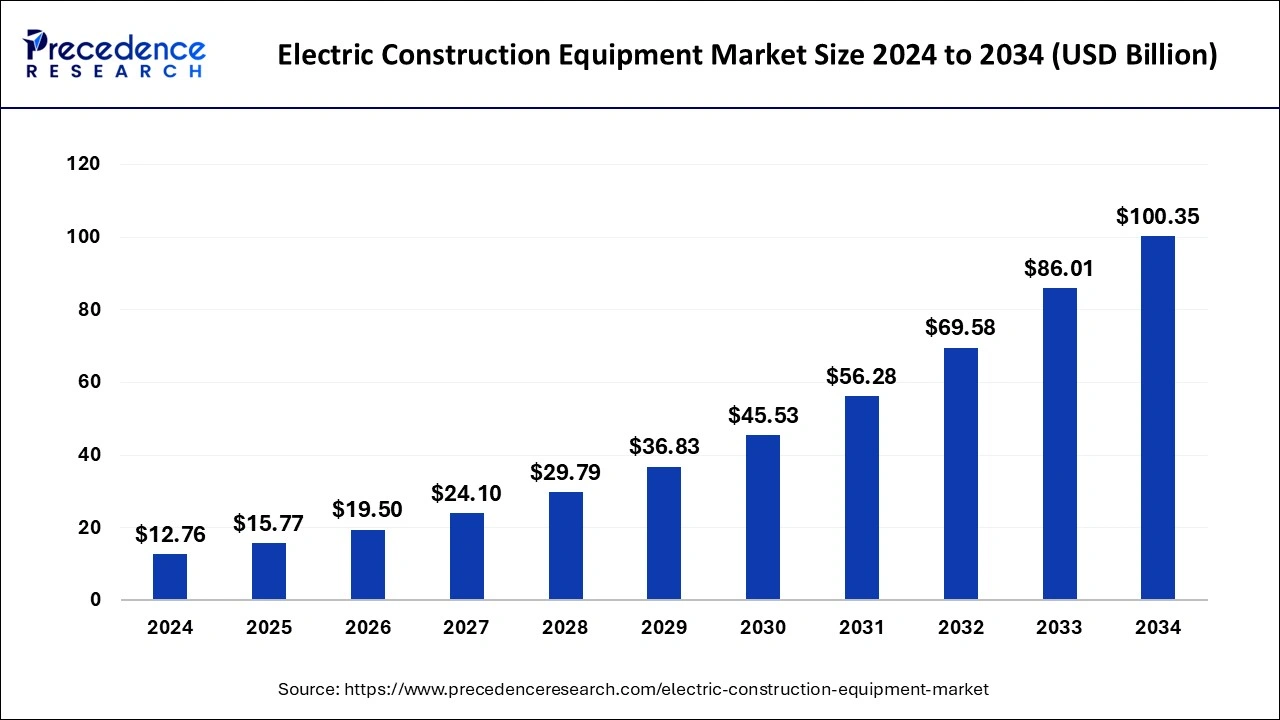

The global electric construction equipment market size surpassed USD 10.32 billion in 2023 and is anticipated to be worth around USD 86.01 billion by 2033, growing at a CAGR of 23.62% from 2024 to 2033.

Key Points

- Asia Pacific contributed 34% of market share in 2023.

- North America is estimated to expand the fastest CAGR between 2024 and 2033.

- By vehicles, the excavators segment held the largest market share of 30% in 2023.

- By vehicles, the cranes segment is anticipated to grow at a remarkable CAGR of 25.2% between 2024 and 2033.

- By source, the lithium-ion segment generated over 44% of market share in 2023.

- By source, the lead acid segment is expected to expand at the fastest CAGR over the projected period.

- By end use, the construction segment generated over 32% of market share in 2023.

- By end use, the industrial segment is expected to expand at the fastest CAGR over the projected period.

