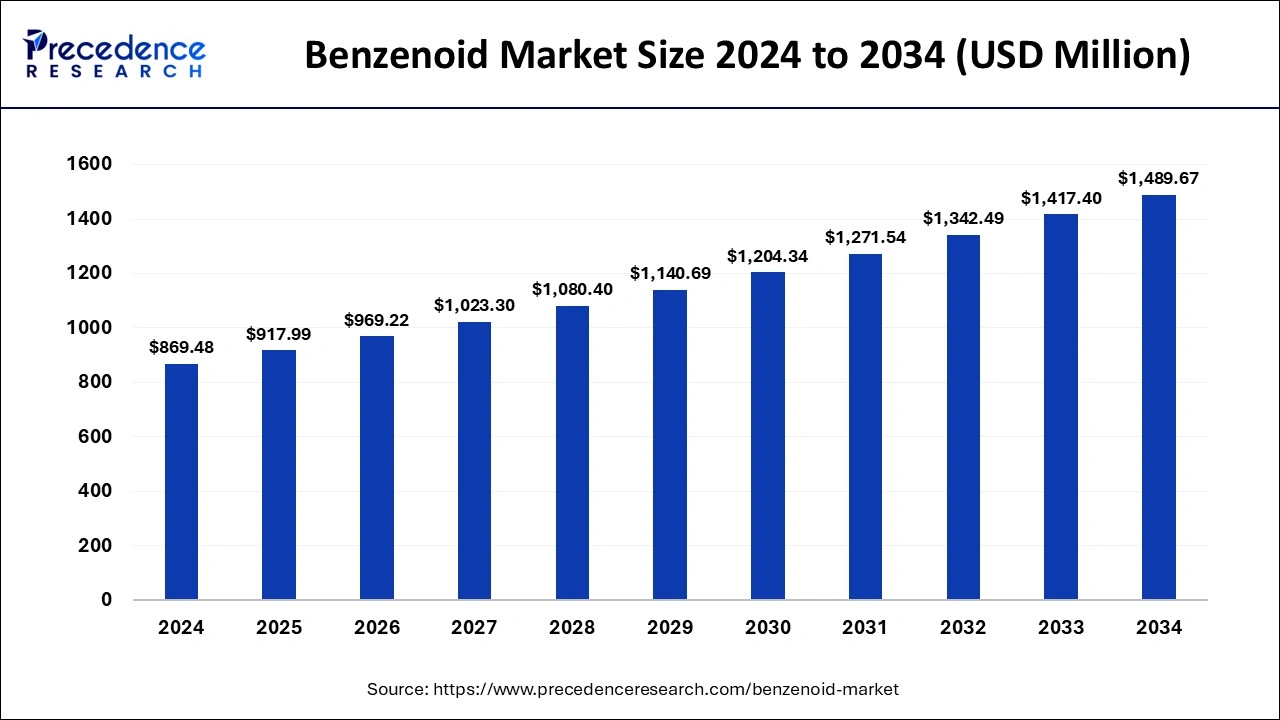

The global benzenoid market size is expected to increase USD 1,417.40 million by 2033 from USD 823.52 million in 2023 with a CAGR of 5.58% between 2024 and 2033.

Key Points

- Asia Pacific led the market with the largest share in 2023.

- By type, the benzaldehyde segment dominated the market in 2023.

- By type, the toluene segment is expected to grow significantly during the forecast period.

- By source, the natural segment dominated the market in 2023.

- By source, the synthetic segment is expected to be the fastest-growing during the forecast period.

- By application, the food and beverages segment dominated the benzenoid market in 2023 and is estimated to be the fastest-growing during the forecast per

The Benzenoid Market encompasses a diverse range of aromatic compounds derived from benzene or closely related structures. These compounds find extensive use in various industries, including fragrance and flavor, pharmaceuticals, and chemicals. The market’s growth is driven by increasing demand for natural and synthetic aroma chemicals due to their wide applications across different sectors.

Growth Factors

Several factors contribute to the growth of the Benzenoid Market. These include the expanding consumer demand for natural and sustainable ingredients in products such as cosmetics and personal care items. Additionally, advancements in chemical synthesis techniques and the growing popularity of premium fragrances are boosting market expansion.

