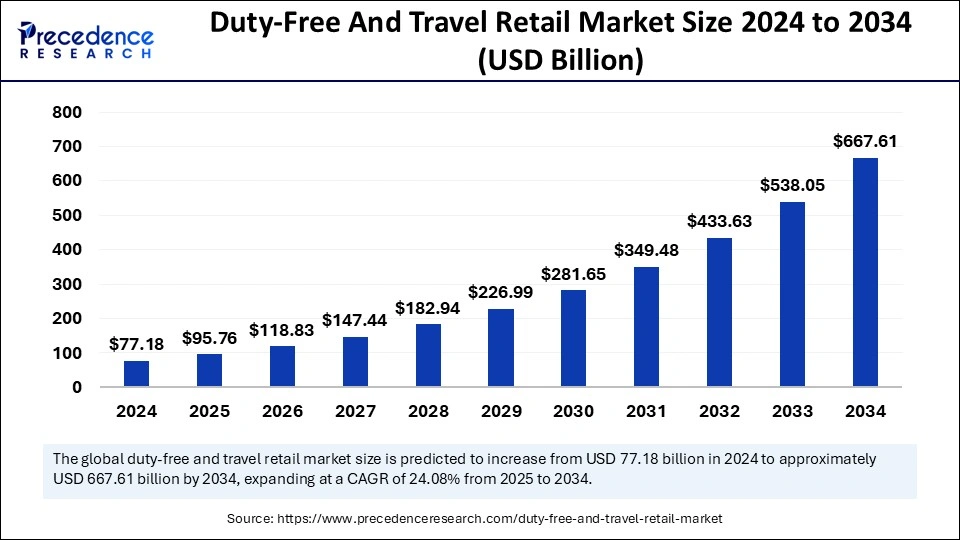

Duty Free and Travel Retail Market to Reach USD 667.61 Bn by 2034

Duty free and travel retail market is projected to grow from USD 77.18 billion in 2024 to USD 667.61 billion by 2034, at a CAGR of 24.08% from 2025 to 2034.

Duty Free And Travel Retail Market Key Takeaways

In 2024, Asia Pacific held the leading position in the duty-free and travel retail market.

Europe is projected to experience rapid growth during the forecast period.

The beauty and personal care segment led the market by product type in 2024.

The fashion accessories and hard luxury segment is expected to expand significantly in the coming years.

By distribution channel, the airports segment dominated the market in 2024.

The seaports segment is anticipated to grow at the fastest pace throughout the forecast period.

Duty Free And Travel Retail Market Overview

The duty-free and travel retail market is experiencing robust growth, driven by the rapid expansion of international travel and tourism. Duty-free and travel retail outlets are strategically located in airports, seaports, cruise ships, and border shops, offering travelers a wide range of products such as luxury goods, perfumes, cosmetics, alcohol, tobacco, fashion accessories, and electronics. The sector benefits from tax exemptions that allow retailers to offer products at competitive prices compared to domestic markets.

The rise in disposable income, particularly in emerging economies, coupled with increasing air passenger traffic, has contributed to the expansion of this market. The growing influence of globalization and the popularity of premium and luxury brands among international travelers have further strengthened the duty-free and travel retail industry.

Duty Free And Travel Retail Market Drivers

The primary driver of the duty-free and travel retail market is the increasing number of international travelers, with air travel becoming more accessible due to lower airline ticket prices and improved global connectivity. Rising disposable income levels in developing economies such as China, India, and Southeast Asian countries have resulted in higher spending on luxury goods and premium products at duty-free stores.

The expansion of international airports and enhanced airport infrastructure have led to increased retail space, providing travelers with a wider selection of products and services. Additionally, the integration of digital technologies, such as self-service kiosks, mobile payments, and personalized promotions, has improved the shopping experience, attracting more customers to duty-free and travel retail stores.

Duty Free And Travel Retail Market Opportunities

The increasing demand for personalized and experiential retailing presents a significant opportunity for the duty-free and travel retail market. Brands are leveraging digital technologies, augmented reality, and artificial intelligence to enhance customer engagement and provide tailored shopping experiences. The rise of omnichannel retailing, where travelers can browse and pre-order duty-free products online before picking them up at the airport, is creating new sales opportunities.

Additionally, the introduction of sustainable and eco-friendly products is gaining traction, as environmentally conscious travelers seek ethical and responsible retail options. Expanding travel routes, particularly in Asia-Pacific and the Middle East, provides a growing customer base for duty-free retailers, leading to increased investment in airport retail spaces.

Duty Free And Travel Retail Market Challenges

Despite its growth potential, the duty-free and travel retail market faces challenges such as fluctuating currency exchange rates, which impact product pricing and traveler spending patterns. Regulatory changes related to tax-free shopping, customs duties, and government restrictions on the sale of certain products, such as alcohol and tobacco, pose hurdles for retailers. The COVID-19 pandemic significantly disrupted international travel, leading to temporary declines in duty-free sales, and future pandemics or geopolitical tensions could similarly affect market performance.

Additionally, the increasing competition from e-commerce and online shopping platforms is challenging traditional travel retail models, requiring retailers to adopt innovative marketing and sales strategies.

Duty Free And Travel Retail Market Regional Insights

Asia-Pacific dominates the duty-free and travel retail market, driven by a surge in international travel, particularly among Chinese, South Korean, and Japanese consumers. Major airport hubs such as Singapore, Hong Kong, and Dubai serve as key retail destinations for luxury shopping.

Europe remains a strong market, with travelers from the United States, the Middle East, and Asia contributing significantly to retail sales in major airports like Heathrow, Charles de Gaulle, and Frankfurt.

North America is seeing steady growth due to increased air travel and cruise tourism, while the Middle East continues to attract high-spending tourists, with Dubai International Airport leading in duty-free sales. Latin America and Africa, though relatively smaller markets, are gradually expanding as tourism and travel infrastructure improve.

Duty Free And Travel Retail Market Recent Developments

The industry has witnessed a surge in digitalization, with many duty-free retailers launching e-commerce platforms and mobile apps for pre-ordering and in-store pickup services. Luxury brands are collaborating with airport retailers to offer exclusive travel retail collections, attracting affluent travelers.

Sustainability is gaining importance, with brands introducing eco-friendly packaging and sustainable product lines to appeal to environmentally conscious consumers. The integration of artificial intelligence for personalized recommendations and customer insights is transforming the shopping experience at duty-free outlets.

Duty Free And Travel Retail Market Companies

- Lotte Duty-Free

- DFS Group

- King Power

- China Duty-Free Group Co. Ltd.

- Flemingo International Ltd.

- Dufry

- Duty Free Americas Inc.

- WHSmith

- Delhi Duty-Free

- Dubai Duty-Free

- The Shilla Duty-Free

Segments Covered in the Report

By Product Type

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Other Types

By Distribution Channel

- Airports

- Onboard Aircraft

- Seaports

- Train Stations

- Airlines

- Ferries

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa