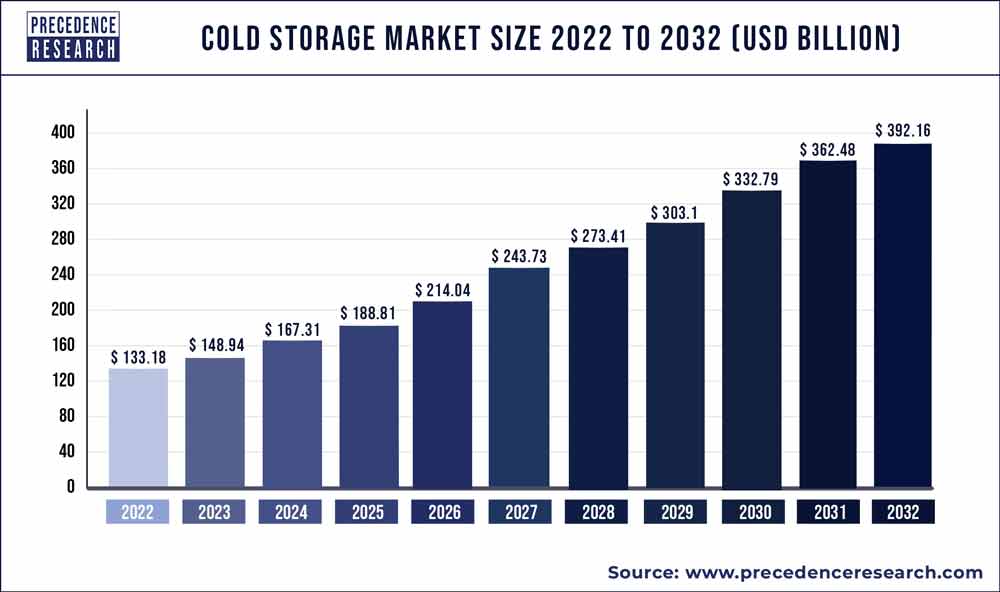

Cold Storage Market to Garner $330.2 Billion, Globally, By 2030 at 11.6% CAGR

According to the industry experts, The cold storage market garnered $ 330.2 billion in 2021 and is expected to generate $ 112 billion by 2030, manifesting a CAGR of 11.6% from 2021 to 2030. The report contains 150+ pages with detailed analysis.

The base year for the study has been considered 2021, the historic year 2019 and 2020, the forecast period considered is from 2021 to 2030. The cold storage market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

The globalization has resulted in the increased trade of goods across the globe owing to the liberalization. This resulted in the international trade of various food items such as fish, meat, eggs, and dairy products. The rising demand for the food products particularly animal based protein such as milk, cheese, meat, and eggs is driving the demand for the cold storage across the globe. The cold storage facilitates in the distribution and storage of perishable products by extending its life and preventing the food from bacteria spoilage.

Download the Sample Pages of this Report for Better Understanding (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1364

Furthermore, the growing penetration of the organized retail sectors is expected to boost the demand for the cold storages significantly during the forecast period. The giant retailers like Walmart, D Mart, Tesco, and 7 Eleven deals in huge volume of food products. The cold storages are an essential part of these food retailers.

Moreover, these huge retailers are expanding their operations and are demanding cold storages to deliver their food products to the end consumers. Therefore, the global cold storage market is estimated to grow rapidly during the forecast period. The rising initiatives by the government to develop a good infrastructure for the smooth functioning of the transport system that spurs the growth of the supply chain management industry is another growth driver for the cold storage market.

Cold Storage Market Scope

This market report studies market dynamics, status and outlook especially in North America, Europe and Asia-Pacific, Latin America, the Middle East and Africa. This research report offers scenario and forecast (revenue/volume), and categorizes the market by key players and various segment. This report also studies global market prominence, competitive landscape, market share, growth rates market dynamics such as drivers, restraints and opportunities, and distributors and sales channels.

