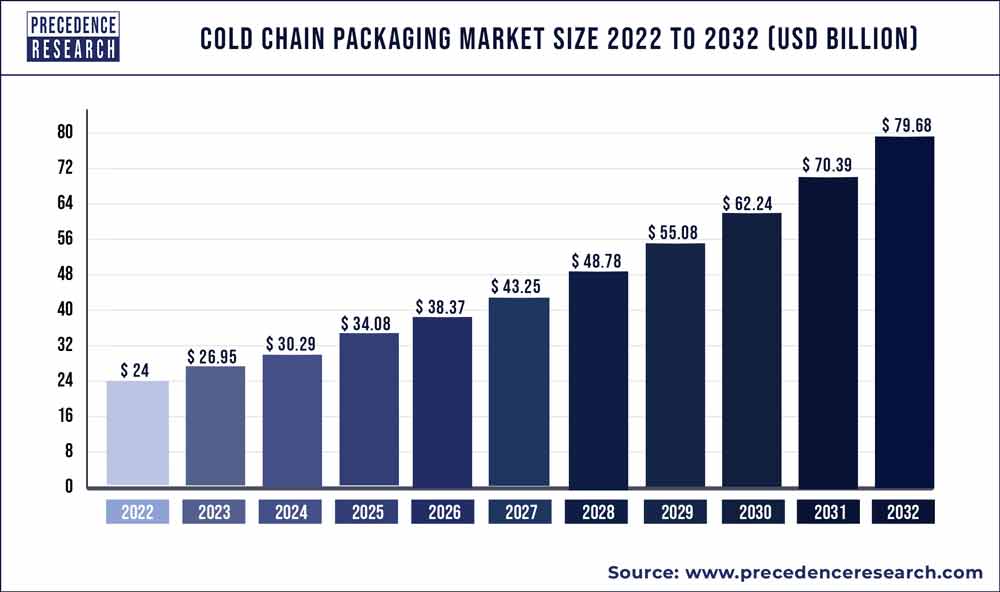

Cold Chain Packaging Market Size to Reach US$ 46.63 Billion By 2030

The cold chain packaging market size is projected to reach US$ 46.63 billion by 2030 from US$ 16.04 billion in 2021, registering a CAGR of 12.6% during the forecast period 2022 to 2030.

The base year for the study has been considered 2021, the historic year 2017 and 2020, the forecast period considered is from 2022 to 2030. The cold chain packaging market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

The growing demand for the various fresh and processed food products and the development of drugs and vaccines that requires special temperature controlled storage or packaging are the major factors that are expected to augment the growth of the global cold chain packaging market during the forecast period.

The rising pressure on the food processing companies to deliver the food products to the consumers along with maintaining the freshness and quality has fueled the demand for the cold chain packaging. The cold chain packaging maintains the physiological properties of the food products and extends its shelf life.

The growing consumption of various food products such as dairy products, fruits, vegetables, fish, meat, and other seafood has significantly fostered the adoption of the cold chain packaging among the food manufacturers and processors. The growing investments in the research and development of efficient and sustainable packaging are expected to offer various growth prospects to the market players in the foreseeable future.

Download a FREE Sample Copy (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1618

Cold Chain Packaging Market Szie Estimations Y-O-Y:

| Market Size Was Valued In 2021 | US$ 16.04 Billion |

| Market Size Is Projected to Reach By 2022 | US$ 19.01 Billion |

| Market Size Is Projected to Reach By 2030 | US$ 46.63 Billion |

| Compound Annual Growth Rate (CAGR) from 2022 to 2030 | 12.6% |

Cold Chain Packaging Market Dynamics

Driver

Surging demand from the pharmaceutical companies

There are certain temperature sensitive products in the pharma industry that requires cold chain packaging. The risks of losing properties owing to the exposure to high temperature associated with some products has led to the growth in the demand for the cold chain packaging. Around 18% of the pharmaceutical spending in 2018 was associated with the cold chain transportation and products, as per a data revealed by Pharmaceutical Commerce Analysis of IQVIA. Therefore, the growing demand for the cold chain packaging from the pharmaceutical industry is expected to drive the growth of the market during the forecast period.

Restraint

High costs of cold chain packaging

The adoption of the colds chain packaging is a costly affair as compared to other packaging. The materials used in the production of cold chain packaging are costly and some of the materials like EPS and PUR promotes sustainability owing to their special properties. The costs of this materials and the higher penetration of the traditional packaging solutions are the major factors that may hinder the market growth during the forecast period.

