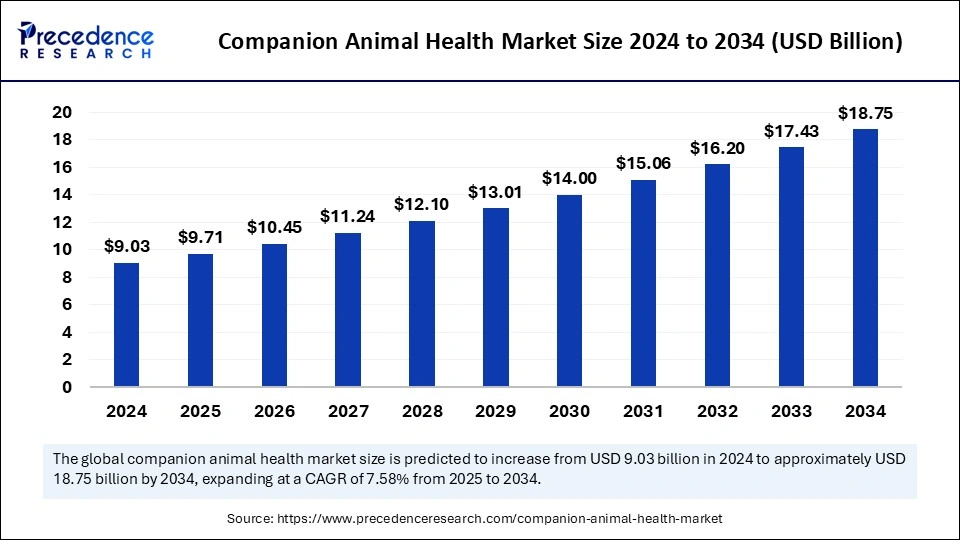

Companion Animal Health Market is forecasted to reach USD 18.75 billion by 2034.

The global companion animal health market size stood at USD 9.03 billion in 2024 and is expected to expand to USD 18.75 billion by 2034, with a CAGR of 7.58%.

Companion Animal Health Market Key Insights

- North America dominated the market by holding more than 39% of market share in 2024.

- Asia Pacific is expected to grow at the fastest rate in the market during the forecast period.

- By animal, the dogs segment held the biggest market share of 42% in 2024.

- By animal, the cats segment is expected to grow rapidly during the forecast period.

- By product, the pharmaceuticals segment held the major market share of 45% in 2024.

- By product, the diagnostics segment is expected to grow rapidly during the forecast period.

- By distribution channel, the hospital pharmacies segment contributed the largest market share of 81% 2024.

- By distribution channel, the e-commerce segment is expected to grow at the fastest rate during the forecast period.

- By end-use, the hospitals and clinics segment recorded more than 81% of market share in 2024.

- By end-use, the point-of-care/in-house testing segment is anticipated to grow at a significant CAGR during the forecast period.

The companion animal health market is experiencing steady growth, driven by increasing pet ownership, advancements in veterinary medicine, and heightened awareness of animal well-being. Companion animals, such as dogs, cats, and other household pets, are increasingly regarded as family members, leading to a surge in demand for preventive healthcare, diagnostics, therapeutics, and nutritional supplements. This shift in pet care dynamics has spurred investments in veterinary services, pharmaceuticals, vaccines, and pet insurance, contributing to market expansion.

As of 2024, the market was valued at approximately USD 9.03 billion and is projected to reach around USD 18.75 billion by 2034, growing at a CAGR of 7.58%. Rising disposable incomes, urbanization, and the growing number of pet owners worldwide have fueled spending on pet healthcare. Additionally, the humanization of pets has led to increased demand for specialized medical treatments, including advanced diagnostics, personalized medicine, and telehealth solutions for veterinary care.

With innovations in veterinary science, including gene therapy, regenerative medicine, and AI-driven diagnostics, the market is set to witness transformative growth. The increasing prevalence of zoonotic diseases, rising veterinary care standards, and regulatory support for animal welfare initiatives will further drive demand for quality pet healthcare solutions.

Sample Link: https://www.precedenceresearch.com/sample/5709

Market Drivers

The growing pet population worldwide is a significant factor fueling the companion animal health market. More households are adopting pets, leading to an increase in demand for preventive and curative veterinary services. The rise in pet ownership, especially in developing economies, is also driving investments in veterinary infrastructure and pharmaceutical innovations.

