Cellular Health Screening Market Size, Share, Report by 2033

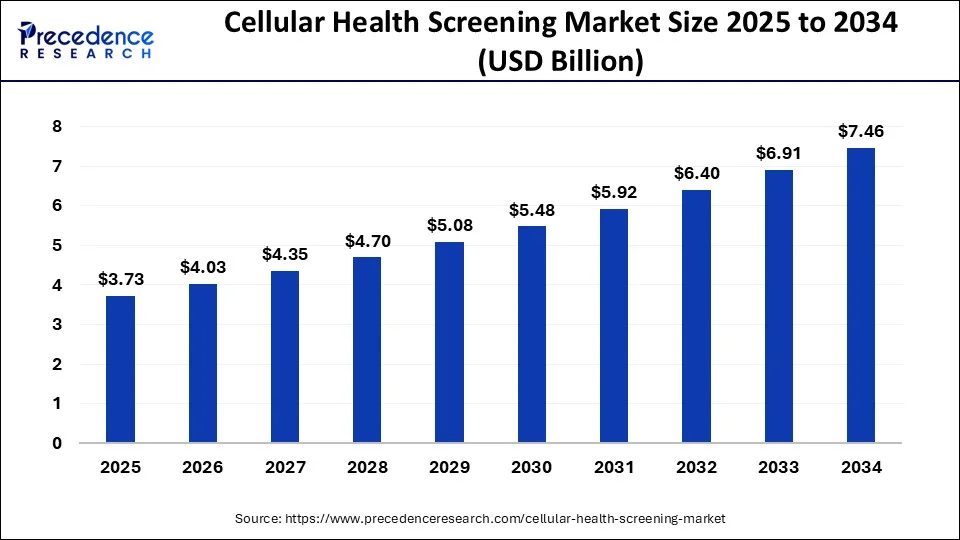

The global cellular health screening market size surpassed USD 3.20 billion in 2023 and is expected to be worth around USD 6.80 billion by 2033, growing at a CAGR of 7.82% from 2024 to 2033.

Key Points

- North America led the global cellular health screening market in 2023 and accounted for a 50% revenue share.

- Asia Pacific is anticipated to be the fastest-growing region in the forecast period.

- By test type, in 2023, the single test panels segment accounted market share of around 79.20%.

- By sample type, in 2023, the blood samples segment held the majority share of over 47.85%.

- By collection site, the hospital segment accounted for the largest share of 39.50% in 2023.

The cellular health screening market is a rapidly growing sector within the broader healthcare industry. Cellular health screening involves the evaluation of the health of cells, the basic building blocks of living organisms. This screening can provide vital information about an individual’s overall health, including potential risks for diseases and the effectiveness of treatments. The market for cellular health screening includes various tests and methodologies aimed at assessing cellular health, such as telomere length testing, oxidative stress testing, mitochondrial function testing, and others. These tests are used for both diagnostic and preventive purposes, aiding in the early detection and management of diseases such as cancer, cardiovascular diseases, and neurological disorders.

Get a Sample: https://www.precedenceresearch.com/sample/4079

Growth Factors

The cellular health screening market is experiencing growth due to several factors:

- Rising Prevalence of Chronic Diseases: The increasing occurrence of chronic conditions such as cancer, diabetes, and cardiovascular diseases has driven the demand for early and accurate diagnostic tools, including cellular health screening.

- Technological Advancements: Rapid progress in biotechnology and molecular biology has led to the development of more accurate and efficient cellular health screening tests, making them more accessible to healthcare providers and patients.

- Aging Population: As the global population ages, there is a greater need for health screening to detect and manage age-related conditions, fueling demand for cellular health screening.

- Growing Awareness of Preventive Healthcare: There is a rising awareness among the general public about the importance of preventive healthcare. Cellular health screening can help identify potential health issues early, enabling proactive management.

- Increased Investment in Research and Development: Companies and research institutions are investing in the development of new cellular health screening tests and technologies, expanding the market.

Region Insights

The market exhibits varying growth rates across different regions:

- North America: North America dominates the cellular health screening market due to its advanced healthcare infrastructure, higher healthcare spending, and strong presence of key market players. The region’s focus on research and development also contributes to its leading position.

- Europe: Europe follows closely, with a mature healthcare system and increasing adoption of advanced diagnostic tests. Countries like Germany and the UK are major contributors to the European market.