Opportunity

Rising demand for reusable packaging

The food processing companies and the pharmaceutical companies are trying hard to reduce their costs and hence are looking for optimized packaging solutions. The reusable cold chain packaging offers an optimized packaging solution without compromising on the quality of the products. The reusable cold chain packaging solutions can reduce costs significantly and can increase profit margins for the food and pharma companies, which is fueling the demand for the reusable packaging.

Challenge

Stringent government regulations

The government regulations on the packaging requires the companies to adopt a certain design and raw materials with advanced features that increases the costs for the manufacturers. Furthermore, the growing complexities in the modern day logistics operations and increasing regulatory issues is creating a challenge for the market players. Furthermore, the strict government norms regarding the use of eco-friendly packaging products is a major challenge for the manufacturers that restricts their profit margins.

Read Also: Dental Practice Management Software Market Share 2022-2030

Report Scope of the Cold Chain Packaging Market

| Report Coverage | Details |

| Market Size by 2030 | USD 46.63 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 12.6% |

| North America Market Share in 2021 | 35% |

| Insulating Materials Market Share in 2021 | 66% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Product, Material, Application, Packaging Format, Geography |

Report Highlights

- Based on the product, insulated container & boxes was the leading segment with over 58% of the market share in 2021. The increased demand for the insulated container & boxes owing to its reusability among the food and pharma companies across the globe has led to the dominance of this segment.

- On the basis of materials, the refrigerant is anticipated to be the most opportunistic segment. The rising concerns over global warming and climate change is fueling the adoption of the refrigerant materials as it is much eco-friendlier as compared to other materials.

- By application, the fish, seafood, and meat were the dominating segment that accounted for a revenue share of around 26% in 2021. The fish, seafood, and meat are highly perishable products that need to be delivered quickly to the end consumers, which have driven the demand for the cold chain packaging in the fish and meat industry.

Cold Chain Packaging market Regional Snapshot

By region, North America dominated the global cold chain packaging market accounting for a market share of around 35% in 2021. The higher penetration of the numerous top food processing companies, higher demand for packaged food and the increased consumption of on-the-go food products has significantly driven the market growth in North America. The increasing production of various new and innovative pharmaceutical products like vaccines and drugs by the several leading pharmaceutical companies in the region is another prominent factor that is expected to spur the demand for the cold packaging in this region.

The growing health consciousness and rising awareness regarding the benefits of organic food products among the population of North America is driving the adoption of the cold chain packaging for the purpose of packing and transportation of organic fruits, vegetables, and meat. The hi8gh production and consumption of meat like chicken, beef, pork, and turkey in US has significantly propelled the market growth.

Asia Pacific is expected to exhibit the highest CAGR during the forecast period. The presence of huge population, rapid urbanization, rapid industrialization, rising disposable income, growing penetration of packaged food, and rising youth population are some of the most prominent factors that are expected to drive the growth of the Asia Pacific market. Market like New Zealand is the highest consumer of ice cream in terms of per capita ice cream consumption in the world. The demand for meat products are higher in Australia, China, and South Korea, which is rapidly boosting the growth of the cold chain packaging market in Asia Pacific.

Recent Developments

- In January 2018, Softbox systems acquired the TP3 Global. This strategy aimed at strengthening and expanding the product portfolio of Softbox.

Some of the prominent players in the global cold chain packaging market include:

- Cascades Inc.

- Cold Chain Technologies

- Creopack

- Cryopak A TCP Company

- Intelsius

- Pelican Products, Inc.

- Softbox

- Sofrigam

- Sonoco ThermoSafs

- va-Q-tec

Segments Covered in the Report

By Product

- Insulated Container and Boxes

- Large

- Medium

- Small

- X-Small

- Petite

- Cold Packs

- Crates

- Dairy

- Pharmaceutical

- Fisheries

- Horticulture

- Temperature Controlled Pallet Shippers

- Labels

By Material

- Insulating Materials

- Expanded Polystyrene (EPS)

- Polyurethane rigid foam (PUR)

- Vacuum Insulated Panel (VIP)

