Cold Chain Market Report by Size 2021 – Revenue Expectations, Growth Status, Demand by Key Players, Opportunities and Global Forecast to 2030

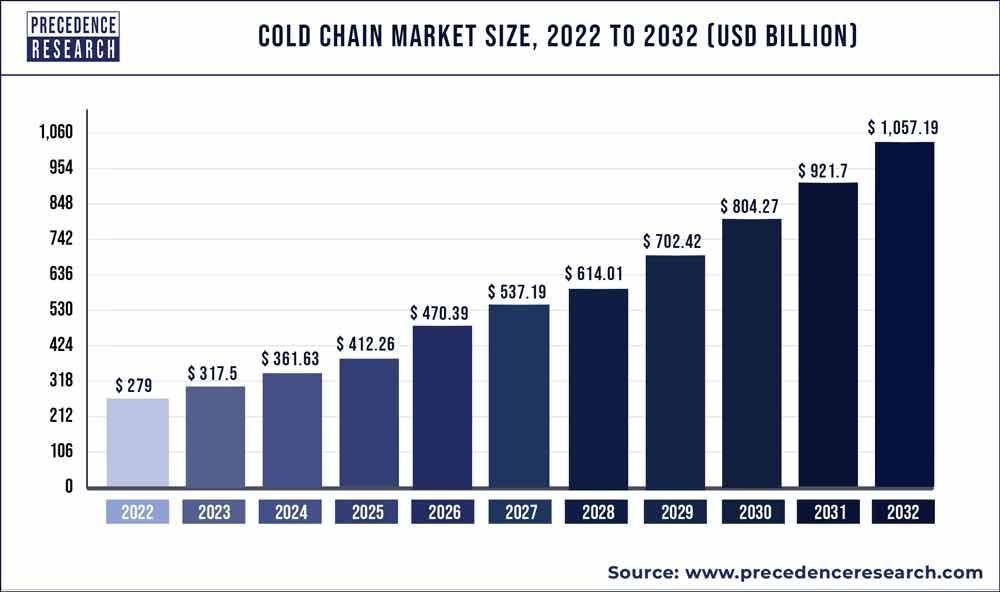

According to Precedence Research, The cold chain market size garnered US$ 232.23 billion in 2021 and is expected to generate US$ 948.24 billion by 2030, manifesting a CAGR of 15.1% from 2021 to 2030. The report contains 150+ pages with detailed analysis.

The base year for the study has been considered 2021, the historic year 2019 and 2020, the forecast period considered is from 2021 to 2030. The cold chain market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

A cold chain is the temperature-controlled supply chain that is used in the storage, transportation and distribution of temperature sensitive products that needs to be preserved in a definite temperature range in order to prevent them from getting rotten. The cold chain providers monitor the temperature of their facility on a regular basis so as to prevent the products from getting decayed.

Some of the temperature sensitive products include fruits, vegetables, medicines, meats and any others. The manufacturersof the sensitive products strictly monitor the temperature at every point of transit from the manufacturing unit till it gets delivered to the consumers. With the development of technology, the manufacturers of the sensitive food products are installing the remote monitoring system for the cold chain units so that the real time temperature can be administered.

Download the FREE Sample Report (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1331

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers, novel product introductions and developments, promotion strategies and Research and Development (R&D) activities in the marketplace. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing. The competitive profiling of these players includes business and financial overview, gross margin, production, sales, and recent developments which can aid in assessing competition in the market.

Some of the major players in the global cold chain market include:

- Agro Merchant Group

- Nordic Logistics and Warehousing LLC

- Preferred Freezer Services LLC

- Cold Chain Technologies Inc.

- Cryopack Industries Inc.

- Creopack

- Cold Box Express Inc.

Cold Chain Market Scope

This market report studies market dynamics, status and outlook especially in North America, Europe and Asia-Pacific, Latin America, the Middle East and Africa. This research report offers scenario and forecast (revenue/volume), and categorizes the market by key players and various segment. This report also studies global market prominence, competitive landscape, market share, growth rates market dynamics such as drivers, restraints and opportunities, and distributors and sales channels.

This research study also integrates Industry Chain analysis and Porter’s Five Forces Analysis. Further, this report offers a competitive scenario that comprises collaborations, market concentration rate and expansions, mergers & acquisitions undertaken by companies.

Browse Healthcare Research Reports @ https://www.marketstatsnews.com/healthcare/

Crucial factors accountable for market growth are:

- The rise in retail stores across the world.

- The rising demand for refrigerated transport vehicles in order to deliver the perishable products to retail stores.

- Increased demand for ready to eat and perishable products in the market.

