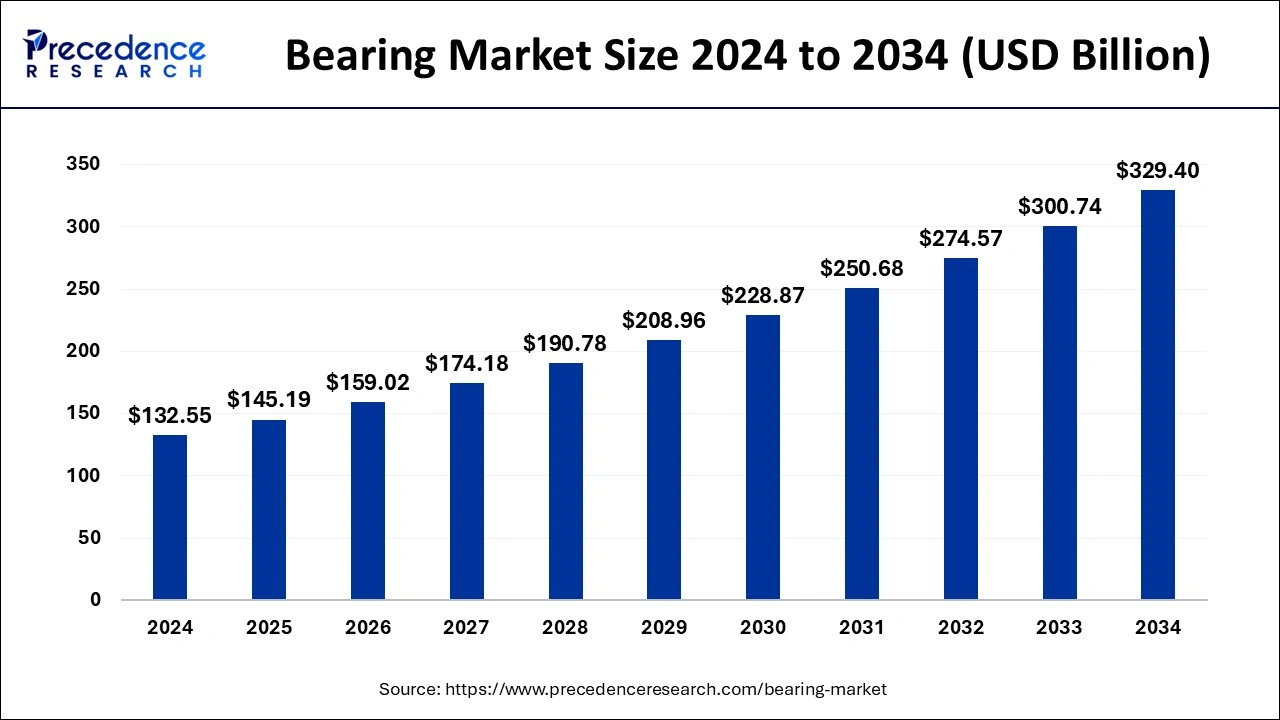

Bearing Market to Reach USD 329.40 Billion by 2034

The global bearing market was valued at USD 132.55 billion in 2024 and is expected to reach USD 329.40 billion by 2034, growing at a CAGR of 9.53%.

The global bearing market is experiencing significant growth, with the market valued at USD 132.55 billion in 2024 and projected to reach USD 329.40 billion by 2034, growing at a notable CAGR of 9.53%. Bearings are essential components used in a wide range of industries, including automotive, industrial machinery, aerospace, and renewable energy. Their primary function is to reduce friction between moving parts, enabling smooth operation and enhancing the efficiency of various machines and equipment. The growth of the bearing market is driven by the increasing demand for high-performance bearings in industries such as automotive and manufacturing, where they are critical to improving machinery efficiency and lifespan. Technological advancements and innovations in bearing materials are also contributing to market expansion, as industries look for more durable, energy-efficient, and sustainable solutions. Furthermore, the rising adoption of electric vehicles (EVs) and renewable energy sources, such as wind power, are driving the demand for specialized bearings, further bolstering market growth.

Bearing Market Key Insights

- Asia Pacific dominated the global bearing market with the largest market share of 41% in 2024.

- The roller bearings segment held the highest market share in 2024.

- The automotive segment captured the largest market share in 2024.

- The railway and aerospace segments are expected to grow significantly during the forecast period.

Bearing Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 329.40 Billion |

| Market Size in 2025 | USD 145.19 Billion |

| Market Size in 2024 | USD 132.55 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.53% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Material, Distribution Channels, Size, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

The bearing market is driven by several factors. The growing demand for high-performance bearings in key industries such as automotive, aerospace, and manufacturing is a significant driver, as these sectors require reliable and efficient components to improve machinery performance and lifespan. The rise of electric vehicles (EVs) is increasing the demand for specialized bearings, particularly for motors, gearboxes, and other EV components. Additionally, the expansion of renewable energy industries, such as wind power, is contributing to the growth of the bearing market, as these sectors rely on durable, high-performance bearings for turbines and other equipment. Technological advancements in bearing design, materials, and manufacturing processes are also fueling market growth, enabling the production of more efficient, durable, and sustainable products. Moreover, the expansion of infrastructure in emerging markets, particularly in Asia Pacific, is boosting demand for bearings in industrial machinery, automotive, and transportation sectors.

