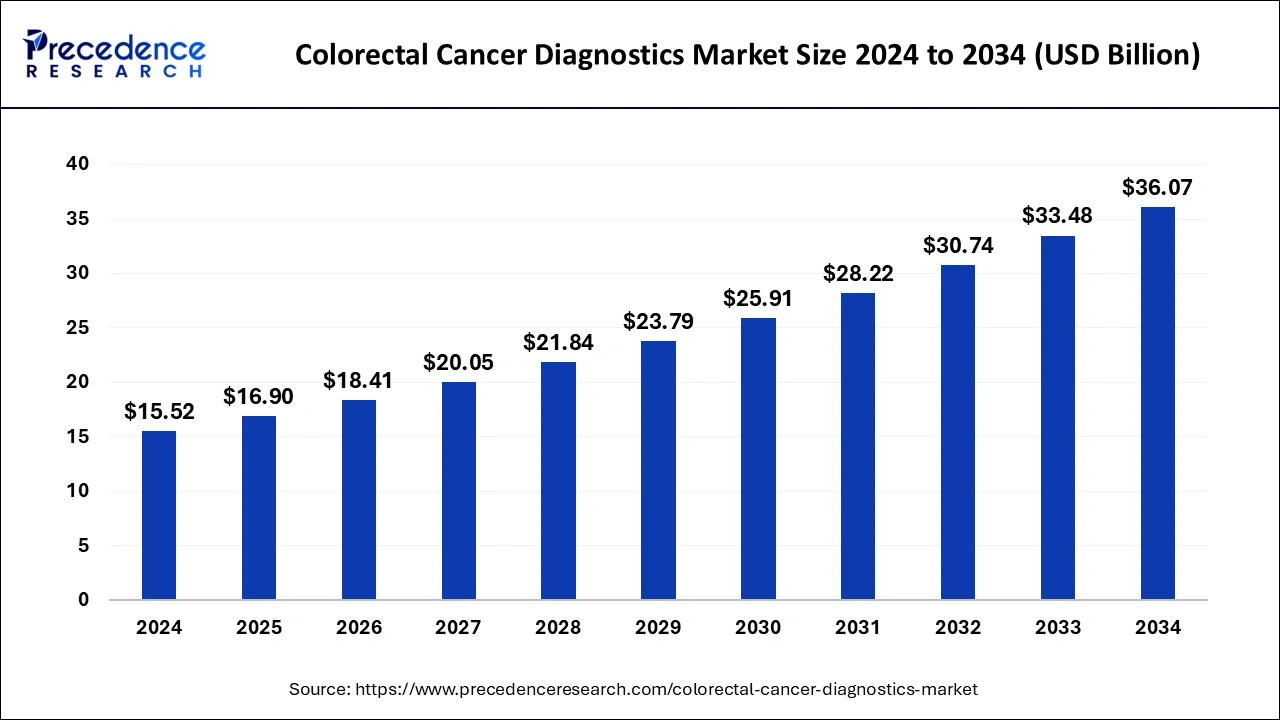

Colorectal Cancer Diagnostics Market Size to Attain USD 33.48 Bn by 2033

The global colorectal cancer diagnostics market size is expected to increase USD 33.48 billion by 2033 from USD 14.25 billion in 2023 with a CAGR of 8.92% between 2024 and 2033.

Key Points

- The North America colorectal cancer diagnostics market size accounted for USD 5.70 billion in 2023 and is expected to attain around USD 13.56 billion by 2033.

- North America dominated the market with the largest revenue share of 40% in 2023.

- Asia- Pacific is observed to be the fastest growing market during the forecast period.

- By test type, the imaging test segment has contributed more than 49% of market share of 2023.

- By test type, the blood test segment is observed to be the fastest growing market during the forecast period.

- By end-use, the hospitals segment has held the major revenue share of 42% in 2023.

- By end-use, the diagnostic imaging centers segment is observed to be the fastest growing in the market during the forecast period.

The Colorectal Cancer Diagnostics Market refers to the global healthcare sector focused on diagnosing colorectal cancer, which is a prevalent and potentially fatal form of cancer affecting the colon or rectum. With advancements in medical technology and increased awareness, the market has witnessed significant growth in recent years. Colorectal cancer diagnostics encompass various screening, diagnostic, and monitoring techniques aimed at early detection and effective management of the disease.

