Clinical Documentation Improvement Market Size, Trends, Report by 2034

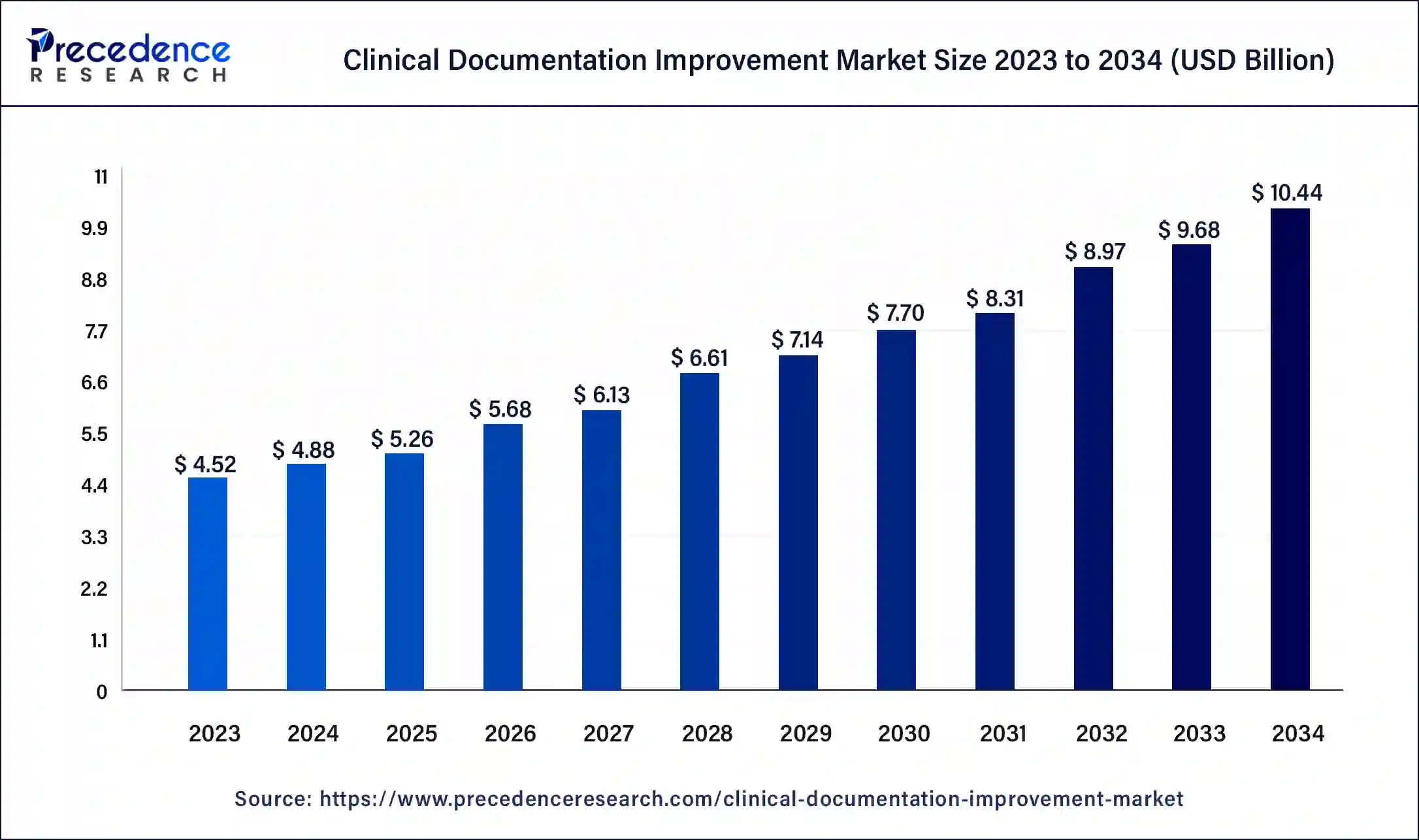

The global clinical documentation improvement market size is estimated at USD 4.52 billion in 2023 and is predicted to surpass around USD 10.44 billion by 2034, expanding at a CAGR of 7.91% from 2024 to 2034.

The Clinical Documentation Improvement (CDI) market is experiencing significant growth driven by increasing adoption of electronic health records (EHR) and regulatory requirements aimed at enhancing healthcare quality and patient outcomes. CDI involves the review and enhancement of medical documentation to ensure accuracy, completeness, and compliance with coding and billing guidelines. This process is crucial for improving the accuracy of medical coding and reimbursement, reducing claim denials, and supporting better clinical decision-making.

Get a Sample: https://www.precedenceresearch.com/sample/4678

Clinical Documentation Improvement Market Key Points

- North America dominated the clinical documentation improvement market with the largest revenue share of 39% in 2023.

- Asia Pacific is expected to host the fastest-growing market during the foreseeable future.

- By product and services, the solutions segment has contributed more than 65% of revenue share in 2023.

