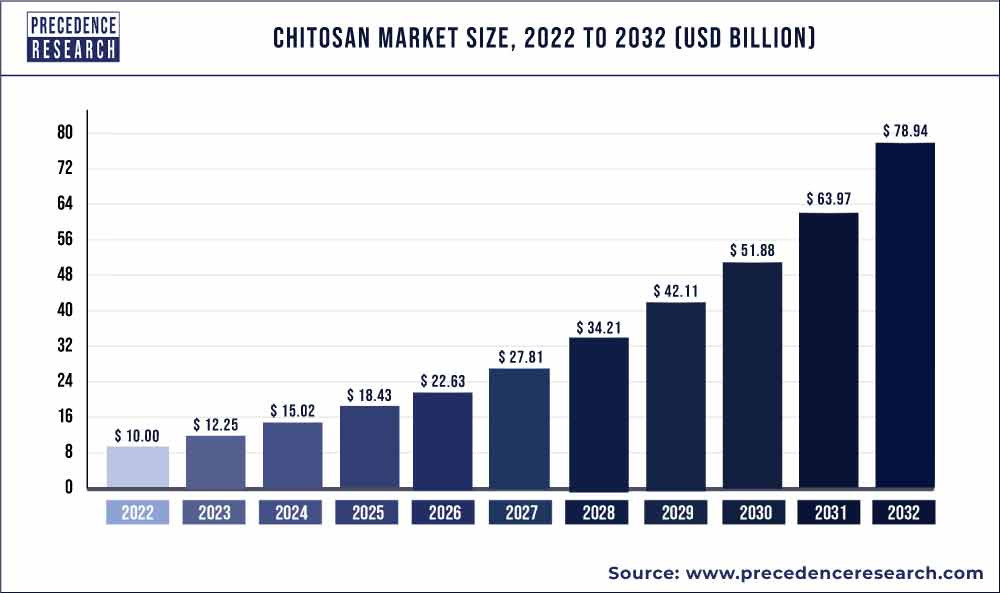

According to Precedence Research, The Chitosan Market size garnered US$ 7 billion in 2021 and is expected to generate US$ 27.36 billion by 2030, manifesting a CAGR of 25% from 2021 to 2030. The report contains 150+ pages with detailed analysis.

The base year for the study has been considered 2021, the historic year 2019 and 2020, the forecast period considered is from 2021 to 2030. The Chitosan market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

Chitosan is a sugar derived from the tough outer skeletons of shellfish such as crab, lobster, and shrimp. It is utilized in medicine. Chitosan is used to treat hypertension, high cholesterol, obesity, wound healing, and other ailments, however there is no scientific proof to back up many of its claims. Chitosan is used in pharmaceutical manufacture as filler in tablets, to improve the way certain medications dissolve, and to conceal bitter flavors.

Download the FREE Sample Report (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1335

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers, novel product introductions and developments, promotion strategies and Research and Development (R&D) activities in the marketplace. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing. The competitive profiling of these players includes business and financial overview, gross margin, production, sales, and recent developments which can aid in assessing competition in the market.

Some of the major players in the global Chitosan market include:

- Primex EHF

- Heppe Medical Chitosan GmbH

- Vietnam Food

- KitoZyme S.A.

- Agratech

- Advanced Biopolymers AS (Norway)

- BIO21 Co., Ltd.

- G.T.C. Bio Corporation

- Taizhou City Fengrun Biochemical Co., Ltd.

- Zhejiang Golden-Shell Pharmaceutical Co., Ltd.

- Biophrame Technologies

- Heppe Medical Chitosan GmbH

- Meron Biopolymer

- Qingdao Yunzhou Biochemistry Co.

- Golden-Shell Pharmaceutical Co. Ltd

- FMC Corp.

Chitosan Market Scope

This market report studies market dynamics, status and outlook especially in North America, Europe and Asia-Pacific, Latin America, the Middle East and Africa. This research report offers scenario and forecast (revenue/volume), and categorizes the market by key players and various segment. This report also studies global market prominence, competitive landscape, market share, growth rates market dynamics such as drivers, restraints and opportunities, and distributors and sales channels.

This research study also integrates Industry Chain analysis and Porter’s Five Forces Analysis. Further, this report offers a competitive scenario that comprises collaborations, market concentration rate and expansions, mergers & acquisitions undertaken by companies.

Crucial factors accountable for market growth are:

- The increasing demand of Chitosan in the end user industries

- Rising water treatment activities at the global level

- Significant progress in the healthcare/medical industry in industrialized countries

- Rising obesity and overweight rates in the region, as well as increased public health awareness

Chitosan Market Report Highlights

- Based on the sources, the Chitosan market is dominated by shrimp followed by crab. Shrimp is considered the primary source of chitosan because it contains approximately 25% to 40% chitin, whereas crab shell contains approximately 15% to 20%.

- The waste water segment is the most prominent segment in the market which contributed largest share in the Chitosan market. Nations have enacted stringent regulations prohibiting the pollution of naturally occurring water bodies and the illegal discharge of wastewater which will create a positive impact on the Chitosan market.

Browse Healthcare Research Reports @ https://www.marketstatsnews.com/healthcare/

Chitosan Market Dynamics

Driver

Increasing demand of Chitosan in Cosmetics Industry

Skincare is the fastest expanding segment of the beauty business. In the United States, sales of skincare products increased by 13% last year, while makeup sales increased by only 1%. During that time, online beauty businesses rose by 24 percent, with skincare leading the way. Net-a- The bestselling category in Porter’s beauty department is skincare, which has grown 40 percent year over year. According to L’Oréal, skincare accounts for 40% of the beauty market but accounts for approximately 60% of global cosmetics industry growth. Chitin, chitosan, and its derivatives are widely utilized in cosmetics, owing to their antioxidant, cleaning, protective, humectant, and antioxidant properties. Because of its particular benefits in the cosmetics sector, the increased demand for skincare in the cosmetics market will have a significant impact on the chitosan market.

Restraint

High production cost owing to the irregular supply of the raw material

The irregular supply of raw materials will hamper the chitosan market growth. India’s shrimp exports fell 14 percent year on year to 575,000 MT in 2020, with the United States, China, and the European Union remaining the country’s top clients. Its raw peeled product sales fell 12% to 21,200 MT last year, while its overall exports of cooked and other value-added products to the US grew. Ecuador, which increased sales of raw peeled products by 15,000 MT, compensated for its decrease in output on the worldwide market. Ecuador increased its shipments of mid-sized shrimp to the United States significantly last year, whereas India lost 14 percent of its market share in the United States. India also lost market share in the shell-on market in the United States to Ecuador and Indonesia.Such irregularities in the raw materials supply, the overall value chain may hamper which in turn hamper the chitosan overall production volume.

Opportunities

Increasing obesity and overweight issues in the region and rising health awareness among people

The region’s expanding obesity and overweight issues, as well as people’s growing health consciousness, will generate prospects for the chitosan industry. According to the Institute of Health Metrics and Evaluation, around 30.0 percent of the world’s population is fat or overweight. According to the CDC, roughly 93 million Americans over the age of 20, or nearly 40% of the U.S. population, have excessive cholesterol, putting them at an elevated risk of heart disease and stroke. Western European countries with the highest cholesterol levels in the world, such as Greenland, Iceland, Andorra, and Germany, have mean blood total cholesterol levels of roughly 5.5 mmol/L.Early study suggests that consuming chitosan orally may lower cholesterol, aid to repair anemia, and enhance physical strength, appetite, and sleep in persons on hemodialysis who have renal failure.

Challenges

The imposition of ban on the import/export

One aspect that was not considered in its conclusions, but which is expected to have a substantial impact on world commerce, is a proposed ban on shrimp imports from India by the European Union. This country is the world’s second-biggest producer of farmed shrimp and the largest source of imports to the Netherlands and the United Kingdom. Following ten years of concerns about the presence of antibiotics in shrimp, India’s pre-export control process will be audited in November. During this procedure, all cargoes going for the EU must be scrutinized, and the EU Commission last year boosted its own inspection regime on consignments from India from 10% to 50%.