Opportunities

- Increasing demand for specialized bearings in the electric vehicle (EV) and renewable energy sectors, such as wind turbines.

- Growth in the automotive sector, driven by advancements in electric vehicles, autonomous cars, and high-performance components.

- Rising infrastructure development in emerging markets, particularly in Asia Pacific, boosting demand for bearings in industrial machinery and transportation.

- Technological advancements leading to the development of more durable, energy-efficient, and cost-effective bearings.

- Growing demand for precision bearings in aerospace, railway, and high-tech applications.

Challenges

- High manufacturing costs for advanced bearings, particularly those used in electric vehicles and renewable energy applications.

- Intense competition from low-cost bearing manufacturers in emerging markets, impacting profit margins for premium products.

- Fluctuating raw material prices, such as steel, can affect bearing production costs and supply chain stability.

- Technological complexity in producing high-performance bearings that meet the specific requirements of industries like aerospace and automotive.

- Environmental concerns and the need for sustainable bearing solutions, requiring investments in green technologies and materials.

Regional Insights

Asia Pacific dominates the global bearing market, accounting for the largest market share of 41% in 2024. The region’s strong industrial base, growing automotive industry, and expanding infrastructure are key factors driving this growth. Countries like China, Japan, and India are witnessing significant demand for bearings in automotive, industrial machinery, and renewable energy sectors. North America also plays a significant role, driven by advancements in manufacturing technologies, aerospace, and the automotive industry, particularly with the rise of electric vehicles.

The U.S. is focusing on innovations in bearing materials and designs to meet the evolving needs of these industries. Europe is another prominent market, with steady demand driven by automotive, industrial equipment, and aerospace sectors. The increasing focus on green energy and sustainability in Europe is also contributing to market growth, especially in renewable energy applications like wind turbines. The Middle East and Africa are emerging markets with growing infrastructure development, leading to increasing demand for bearings in industrial machinery, construction, and transportation sectors.

Read Also: Fresh Food Packaging Market Size Analysis 2022 To 2030

Market Companies

- Schaeffler AG

- RBC Bearings Incorporated

- JTEKT Corporation

- NTN Bearing Corporation

- Danaher

Recent developments in the bearing market include significant advancements in technology and materials to enhance bearing performance and efficiency. Manufacturers are focusing on producing bearings that can withstand higher temperatures, offer longer lifespans, and provide better energy efficiency, particularly for electric vehicles (EVs) and renewable energy applications. The rise of electric vehicles has led to innovations in specialized bearings for motors, gearboxes, and other EV components, with a growing emphasis on reducing friction and improving durability. Additionally, there has been an increased demand for precision bearings in aerospace and railway applications, prompting further R&D in the field. In the renewable energy sector, particularly in wind turbine applications, companies are developing bearings designed to handle the demanding conditions of large-scale turbines. Furthermore, there is growing investment in Asia Pacific, where industrial growth, particularly in China and India, is driving the demand for high-performance bearings. Many bearing manufacturers are also exploring the use of new materials such as ceramic and hybrid bearings to improve efficiency and reduce environmental impact.

Recent Developments

Recent developments in the bearing market include significant advancements in technology and materials to enhance bearing performance and efficiency. Manufacturers are focusing on producing bearings that can withstand higher temperatures, offer longer lifespans, and provide better energy efficiency, particularly for electric vehicles (EVs) and renewable energy applications. The rise of electric vehicles has led to innovations in specialized bearings for motors, gearboxes, and other EV components, with a growing emphasis on reducing friction and improving durability. Additionally, there has been an increased demand for precision bearings in aerospace and railway applications, prompting further R&D in the field. In the renewable energy sector, particularly in wind turbine applications, companies are developing bearings designed to handle the demanding conditions of large-scale turbines. Furthermore, there is growing investment in Asia Pacific, where industrial growth, particularly in China and India, is driving the demand for high-performance bearings. Many bearing manufacturers are also exploring the use of new materials such as ceramic and hybrid bearings to improve efficiency and reduce environmental impact.

Segments Covered in the Report

This research report includes complete assessment of the market with the help of extensive qualitative and quantitative insights, and projections regarding the market. This report offers breakdown of market into prospective and niche sectors. Further, this research study calculates market revenue and its growth trend at global, regional, and country from 2025 to 2034. This report includes market segmentation and its revenue estimation by classifying it on the basis of product, material, application, type, component, distribution channel, and region as follows:

Market Segmentation

By Product Type

- Plain Bearing

- Ball Bearing

- Four-point Contact

- Self-aligning

- Deep Groove

- Angular Contact

- Others

- Roller Bearing

- Others

By Type

- Mounted Bearing

- Unmounted Bearing

By Material

- Metal

- Stainless Steel

- Chrome Steel

- Carbon Steel

- Brass

- Others

- Plastic

- Ceramic

By Distribution Channel

- OEM

- Aftermarker

By Size

- 30 to 40

- 41 to 50

- 51 to 60

- 61 to 70

- 70 & above

By Application

- Electrical

- Construction

- Aerospace

- Automotive

- Power Transmission

- Oil & Gas

By Regional

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America