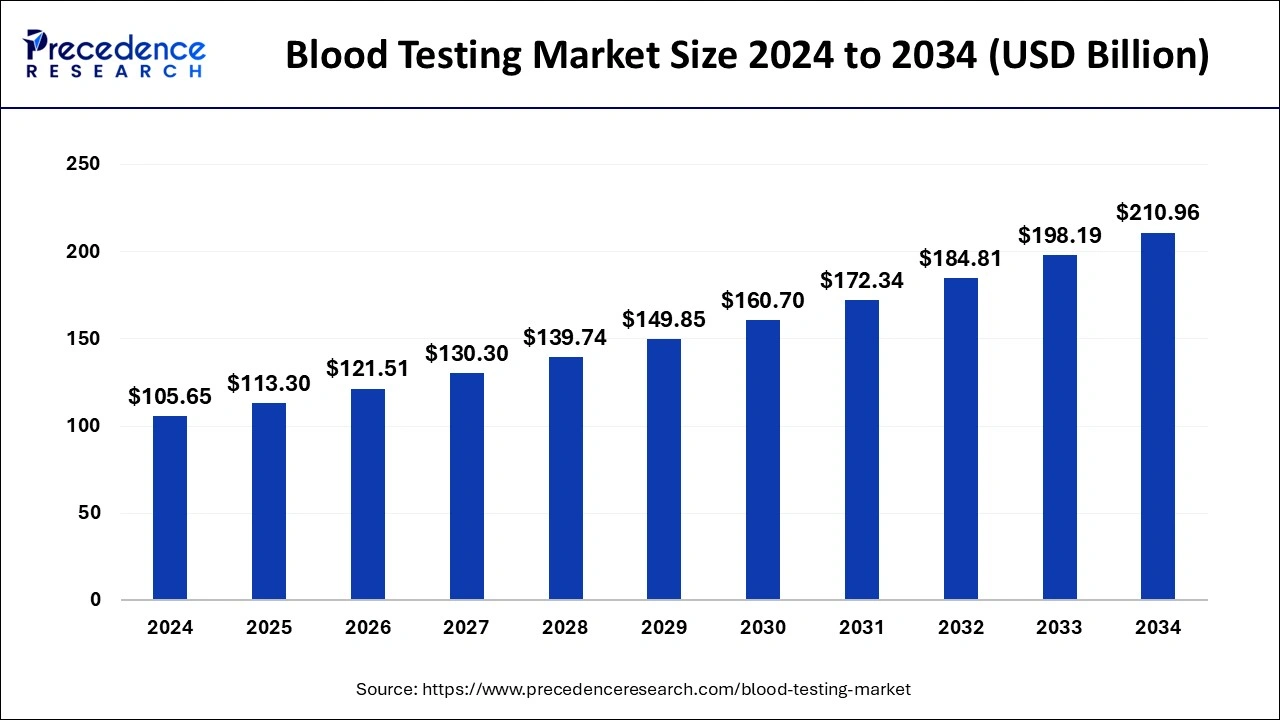

Blood Testing Market Size to Reach USD 198.19 Billion by 2033

The global blood testing market size is expected to increase USD 198.19 billion by 2033 from USD 98.52 billion in 2023 with a CAGR of 7.24% between 2024 and 2033.

Key Points

- The North America blood testing market size is exhibited at USD 43.35 billion in 2023 and is expected to attain around USD 88.19 billion by 2033, poised to grow at a CAGR of 7.36% between 2024 and 2033.

- North America led the market with the largest revenue share of 44% in 2023.

- Asia-Pacific is observed to experience the fastest rate of growth during the forecast period.

- By test type, the glucose segment has contributed more than 18% of revenue share in 2023.

The blood testing market is a critical segment of the healthcare industry, encompassing a wide array of diagnostic tests performed on blood samples to assess various health parameters. These tests play a pivotal role in disease detection, monitoring of chronic conditions, and overall health assessment. Key tests include complete blood count (CBC), blood chemistry tests, blood clotting tests, and tests for infectious diseases such as HIV and hepatitis. With advancements in technology and increasing demand for early disease detection, the blood testing market has experienced substantial growth globally.

Get a Sample: https://www.precedenceresearch.com/sample/4459

Growth Factors

Several factors contribute to the growth of the blood testing market. Firstly, the rising prevalence of chronic diseases such as diabetes, cardiovascular diseases, and cancer necessitates regular blood tests for disease monitoring and management. Additionally, increasing geriatric population globally requires frequent health monitoring, thereby driving demand for blood tests. Technological advancements in blood testing methodologies, such as the introduction of point-of-care testing and molecular diagnostics, have also expanded market opportunities. Moreover, the growing awareness among patients about preventive healthcare and the importance of early diagnosis further fuels market growth.

