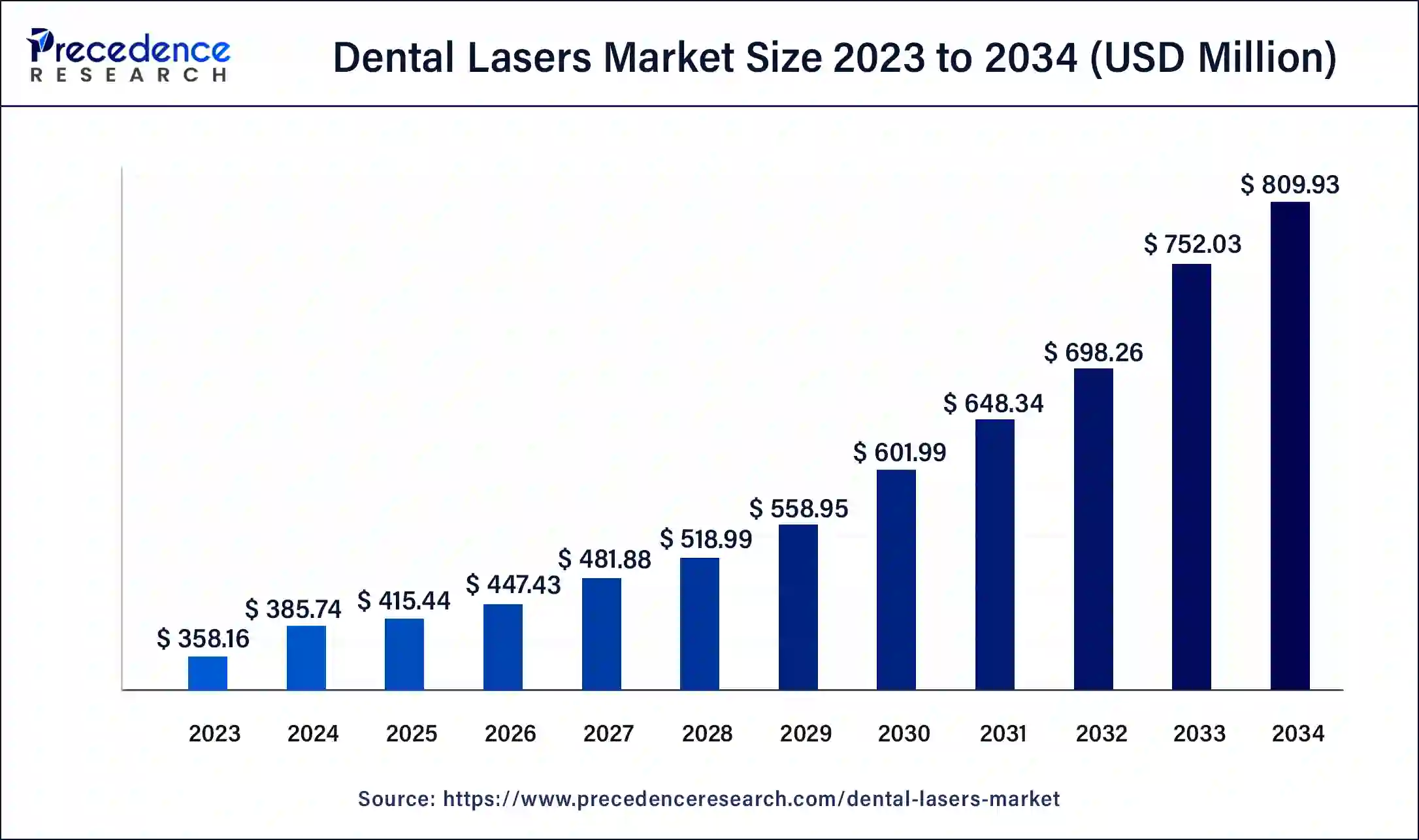

The global dental lasers market size surpassed USD 358.16 million in 2023 and is projected to be worth around USD 747.85 million by 2033, growing at a CAGR of 7.64% from 2024 to 2033.

Key Points

- The North America dental lasers market size accounted for USD 161.17 million in 2023 and is expected to attain around USD 336.53 million by 2033.

- North America led the market with the largest market share of 45% in 2023.

- Asia Pacific is expected to experience the fastest CAGR of 8.15% over the forecast period.

- By product, the dental surgical laser segment has accounted more than 90% of market share in 2023.

- By application, the periodontics segment has held the largest market share of 19% in 2023.

- By end use, the dental clinics segment has generated more than 55% of market share in 2023.

