Digital Transformation in BFSI Market Size, Share, Report By 2033

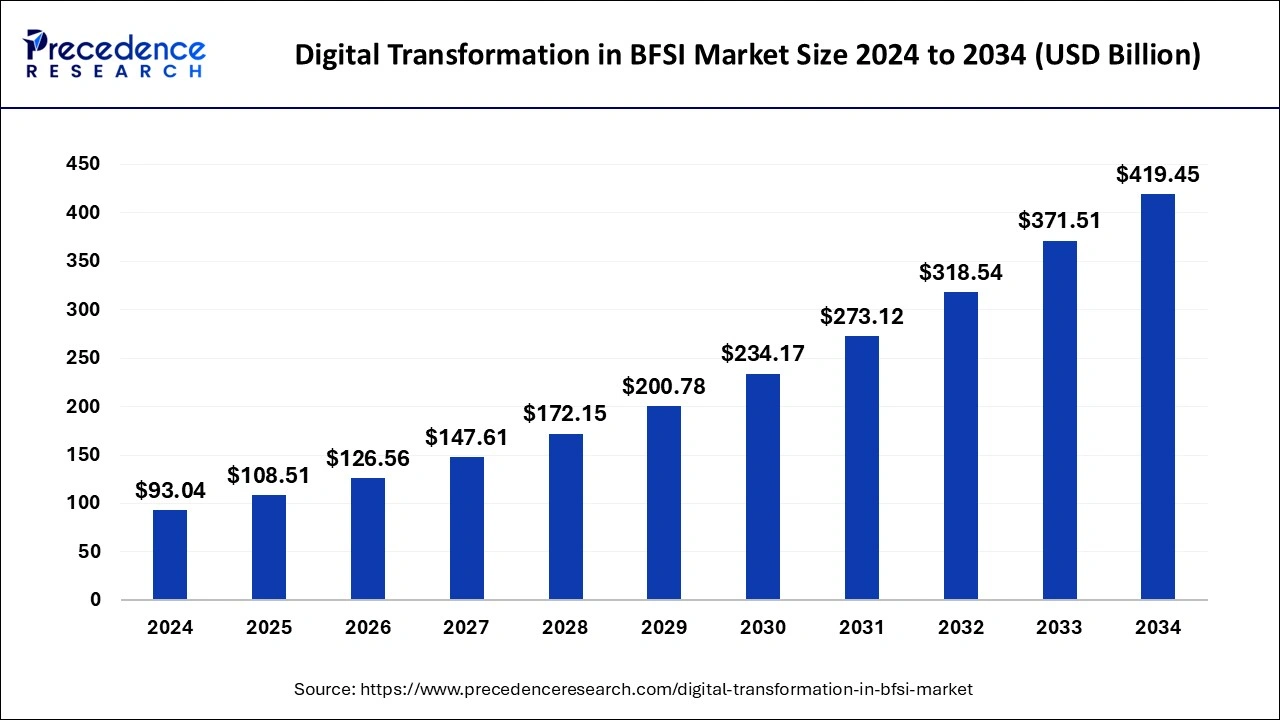

The global digital transformation in BFSI market size is expected to increase USD 371.51 billion by 2033 from USD 79.77 billion in 2023 with a CAGR of 16.63% between 2024 and 2033.

Key Points

- North America led the digital transformation in BFSI market with the largest market size in 2023.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

- By component, the solution segment dominated the market with the highest growth in 2023.

- By deployment, the on-premise segment projected the highest growth in 2023.

- By deployment, the cloud segment is estimated to grow at the fastest rate during the forecast period.

- By enterprise, large enterprise segment dominated the market with the largest market share in 2023.

- By technology, the artificial intelligence segment dominated the market with the largest revenue in 2023.

- By end-user, the banks segment dominated the digital transformation in BFSI market in 2023.

Digital transformation in the Banking, Financial Services, and Insurance (BFSI) sector is a significant shift driven by technology adoption to enhance operational efficiency, customer experience, and competitive advantage. This transformation encompasses the integration of digital technologies across various functions within financial institutions, including customer service, transactions, risk management, and back-office operations. Key technologies driving this transformation include artificial intelligence (AI), machine learning (ML), blockchain, big data analytics, and cloud computing. The BFSI sector’s journey towards digitalization aims to streamline processes, reduce costs, mitigate risks, and ultimately deliver superior financial services in a rapidly evolving digital landscape.

Get a Sample: https://www.precedenceresearch.com/sample/4466

Growth Factors

Several factors propel digital transformation in the BFSI sector. Firstly, the increasing consumer demand for convenient, personalized, and seamless digital banking experiences drives financial institutions to invest in digital channels and technologies. Secondly, regulatory requirements push banks and insurers to adopt digital solutions for compliance, reporting, and data security. Moreover, competition from fintech startups and tech giants entering the financial services space accelerates digital transformation as traditional institutions strive to innovate and maintain market relevance. Additionally, the COVID-19 pandemic highlighted the necessity of digital capabilities for business continuity, further expediting digital transformation initiatives across the BFSI sector.

