Credit Card Payments Market Size to Worth USD 1,331.50 Bn By 2033

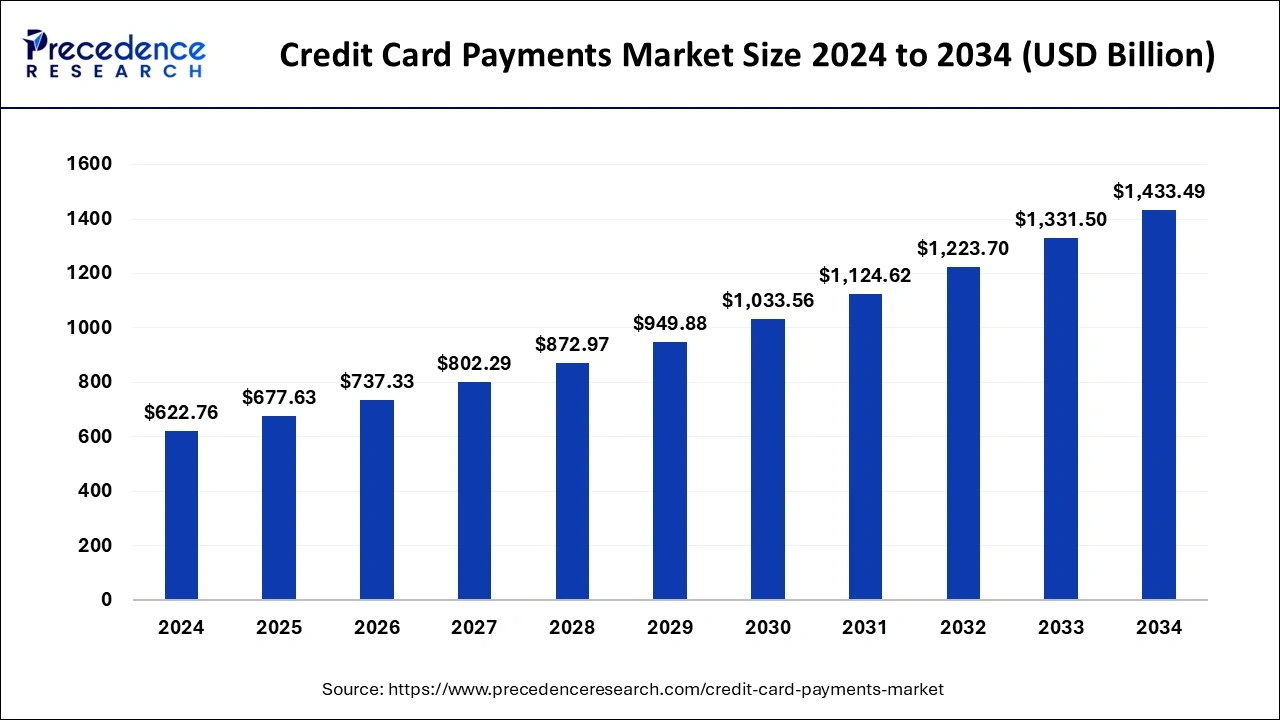

The global credit card payments market size is expected to increase USD 1,331.50 billion by 2033 from USD 572.34 billion in 2023 with a CAGR of 8.81% between 2024 and 2033.

Key Points

- The North America credit card payments market size reached USD 246.11 billion in 2023 and is expected to expand around USD 579.20 billion by 2033, at a CAGR of 8.93% from 2024 to 2033.

- North America held the dominant share of the credit card payments market in 2023.

- Europe is expected to expand at a rapid pace in the market during the forecast period.

- By card type, the general purpose credit cards segment accounted for the largest share of the market in 2023 and is projected to continue its dominance over the forecast period.

- By card type, the specialty & other credit cards segment is expected to witness considerable growth in the market over the forecast period.

- By application, the food & groceries segment held the largest share of the market in 2023.

- By application, the health & pharmacy segment is expected to grow significantly in the market during the forecast period.

- By provider, the Mastercard segment is estimated to hold the dominating share of the market during the forecast period.

- By provider, the Visa segment is expected to grow notably in the market over the studied period.

The credit card payments market has experienced significant growth and evolution over recent years, driven by technological advancements, changing consumer preferences, and regulatory developments. Credit cards have become a ubiquitous tool for consumers globally, offering convenience, security, and various rewards and benefits. The market encompasses a broad ecosystem involving financial institutions, payment processors, merchants, and consumers, all interconnected through a complex network of transactions.

Get a Sample: https://www.precedenceresearch.com/sample/4460

Growth Factors

Several key factors contribute to the growth of the credit card payments market. Firstly, technological innovations such as contactless payments, mobile wallets, and digital banking integrations have transformed the way consumers and businesses transact. These advancements have simplified payment processes, enhanced security measures, and expanded accessibility, driving adoption rates worldwide.

