Embolic Protection Devices Market Size, Share, Report by 2033

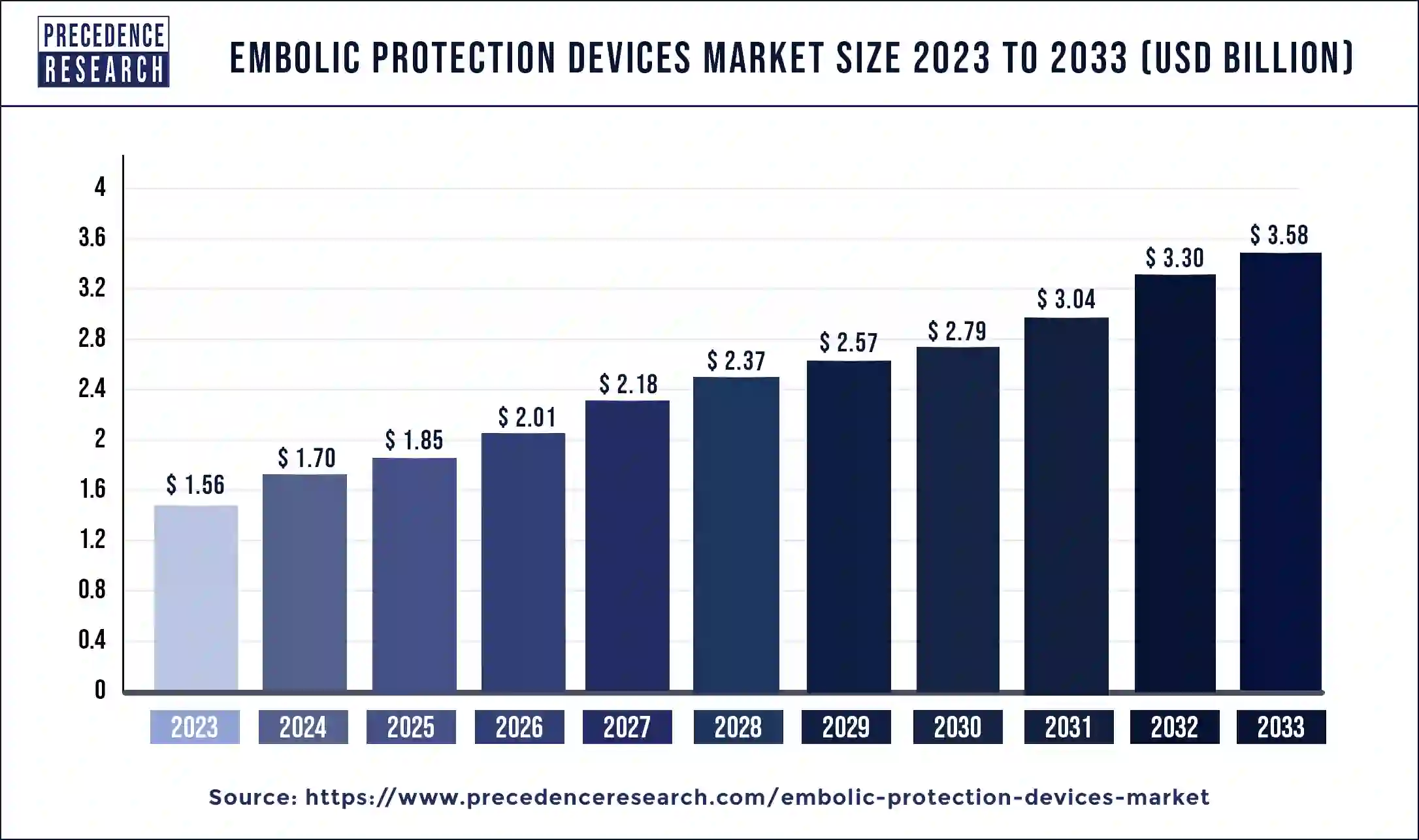

The global embolic protection devices market size is expected to increase by USD 3.58 billion by 2033 from USD 1.56 billion in 2023 with a CAGR of 8.64% between 2024 and 2033.

Key Points

- The North America embolic protection devices market size accounted for USD 560 million in 2023 and is expected to attain around USD 1,310 million by 2033, poised to grow at a CAGR of 8.87% between 2024 and 2033.

- North America has held a major revenue share of 36% in 2023.

- Asia Pacific is expected to show rapid growth in the global market during the forecast period.

- By product, the distal occlusion systems segment held a significant share of the market in 2023.

- By product, the proximal occlusion systems segment is expected to grow rapidly in the market over the projected period.

- By application, the cardiovascular diseases segment has contributed more than 41% of revenue share in 2023.