Regional Insights

The blood testing market exhibits varying dynamics across different regions. In North America, the market is driven by a robust healthcare infrastructure, high healthcare expenditure, and proactive adoption of advanced diagnostic technologies. Europe follows a similar growth trajectory, characterized by a significant focus on research and development in healthcare diagnostics. Asia-Pacific is witnessing rapid market expansion due to improving healthcare infrastructure, increasing disposable income, and rising healthcare spending in countries like China and India. Latin America and the Middle East & Africa regions are also experiencing growth, albeit at a slower pace, influenced by improving access to healthcare services and rising awareness about the importance of diagnostic testing.

Blood Testing Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 98.52 Billion |

| Market Size in 2024 | USD 105.65 Billion |

| Market Size by 2033 | USD 198.19 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 7.24% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Blood Testing Market Dynamics

Drivers

Several drivers propel the growth of the blood testing market. Advancements in technology, such as the development of novel biomarkers and high-sensitivity testing methods, enhance the accuracy and efficiency of blood tests, thereby increasing their adoption. The shift towards personalized medicine and targeted therapies requires precise diagnostic tests, driving demand for specialized blood testing solutions. Furthermore, regulatory initiatives promoting early disease detection and screening programs contribute to market growth. The integration of artificial intelligence and machine learning in blood testing processes is expected to further streamline diagnostic procedures and drive market expansion.

Opportunities

The blood testing market presents numerous opportunities for stakeholders. Expansion into emerging markets offers significant growth prospects, given the increasing healthcare investments and improving healthcare infrastructure in these regions. The rise of direct-to-consumer testing services and telehealth platforms facilitates easier access to blood testing services, especially in remote or underserved areas. Collaborations between diagnostic companies and pharmaceutical firms for companion diagnostics and clinical trial support present avenues for market expansion. Additionally, the growing trend towards home-based testing kits and self-monitoring devices opens up new consumer markets and revenue streams for market players.

Challenges

Despite the promising growth prospects, the blood testing market faces several challenges. Regulatory complexities and stringent approval processes for new diagnostic tests can hinder market entry and product commercialization. Reimbursement issues and pricing pressures in healthcare systems globally pose challenges to market penetration and profitability for blood testing companies. Moreover, concerns regarding patient data privacy and confidentiality in the era of digital health pose ethical and operational challenges. Ensuring the accuracy and reliability of test results amidst variability in sample quality and testing conditions remains a persistent challenge for diagnostic laboratories.

Read Also: Artificial Intelligence (AI) in Epidemiology Market Size, Report By 2033

Blood Testing Market Companies

- Abbott

- F. Hoffmann-La Roche AG

- Bio-Rad Laboratories, Inc.

- BioMerieux SA

- Quest Diagnostics

- Biomerica, Inc.

- Becton, Dickinson and Company

- Siemens Healthineers

- Danaher Corporation

- Trinity Biotech Plc

- Sinocare Inc

- Becton Dickson & Company

Recent Developments

- In April 2024, Quest Diagnostics launched a p-tau217 blood biomarker test. This test is done to diagnose patients suffering from Alzheimer’s Disease.

- In March 2024, Labcorp launched the pTau217 blood biomarker test. This test will help to identify the prevalence of Alzheimer’s disease among the patients.

- In December 2023, Savara launched a new blood test for treating patients suffering from lung disorders. The blood test is named ‘aPAP ClearPath’ that can help doctors to treat patients suffering from rare lung diseases called ‘autoimmune pulmonary alveolar proteinosis (aPAP).

- In August 2023, C2N Diagnostics launched the PrecivityAD2 blood test. This blood test is done to assess patients suffering from mild Alzheimer’s disease.

- In July 2023, Quanterix Corporation launched a new biomarker blood test for diagnosing Alzheimer’s disease. This test is named ‘LucentAD’, and it helps in diagnosing patients experiencing cognitive symptoms of Alzheimer’s disease.

- In March 2023, Abbott announced that the U.S. Food and Drug Administration (FDA) had approved laboratory traumatic brain injury (TBI) blood tests in the U.S.. This new blood test method will help to reduce the waiting times in hospitals and replace CT scans for examining mild traumatic brain injuries.

Segments Covered in the Report

By Test Type

- Glucose Testing

- A1C Testing

- Direct LDL Testing

- Lipid Panel Testing

- Prostate-specific Antigen Testing

- COVID-19 Testing

- BUN Testing

- Vitamin D Testing

- Thyroid-stimulating Hormone (TSH)

- Serum Nicotine/Cotinine

- High-sensitivity CRP Testing

- Testosterone Testing

- ALT Testing

- Cortisol Testing

- Creatinine Testing

- AST Testing

- Other Blood Tests

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/