- Asia-Pacific: The Asia-Pacific region is expected to witness significant growth due to its large population, rising disposable income, and increasing awareness of preventive healthcare. Countries such as China and India are driving the market in this region.

- Latin America and Middle East & Africa: These regions are still emerging markets for cellular health screening. However, increasing investments in healthcare infrastructure and growing awareness are expected to drive growth in the coming years.

Cellular Health Screening Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.82% |

| Global Market Size in 2023 | USD 3.20 Billion |

| Global Market Size in 2024 | USD 3.45 Billion |

| Global Market Size by 2033 | USD 6.80 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Test Type, By Sample Type, and By Collection Site |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cellular Health Screening Market Dynamics

Drivers

Key drivers of the cellular health screening market include:

- Demand for Personalized Medicine: Cellular health screening tests provide precise information about an individual’s cellular condition, enabling personalized treatment plans and interventions.

- Growth in Preventive Healthcare: The emphasis on preventive healthcare and early diagnosis is boosting the demand for cellular health screening.

- Technological Advancements: Innovations in molecular biology and genetic testing have led to more sophisticated and efficient cellular health screening tests.

- Regulatory Approvals and Reimbursement Policies: Favorable regulatory approvals and reimbursement policies are encouraging the adoption of cellular health screening tests.

- Awareness Campaigns: Initiatives to raise awareness about the benefits of cellular health screening are expanding the market’s reach.

Opportunities

The cellular health screening market offers several opportunities for growth:

- Expansion into Emerging Markets: Companies can tap into emerging markets such as Asia-Pacific and Latin America to expand their customer base.

- Development of Advanced Screening Technologies: Continued investment in research and development can lead to the creation of new and more advanced cellular health screening tests.

- Integration with Digital Health Platforms: Integration with digital health platforms can enhance the accessibility and convenience of cellular health screening tests.

- Partnerships and Collaborations: Strategic partnerships and collaborations between research institutions, healthcare providers, and market players can drive innovation and market penetration.

- Telehealth and Remote Monitoring: The rise of telehealth and remote monitoring solutions provides opportunities for offering cellular health screening services to a broader audience.

Challenges

Despite the growth potential, the cellular health screening market faces several challenges:

- High Cost of Testing: The cost of cellular health screening tests can be prohibitive for some patients, limiting market growth.

- Regulatory Hurdles: Strict regulatory requirements for diagnostic tests can slow down the introduction of new tests to the market.

- Limited Awareness: Although awareness is increasing, there is still a lack of understanding about cellular health screening among the general public.

- Technical Complexity: The technical complexity of cellular health screening tests may pose challenges for healthcare providers in terms of implementation and interpretation.

- Competition from Alternative Diagnostic Tests: The market faces competition from other diagnostic tests and screening methods, which may offer similar insights at a lower cost.

Read Also: Airport 4.0 Market Size, Share, Trends, Report by 2033

Recent Developments

- In July 2023, Regenerus Labs launched the TruAge Complete test, a sophisticated epigenetic test that provides an accurate, complete, and actionable study of a patient’s biological aging and health insights.

- In April 2023, Virtua Health introduced a mobile health and cancer screening unit to increase accessibility to crucial cancer diagnostics.

- In January 2023, Atomo Diagnostics, an Australian diagnostic company, established a long-term partnership with NG Biotech SAS to produce and distribute rapid blood-based pregnancy tests for both home and professional usage in prominent markets.

- In May 2022, QIAGEN NV unveiled the QIAstat Dx Rise and enhanced panels, which feature a closed system for hands-off sample preparation and processing, offering improved convenience for users.

Cellular Health Screening Market Companies

- Life Length

- SpectraCell Laboratories, Inc.

- RepeatDx

- Cell Science Systems

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings

- OPKO Health, Inc.

- Genova Diagnostics (GDX)

- Immundiagnostik AG

- DNA Labs India

Segments Covered in the Report

By Test Type

- Single Test Panels

- Telomere Tests

- Oxidative Stress Tests

- Inflammation Tests

- Heavy Metals Tests

- Multi-test Panels

By Sample Type

- Blood

- Saliva

- Serum

- Urine

By Collection Site

- Home

- Office

- Hospital

- Diagnostic Labs

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/