Cancer Biologics Market Size to Surpass USD 214.59 Bn by 2033

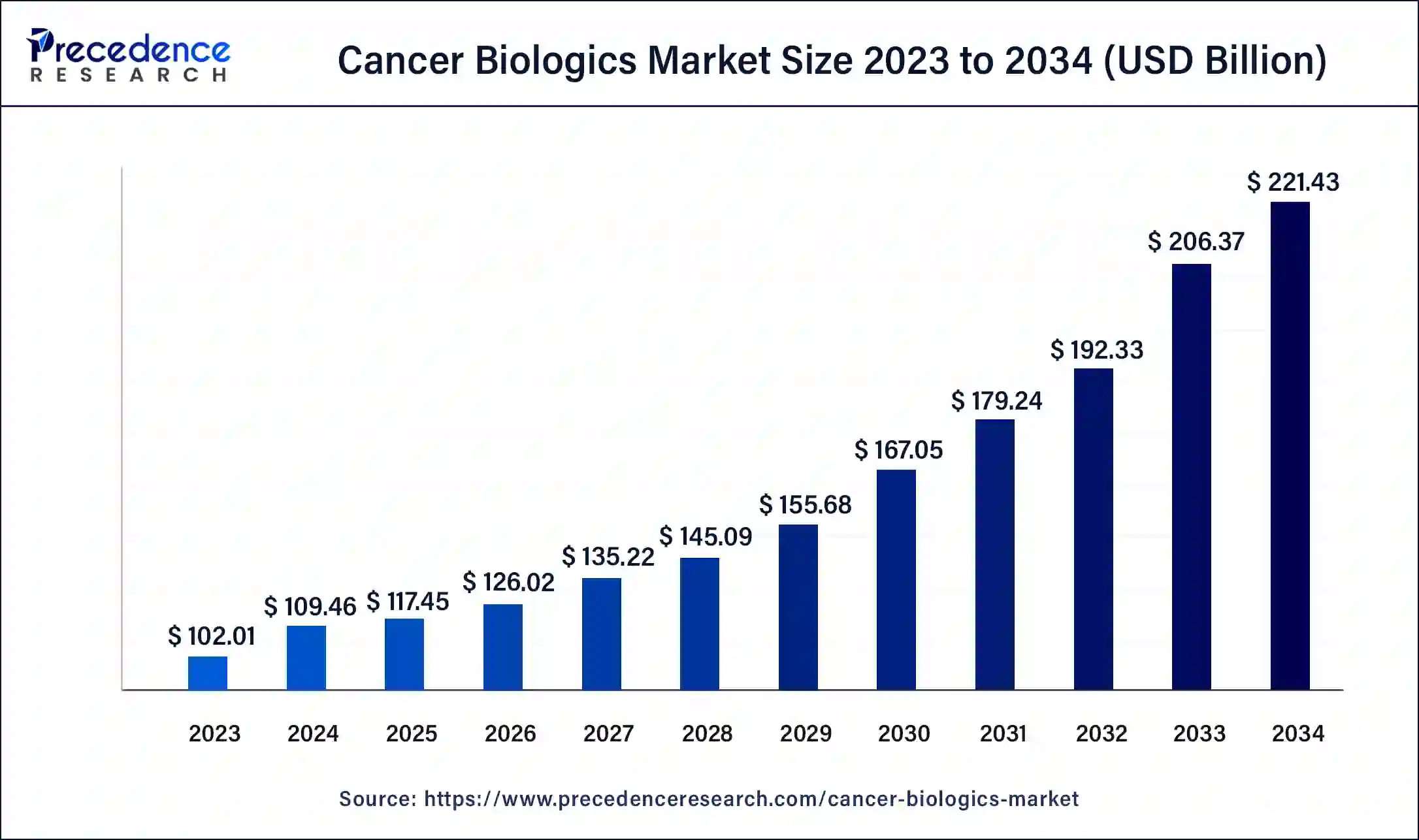

The global cancer biologics market size surpassed USD 102.01 billion in 2023 and is anticipated to attain around USD 214.59 billion by 2033, growing at a CAGR of 7.12% from 2024 to 2033.

Key Points

- North America dominated the cancer biologics market in 2023

- Asia Pacific is expected to grow steadily in the market during the forecast period.

- The monoclonal antibodies segment dominated the market by drug class in 2023.

- The cancer growth inhibitors segment is expected to grow to the highest CAGR in the market by application during the forecast period.

- The blood cancer segment dominated the market by application in 2023.

- The lung cancer segment is expected to grow to the highest CAGR in the market by application during the forecast period.

- In 2023, the hospital segment dominated the market by end-use.

- The cancer center segment is expected to grow to the highest CAGR in the market by end-use during the forecast period.

The Cancer Biologics Market has witnessed substantial growth in recent years, driven by a myriad of factors contributing to its expansion. Biologics, which are biological products derived from living organisms, have emerged as a promising avenue in the treatment of cancer due to their targeted mechanisms of action and reduced toxicity compared to traditional chemotherapy. This market encompasses a wide range of biologic therapies including monoclonal antibodies, cancer vaccines, cytokines, and targeted therapies, all designed to combat various forms of cancer.