The global electric construction equipment market is witnessing a transformative shift driven by the need for cleaner, more sustainable construction practices, stringent emissions regulations, and technological advancements in electric vehicle technology. Electric construction equipment, including excavators, loaders, cranes, and bulldozers, are powered by batteries or electric motors, offering lower emissions, reduced noise pollution, and potentially lower operating costs compared to traditional diesel-powered equipment. As construction companies and governments worldwide prioritize environmental sustainability and seek to minimize the carbon footprint of construction activities, the demand for electric construction equipment is expected to surge in the coming years.

Get a Sample: https://www.precedenceresearch.com/sample/4046

Growth Factors:

Several key factors are driving the growth of the global electric construction equipment market. Firstly, increasing environmental awareness and concerns over air pollution and greenhouse gas emissions have prompted governments to introduce stringent regulations and incentives to promote the adoption of electric construction equipment. Additionally, technological advancements in battery technology, such as improved energy density, faster charging capabilities, and declining costs, have made electric construction equipment more viable and attractive to construction companies. Moreover, the growing availability of charging infrastructure and advancements in renewable energy sources have alleviated concerns regarding the range and reliability of electric construction equipment, further driving adoption.

Region Insights:

The adoption of electric construction equipment varies significantly across regions, influenced by factors such as regulatory frameworks, infrastructure development, construction activity levels, and market maturity. In regions with strict emissions regulations and ambitious sustainability goals, such as Europe and North America, the demand for electric construction equipment is particularly high. European countries, in particular, have been at the forefront of promoting electric construction equipment through regulatory incentives, subsidies, and public procurement policies favoring low-emission vehicles. In contrast, emerging markets in Asia-Pacific and Latin America are also witnessing growing interest in electric construction equipment, driven by urbanization, infrastructure development, and increasing environmental awareness.

Trends:

Several trends are shaping the evolution of the electric construction equipment market. One prominent trend is the integration of telematics and connectivity features in electric construction equipment, enabling real-time monitoring, remote diagnostics, and predictive maintenance, thereby improving efficiency, productivity, and equipment uptime. Another trend is the development of modular and interchangeable battery systems, allowing construction companies to optimize fleet management, reduce downtime, and adapt to varying project requirements. Moreover, the shift towards autonomous and semi-autonomous construction equipment, equipped with advanced sensing and control systems, is gaining momentum, enhancing safety, precision, and productivity on construction sites.

Electric Construction Equipment Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 23.62% |

| Global Market Size in 2023 | USD 10.32 Billion |

| Global Market Size in 2024 | USD 12.76 Billion |

| Global Market Size by 2033 | USD 86.01 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Vehicles, By Source, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Electric Construction Equipment Market Dynamics

Drivers:

The adoption of electric construction equipment is driven by several factors, including environmental regulations, operational cost savings, and technological advancements. Stringent emissions standards imposed by governments and regulatory bodies have compelled construction companies to seek cleaner alternatives to diesel-powered equipment, leading to increased interest in electric construction equipment. Additionally, the potential for cost savings associated with lower fuel and maintenance costs of electric equipment, coupled with the availability of incentives and subsidies for electric vehicle adoption, further incentivizes construction companies to transition to electric construction equipment. Technological advancements in battery technology, such as improved energy density and charging infrastructure, address concerns related to range, performance, and reliability, driving confidence in electric construction equipment among construction industry stakeholders.

Opportunities:

The electric construction equipment market presents numerous opportunities for stakeholders across the value chain. Manufacturers have the opportunity to capitalize on the growing demand for electric construction equipment by investing in research and development to improve battery technology, enhance equipment performance, and expand product offerings to cater to diverse construction applications. Additionally, infrastructure providers have the opportunity to expand and diversify charging infrastructure for electric construction equipment, including on-site charging solutions, fast-charging stations, and battery swapping stations, to support the growing fleet of electric equipment. Furthermore, governments and regulatory bodies can leverage public procurement policies, subsidies, and incentives to accelerate the adoption of electric construction equipment and promote sustainable construction practices.