Benzenoid Market Trends

- Growing Demand in Fragrance and Flavor Industries: Benzenoids like benzaldehyde, toluene, and xylene are widely used in fragrances and flavors, driving demand from these industries.

- Shift towards Natural Ingredients: There’s a rising consumer preference for natural ingredients in fragrances and flavors, leading to increased production and use of natural benzenoids sourced from plants.

- Technological Advancements: Innovations in extraction techniques and synthesis methods are improving the efficiency and sustainability of benzenoid production.

- Regulatory Influences: Regulatory changes focusing on environmental impact and safety are prompting manufacturers to adopt greener processes and sustainable sourcing of raw materials.

- Health and Wellness Trends: Benzenoids are also finding applications in pharmaceuticals and personal care products due to their therapeutic properties, aligning with the growing health and wellness trends.

Region Insights

The market’s geographical distribution highlights significant activity in regions like North America, Europe, and Asia-Pacific. North America leads in terms of technological advancements and consumer preference for high-quality fragrances. Meanwhile, Asia-Pacific shows robust growth due to expanding industrial applications and increasing investments in the fragrance and flavor industry.

Benzenoid Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 1,417.40 Million |

| Market Size in 2023 | USD 823.52 Million |

| Market Size in 2024 | USD 869.48 Million |

| Market Growth Rate from 2024 to 2033 | CAGR of 5.58% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Source, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Benzenoid Market Dynamics

Drivers:

Key drivers of the Benzenoid Market include the rising disposable incomes and changing lifestyles that fuel demand for premium personal care products. Moreover, the shift towards natural ingredients in food and beverages drives the adoption of benzenoids as flavor enhancers, propelling market growth further.

Opportunities:

Opportunities in the market abound, particularly in emerging economies where rapid urbanization and industrialization create new avenues for product innovation and market expansion. Furthermore, the growing trend towards organic and natural products presents opportunities for manufacturers to develop sustainable and eco-friendly benzenoid compounds.

Challenges

Despite growth prospects, challenges such as stringent regulatory requirements regarding the use of synthetic chemicals and fluctuations in raw material prices pose significant hurdles for market players. Additionally, environmental concerns and sustainability issues necessitate continuous adaptation and innovation within the industry.

Read Also: Pine Derived Chemicals Market Size to Worth USD 9.06 Bn by 2033

Benzenoid Market Companies

- Evonik Industries AG

- Mitsubishi Chemical Corporation

- SABIC (Saudi Basic Industries Corporation)

- Total S.A.

- INEOS Group Holdings S.A.

- Eastman Chemical Company

- Shell Chemical LP

- LyondellBasell Industries N.V.

- Chevron Philips Chemical Company LLC

- Lanxess AG

- Huntsman Corporation

- Dupont de Nemours, Inc.

- Exxon Mobil Corporation

- Dow Chemical Company

- BASF SE

Recent Developments

- In October 2022, LANXESS a specialty chemical company displayed its portfolio and concentrated expertise in home and personal care formulations like personal care products, cleaners, and detergents at SEPAWA. In those formulations, Purox S (sodium benzoate) and Purox B (benzoic acid) are naturally identical, fully biodegradable, and highly effective preservatives are used. They help to provide effective protection from personal care products and detergents from fungi, bacteria, etc.

- In November 2023, high SPF and effective UVA protection sunscreen ingredients were launched by Croda. The ingredients include benzyl alcohol, stearic acid, titanium oxide, titanium dioxide, etc.

- In January 2024, a global leader in high-performance polymer, Covestro, and the U.S.-based producer of ISCC PLUS-certified circular chemicals, Encina, reached a long-term supply agreement for chemically recycled, circular feedstock obtained from the post-consumer end-of-life plastic. Encina will supply benzene and toluene Covestro for the completion of the world’s world-scale production facility of Encina. The benzene and toluene raw materials are used for the manufacturing of TDI (toluene diisocyanate) and MDI (methylene diphenyl diisocyanate).

Segments Covered in the Report

By Type

- Benzaldehyde

- Benzoic Acid

- Toluene

- Xylene

- Styrene

By Source

- Natural

- Synthetic

By Application

- Flavor and Fragrance

- Food and Beverages

- Pharmaceuticals

- Polymers and Plastics

- Paints and Coatings

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/