Get a Sample: https://www.precedenceresearch.com/sample/4005

One of the primary growth factors fueling the expansion of the Cancer Biologics Market is the increasing prevalence of cancer worldwide. With cancer incidence rates on the rise globally, there is a growing demand for innovative and effective treatment options. Biologics offer a personalized approach to cancer therapy by targeting specific molecules and pathways involved in tumor growth, thereby improving treatment outcomes and patient survival rates.

Regionally, North America dominates the Cancer Biologics Market, driven by factors such as advanced healthcare infrastructure, high healthcare expenditure, and early adoption of biologic therapies. The presence of key market players and robust research and development activities further contribute to the region’s leadership position in the market. Europe follows closely, with significant investments in cancer research and a favorable regulatory environment supporting the development and commercialization of biologic therapies.

Cancer Biologics Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.12% |

| Global Market Size in 2023 | USD 102.01 Billion |

| Global Market Size by 2033 | USD 214.59 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Drug Class, By Applications, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cancer Biologics Market Dynamics

Several drivers propel the growth of the Cancer Biologics Market, including ongoing advancements in biotechnology, increasing investments in oncology research, and a growing focus on precision medicine. The development of novel biologic agents targeting specific cancer biomarkers holds promise for personalized cancer treatment, driving the demand for biologic therapies. Additionally, collaborative efforts between pharmaceutical companies and research institutions are fostering innovation in cancer biologics, leading to the introduction of novel treatment modalities.

Opportunities abound in the Cancer Biologics Market, particularly in emerging economies where the burden of cancer is rising rapidly. With improving healthcare infrastructure and increasing access to healthcare services, these regions present untapped potential for market expansion. Moreover, the growing trend towards combination therapies involving biologics, chemotherapy, and immunotherapy opens up new avenues for market players to explore, offering enhanced therapeutic outcomes for cancer patients.

However, the Cancer Biologics Market is not without its challenges. High costs associated with biologic therapies pose a significant barrier to access, particularly in developing countries where affordability remains a concern. Moreover, the complex manufacturing processes involved in biologics production and the stringent regulatory requirements for approval present challenges for market entrants. Additionally, the emergence of biosimilars poses a threat to market incumbents, leading to pricing pressures and market competition.

Read Also: Urinalysis Market Size to Surpass USD 3.65 Billion by 2033

Recent Developments

- Dr. Reddy’s Laboratories declared in March 2024 that Versavo® (bevacizumab) would be available in the UK. Avastin’s biosimilar Versavo is effective against multiple cancer types, such as advanced non-squamous non-small cell lung cancer, metastatic colorectal cancer, ovarian cancer, recurrent glioblastoma, metastatic renal cell carcinoma, advanced cervical cancer, and metastatic breast cancer.

- BioNTech and Duality Biologics declared in January 2024 that a Phase III trial of a medication for breast cancer has begun. BioNTech and Duality are conducting a Phase III trial to evaluate their antibody-drug conjugate in patients whose tumors have low levels of progesterone or estrogen and respond to these hormones. This corresponds to between 40% and 45% of patients with metastatic breast cancer who are on Herceptin for HER2.

- Angle, a liquid biopsy firm that provides diagnostic solutions for circulating tumor cells (CTCs) in drug development, research, and clinical oncology, announced in November 2023 that the Portrait PD-L1 test would be available for CTCs to assess PD-L1 protein expression.

- In April 2023, TORL BioTherapeutics LLC, a biopharmaceutical company focused on developing new biologics for cancer treatment, announced its public launch and the closing of a $158 million Series B financing.

Cancer Biologics Market Companies

- Abbott

- Angel

- Amgen, Inc

- AstraZeneca

- BioNTech

- Bristol-Mayer Squibb Company

- Dr. Reddy’s Laboratories

- Duality Biologics

- Eli Lilly and Company

- F.Hoffmann-La Roche Ltd.

- Gilead Sciences, Inc.

- Glenmark Pharmaceuticals Ltd

- GSK plc.

- Ichnos Sciences Inc

- Johnson & Johnson Services, Inc

- Pfizer, Inc

- TFC Therapeutics

Segments Covered in the Report

By Drug Class

- Monoclonal Antibodies

- Naked Monoclonal Antibodies

- Conjugated Monoclonal Antibodies

- Bispecific Monoclonal Antibodies

- Cancer Growth Inhibitors

- Tyrosine Kinase Inhibitor

- Mtor Inhibitors

- Proteasome Inhibitors

- Others

- Vaccines

- Preventive Vaccines

- Therapeutic Vaccines

- Recombinants Proteins

- CAR-T Cells

- Angiogenesis Inhibitors

- Interleukins (IL)

- Interferons (IFN)

- Gene Therapy

- Others

By Applications

- Blood Cancer

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Prostate Cancer

- Gastric Cancer

- Ovarian Cancer

- Skin Cancer

- Liver Cancer

- Others

By End use

- Hospitals

- Cancer Center

- Academics & Research Institutes

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/