Composites Market to Reach USD 213.32 Billion by 2034

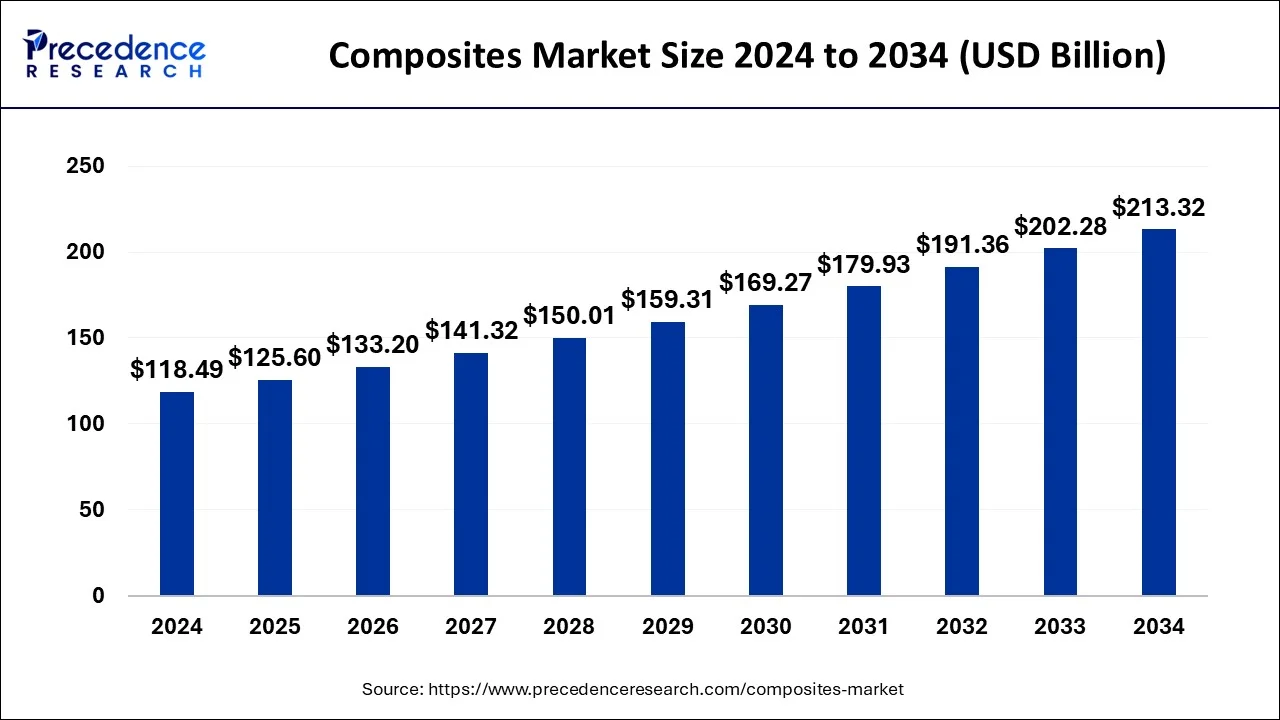

The global composites market was valued at USD 118.49 billion in 2024 and is expected to reach USD 213.32 billion by 2034, growing at a CAGR of 6.05%.

The composites market is experiencing significant growth, driven by the increasing demand for lightweight, durable materials across various industries such as automotive, aerospace, and construction. Asia Pacific leads the market, with strong manufacturing capabilities and rising demand for composites. The automotive sector, particularly electric vehicles (EVs), is a key driver, as manufacturers seek to reduce weight for improved performance and fuel efficiency. Glass fiber continues to dominate the market due to its versatility and cost-effectiveness. Advancements in manufacturing processes, like the layup process, are improving production efficiency. Additionally, sustainability is becoming a major focus, with innovations in eco-friendly composites and recycling technologies gaining traction. Overall, the market is expanding with opportunities in emerging markets and continued innovation in composite materials.

Composites Market Key Insights

- Asia Pacific led the composites market with the largest market share of 46% in 2024.

- The glass fiber segment contributed the highest market share of 61% in 2024.

- The layup process segment held the largest market share of 36% in 2024.

- The automotive and transportation segment accounted for the highest market share of 22% in 2024.