Moreover, the rising trend of e-commerce and online shopping has significantly boosted credit card usage. Consumers increasingly prefer the convenience and flexibility of paying online, contributing to higher transaction volumes and expanding the market size. Additionally, the proliferation of smartphones and internet penetration in emerging markets has democratized access to financial services, further fueling the demand for credit card payments.

Regional Insights

The credit card payments market exhibits varying dynamics across different regions. In developed economies such as North America and Western Europe, credit card penetration is high, with a mature market characterized by established financial infrastructure and robust consumer spending. These regions also witness continuous innovation in payment technologies and regulatory frameworks aimed at enhancing consumer protection and payment security.

Conversely, emerging markets in Asia-Pacific, Latin America, and Africa present immense growth opportunities. Rapid urbanization, increasing disposable incomes, and a growing middle class are driving the adoption of credit cards in these regions. Governments and financial institutions are investing in expanding banking services and improving financial literacy to facilitate greater inclusion in the formal financial system.

Credit Card Payments Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 572.34 Billion |

| Market Size in 2024 | USD 622.76 Billion |

| Market Size by 2033 | USD 1,331.50 Billion |

| Market Growth Rate | CAGR of 8.81% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Card Type, Application, Provider, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Credit Card Payments Market Dynamics

Drivers

Several drivers propel the growth of the credit card payments market globally. Firstly, the shift towards a cashless society, driven by convenience and hygiene considerations, encourages consumers to opt for electronic payment methods such as credit cards. Additionally, the integration of artificial intelligence (AI) and machine learning in fraud detection and customer service enhances security and improves user experience, thereby boosting confidence in credit card usage.

Furthermore, partnerships between financial institutions, fintech companies, and merchants are fostering innovation in payment solutions. Collaborations to develop loyalty programs, cashback offers, and personalized rewards attract consumers and drive card usage. Moreover, regulatory initiatives promoting interoperability and standardization in payment systems contribute to market growth by reducing transaction costs and improving efficiency.

Opportunities

The credit card payments market presents numerous opportunities for stakeholders. Expansion into new geographies, particularly emerging markets with underpenetrated payment infrastructure, offers substantial growth prospects. Fintech innovations such as peer-to-peer payments, blockchain-based solutions, and biometric authentication systems are reshaping the landscape, creating opportunities for new entrants and incumbents alike to differentiate their offerings.

Moreover, the increasing adoption of credit cards among small and medium-sized enterprises (SMEs) presents a lucrative market segment. SMEs benefit from credit card solutions for managing cash flow, making business purchases, and accessing credit facilities. Partnerships with fintech startups enable traditional financial institutions to enhance their product offerings and tap into niche markets, such as gig economy workers and digital nomads, who rely heavily on digital payments.

Challenges

Despite its growth prospects, the credit card payments market faces several challenges. One significant issue is cybersecurity and data privacy concerns associated with storing and processing sensitive payment information. Instances of data breaches and identity theft pose risks to consumer trust and regulatory compliance, necessitating continuous investments in robust security measures and regulatory adherence.

Furthermore, regulatory complexities and varying compliance requirements across jurisdictions present challenges for multinational financial institutions operating in multiple markets. Adapting to evolving regulatory frameworks, such as GDPR in Europe and PSD2 regulations, requires substantial resources and expertise to ensure compliance while maintaining operational efficiency.

Moreover, the COVID-19 pandemic has highlighted vulnerabilities in the credit card payments ecosystem, such as increased default rates and changes in consumer spending behavior. Economic uncertainties and fluctuations in interest rates can impact credit card issuers’ profitability and necessitate proactive risk management strategies.

Read Also: Blood Testing Market Size to Reach USD 198.19 Billion by 2033

Credit Card Payments Market Companies

- American Express

- Bank of America

- Barclays

- Capital One

- Chase

- Citibank

- Discover

- HSBC

- ICICI Bank

- JPMorgan

- Mastercard

- MUFG

- Santander

- SBI Cards

- State Farm

- U.S. Bancorp

- Visa

- Wells Fargo

- Westpac

- Worldpay

Recent Developments

- In February 2024, American Express and Delta Air Lines unveiled upgraded Delta SkyMiles American Express Cards, intended to improve the travel experience and provide everyday value to consumers and business owners.

- In March 2024, SBI Card, in partnership with Titan Company Ltd, announced the launch of Titan SBI Card. Titan SBI Card offers features that include cashback, titan gift vouchers, and reward points. The cardholders can avail benefits worth over Rs. 2,00,000 per annum.

- In June 2024, Adani One and ICICI Bank announced the launch of India’s first co-branded credit cards with airport-linked benefits in collaboration with Visa. Available in two variants – Adani One ICICI Bank Signature Credit Card and Adani One ICICI Bank Platinum Credit Card – the cards offer a substantial reward program.Companies

Segments Covered in the Report

By Card Type

- General Purpose Credit Cards

- Specialty and Other Credit Cards

By Application

- Food and Groceries

- Health and Pharmacy

- Restaurants and Bars

- Consumer Electronics

- Media and Entertainment

- Travel and Tourism

- Other Applications

By Provider

- Visa

- Mastercard

- Other Providers

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/