- Increased demand for cold chain systems in the pharmaceutical industry.

- The surge in demand for cold storages to preserve the fruits and vegetable.

Report Highlights

- In the commercial segment, the demand for cold storage systems in the retail stores, supermarkets and hypermarkets are estimated to contribute significantly towards the growth of the cold chain market.

- In the public sector, the Cold Chain Market is also expected to grow remarkably because of the increasing Government investments to develop advanced cold storage facilities.

- By Geography, North America leads the Cold Chain Market by revenues share because of its massive demand for the perishable food products.

Cold Chain Market Dynamics

Driver – The rising consumer demand for the perishable products, awareness about the importance of consuming the perishable products such as milk, meat, fruits and others are the primary attributes that is expected to drive the growth of the cold chain market, Moreover, the surge in demand for ready to eat and processed food products in the market across the globe will contribute significantly towards the growth of the cold chain market.

Restraint – The major restraining factors that is expected to hinder the growth of the cold chain market includes emission of greenhouse gases from the refrigeration units, production of carbon dioxide by the diesel powered transportation refrigeration units, food and packaging waste at each stage of supply chain, high power consumption and others.

Opportunity – The rapid surge in the development of retail chain, supermarket, hypermarkets and others will produce huge opportunities for the growth of the cold chain market. Also, in the developing countries such as China and India there has been an increase in demand for the processed food products and this is expected to produce huge opportunities forthe growth of cold chain market.

Challenges – Production of energy efficient and low greenhouse gas emissions refrigeration units is the major challenge faced by the cold chain markets. Furthermore, lack of proper food storage, poor cold chain logistics, lack of standardization are some of the challenges for the growth of the cold chain market.

Recent Developments

- On 30th March 2021 Cold chain Technologies announced that it has partnered with B Medical Systems to offer comprehensive thermal packaging and stationary refrigeration solutions for temperature critical medications.

- On 23rd September 2021 Cryopak, a leader in temperature assurance packaging and temperature monitoring devices has introduced “BOXEDin” a concept to ship high value biologics for longer-range profile duration.

Regional Snapshots

North America is expected to hold the largest revenue share contributing more than 37% market share in 2021 and is expected to remain in dominant position during the forecast period. The significant growth in this region is due to the presence of major market players continuously involved in developing new technologies to produce an energy efficient cold chain system. Furthermore, the increasing demand for the perishable food products in the North American market contributes significantly towards the growth of the cold chain market.

Asia Pacific region is anticipated to be the fastest growing region owing to the rise in Government investments in order to develop advanced logistics infrastructure. In this region, China is expected to hold a significant share owing to the rise in demand for technological advancements in food processing, packaging and storage of seafoods. Moreover, the development in the pharmaceutical sector in India and China will fuel the growth of the cold chain market in this region.

Cold Chain Market Segments Covered

By Type

- Storage

- Warehouses

- On-grid

- Off-grid

- Reefer Containers

- Warehouses

- Monitoring Components

- Hardware

- Software

- Transportation

- Road

- Sea

- Rail

- Air

By Sector

- Private

- Cooperative

- Public

By Temperature Type

- Frozen

- Chilled

By Packaging

- Product

- Crates

- Dairy

- Pharmaceuticals

- Fishery

- Horticulture

- Insulated Containers & Boxes

- Payload Size

- Large (32 to 66 liters)

- Medium (21 to 29 liters)

- Small (10 to 17 liters)

- X-small (3 to 8 liters)

- Petite (0.9 to 2.7 liters)

- Type

- Cold Chain Bags/Vaccine Bags

- Corrugated Boxes

- Others

- Payload Size

- Cold Packs

- Labels

- Temperature-controlled Pallet Shippers

- Crates

- Materials

- Insulating Materials

- EPS

- PUR

- VIP

- Cryogenic Tanks

- Others (Insulating Pouches, Hard Cased Thermal Boxes, and Active Thermal Systems)

- Refrigerants

- Fluorocarbons

- Inorganics

- Ammonia

- CO2

- Hydrocarbons

- Fluorocarbons

- Insulating Materials

By Application

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Fish, Meat, and Seafood

- Processed Food

- Pharmaceuticals

- Vaccines

- Blood Banking

- Bakery & Confectionary

- Others (Ready-to-Cook, Poultry)

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Russia

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Research Objective

- To provide a comprehensive analysis of the cold chain industry and its sub-segments in the global market, thereby providing a detailed structure of the industry

- To provide detailed insights into factors driving and restraining the growth of this global market

- To provide a distribution chain analysis/value chain for the this market

- To estimate the market size of the global cold chain market where 2019 would be the historical period, 2020 shall be the base year, and 2020 to 2027 will be the forecast period for the study