This research study also integrates Industry Chain analysis and Porter’s Five Forces Analysis. Further, this report offers a competitive scenario that comprises collaborations, market concentration rate and expansions, mergers & acquisitions undertaken by companies.

North America was the market leader in 2020. North America is characterized by huge demand for the frozen food. The increased disposable income, busy and hectic schedules, increased demand for the convenient foods, rising demand for the animal based proteins, and increased penetration of the organized retail sector are the various factors that fostered the cold storage market in North America.

Asia Pacific is estimated to be the most opportunistic market during the forecast period. The Asia Pacific region is characterized by the huge and rising population, rising employment, growing demand for ready-to-cook and ready-to-eat food products, and huge demand for the dairy products like milk. All these factors are expected to drive the demand for the cold storages in the region. The rising investments by the giant retailers like supermarkets and hypermarkets in the region to expand in this region is further expected to fuel the demand for the cold storages.

However, the increased costs of the cold storages and lack of adequate infrastructure in the underdeveloped regions may hamper the growth of the cold storage market during the forecast period. Further the under-penetration of organized retail sector in the underdeveloped market is a major reason behind the insignificant growth of the market.

The rapidly growing foodservice industry and the constant launches of new food products is significantly spurring the growth of the market. The various foodservice units like restaurants and cafes require cold storages to keep the supply of food products like fruits, meats, and vegetables undisturbed.

Based on the warehouse type, the private segment is expected to be the fastest-growing segment during the forecast period. This can be attributed to the rising investments by the retail giants like Walmart to build a warehouse facility in order to expand its stores at various locations. The growing number of stores of various retailers is ramping up the investments in building new private warehouses, which in turn is significantly boosting the demand for the cold storage systems.

Based on the temperature type, the frozen segment dominated the cold storage market in 2020. The huge demand for the frozen food is the primary reason behind it. The busy and hectic schedule of the consumers resulted in the increased demand for the frozen food. The growing demand for ready-to-cook and other convenience foods is driving the gr犀利士

owth of this segment. The Asia Pacific is the most lucrative market for the frozen foods and the demand for the cold storages is expected to grow rapidly in this developing region.

Based on the application, the dairy segment dominated the global cold storage market in 2020. The huge demand for the various dairy products such as milk, cheese, and butter had augmented the growth of this segment across the globe. The rising consumption with the growing population is estimated to drive the segment growth during the forecast period. Moreover, the increasing health consciousness among the population is fueling the demand for the dairy products for its nutritional benefits is expected to drive the segment growth.

In January 2020, Americold Logistics completed the acquisition of Nova Cold Logistics to expand and strengthen its position in Canada.The various developmental strategies like acquisition, partnerships, mergers, and government policies fosters market growth and offers lucrative growth opportunities to the market players.

Browse Healthcare Research Reports @ https://www.marketstatsnews.com/healthcare/

Key Players/Manufacturers

This report also provides detailed company profiles of the key market players. This research report also highlights the competitive landscape of the cold storage market and ranks noticeable companies as per their occurrence in diverse regions across the globe and crucial developments initiated by them in the market space.

This research study also tracks and evaluates competitive developments, such as collaborations, partnerships, and agreements, mergers and acquisitions; novel product introductions and developments, promotion strategies and Research and Development (R&D) activities in the marketplace. The competitive profiling of these players includes business and financial overview, gross margin, production, sales, and recent developments which can aid in assessing competition in the market.

Some of the prominent players in the global cold storage market include:

- Americold Logistics

- Lineage Logistics Holdings

- Nichirei Corporation

- Burris Logistics

- Agro Merchants Group

- Kloosterboer

- United States Cold Storage

- Tippmann Group

- VersaCold Logistics Services

- Henningsen Cold Storage Co

- Coldman

- Congebec Inc.