Get a Sample: https://www.precedenceresearch.com/sample/4308

Growth Factors

Several factors contribute to the growth of the colorectal cancer diagnostics market. These include rising incidence and prevalence of colorectal cancer worldwide, growing aging population, adoption of unhealthy lifestyles, and increased awareness campaigns promoting early detection and screening. Additionally, advancements in diagnostic technologies such as biomarker identification, genetic testing, and imaging modalities have also fueled market growth.

Region Insights

The colorectal cancer diagnostics market exhibits regional variations influenced by factors such as healthcare infrastructure, economic development, government initiatives, and prevalence rates. Developed regions like North America and Europe dominate the market due to higher healthcare expenditures, better access to diagnostic services, and early adoption of advanced technologies. Meanwhile, emerging economies in Asia-Pacific and Latin America are witnessing rapid market growth driven by improving healthcare infrastructure and rising awareness about cancer screening.

Colorectal Cancer Diagnostics Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 8.92% |

| Colorectal Cancer Diagnostics Market Size in 2023 | USD 14.25 Billion |

| Colorectal Cancer Diagnostics Market Size in 2024 | USD 15.52 Billion |

| Colorectal Cancer Diagnostics Market Size by 2033 | USD 33.48 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Test Type and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Colorectal Cancer Diagnostics Market Dynamics

Drivers:

Key drivers shaping the colorectal cancer diagnostics market include increasing investments in cancer research and development, technological advancements leading to more accurate and efficient diagnostic methods, and supportive government initiatives promoting cancer screening programs. Moreover, growing collaborations between healthcare organizations and diagnostic companies to enhance early detection and treatment outcomes further drive market growth.

Opportunities:

The colorectal cancer diagnostics market presents numerous opportunities for stakeholders, including healthcare providers, diagnostic companies, and research institutions. These opportunities include the development of innovative diagnostic tools and techniques, expansion into emerging markets with unmet medical needs, and strategic partnerships for product development and distribution. Additionally, the integration of artificial intelligence and machine learning algorithms into diagnostic workflows holds promise for improving accuracy and efficiency in colorectal cancer detection.

Challenges:

Despite the promising growth prospects, the colorectal cancer diagnostics market faces several challenges. These include the high cost of advanced diagnostic technologies, limited access to screening and diagnostic services in certain regions, and patient reluctance to undergo invasive procedures. Furthermore, the complexity of colorectal cancer biology and the need for personalized diagnostic approaches pose challenges in developing universally applicable diagnostic solutions.

Read Also: Battery Power Tools Market Size to Attain USD 49.70 Bn by 2033

Colorectal Cancer Diagnostics Market Recent Developments

- In January 2024, A novel minimal residual disease (MRD) assay called Mx has been released by the technology company Tempus. It is intended for use in research on colorectal cancer (CRC). The xM assay is a plasma-based, tumor-naïve test that finds circulating tumour DNA (ctDNA) in blood samples from individuals who have had surgery for early-stage colorectal cancer. The xM assay, which is only now accessible for research purposes, is a liquid biopsy method of evaluating MRD that does not require baseline tumor tissue. Using methylation and genetic variation classifiers yields a binary MRD result.

- In November 2023, Leading precision oncology business Guardant Health, Inc. said it has introduced ShieldTM, a blood-based colorectal cancer screening test, in association with Samsung Medical Center in South Korea.

- In March 2023, With great pleasure, BGI Genomics announced the introduction of COLOTECTTM 1.0 in Slovakia, working with local partner Zentya. Zentya is a Slovak provider of healthcare solutions committed to giving patients access to cutting-edge genetic screening technology to help diagnose and expedite the treatment of hereditary illnesses.

Colorectal Cancer Diagnostics Market Companies

- Abbott Laboratories

- BioMerieux SA

- Dickinson and Company

- GE Healthcare

- Qiagen N.V

- Thermo Fischer Scientific

- Hologic Inc

- Epigenomics AG

- F-Hoffmann-La Roche Ltd

- Siemens Healthineers

- Sysmex Corporation

Segments Covered in the Report

By Test Type

- Blood Test

- Stool Test

- Fecal Occult Blood Test (FOBT)

- Fecal Biomarker Test

- CRC DNA Screening Test

- Imaging Test

- Computed Tomography (CT) scan

- Ultrasound

- Magnetic Resonance Imaging (PET) scan

- Positron Emission Tomography (PET) scan

- Colonoscopy

- Other Imaging Tests

- Biopsy

- Other Test Types

By End-use

- Hospitals

- Diagnostic Imaging Centers

- Cancer Research Centers

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/