Composites Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 118.49 Billion |

| Market Size in 2025 | USD 125.60 Billion |

| Market Size by 2034 | USD 213.32 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.05% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, Resin, Manufacturing Process, Region |

Market Drivers

The growth of the composites market is driven by several factors. The increasing demand for lightweight, durable materials in industries such as automotive, aerospace, and construction is a key driver, as composites offer enhanced performance while reducing weight. The rise of electric vehicles (EVs) and advancements in automotive manufacturing techniques are further boosting the demand for composite materials, particularly in the automotive and transportation sectors, which accounted for the highest market share in 2024. Additionally, the growing focus on sustainability and energy efficiency is driving the adoption of composites due to their potential for reducing environmental impact. The Asia Pacific region plays a significant role in this growth, with its strong manufacturing capabilities and increasing demand for composites in various sectors. Moreover, the dominance of glass fiber, which captured the largest market share, is fueled by its versatility and cost-effectiveness in various applications, while advancements in manufacturing processes, such as the layup process, are enabling greater efficiency and quality in composite production.

Opportunities

- Increasing demand for lightweight and durable materials in the automotive and transportation sectors, driven by electric vehicle (EV) growth.

- Growing adoption of composites in industries like aerospace, construction, and renewable energy, offering new market opportunities.

- Advancements in manufacturing processes, such as the layup process, enabling higher efficiency and reduced production costs.

- Expanding demand in emerging markets, especially in Asia Pacific, due to strong industrial growth and manufacturing capabilities.

- Rising focus on sustainability and eco-friendly materials, with composites offering a solution for reduced environmental impact.

Challenges

- High production costs and complexities in the manufacturing of composites may limit market expansion.

- Limited awareness and understanding of composite materials in certain industries, hindering widespread adoption.

- Intense competition from traditional materials like metals and plastics, which may be more cost-effective in some applications.

- Supply chain disruptions and reliance on specific raw materials, such as glass fibers, which may impact availability and prices.

- Environmental concerns surrounding the recycling and disposal of composite materials, leading to regulatory challenges.

Regional Insights

The Asia Pacific region dominates the composites market, accounting for the largest market share in 2024, driven by strong manufacturing capabilities and increasing demand for composites across various industries like automotive, construction, and aerospace. North America also plays a significant role in the market, particularly in the automotive and aerospace sectors, with a focus on innovation and sustainability.

Europe shows steady growth, with increasing adoption of composites in automotive and renewable energy sectors, as well as advancements in manufacturing technologies. Latin America is witnessing gradual market expansion, driven by rising industrialization and demand for lightweight materials. The Middle East and Africa are emerging markets for composites, with growing demand in sectors such as construction, oil and gas, and transportation.

Read Also: Fresh Food Packaging Market Size Analysis 2022 To 2030

Market Companies

- Hexcel Corporation

- DuPont

- Momentive Performance Materials, Inc.

- Jushi Group Co., Ltd.

- Compagnie de Saint-Gobain S.A

- Weyerhaeuser Company

- Cytec Industries

Recent Developments

Recent developments in the composites market include advancements in manufacturing technologies, particularly in the layup process, which is enhancing production efficiency and reducing costs. The growing focus on sustainability has led to innovations in eco-friendly composite materials, with companies investing in recycling technologies to improve the end-of-life management of composites. In the automotive sector, there has been a notable increase in the adoption of composites, especially in electric vehicles (EVs), as manufacturers seek to reduce vehicle weight for better fuel efficiency and performance. The glass fiber segment continues to dominate due to its versatility and cost-effectiveness, while research into alternative fibers and materials is expanding the market’s scope. Additionally, the Asia Pacific region remains a key growth area, with significant investments in manufacturing capabilities and rising demand for composites in various industries such as construction, aerospace, and automotive.

Segments Covered in the Report

By Product Type

- Glass Fiber

- Carbon Fiber

- Others

By Resin Type

- Thermoplastic

- Thermosetting

- Others

By Manufacturing Process Type

- Injection Molding Process

- Resin Transfer Molding Process

- Pultrusion Process

- Layup Process

- Filament Winding Process

- Compression Molding Process

- Others

By End Use

- Electrical & Electronics

- Automotive & Transportation

- Wind Energy

- Aerospace & Defense

- Pipes & Tanks

- Construction & Infrastructure

- Marine

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America