- Cryogenic Tanks

- Others

- Refrigerants

- Fluorocarbons

- Hydrocarbon

- Inorganics

By Application

- Dairy Products

- Milk

- Butter

- Cheese

- Ice Cream

- Fruit and Pulp Concentrates

- Fish, Seafood, and Meat

- Processed Food

- Fruits and Vegetables

- Bakery and Confectioneries

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

By Packaging Format

- Reusable Packaging

- Disposable Packaging

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cold Chain Packaging Market

5.1. COVID-19 Landscape: Cold Chain Packaging Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cold Chain Packaging Market, By Product

8.1. Cold Chain Packaging Market, by Product Type, 2022-2030

8.1.1. Insulated Container and Boxes

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Cold Packs

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Crates

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Temperature Controlled Pallet Shippers

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Labels

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Cold Chain Packaging Market, By Material

9.1. Cold Chain Packaging Market, by Material, 2022-2030

9.1.1. Insulating Materials

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Refrigerants

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Cold Chain Packaging Market, By Application

10.1. Cold Chain Packaging Market, by Application Type, 2022-2030

10.1.1. Dairy Products

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Fruit and Pulp Concentrates

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Fish, Seafood, and Meat

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Processed Food

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Fruits and Vegetables

10.1.5.1. Market Revenue and Forecast (2017-2030)

10.1.6. Bakery and Confectioneries

10.1.6.1. Market Revenue and Forecast (2017-2030)

10.1.7. Pharmaceuticals

10.1.7.1. Market Revenue and Forecast (2017-2030)

10.1.8. Others

10.1.8.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Cold Chain Packaging Market, By Packaging Format

11.1. Cold Chain Packaging Market, by Packaging Format Type, 2022-2030

11.1.1. Reusable Packaging

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Disposable Packaging

11.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Cold Chain Packaging Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2017-2030)

12.1.2. Market Revenue and Forecast, by Material (2017-2030)

12.1.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.1.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Material (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.1.5.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Material (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.1.6.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.2. Market Revenue and Forecast, by Material (2017-2030)

12.2.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.2.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Material (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.2.5.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Material (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.2.6.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Material (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.2.7.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Material (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.2.8.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.2. Market Revenue and Forecast, by Material (2017-2030)

12.3.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.3.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Material (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.3.5.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Material (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.3.6.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Material (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.3.7.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Material (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.3.8.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.2. Market Revenue and Forecast, by Material (2017-2030)

12.4.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.4.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Material (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.4.5.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Material (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.4.6.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Material (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.4.7.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Material (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.4.8.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.5.2. Market Revenue and Forecast, by Material (2017-2030)

12.5.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.5.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Material (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.5.5.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Material (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Application Type (2017-2030)

12.5.6.4. Market Revenue and Forecast, by Packaging Format Type (2017-2030)

Chapter 13. Company Profiles

13.1. Cascades Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Cold Chain Technologies

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Creopack

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Cryopak A TCP Company

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Intelsius

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Pelican Products, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Softbox

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Sofrigam

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Sonoco ThermoSafs

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. va-Q-tec

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Why Buy this Report?

The purpose of Precedence Research’s cold chain packaging market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1618

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://precedenceresearchnews.wordpress.com

Frequently Asked Questions:

[sc_fs_multi_faq headline-0=”h6″ question-0=”What is the current size of cold chain packaging market?” answer-0=”According to Precedence Research, the global cold chain packaging market size was reached at US$ 16.04 billion in 2021 and is anticipated to rake US$ 46.63 billion by 2030. ” image-0=”” headline-1=”h6″ question-1=”What will be the CAGR of global cold chain packaging market?” answer-1=”The global cold chain packaging market is expected to drive growth at a CAGR of 12.6% during the forecast period 2022 to 2030. ” image-1=”” headline-2=”h6″ question-2=”Who are the major players operating in the cold chain packaging market?” answer-2=”The major players operating in the cold chain packaging market are Cascades Inc., Cold Chain Technologies, Creopack, Cryopak A TCP Company, Intelsius, Pelican Products, Inc., Softbox, Sofrigam, Sonoco ThermoSafs, and va-Q-tec. ” image-2=”” headline-3=”h6″ question-3=”Which are the driving factors of the cold chain packaging market?” answer-3=”The growing demand for the various fresh and processed food products and the development of drugs and vaccines that requires special temperature controlled storage or packaging are the major factors that are expected to augment the growth of the global cold chain packaging market during the forecast period. ” image-3=”” headline-4=”h6″ question-4=”Which region will lead the global cold chain packaging market?” answer-4=”The North America dominated the global cold chain packaging market in 2021 and will lead in the near future. ” image-4=”” count=”5″ html=”true” css_class=””]