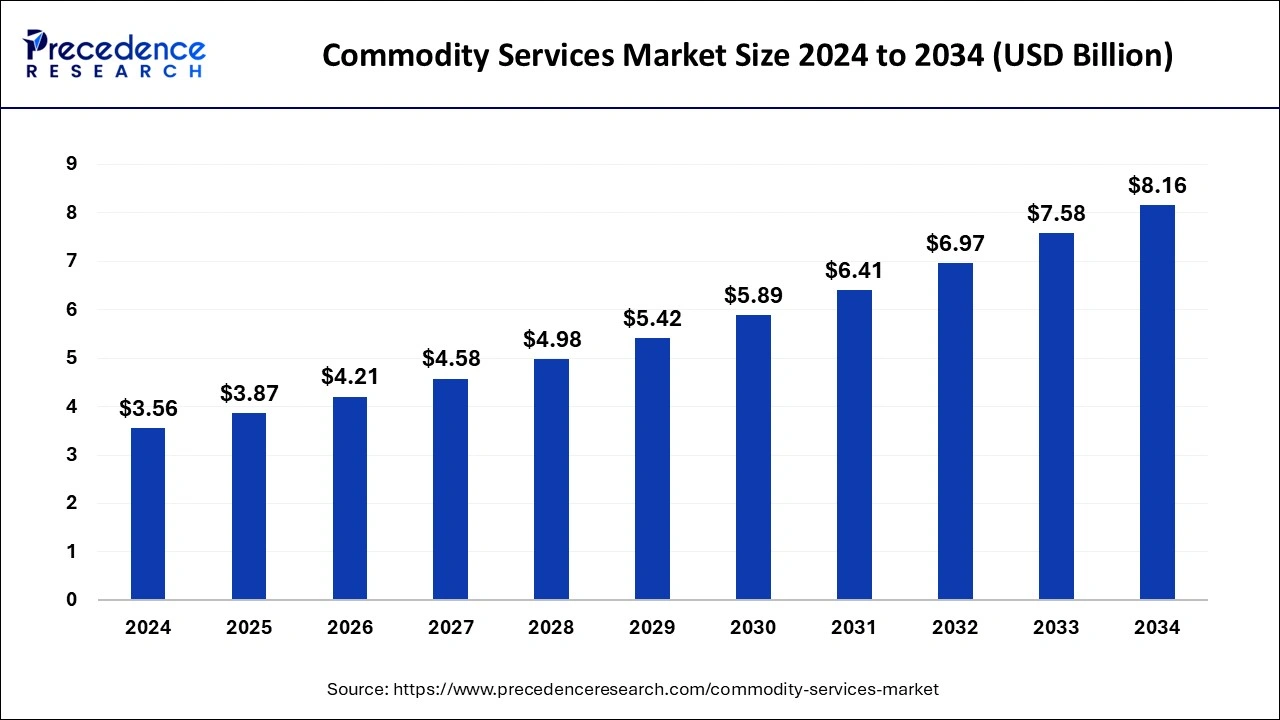

Commodity Services Market Size to Cross USD 7.58 Billion by 2033

The global commodity services market size is expected to increase USD 7.58 billion by 2033 from USD 3.27 billion in 2023 with a ACGR of 8.76% between 2024 and 2033.

Key Points

- North America holds the largest share of the commodity services market.

- Asia Pacific is expected to witness rapid growth in the market.

- By type, the agriculture segment dominated the market in 2023.

- By type, the metal segment is expected to be the fastest growth in the market during the forecast period.

- By entity, the producers segment held the largest share of the market in 2023.

- By entity, the manufacturers segment is expected to grow rapidly in the market during the forecast period.

The commodity services market encompasses a broad range of industries involved in the production, trade, and distribution of various raw materials and goods. These commodities include agricultural products, metals, energy resources, and other tangible assets traded on global exchanges. Commodity services facilitate the buying, selling, storage, transportation, and financing of these goods, connecting producers with consumers and investors worldwide. The market plays a crucial role in supporting economic activities, serving as a foundation for industries ranging from agriculture and manufacturing to energy and finance.

Get a Sample: https://www.precedenceresearch.com/sample/4364

Growth Factors:

Several factors contribute to the growth of the commodity services market. Economic expansion, industrialization, and population growth drive demand for raw materials and goods, stimulating trade and investment in commodity markets. Technological advancements enhance efficiency in commodity trading, storage, and transportation, facilitating smoother transactions and reducing costs. Moreover, increasing globalization and interconnectedness of markets create opportunities for diversification and expansion in commodity trading activities, attracting new participants and investors to the market.

Region Insights:

The commodity services market operates on a global scale, with different regions specializing in the production and trade of specific commodities based on natural resources, infrastructure, and market demand. Regions rich in agricultural land, such as North and South America, dominate the production and export of crops like corn, soybeans, and wheat. Meanwhile, regions abundant in mineral resources, such as Africa and Australia, play a significant role in the global mining industry, supplying metals like gold, copper, and iron ore. Energy-rich regions like the Middle East and Russia are key players in the production and export of oil and natural gas.

Commodity Services Market Scope

| Report Coverage | Details |

| Commodity Services Market Size in 2023 | USD 3.27 Billion |

| Commodity Services Market Size in 2024 | USD 3.56 Billion |

| Commodity Services Market Size by 2033 | USD 7.58 Billion |

| Commodity Services Market Growth Rate | CAGR of 8.76% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Entity, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Commodity Services Market Dynamic

Drivers:

Several drivers influence the commodity services market dynamics. Fluctuations in global economic conditions, geopolitical tensions, and natural disasters can impact commodity prices and market sentiment. Government policies and regulations, including trade tariffs, subsidies, and environmental regulations, also influence supply and demand dynamics in commodity markets. Moreover, currency exchange rates, inflation, and interest rates affect the attractiveness of commodities as alternative investments, influencing trading activities and market trends.

Opportunities:

The commodity services market offers various opportunities for investors, traders, and businesses to capitalize on changing market conditions and trends. With growing demand for commodities driven by population growth and urbanization, there are opportunities for investment in infrastructure development, supply chain management, and technology innovation to enhance efficiency and sustainability in commodity production and trade. Moreover, emerging markets and sectors, such as renewable energy and carbon trading, present new avenues for diversification and growth in the commodity services market.

Challenges:

Despite its potential for growth and profitability, the commodity services market faces several challenges. Volatility in commodity prices, supply chain disruptions, and geopolitical uncertainties can pose risks to investors and traders, leading to financial losses and market instability. Environmental and social concerns, such as climate change, deforestation, and labor rights, raise ethical and regulatory challenges for commodity producers and traders, requiring sustainable practices and transparency in supply chains. Additionally, regulatory compliance, cybersecurity threats, and market competition pose challenges for businesses operating in the commodity services market, requiring continuous adaptation and risk management strategies.

Read Also: Autonomous Forklift Market Size to Cross USD 13.91 Billion by 2033

Commodity Services Market Companies

- Cargill

- Gunvor

- Louis Dreyfus Company

- Mercuria energy group

- Trafigura

- Archer Daniels Midland

- Bunge limited

- Mabanaft

- Wilmar International

- COFCO Group

- Koch industries

- Hedgers

- Glencore

- Vitol

- Arbitrageurs

Segment Covered in the Report

By Type

- Metal

- Energy

- Agricultural

- Livestock

- Meat

- Others

By Entity

- Investors

- Consumers

- Manufacturers

- Traders

- Business Entities

- Producers

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/