- Conestoga Cold Storage

- NewCold

- Hanson Logistics

Cold Storage Market Segments Covered

By Warehouse Type

- Private

- Public

By Temperature Type

- Frozen

- Chilled

By Construction

- Bulk Storage

- Production Stores

- Ports

By Application

- Dairy

- Processed Food

- Fruits & Vegetables

- Fish, Meat, & Sea Food

- Pharmaceuticals

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Research Objective

- To provide a comprehensive analysis of the cold storage industry and its sub-segments in the global market, thereby providing a detailed structure of the industry

- To provide detailed insights into factors driving and restraining the growth of this global market

- To provide a distribution chain analysis/value chain for the this market

- To estimate the market size of the global cold storage market where 2019 would be the historical period, 2020 shall be the base year, and 2020 to 2027 will be the forecast period for the study

- To provide strategic profiling of key companies (manufacturers and distributors) present across the globe, and comprehensively analyze their competitiveness/competitive landscape in this market

- To analyze the global market in four main geographies, namely, North America, Europe, Asia-Pacific, and the Rest of the World

- To provide country-wise market value analysis for various segments of the cold storage

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cold Storage Market

5.1. COVID-19 Landscape: Cold Storage Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cold Storage Market, By Warehouse

8.1. Cold Storage Market, by Warehouse Type, 2021-2030

8.1.1. Private

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Public

8.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Cold Storage Market, By Temperature

9.1. Cold Storage Market, by Temperature, 2021-2030

9.1.1. Frozen

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Chilled

9.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Cold Storage Market, By Construction Type

10.1. Cold Storage Market, by Construction Type, 2021-2030

10.1.1. Bulk Storage

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. Production Stores

10.1.2.1. Market Revenue and Forecast (2019-2030)

10.1.3. Ports

10.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 11. Global Cold Storage Market, By Application Type

11.1. Cold Storage Market, by Application Type, 2021-2030

11.1.1. Dairy

11.1.1.1. Market Revenue and Forecast (2019-2030)

11.1.2. Processed Food

11.1.2.1. Market Revenue and Forecast (2019-2030)

11.1.3. Fruits & Vegetables

11.1.3.1. Market Revenue and Forecast (2019-2030)

11.1.4. Fish, Meat, & Sea Food

11.1.4.1. Market Revenue and Forecast (2019-2030)

11.1.5. Pharmaceuticals

11.1.5.1. Market Revenue and Forecast (2019-2030)

Chapter 12. Global Cold Storage Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.1.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.1.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.1.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.1.5.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.1.5.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.1.5.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.1.6.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.1.6.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.1.6.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.2.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.2.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.2.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.2.5.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.2.5.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.2.5.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.2.6.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.2.6.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.2.6.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.2.7.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.2.7.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.2.7.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.2.8.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.2.8.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.2.8.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.3.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.3.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.3.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.3.5.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.3.5.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.3.5.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.3.6.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.3.6.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.3.6.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.3.7.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.3.7.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.3.7.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.3.8.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.3.8.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.3.8.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.4.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.4.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.4.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.4.5.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.4.5.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.4.5.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.4.6.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.4.6.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.4.6.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.4.7.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.4.7.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.4.7.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.4.8.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.4.8.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.4.8.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.5.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.5.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.5.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.5.5.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.5.5.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.5.5.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Warehouse (2019-2030)

12.5.6.2. Market Revenue and Forecast, by Temperature (2019-2030)

12.5.6.3. Market Revenue and Forecast, by Construction Type (2019-2030)

12.5.6.4. Market Revenue and Forecast, by Application Type (2019-2030)

Chapter 13. Company Profiles

13.1. Americold Logistics

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Lineage Logistics Holdings

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Nichirei Corporation

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Burris Logistics

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Agro Merchants Group

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Kloosterboer

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. United States Cold Storage

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Tippmann Group

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. VersaCold Logistics Services

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Henningsen Cold Storage Co

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

13.11. Coldman

13.11.1. Company Overview

13.11.2. Product Offerings

13.11.3. Financial Performance

13.11.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Why Buy this Report?

The purpose of Precedence Research’s cold storage market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1364

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com