growth and innovation. One significant opportunity lies in the development of high-performance barrier films with enhanced barrier properties and sustainability features. Innovations in materials science and nanotechnology offer avenues for creating barrier films that are thinner, lighter, and more effective in protecting packaged goods while minimizing environmental impact.

Furthermore, expanding applications of barrier films beyond traditional packaging sectors present new growth opportunities. For instance, the use of barrier films in photovoltaic modules for solar energy applications, and in automotive and aerospace industries for protective coatings and laminates, offers avenues for market expansion and diversification.

Moreover, the growing emphasis on active and intelligent packaging solutions incorporating barrier films with functionalities such as antimicrobial properties, oxygen scavenging, and moisture control presents lucrative opportunities for market players. These advanced packaging technologies help extend product shelf life, improve safety, and enhance consumer experience, thereby driving market growth.

Challenges:

Despite the favorable market conditions, the barrier films industry faces several challenges that may impede growth. One such challenge is the volatility in raw material prices, particularly petroleum-based resins used in the production of barrier films. Fluctuations in crude oil prices and supply chain disruptions can significantly impact manufacturing costs and profit margins for industry players.

Moreover, stringent regulations and compliance requirements regarding food contact materials and packaging safety pose challenges for manufacturers in terms of ensuring regulatory compliance and meeting quality standards. Adhering to these regulations necessitates investments in testing, certification, and quality control measures, which can increase production costs and time-to-market for barrier film products.

Furthermore, the increasing competition in the barrier films market, coupled with price pressures from low-cost alternatives and substitute materials, poses challenges for market players in terms of maintaining profitability and market share. To stay competitive, manufacturers need to continuously innovate, improve product performance, and offer value-added solutions tailored to customer needs.

Read Also: Neurotech Devices Market Size to Hit USD 55.14 Bn by 2033

Recent Developments

- In March 2024, At the CFIA exhibition in Rennes, France, specialty film producer Jindal Films introduced new mono-material barrier film solutions, BICOR 25 and 30 MBH568 films. The solutions for polypropylene (PP) and polyethylene (PE) nanomaterials are intended to assist packaging companies in complying with the impending European mechanical recycling regulations.

- In October 2023, Madura Tea, an Australian company, used Koehler NexPlus Seal Pure MOB 72 gsm flexible paper packaging. German suppliers Gundlach Packaging Group and Koehler Paper provided test materials after promising results.

Barrier Films Market Companies

- Berry Global Inc.

- Amcor Plc

- Sealed Air

- Toppan Printing Co.

- Cosmo Films Ltd.

- Jindal Poly Films Ltd.

Segment Covered in the Report

By Material

- Polyethylene

- Polypropylene

- Polyester

- Polyamide

- Organic Coating

- Inorganic Oxide Coating

By Packaging Type

- Pouches

- Bags

- Blister Packs

By End-use

- Food & Beverage

- Pharmaceutical & Medical

- Electronics

- Agriculture

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/