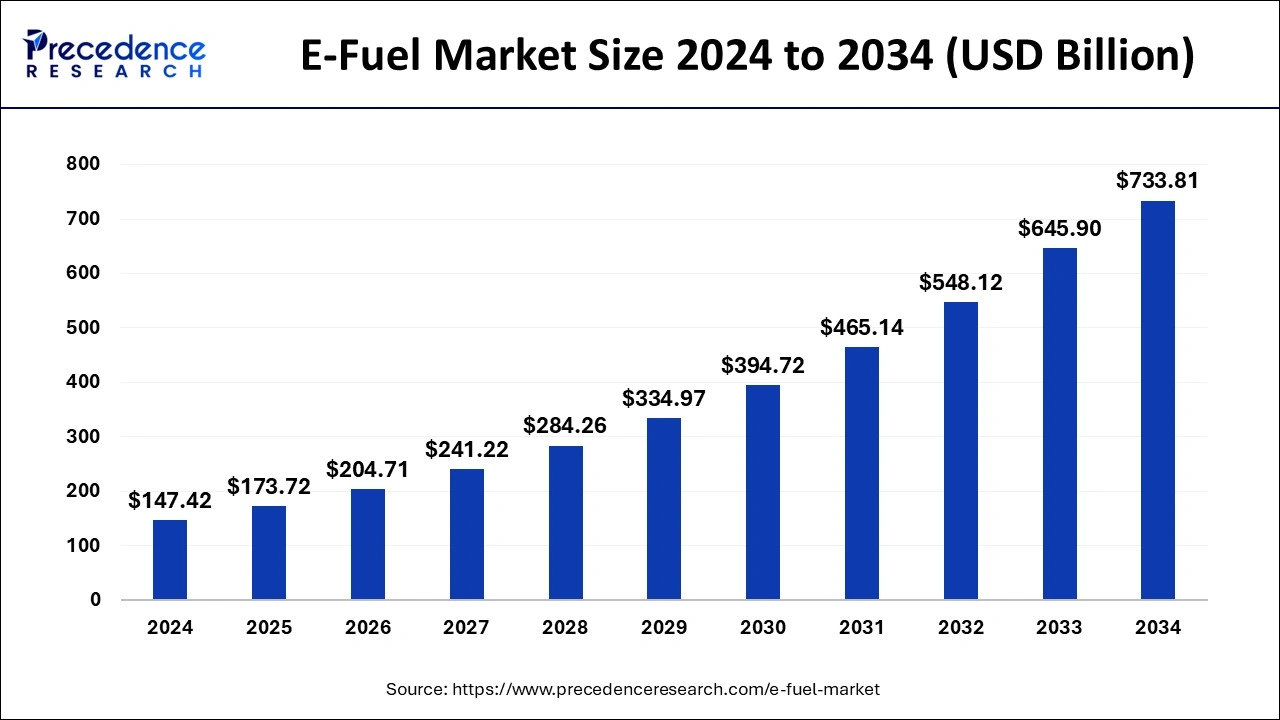

E-Fuel Market Size to Surpass USD 645.90 Billion By 2033

The global e-fuel market size surpassed USD 125.10 billion in 2023 and is projected to be worth around USD 645.90 billion by 2033, expanding at a CAGR of 17.83% from 2024 to 2033.

Key Points

- In Europe, the e-fuel market is experiencing rapid growth and significant momentum, dominating the global market with a 47% revenue share in 2023.

- Germany has accounted market share of over 21.3% in 2023.

- North America is expected to witness the fastest growth in the global market during the projected period.

- Based on a product, in 2023, the ethanol segment has dominated the market with market share of 27% in 2023.

- Based on state, the liquid segment held the largest market share of 76.9% in 2023.

- Based on production method, the market was dominated by the power-to-liquid segment in 2023 with market share of 38.7%.

- Based on technology, the hydrogen technology segment has contributed the largest revenue share of around 59% in 2023.

- Based on a carbon source, the point source segment accounted for the largest market share of over 81.4% in 2023.

- Based on carbon capture, the pre-combustion segment has held the largest market share of 68.3% in 2023.

- Based on end use, the automotive segment dominated the market of around 28.5% in 2023.

The E-Fuel market represents a significant shift towards sustainable energy solutions in the transportation sector. E-Fuels, also known as synthetic fuels or electrofuels, are produced using renewable energy sources such as wind, solar, or hydropower to convert carbon dioxide and water into synthetic hydrocarbons. These fuels offer a promising alternative to traditional fossil fuels, as they can be used in existing combustion engines with minimal modifications, thus helping to reduce greenhouse gas emissions and combat climate change. The E-Fuel market is poised for substantial growth as governments, industries, and consumers increasingly prioritize environmental sustainability and energy security.

Get a Sample:https://www.precedenceresearch.com/sample/4068

Growth Factors:

Several factors are driving the growth of the E-Fuel market. Firstly, the growing concern over climate change and air pollution has led to a global push for decarbonization and the transition towards renewable energy sources. E-Fuels offer a carbon-neutral or even carbon-negative alternative to conventional fuels, making them an attractive option for reducing emissions from transportation and other sectors.

Moreover, advancements in renewable energy technologies, particularly in the areas of electrolysis and synthetic fuel production, have made E-Fuels more economically viable and scalable. As the costs of renewable energy continue to decline, the production of E-Fuels becomes increasingly competitive with traditional fossil fuels, driving further adoption and investment in the sector.

Region Insights:

The adoption of E-Fuels varies across different regions, influenced by factors such as government policies, energy infrastructure, and market dynamics. In Europe, countries such as Germany and Sweden have been at the forefront of promoting E-Fuels as part of their efforts to achieve carbon neutrality and reduce dependence on imported fossil fuels. The European Union’s Renewable Energy Directive (RED II) sets targets for the use of renewable energy in transportation, providing incentives for the production and use of E-Fuels.