- By end user, the healthcare providers segment has held the largest revenue share of 69% in 2023.

Clinical Documentation Improvement Market Trends

In terms of trends, the CDI market is witnessing a shift towards automated CDI solutions leveraging artificial intelligence (AI) and natural language processing (NLP) technologies. These advanced tools help healthcare providers streamline documentation processes, identify clinical documentation gaps, and improve overall workflow efficiency. Moreover, there is a growing emphasis on CDI software solutions that integrate seamlessly with existing EHR systems, facilitating real-time documentation updates and feedback to clinicians.

Regional Insights

Regionally, North America dominates the CDI market, driven by stringent regulatory frameworks such as ICD-10 coding implementation and the Hospital Readmissions Reduction Program (HRRP). These regulations compel healthcare providers to focus on accurate documentation to avoid financial penalties and optimize reimbursements. In Europe and Asia-Pacific, increasing healthcare expenditure, rising adoption of EHR systems, and government initiatives promoting healthcare IT infrastructure are contributing to market growth.

Clinical Documentation Improvement Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 10.44 Billion |

| Market Size in 2023 | USD 4.52 Billion |

| Market Size in 2024 | USD 4.88 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.91% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product & Service, End users, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Products Insights

Software solutions are central to CDI efforts, providing tools for real-time documentation review, coding optimization, and clinical workflow integration. These solutions often utilize artificial intelligence and natural language processing to assist healthcare providers in capturing accurate patient data and improving compliance with coding standards.

Services Insights

Consulting services play a crucial role in CDI, offering expertise in clinical documentation best practices, coding guidelines, and regulatory compliance. These services help healthcare organizations implement effective CDI programs tailored to their specific needs, optimizing revenue cycle management and ensuring accurate reimbursement.

End Users Insights

End users of CDI solutions include hospitals, clinics, physician practices, and other healthcare facilities striving to enhance the quality and accuracy of their clinical documentation. Healthcare providers benefit from CDI by improving patient care coordination, supporting clinical decision-making, and minimizing compliance risks associated with inaccurate documentation. The market continues to expand as healthcare systems prioritize efficient documentation practices to meet evolving regulatory requirements and improve overall patient outcomes

Read Also: Bucket Trucks Market Size to Surpass USD 2.93 Billion by 2034

Clinical Documentation Improvement Market Dynamics

Driver

Key drivers for the CDI market include the rising prevalence of chronic diseases, which necessitates accurate clinical documentation for effective disease management and continuity of care. Additionally, the shift towards value-based care models encourages healthcare organizations to invest in CDI solutions to improve clinical outcomes and patient satisfaction while reducing healthcare costs. Furthermore, advancements in healthcare analytics and reporting capabilities offered by CDI tools are enhancing decision support and population health management initiatives.

Opportunities

Opportunities in the CDI market lie in the expansion of CDI services beyond hospitals to outpatient facilities, physician practices, and ambulatory care settings. There is also potential for growth in telehealth and remote patient monitoring, where accurate documentation is crucial for ensuring continuity of care and reimbursement. Moreover, the integration of CDI with clinical decision support systems (CDSS) and predictive analytics offers opportunities for proactive patient care management and risk stratification.

Challenges

However, the CDI market faces challenges such as the complexity of clinical documentation processes, which require continuous education and training of healthcare professionals. Resistance to change among clinicians and coding staff, coupled with interoperability issues between different EHR systems, can hinder the seamless implementation and effectiveness of CDI solutions. Moreover, ensuring patient data privacy and security remains a critical concern, particularly with the increasing volume of digital health information being processed and shared.

Clinical Documentation Improvement Market Companies

- 3M Company

- Optum

- Nuance

- Dolbey Systems

- Streamline Health

- Vitalware

- Chartwise

- Craneware

- Epic Systems

- Flash Code

Recent Developments

- In March 2024, generative AI company Abridge announced a strategic collaboration with NVIDIA to improve clinician workflows and patient care through AI-powered solutions. Abridge also received investment from NVIDIA’s venture capital branch, NVentures.

- In October 2023, eClinicalWorks launched a new AI-powered clinical documentation software. Sunoh.ai listens to patients during medical appointments so that providers can focus on conversations without having to write down notes.

- In April 2023, Amazon Web Services (AWS) announced a partnership with 3M Health Information Systems to advance collaboration on the M*Modal virtual assistant technology. 3M received access to Amazon’s AWS Machine Learning and generative AI services Amazon Bedrock, Amazon Comprehend Medical, and Amazon Transcribe to refine the ambient clinical documentation virtual assistant.

Segments Covered in the Report

By Product & Service

- Solutions

- Clinical Documentation

- Clinical Coding

- Charge Capture

- Clinical Documentation Improvement

- Others

- Consulting Services

By End users

- Healthcare Providers

- Inpatient Settings

- Outpatient Settings

- Healthcare Payers

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/