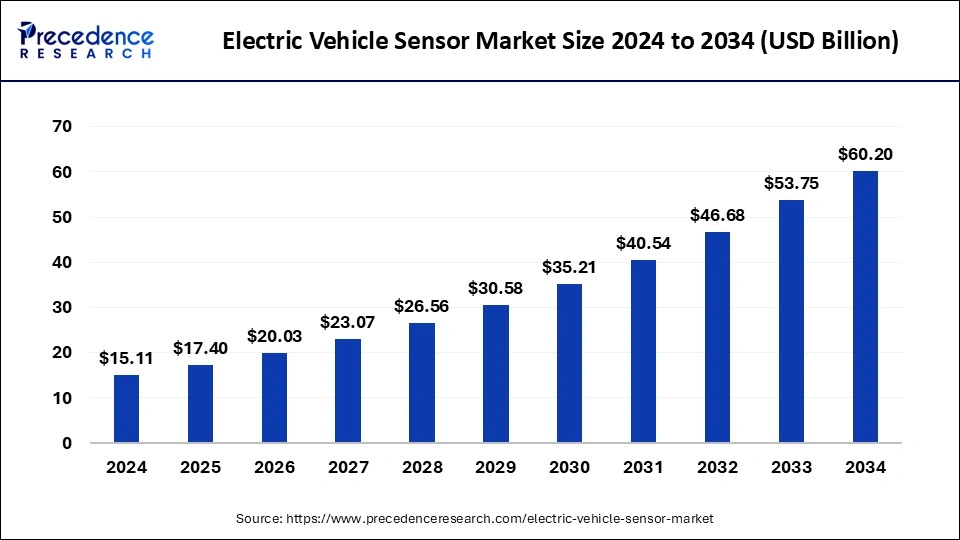

Electric Vehicle Sensor Market Size to Worth USD 53.75 Bn by 2033

The global electric vehicle sensor market size is expected to increase USD 53.75 billion by 2033 from USD 13.12 billion in 2023 with a CAGR of 15.14% between 2024 and 2033.

Key Points

- Asia Pacific dominated the market with the highest market share in 2023.

- Europe is observed to grow at a significant rate during the forecast period.

- By product type, the temperature sensor segment dominated the market with the largest market share in 2023.

- By propulsion type, the battery electric vehicles segment projected the largest market share in 2023.

The electric vehicle (EV) sensor market is rapidly evolving as the automotive industry pivots toward electric mobility. This transformation is driven by the need for sustainable transportation, stringent government regulations on emissions, advancements in sensor technologies, and the growing consumer preference for electric vehicles. The market encompasses a wide range of sensors used in EVs, including temperature sensors, current sensors, pressure sensors, position sensors, and more. These sensors are crucial for the efficient and safe operation of EVs, playing a vital role in battery management, motor control, and overall vehicle performance.

Get a Sample: https://www.precedenceresearch.com/sample/4605

Growth Factors

- Increasing Adoption of Electric Vehicles: One of the primary growth drivers for the EV sensor market is the increasing adoption of electric vehicles worldwide. Governments are incentivizing the purchase of EVs through subsidies and tax benefits, while simultaneously imposing stringent emission regulations on traditional internal combustion engine vehicles. This has led to a significant surge in the production and sales of EVs, thereby driving the demand for EV sensors.

- Technological Advancements: The continuous advancements in sensor technologies are also propelling the growth of the EV sensor market. Modern sensors offer enhanced accuracy, reliability, and efficiency, which are critical for the optimal performance of electric vehicles. Innovations such as miniaturization of sensors and the development of smart sensors are contributing to the market expansion.

- Battery Management Systems: The growing importance of battery management systems (BMS) in EVs is another key growth factor. BMS relies heavily on various sensors to monitor the state of the battery, including its temperature, voltage, and current. This ensures the safety, longevity, and efficiency of the battery, which is a crucial component of electric vehicles.

- Autonomous and Connected Vehicles: The rise of autonomous and connected vehicles is further boosting the demand for advanced sensors. These vehicles require a plethora of sensors for navigation, obstacle detection, and communication with other vehicles and infrastructure. As electric vehicles often serve as platforms for these advanced technologies, the EV sensor market is poised for significant growth.

Region Insights

The North American market is characterized by substantial investments in electric vehicle infrastructure and a strong focus on reducing carbon emissions. The presence of leading automotive manufacturers and technology companies in the region further accelerates the development and adoption of EV sensors. The United States and Canada are key contributors to the market growth in this region.

Europe is one of the leading regions in the EV sensor market, driven by stringent emission regulations, government incentives, and a well-established automotive industry. Countries such as Germany, France, and the Netherlands are at the forefront of EV adoption. The European Union’s aggressive push towards achieving zero-emission targets by 2050 is expected to further fuel the market growth. The Asia-Pacific region is witnessing the fastest growth in the EV sensor market, with China being the dominant player. The Chinese government’s robust support for electric mobility, coupled with the presence of numerous EV manufacturers, has positioned the country as a global leader in electric vehicle production and sales. Other countries like Japan and South Korea are also contributing significantly to the market growth.