Challenges:

Despite the growth prospects, the electric construction equipment market faces several challenges that could impede widespread adoption. One of the primary challenges is the upfront cost premium associated with electric construction equipment compared to conventional diesel-powered equipment, which may deter some construction companies from investing in electric alternatives. Moreover, the limited availability of charging infrastructure, particularly in remote or off-grid construction sites, poses challenges in terms of range, uptime, and operational flexibility of electric construction equipment. Additionally, concerns regarding the performance, durability, and reliability of electric construction equipment, especially in harsh operating conditions and heavy-duty applications, need to be addressed through continuous innovation and technological advancements. Overcoming these challenges will require collaboration among manufacturers, infrastructure providers, governments, and industry stakeholders to accelerate the transition to electric construction equipment and realize the full potential of sustainable construction practices.

Read Also: Carbon Footprint Management Market Size, Trend, Report by 2033

Recent Developments

- In 2023, Komatsu achieved significant strides in the electric construction equipment sector. Key releases included the PC05E-1 Electric Micro Excavator, offering zero emissions in Europe for their 3-ton mini excavator range. Additionally, Komatsu introduced the PC200LCE-11 and PC210LCE-11 Electric Excavators, their initial large electric models, promising performance comparable to diesel equivalents but with zero emissions. At CONEXPO 2023, they unveiled the HB365LC-3 Hybrid Excavator, enhancing fuel efficiency and reducing emissions by integrating a diesel engine with an electric motor and battery.

- In June 2022, Cummins and Komatsu signed a memorandum of understanding to collaborate on zero-emission haulage equipment development. Komatsu had previously announced a power-agnostic truck concept in 2021, capable of utilizing various power sources such as diesel-electric, trolley, battery power, and hydrogen fuel cells.

- In the same month of June 2022, John Deere announced a global partnership with Wacker Neuson to develop excavators ranging from 0 to 9 metric tons. Wacker Neuson will manufacture excavators under five metric tons, while John Deere will oversee design, manufacturing, and technology innovation for models between 5 to 9 metric tons.

- In May 2022, Volvo Construction Equipment (Volvo CE) made an investment in Dutch firm Limach, specializing in electric excavators for the domestic market. This investment supports Volvo CE’s long-term electrification strategy and expands its electromobility product range.

- March 2022 saw the joint development showcase of the PC01E-1 by Honda and Komatsu. This electric micro excavator, powered by portable and interchangeable mobile batteries, represents Komatsu’s first foray into electric micro excavators, developed in collaboration with Honda.

- In December 2021, Volvo Construction Equipment (Volvo CE) collaborated with partners across the electric ecosystem to deliver a comprehensive site solution for real urban applications. This project involved machine demonstrations in Gothenburg, supported by entities such as Gothenburg City, NCC, Gothenburg Energy, Lindholmen Science Park, Chalmers University of Technology, and ABB Electrification Sweden, with funding from the Swedish Energy Agency.

- In October 2021, Caterpillar Venture Capital Inc. (Caterpillar) and another venture invested USD 16 million in BrightVolt, Inc. BrightVolt Inc. is renowned for designing, developing, and manufacturing safe, high-energy, low-cost solid-state lithium-ion batteries. This funding aims to advance larger form-factor products catering to industrial electrification and e-mobility markets.

Electric Construction Equipment Market Companies

- Volvo Construction Equipment

- Komatsu

- Caterpillar

- John Deere

- Honda

- Cummins

- Wacker Neuson

- XCMG

- Hitachi Construction Machinery

- Liebherr

- JCB

- Doosan Infracore

- Hyundai Construction Equipment

- Kobelco Construction Machinery

- Sany Group

Segments Covered in the Report

By Vehicles

- Excavators

- Loaders

- Cranes

- Others

By Source

- Lithium-Ion

- Lead Acid

- Others

By End-use

- Residential

- Construction

- Industrial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/