- By application, the peripheral vascular diseases segment is expected to witness the fastest growth in the market over the forecast period.

The Embolic Protection Devices Market refers to the medical devices designed to prevent the migration of embolic material (such as blood clots or plaque) during minimally invasive procedures, particularly in vascular interventions like angioplasty or stenting. These devices aim to reduce the risk of stroke, myocardial infarction, and other complications by capturing or deflecting emboli away from vital organs.

Get a Sample: https://www.precedenceresearch.com/sample/4403

Growth Factors

The market for embolic protection devices is experiencing robust growth due to the rising prevalence of cardiovascular diseases worldwide, coupled with the increasing adoption of minimally invasive procedures. Technological advancements in device design, such as improved capture efficiency and ease of use, are also driving market growth. Additionally, a growing geriatric population, who are more prone to cardiovascular ailments, contributes to market expansion.

Region Insights:

Geographically, North America and Europe dominate the embolic protection devices market, primarily due to well-established healthcare infrastructure, higher adoption rates of advanced medical technologies, and a larger patient pool requiring vascular interventions. However, the Asia-Pacific region is witnessing rapid market growth, driven by improving healthcare infrastructure, increasing disposable income, and a rising prevalence of cardiovascular diseases in countries like China and India.

Embolic Protection Devices Market Scope

| Report Coverage | Details |

| Embolic Protection Devices Market Size in 2023 | USD 1.56 Billion |

| Embolic Protection Devices Market Size in 2024 | USD 1.70 Billion |

| Embolic Protection Devices Market Size by 2033 | USD 3.58 Billion |

| Embolic Protection Devices Market Growth Rate | CAGR of 8.64% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Embolic Protection Devices Market Dynamics

Drivers:

Several factors are driving the demand for embolic protection devices, including the growing prevalence of cardiovascular diseases, the rising preference for minimally invasive procedures among patients and healthcare providers, and advancements in device technology. Moreover, increasing awareness about the benefits of embolic protection devices in reducing procedural complications further fuels market growth.

Opportunities:

Opportunities for growth in the embolic protection devices market include expanding into emerging markets with high unmet medical needs, developing innovative devices with enhanced efficacy and safety profiles, and strategic collaborations or partnerships with healthcare providers and research institutions to facilitate product development and market penetration.

Challenges:

Despite the favorable market conditions, challenges persist in the embolic protection devices market, such as stringent regulatory requirements for device approval, high procedural costs associated with the use of these devices, and limited reimbursement coverage in certain regions. Additionally, the complexity of vascular anatomy and variability in patient physiology pose challenges for device efficacy and procedural outcomes.

Read Also: Self-adhesive Labels Market Size to Worth USD 87.20 Bn by 2033

Embolic Protection Devices Market Recent Developments

- In January 2023, Cardinal Health Inc., a distinguished leader in healthcare services and medical products, embarked on a strategic collaboration with Palantir, a renowned technology company specializing in data integration and analysis. This innovative partnership marks a significant step forward in the realm of healthcare supply chain management.

- In February 2023, Medtronic plc announced the launch of its EnVeo™ drug-eluting stent (DES) for the treatment of patients with PAD.

- In March 2023, Terumo Corporation received a CE mark for its Zilver PTX™ DCB for the treatment of patients with PAD.

- In July 2022, Edwards Lifesciences Corporation announced the FDA approval of its Amplatzer™ Vascular Plug II for the treatment of patients with pulmonary arteriovenous malformations (PAVMs).

- In June 2022, Cook Medical announced the FDA approval of its NirMesh™ Vascular Occlusion Device for the treatment of patients with varicose veins.

- In May 2022, Johnson & Johnson Services, Inc. announced the FDA approval of its Embozene™ Microspheres for the treatment of patients with symptomatic cerebral arteriovenous malformations (AVMs).

- In October 2023, German cardiovascular medical device company Protembis secured US Food and Drug Administration (FDA) approval for its PROTEMBO Pivotal IDE Trial. The ProtEmbo System from Protembis is an intra-aortic filter device offering protection for the brain from embolic material released during a transcatheter aortic valve replacement (TAVR) procedure.

Embolic Protection Devices Market Companies

- Abbott Laboratories

- Allium Medical Solutions Ltd.

- Boston Scientific Corporation

- Cardinal Health Inc.

- Contego Medical LLC

- Innovative Cardiovascular Solutions LLC

- Edwards Lifesciences Corporation

- Medtronic Inc.

- Silk Road Medical Inc.

Segments Covered in the Report

By Product

- Distal Occlusion Filters

- Proximal Occlusion Filters

- Distal Filters

By Application

- Neurovascular Diseases

- Cardiovascular Diseases

- Peripheral Vascular Diseases

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/