Trends

Integration of Advanced Driver Assistance Systems (ADAS): The integration of ADAS in electric vehicles is a prominent trend shaping the EV sensor market. ADAS relies on a network of sensors, including cameras, radar, and LiDAR, to enhance vehicle safety and driving experience. As more EVs are equipped with ADAS features, the demand for high-precision sensors is on the rise.

Wireless Charging Sensors: The development of wireless charging technology for electric vehicles is driving the need for specialized sensors. These sensors are used to detect the alignment and proximity of the vehicle to the charging pad, ensuring efficient energy transfer. Wireless charging is expected to become more prevalent, further boosting the market for EV sensors.

Predictive Maintenance: Predictive maintenance is gaining traction in the automotive industry, including the electric vehicle sector. Sensors play a crucial role in monitoring the health of various vehicle components and predicting potential failures before they occur. This trend is driving the adoption of sophisticated sensors capable of providing real-time data and diagnostics.

Enhanced Human-Machine Interface (HMI): The focus on improving the human-machine interface in electric vehicles is leading to the development of advanced sensors. These sensors enable features such as gesture recognition, voice control, and haptic feedback, enhancing the overall driving experience. As consumer expectations for innovative HMI solutions grow, so does the demand for cutting-edge sensors.

Electric Vehicle Sensor Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 53.75 Billion |

| Market Size in 2023 | USD 13.12 Billion |

| Market Size in 2024 | USD 15.11 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 15.14% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product Type, Propulsion, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Electric Vehicle Sensor Market Dynamics

Drivers

Environmental Concerns: The growing awareness of environmental issues and the need to reduce greenhouse gas emissions are major drivers for the EV sensor market. Electric vehicles are considered a cleaner alternative to traditional vehicles, and the increasing focus on sustainability is driving the adoption of EVs and, consequently, the demand for EV sensors.

Government Regulations and Incentives: Government policies and incentives play a crucial role in driving the growth of the EV sensor market. Regulations aimed at reducing emissions and promoting clean energy vehicles are encouraging the production and adoption of electric vehicles. Financial incentives, tax breaks, and subsidies for EV manufacturers and buyers are further boosting the market

Opportunities

Expansion in Emerging Markets: Emerging markets present significant growth opportunities for the EV sensor market. Countries in regions such as Latin America, Africa, and Southeast Asia are gradually adopting electric vehicles, driven by urbanization, rising incomes, and government initiatives. Expanding into these markets can offer substantial growth prospects for sensor manufacturers.

Development of Advanced Sensor Technologies: The ongoing development of advanced sensor technologies, such as solid-state sensors, flexible sensors, and nanotechnology-based sensors, offers significant opportunities for the EV sensor market. These innovations promise enhanced performance, reliability, and new functionalities, driving the adoption of electric vehicles

Challenges

High Cost of Advanced Sensors: The high cost of advanced sensors remains a challenge for the EV sensor market. While sensor technologies are continuously evolving, the cost associated with high-precision and high-performance sensors can be prohibitive. This can impact the overall cost of electric vehicles, making them less affordable for consumers.

Technical Complexities: The integration of sensors into electric vehicles involves technical complexities, including compatibility issues, signal interference, and the need for robust software and algorithms. Ensuring seamless integration and reliable performance of sensors is a challenge that requires continuous innovation and expertise.

Read Also: Chemical Recycling and Dissolution of Plastics Market Report 2033

Electric Vehicle Sensor Market Companies

- Melexis

- Continental AG

- NXP Semiconductors

- Valeo

- Robert Bosch

- Venture Capital GmbH

- Denso Corporation

- Renesas Electronics

- Panasonic

- Sensate Technologies Inc.

- Amphenol Advanced Sensors

Recent Developments

- In May 2022, Continental is expanding its range of sensor portfolio with the launch of its two latest electric vehicle sensors the Battery Impact Detection (BID), and the Current Sensor Module (CSM) system with the technology for protecting battery or on battery parameter retention.

- In June 2024, Planet Electric, a Delhi-based automobile startup is planning to introduce its first electric vehicle. The company is claiming the integration of industries first weight sensor telematics system which will provide real-time updates on cargo weight, and responds to the vehicle’s driving range.

- In October 2023, NVIDIA comes in the strategic partnership with the Foxconn to launch the next wave of intelligent electric vehicle (EV) platforms for the worldwide automotive market.

- In January 2024, Texas Instruments (TI) is launched the latest semiconductor design the AWR2544 77GHz mm-wave radar sensor chip, the first satellite radar architectures allows increase level of autonomy by enhancing sensor fusion and decision making in ADAS.

- In November 2023, United Safety & Survivability Corporation, a leading player in the advanced safety solutions is launched the new innovation, a Lithium-Ion Battery Failure Detection Sensor for transforming the safety standards of the electric vehicles across industries.

- In April 2023, Volvo, a leading automaker is starts its production of its EX90 electric vehicles with the integration of laser sensors to enhancing safety and self-driving features in the EX90. With enabling the EX90 will become the first consumer vehicle to standardize this technology.

Segments Covered in the Report

By Product Type

- Temperature Sensors

- Motion Sensors

- Pressure Sensors

- Speed Sensors

- Gas Sensors

By Propulsion

- Hybrid electric Vehicle (HEVs)

- Plug-in Hybrid Electric Vehicle (PHEVs)

- Battery Electric Vehicle (BEVs)

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/