- To provide strategic profiling of key companies (manufacturers and distributors) present across the globe, and comprehensively analyze their competitiveness/competitive landscape in this market

- To analyze the global market in four main geographies, namely, North America, Europe, Asia-Pacific, and the Rest of the World

- To provide country-wise market value analysis for various segments of the cold chain

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cold Chain Market

5.1. COVID-19 Landscape: Cold Chain Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cold Chain Market, By Type

8.1. Cold Chain Market, by Type, 2021-2030

8.1.1. Storage (Warehouses, Reefer Containers)

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Monitoring Components (Hardware, Software)

8.1.2.1. Market Revenue and Forecast (2019-2030)

8.1.3. Transportation (Road, Sea, Rail, Air)

8.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Cold Chain Market, By Sector

9.1. Cold Chain Market, by Sector, 2021-2030

9.1.1. Private

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Cooperative

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Public

9.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Cold Chain Market, By Temperature Type

10.1. Cold Chain Market, by Temperature Type, 2021-2030

10.1.1. Frozen

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. Chilled

10.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 11. Global Cold Chain Market, By Packaging

11.1. Cold Chain Market, by Packaging, 2021-2030

11.1.1. Product

11.1.1.1. Market Revenue and Forecast (2019-2030)

11.1.2. Materials (Insulating Materials, Refrigerants)

11.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 12. Global Cold Chain Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2019-2030)

12.1.2. Market Revenue and Forecast, by Sector (2019-2030)

12.1.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.1.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2019-2030)

12.1.5.2. Market Revenue and Forecast, by Sector (2019-2030)

12.1.5.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.1.5.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2019-2030)

12.1.6.2. Market Revenue and Forecast, by Sector (2019-2030)

12.1.6.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.1.6.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2019-2030)

12.2.2. Market Revenue and Forecast, by Sector (2019-2030)

12.2.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.2.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2019-2030)

12.2.5.2. Market Revenue and Forecast, by Sector (2019-2030)

12.2.5.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.2.5.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2019-2030)

12.2.6.2. Market Revenue and Forecast, by Sector (2019-2030)

12.2.6.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.2.6.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2019-2030)

12.2.7.2. Market Revenue and Forecast, by Sector (2019-2030)

12.2.7.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.2.7.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2019-2030)

12.2.8.2. Market Revenue and Forecast, by Sector (2019-2030)

12.2.8.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.2.8.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2019-2030)

12.3.2. Market Revenue and Forecast, by Sector (2019-2030)

12.3.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.3.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2019-2030)

12.3.5.2. Market Revenue and Forecast, by Sector (2019-2030)

12.3.5.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.3.5.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2019-2030)

12.3.6.2. Market Revenue and Forecast, by Sector (2019-2030)

12.3.6.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.3.6.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2019-2030)

12.3.7.2. Market Revenue and Forecast, by Sector (2019-2030)

12.3.7.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.3.7.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2019-2030)

12.3.8.2. Market Revenue and Forecast, by Sector (2019-2030)

12.3.8.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.3.8.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2019-2030)

12.4.2. Market Revenue and Forecast, by Sector (2019-2030)

12.4.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.4.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2019-2030)

12.4.5.2. Market Revenue and Forecast, by Sector (2019-2030)

12.4.5.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.4.5.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2019-2030)

12.4.6.2. Market Revenue and Forecast, by Sector (2019-2030)

12.4.6.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.4.6.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2019-2030)

12.4.7.2. Market Revenue and Forecast, by Sector (2019-2030)

12.4.7.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.4.7.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2019-2030)

12.4.8.2. Market Revenue and Forecast, by Sector (2019-2030)

12.4.8.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.4.8.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2019-2030)

12.5.2. Market Revenue and Forecast, by Sector (2019-2030)

12.5.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.5.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2019-2030)

12.5.5.2. Market Revenue and Forecast, by Sector (2019-2030)

12.5.5.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.5.5.4. Market Revenue and Forecast, by Packaging (2019-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2019-2030)

12.5.6.2. Market Revenue and Forecast, by Sector (2019-2030)

12.5.6.3. Market Revenue and Forecast, by Temperature Type (2019-2030)

12.5.6.4. Market Revenue and Forecast, by Packaging (2019-2030)

Chapter 13. Company Profiles

13.1. Agro Merchant Group

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Nordic Logistics and Warehousing LLC

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Preferred Freezer Services LLC

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Cold Chain Technologies Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Cryopack Industries Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Creopack

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Cold Box Express Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Why Buy this Report?

The purpose of Precedence Research’s cold chain market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1331

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com