The dental lasers market has witnessed significant growth in recent years, driven by advancements in technology and an increasing demand for minimally invasive dental procedures. Dental lasers are innovative tools that offer precise and efficient solutions for a wide range of dental procedures, including cavity treatment, gum disease therapy, teeth whitening, and oral surgery. These devices utilize laser energy to target specific areas of the oral cavity with minimal damage to surrounding tissues, resulting in faster healing times and reduced patient discomfort.

Get a Sample: https://www.precedenceresearch.com/sample/4141

Growth Factors:

Several factors contribute to the growth of the dental lasers market. Technological advancements have led to the development of more versatile and efficient laser systems, expanding their applications in various dental procedures. Additionally, growing awareness among both dental practitioners and patients about the benefits of laser dentistry, such as reduced pain, faster recovery, and improved outcomes, has fueled market growth. Moreover, the increasing prevalence of dental disorders, coupled with the rising demand for cosmetic dental procedures, has further propelled the adoption of dental lasers worldwide.

Region Insights:

The dental lasers market exhibits regional variations in terms of adoption and market dynamics. North America and Europe dominate the market, driven by advanced healthcare infrastructure, high healthcare expenditure, and a strong focus on technological innovation. However, emerging economies in Asia-Pacific, such as China, India, and Japan, are witnessing rapid growth due to increasing healthcare awareness, rising disposable incomes, and expanding dental tourism. Latin America and the Middle East & Africa regions are also expected to experience significant growth, supported by improving healthcare infrastructure and a growing patient pool.

Dental Lasers Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.64% |

| Global Market Size in 2023 | USD 358.16 Million |

| Global Market Size in 2024 | USD 385.52 Million |

| Global Market Size by 2033 | USD 747.85 Million |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Dental Lasers Market Dynamics

Drivers:

Several drivers contribute to the expansion of the dental lasers market. The growing preference for minimally invasive dental procedures among patients, coupled with the rising demand for cosmetic dentistry, is a key driver. Additionally, the advantages offered by dental lasers, such as precise tissue ablation, reduced bleeding, and shorter treatment durations, drive their adoption among dental practitioners. Moreover, the increasing prevalence of dental diseases, such as periodontal diseases and dental caries, fuels the demand for advanced treatment modalities like laser dentistry.

Opportunities:

The dental lasers market presents numerous opportunities for growth and innovation. Continued advancements in laser technology, such as the development of portable and user-friendly laser devices, can expand the market reach and accessibility of laser dentistry. Moreover, increasing investments in research and development activities aimed at expanding the applications of dental lasers, particularly in emerging dental specialties like endodontics and implantology, can unlock new opportunities for market players. Furthermore, collaborations between dental laser manufacturers and dental institutions can facilitate technology transfer and promote awareness about the benefits of laser dentistry.

Challenges:

Despite the promising growth prospects, the dental lasers market faces several challenges. High initial capital investments required for purchasing and maintaining dental laser systems may limit their adoption, particularly among small dental practices and in developing regions. Moreover, the lack of reimbursement policies for laser dental procedures in some countries may hinder market growth. Additionally, concerns regarding the safety and efficacy of dental lasers, as well as the need for specialized training for dental practitioners, pose challenges to widespread adoption. Addressing these challenges will be crucial for the sustained growth of the dental lasers market.

Read Also: External Pacemaker Market Size to Surpass USD 2.48 Bn by 2033

Dental Lasers Market Recent Developments

- In January 2024, Calcivis launched its groundbreaking new preventive dental technology in the United States. The business filed a PMA supplement with the FDA for enhancements to its imaging system last year, and the new ergonomic, wireless, handheld imaging device has been approved for commercialization.

- In August 2023, Boston Micro Fabrication (BMF), a leader in advanced manufacturing solutions for ultra-high precision applications, entered into the dental market with the launch of UltraThineer, the world’s thinnest cosmetic dental veneer. The new 3D printed veneers use projection micro stereolithography (PµSL), a technology that custom-manufactures veneers that are 3x thinner than traditional veneers and require significantly less preparation for dental professionals.

Dental Lasers Market Companies

- BIOLASE, Inc.

- Fotona

- Gigaalaser Group

- IPG Photonics Corp.

- CAO Group, Inc.

- Kavo Dental (Envista)

- Dentsply Sirona Inc.

- Lumenis

Segments Covered in the Report

By Product

- Dental Surgical Lasers

- Dental Welding Lasers

By Application

- Conservative Dentistry

- Endodontic Treatment

- Oral Surgery

- Implantology

- Peri-implantitis

- Periodontics

- Tooth Whitening

By End-use

- Hospitals

- Dental Clinics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/