In North America, the United States and Canada are also exploring the potential of E-Fuels to reduce emissions from transportation and heavy industry. Initiatives such as California’s Low Carbon Fuel Standard (LCFS) and federal tax incentives for renewable fuels encourage investment in E-Fuel production facilities and research into advanced biofuels.

In Asia-Pacific, countries like Japan and South Korea are investing in E-Fuels as part of their strategies to diversify energy sources and reduce dependence on imported oil. These countries view E-Fuels as a way to enhance energy security, promote technological innovation, and support sustainable economic growth.

E-Fuel Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 17.83% |

| Global Market Size in 2023 | USD 125.10 Billion |

| Global Market Size in 2024 | USD 147.42 Billion |

| Global Market Size by 2033 | USD 645.90 Billion |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By State, By Production Method, By Technology, By End-use, By Carbon Source and By Carbon Capture |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

E-Fuel Market Dynamics

Drivers:

Several drivers are propelling the growth of the E-Fuel market. One key driver is the increasing stringency of environmental regulations aimed at reducing greenhouse gas emissions from transportation and other sectors. Governments around the world are implementing policies such as carbon pricing, renewable fuel mandates, and emission standards to incentivize the adoption of low-carbon alternatives like E-Fuels.

Additionally, the volatility of oil prices and geopolitical tensions in key oil-producing regions have highlighted the risks associated with reliance on fossil fuels. E-Fuels offer a more stable and sustainable energy source, reducing exposure to price fluctuations and supply disruptions in the global energy market.

Furthermore, technological advancements in renewable energy and synthetic fuel production are driving down the costs of E-Fuels and improving their efficiency and scalability. Innovations in electrolysis, catalysis, and carbon capture technologies are making it possible to produce E-Fuels at increasingly competitive prices, further accelerating their adoption.

Opportunities:

The E-Fuel market presents significant opportunities for stakeholders across the value chain. For renewable energy developers and energy companies, investing in E-Fuel production facilities can provide a new revenue stream and diversify their portfolio of clean energy solutions. By integrating renewable energy sources with E-Fuel production, these companies can leverage existing infrastructure and expertise to meet growing demand for sustainable transportation fuels.

Moreover, E-Fuels offer opportunities for collaboration between industries such as automotive, aviation, and shipping to develop and deploy low-carbon fuel solutions. Partnerships between fuel producers, vehicle manufacturers, and logistics companies can drive innovation, scale production, and create new markets for E-Fuels in various transportation sectors.

Furthermore, the development of E-Fuels can support rural economies and agricultural communities by creating new markets for biomass feedstocks such as crop residues, forestry waste, and algae. By valorizing these biomass resources, E-Fuel production can generate economic opportunities, promote rural development, and contribute to sustainable land management practices.

Challenges:

Despite the opportunities presented by E-Fuels, several challenges must be addressed to realize their full potential. One challenge is the high cost of E-Fuel production compared to conventional fossil fuels, particularly in the absence of carbon pricing or other incentives to internalize the environmental costs of carbon emissions. Without adequate policy support and market mechanisms to level the playing field, E-Fuels may struggle to compete with cheap oil and gas.

Moreover, the scalability of E-Fuel production remains a challenge, as current technologies for electrolysis and synthetic fuel synthesis are not yet mature enough to achieve large-scale production at competitive costs. Research and development efforts are needed to improve the efficiency, reliability, and cost-effectiveness of E-Fuel production processes, including the development of new catalysts, reactor designs, and integrated supply chains.

Furthermore, the infrastructure for storing, transporting, and distributing E-Fuels is still underdeveloped compared to the extensive network of pipelines, refineries, and fueling stations for conventional fuels. Investments in infrastructure upgrades and retrofitting will be necessary to support the widespread adoption of E-Fuels and ensure their availability to consumers across different regions and sectors.

Read Also: Wind Turbine Composite Materials Market Size, Trends, Report By 2033

Recent Developments

- In March 2024, indiaOil launched ETHANOL 100 as an alternative automotive fuel. The Indian government made this courageous move in the automotive sector to reduce its dependency on fossil fuels, thus contributing to the global target of seizing carbon emissions and making the climate free from environmental toxication by internal combustion of conventionally working vehicles.

- In April 2023, Norwegian Air Shuttle ASA collaborated with Norsk e-fuel in Norway. The target of launching this new plant is to cater to the aviation industry by producing sustainable e-fuels by 2026. Through this collaboration, enterprises are expected to scale up their e-fuel production while holding high positions in the global market.

E-Fuel Market Companies

- Archer Daniels Midland Co.

- Ballard Power Systems, Inc.

- Ceres Power Holding Plc

- Clean Fuels Alliance America

- Climeworks AG

- E-Fuel Corporation

- eFuel Pacific Limited

- Hexagon Agility

- Neste

- Norsk e-Fuel AS

Segments Covered in the Report

By Product

- E-diesel

- E-gasoline

- Ethanol

- Hydrogen

- E-kerosene

- E-methane

- E-methanol

- Others

By State

- Liquid

- Gas

By Production Method

- Power-to-liquid

- Power-to-gas

- Gas-to-liquid

- Biologically derived fuels

By Technology

- Hydrogen technology (Electrolysis)

- Fischer-tropsch

- Reverse-water-gas-shift (RWGS)

By End-use

- Automotive

- Marine

- Industrial

- Railway

- Aviation

- Others

By Carbon Source

- Point source

- Smokestack

- Gas well

- Direct air capture

By Carbon Capture

- Post-combustion

- Pre-combustion

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/