Trends Shaping Digital Transformation

Key trends shaping digital transformation in BFSI include the rise of mobile banking apps, AI-powered chatbots for customer service, robo-advisors for investment management, and blockchain for secure transactions and smart contracts. Moreover, the shift towards open banking frameworks, where financial institutions collaborate with third-party providers via APIs to offer enhanced services, is gaining traction. Data analytics and AI-driven insights are transforming risk management and fraud detection capabilities, enabling proactive decision-making and personalized customer experiences. Furthermore, the adoption of cloud computing facilitates scalability, agility, and cost-efficiency in delivering financial services.

Region Insights

Digital transformation in the BFSI sector varies regionally based on regulatory environments, technological infrastructure, and consumer preferences. In North America, for instance, established financial institutions are investing heavily in digital technologies to maintain market leadership amid competition from agile fintech startups. Europe is witnessing regulatory initiatives like the Revised Payment Services Directive (PSD2), promoting open banking and fostering innovation in financial services. Emerging markets in Asia-Pacific are leapfrogging traditional banking infrastructures with mobile-first approaches and digital payment solutions, driven by widespread smartphone penetration and evolving consumer behaviors.

Digital Transformation in BFSI Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 79.77 Billion |

| Market Size in 2024 | USD 93.04 Billion |

| Market Size by 2033 | USD 371.51 Billion |

| Market Growth Rate | CAGR of 16.63% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Component, Deployment, Enterprise, Technology, End-User and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Digital Transformation in BFSI Market Dynamics

Drivers

The primary drivers of digital transformation in BFSI include improving operational efficiency through automation and digitization of processes. Enhanced customer engagement and satisfaction are achieved by offering personalized services and seamless omnichannel experiences. Cost reduction is another driver, as digital technologies enable streamlined operations and reduced dependency on physical infrastructure. Furthermore, regulatory compliance necessitates digital solutions for data security, transparency, and reporting. Lastly, strategic partnerships and collaborations with fintech firms and technology providers accelerate innovation and expand service offerings.

Opportunities

Digital transformation presents numerous opportunities for BFSI institutions, including expanding market reach through digital channels, entering new customer segments, and diversifying revenue streams with innovative financial products. Enhanced data analytics capabilities enable better risk management, pricing strategies, and product development. Moreover, leveraging AI and ML technologies enables predictive analytics for personalized customer recommendations and fraud prevention. The adoption of blockchain fosters trust and transparency in financial transactions, opening avenues for smart contracts and decentralized finance (DeFi) applications.

Challenges

Despite its benefits, digital transformation in BFSI comes with challenges. Legacy IT systems and infrastructure pose integration complexities and security risks during digital adoption. Data privacy concerns and regulatory compliance requirements add another layer of complexity, particularly with cross-border operations. Skill gaps in digital literacy and technology expertise among employees necessitate training and upskilling initiatives. Moreover, resistance to change within organizational culture and stakeholder alignment can hinder effective implementation of digital transformation strategies. Furthermore, ensuring cybersecurity resilience against evolving threats remains a perpetual challenge for BFSI institutions.

Read Also: Sheet Metal Market Size to Worth USD 524.27 Bn by 2033

Digital Transformation in BFSI Market Companies

- Oracle

- Fujitsu

- Accenture

- HID Global Corporation.

- SAP SE

- Google LLC

- AlphaSense Inc.

- Cognizant

- Microsoft Corporation

- International Business Machines Corporation

Recent Development

- In May 2024, Infosys, Tata Consulting Services, Tech Mahindra, and Wipro, all the IT companies, are winning the digital transformation deals in banking, financial services, and Insurance) industry. The organizations see the potential opportunities in core banking, payment, and other applications.

- In June 2024, InfoAxon comes into a strategic collaboration with Liferay to help boost the digital transformation for Reliance Digital Insurance (RGI). The collaboration is set to enhance RGI’s digital landscape and deliver a revolutionary journey to the consumer and prospects.

- In May 2024, ModernFi, an API-driven and fully integrated deposit network, announced the partnership with the Q2’s Digital Banking Platform through the Q2 Partner Accelerator Program. The collaboration brings a reciprocal program into digital banking.

- In May 2024, Decentro, India’s leading Fintech infrastructure platform, launched the next-generation Payment Stack. The platform is designed to cater to businesses delivering high performance, expansive payment needs, compliance, and security.

Segments Covered in the Report

By Component

- Solution

- Service

By Deployment

- On-Premise

- Cloud

By Enterprise

- Large Enterprises

- Small and Medium-sized Enterprises

By Technology

- Artificial Intelligence

- Cloud Computing

- Blockchain

- Big Data and Business Analytics

- Cybersecurity

- Others

By End-User

- Banks

- Insurance Companies

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/