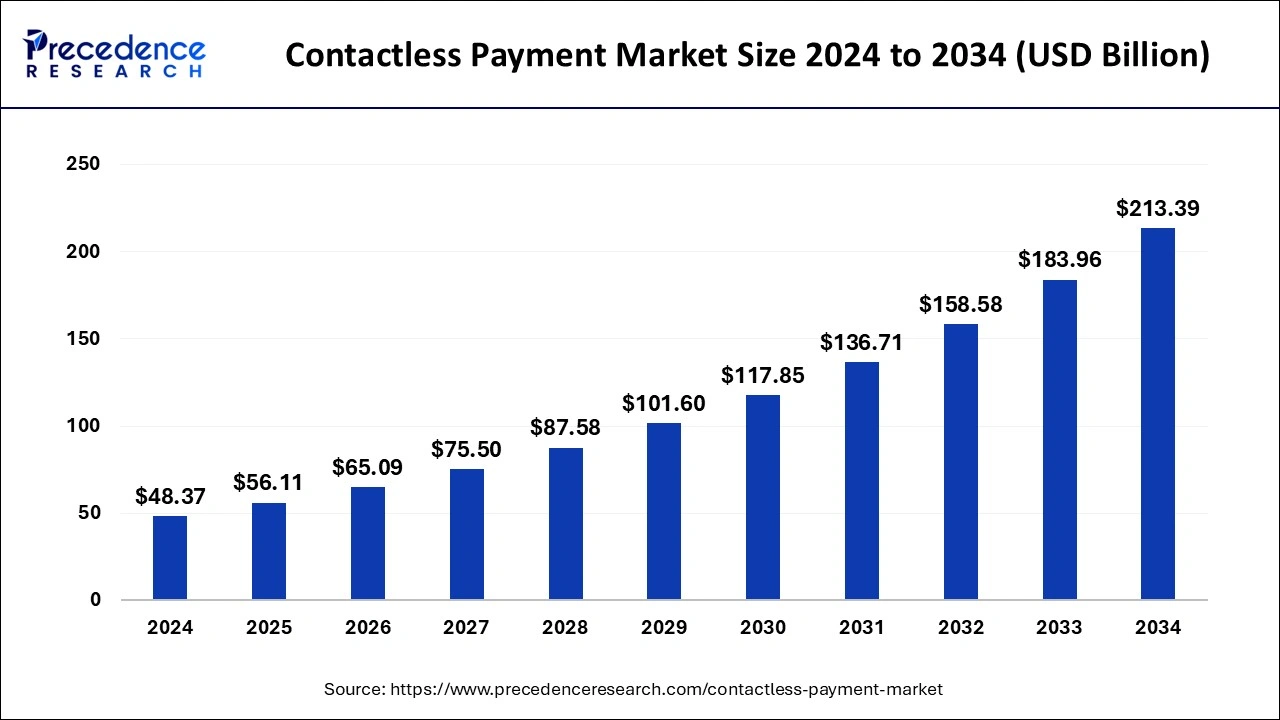

Contactless Payments Market to Hit $213.39B Market Size by 2034

The Contactless Payment Market, worth $48.37B in 2024, is projected to grow at a 16% CAGR, reaching $213.39B by 2034.

Contactless Payments Market Key Insights

- In 2024, North America held the highest market share globally.

- Payment terminal solutions made up more than 40% of total revenue.

- Retail applications contributed over 60% of the revenue share.

- Smartphones & wearables led with 60%+ of revenue in 2024.

The contactless payment market has evolved from a convenience-driven innovation to a necessity in today’s digital economy. Consumers worldwide are adopting tap-and-go transactions due to their speed, security, and ease of use. Financial institutions, retailers, and tech giants are continuously enhancing payment ecosystems, ensuring seamless experiences across multiple devices. From NFC-enabled cards to mobile wallets and wearables, contactless payments are reshaping how people interact with money.

The pandemic accelerated adoption, making cashless transactions the new norm. Businesses integrated digital solutions, and consumers became accustomed to hygienic, frictionless transactions. Governments and regulatory bodies supported this transition by increasing transaction limits and incentivizing businesses to go digital. With an increasing number of smart devices connected to payment networks, the future of cashless transactions appears more promising than ever.

Sample Link: https://www.precedenceresearch.com/sample/1044

Market Drivers

Smartphone penetration and the rise of digital wallets have fueled market expansion. Consumers now prefer payment methods that eliminate the need for cash or physical cards. Security enhancements, including biometric authentication and tokenization, have also played a critical role in boosting consumer confidence.

Retail and e-commerce growth further drive contactless adoption, with businesses prioritizing seamless checkout experiences. Additionally, government initiatives promoting cashless economies have encouraged both individuals and enterprises to embrace digital transactions.

Opportunities

Emerging markets present immense growth potential as they transition from cash-based economies to digital payment infrastructures. Fintech startups are collaborating with banks to introduce innovative financial solutions, bridging gaps in financial accessibility. The rise of AI and machine learning in fraud detection enhances security, making contactless payments safer than ever.

Wearable payment technology, including smartwatches and NFC rings, is gaining popularity, opening new revenue streams for tech firms. Moreover, partnerships between retailers and payment providers offer lucrative opportunities to enhance customer experiences through loyalty programs and integrated financial services.

Challenges

Despite rapid adoption, challenges persist. Security concerns and the potential for cyber threats remain significant. While advancements in encryption and fraud detection mitigate risks, some consumers remain wary of digital payment security.

The digital divide also hinders widespread adoption in certain regions, where banking infrastructure and internet access are limited. Regulatory complexities further complicate operations for multinational financial service providers, requiring constant adaptation to evolving compliance standards.

Regional Insights

- North America leads in adoption due to high smartphone penetration and advanced financial infrastructure.

- Europe benefits from strong regulatory support and widespread consumer trust in digital payments.

- Asia-Pacific experiences exponential growth, driven by digital transformation in China, India, and Southeast Asia.

- Latin America and the Middle East & Africa are gradually adopting contactless payments, with fintech innovation addressing infrastructural challenges.

Read Also: Robotics Technology Market Size