Another key driver is the increasing awareness of pet health and wellness. Pet owners today are more informed about disease prevention, nutrition, and routine veterinary care, which has resulted in higher spending on vaccinations, diagnostic tests, and therapeutic treatments. With the introduction of pet insurance policies, veterinary expenses have become more manageable, further encouraging pet owners to seek high-quality healthcare services.

The advancement of veterinary diagnostics and therapeutics is revolutionizing pet healthcare. The development of new vaccines, novel biologics, digital diagnostic tools, and AI-based treatment planning is improving early disease detection and better treatment outcomes. Telemedicine is also gaining traction, allowing pet owners to consult veterinarians remotely, which enhances accessibility to veterinary care, particularly in rural and underserved areas.

Opportunities

The expansion of pet insurance services is opening new opportunities for the companion animal health market. With rising veterinary costs, more pet owners are opting for insurance plans that cover medical procedures, emergency care, and chronic disease management. As insurers expand their offerings, pet healthcare accessibility is improving, leading to greater market penetration.

The growing trend of pet nutraceuticals and functional foods presents another promising opportunity. Pet owners are increasingly focused on preventive healthcare, driving demand for supplements that support joint health, digestion, immunity, and cognitive function. The rise of organic and specialized diets for pets is also fueling growth in pet nutrition and wellness products.

The integration of digital health solutions in veterinary care is another emerging opportunity. AI-powered diagnostics, wearable pet health monitors, and cloud-based veterinary record systems are transforming the way veterinarians track and manage pet health. These technologies enhance early disease detection and improve treatment efficacy, leading to better clinical outcomes for companion animals.

Challenges

Despite its growth, the companion animal health market faces several challenges, including high costs associated with veterinary care and treatments. Advanced medical procedures, diagnostics, and prescription medications can be expensive, making it difficult for pet owners without insurance to afford essential healthcare services for their pets.

The shortage of skilled veterinarians is another pressing concern. Many regions, particularly in developing countries, face a lack of trained veterinary professionals, leading to limited access to quality healthcare for pets. This shortage affects timely diagnosis and treatment, restricting the market’s full potential.

Strict regulatory frameworks and lengthy drug approval processes also pose hurdles. Developing and commercializing new veterinary drugs and vaccines requires rigorous compliance with government regulations, which can slow down innovation and market entry for new products. The need for extensive clinical trials and safety assessments further increases costs and delays the introduction of novel therapies.

Regional Insights

North America leads the companion animal health market, primarily due to high pet adoption rates, well-established veterinary infrastructure, and strong consumer spending on pet care. The presence of major pharmaceutical companies and research institutions in the region further strengthens market growth. The increasing popularity of pet insurance in the United States and Canada is making veterinary care more accessible, contributing to the expansion of the market.

Europe is another significant market, with countries like Germany, the UK, and France driving growth. The region’s strict animal welfare regulations and widespread awareness of preventive healthcare have led to increased adoption of vaccinations, diagnostic tests, and pet wellness programs. The presence of government-backed animal health initiatives also boosts the market’s growth potential.

The Asia-Pacific region is experiencing rapid growth, fueled by rising disposable incomes, increasing pet ownership, and expanding veterinary services. Countries like China, India, and Japan are witnessing a surge in demand for pet pharmaceuticals, nutritional products, and veterinary diagnostics. Growing awareness of zoonotic diseases and government efforts to strengthen animal healthcare infrastructure further accelerate market expansion.

Latin America and the Middle East & Africa are emerging markets with growing potential. Increasing awareness of pet healthcare, expanding veterinary clinics, and rising urbanization are contributing to market growth in these regions. While still in the early stages of development, investments in animal health and the introduction of affordable pet care solutions are expected to drive future expansion.

Read Also: Autoinjectors Market

Market Companies

- Mars Inc.

- Embark Veterinary, Inc.

- SYNLAB

- NationWide Laboratories

- IVC Evidensia

- CVS Group Plc

- Greencross Vets

- Zoetis Services LLC

- IDEXX Laboratories, Inc.

- The Animal Medical Center