Despite guarantees from Indian officials, 11 examples of noncompliance, mainly with nitrofurans, have been registered since the beginning of the year. As a result, the EU has reached the end of its patience, and if the upcoming audit uncovers ongoing flaws in the system, a ban is a very real prospect.

Regional Snapshots

The Asia Pacific held the largest share in the Chitosan market. One of the primary elements boosting chitosan demand is the easy availability of its raw material, derived as a waste product from the fishing sector. Vietnam is the Southeast Asian country making inroads in the shrimp industry, increasing its farmed shrimp exports by 8% in 2020 to USD 3.3 billion, aided by an increase in vannamei prawn sales due to increased retail demand during the pandemic. India, the world’s largest shrimp exporter, had a tough year in 2020, with the COVID-19 pandemic significantly affecting production and export performance. Last year, the South Asian country produced between 650,000 and 700,000 metric tons of shrimp, falling from 780,000 to 800,000 MT in 2019. Production in India’s shrimp-farming states of Odisha, West Bengal, Andhra Pradesh, and Gujarat all declined in 2020, according to data from the Society of Aquaculture Professionals (SAP).

Market Segments Covered

By Source

- Shrimps

- Prawns

- Crabs

- Other Sources

By Application

- Water treatment

- Cosmetics

- Pharmaceutical and Biomedical

- Food and Beverage

- Other Applications

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Research Objective

- To provide a comprehensive analysis of the Chitosan industry and its sub-segments in the global market, thereby providing a detailed structure of the industry

- To provide detailed insights into factors driving and restraining the growth of this global market

- To provide a distribution chain analysis/value chain for the this market

- To estimate the market size of the global Chitosan market where 2019 would be the historical period, 2020 shall be the base year, and 2020 to 2027 will be the forecast period for the study

- To provide strategic profiling of key companies (manufacturers and distributors) present across the globe, and comprehensively analyze their competitiveness/competitive landscape in this market

- To analyze the global market in four main geographies, namely, North America, Europe, Asia-Pacific, and the Rest of the World

- To provide country-wise market value analysis for various segments of the Chitosan

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Chitosan Market

5.1. COVID-19 Landscape: Chitosan Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Chitosan Market, By Source

8.1. Chitosan Market, by Source Type, 2021-2030

8.1.1. Shrimps

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Prawns

8.1.2.1. Market Revenue and Forecast (2019-2030)

8.1.3. Crabs

8.1.3.1. Market Revenue and Forecast (2019-2030)

8.1.4. Other Sources

8.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Chitosan Market, By Application

9.1. Chitosan Market, by Application, 2021-2030

9.1.1. Water treatment

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Cosmetics

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Pharmaceutical and Biomedical

9.1.3.1. Market Revenue and Forecast (2019-2030)

9.1.4. Food and Beverage

9.1.4.1. Market Revenue and Forecast (2019-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Chitosan Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Source (2019-2030)

10.1.2. Market Revenue and Forecast, by Application (2019-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Source (2019-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Source (2019-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Source (2019-2030)

10.2.2. Market Revenue and Forecast, by Application (2019-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Source (2019-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Source (2019-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Source (2019-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2019-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Source (2019-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2019-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Source (2019-2030)

10.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Source (2019-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Source (2019-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Source (2019-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2019-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Source (2019-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2019-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Source (2019-2030)

10.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Source (2019-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Source (2019-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Source (2019-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2019-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Source (2019-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2019-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Source (2019-2030)

10.5.2. Market Revenue and Forecast, by Application (2019-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Source (2019-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Source (2019-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2019-2030)

Chapter 11. Company Profiles

11.1. Primex EHF

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Heppe Medical Chitosan GmbH

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Vietnam Food

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. KitoZyme S.A.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Agratech

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Advanced Biopolymers AS (Norway)

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. BIO21 Co., Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. G.T.C. Bio Corporation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Taizhou City Fengrun Biochemical Co., Ltd.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Zhejiang Golden-Shell Pharmaceutical Co., Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Why Buy this Report?

The purpose of Precedence Research’s Chitosan market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1335

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com