Engineering Plastics Market Size to Worth USD 283.87 Bn by 2033

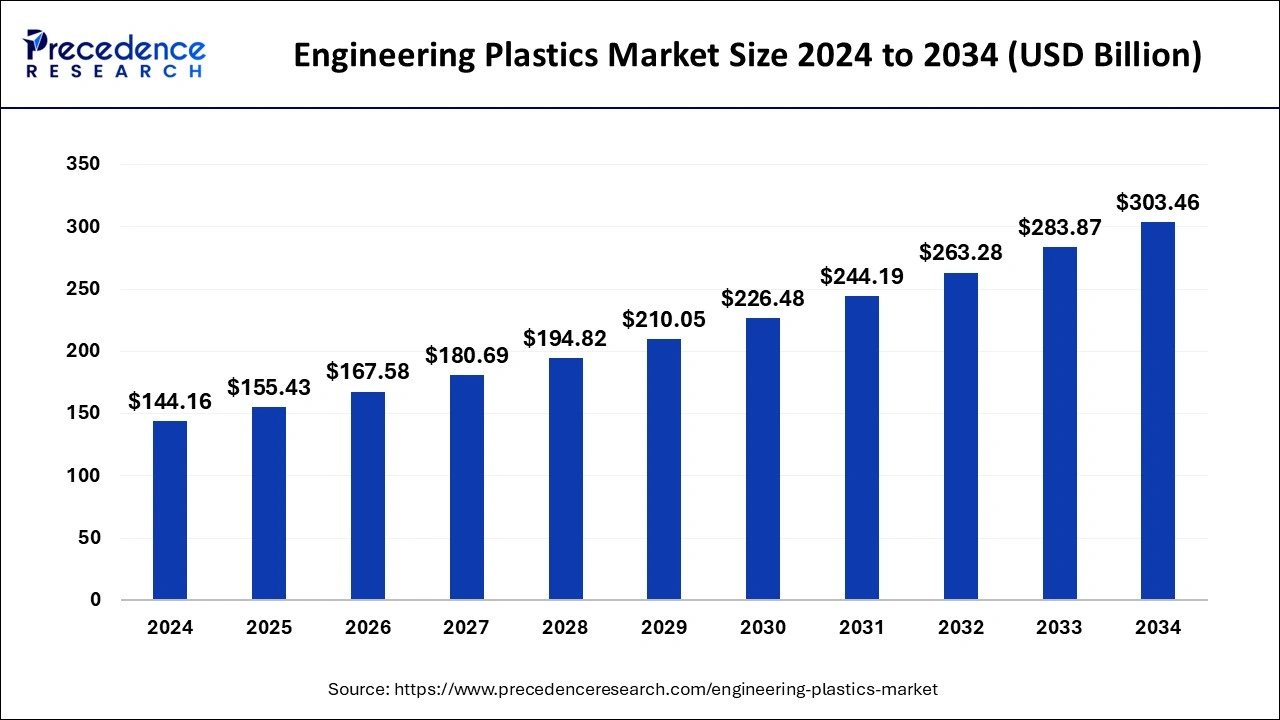

The global engineering plastics market size is expected to increase USD 283.87 billion by 2033 from USD 133.70 billion in 2023 with a CAGR of 7.82% between 2024 and 2033.

Key Points

- Asia Pacific dominated the market with the highest market share of 45% in 2023.

- North America held a notable share of the market in 2023.

- By resin type, the styrene copolymers (ABS and SAN) segment has held the largest market share of 35% in 2023.

- By resin type, the polycarbonate (PC) is expected to grow at a notable CAGR during forecast period.

- By end-use, the automotive & transportation segment accounted for the major market share of 365 in 2023.

- By end-use, the electrical & electronics segment is expected to grow to the highest CAGR during forecast period.

The engineering plastics market is a dynamic segment of the plastics industry characterized by high-performance materials designed for specialized applications in various sectors including automotive, electronics, construction, and healthcare. Engineering plastics offer superior mechanical properties, thermal stability, chemical resistance, and durability compared to conventional plastics, making them ideal for demanding engineering applications. This market encompasses a wide range of materials such as polyamides (nylons), polyesters, polycarbonates, polyacetals, and polyphenylene sulfide (PPS), each tailored to meet specific performance requirements.

Get a Sample: https://www.precedenceresearch.com/sample/4256

Growth Factors

The growth of the engineering plastics market is fueled by several key factors. One significant driver is the increasing substitution of traditional materials like metals and ceramics with engineering plastics due to their lightweight nature, corrosion resistance, and design flexibility. Growing demand for lightweight components in automotive and aerospace industries to improve fuel efficiency is propelling the adoption of engineering plastics. Additionally, technological advancements enabling the development of bio-based and recyclable engineering plastics are expanding market opportunities and addressing sustainability concerns.

Region Insights

The adoption of engineering plastics varies by region, influenced by industrialization, infrastructure development, and regulatory frameworks. Developed regions such as North America and Europe have robust automotive and electronics industries driving demand for engineering plastics. Asia Pacific, particularly China and India, is a key growth region due to rapid industrialization, urbanization, and investments in manufacturing. The Middle East and Africa are also emerging markets for engineering plastics, driven by infrastructure projects and increasing consumer demand for durable and lightweight materials.

Engineering Plastics Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.82% |

| Global Market Size in 2023 | USD 133.70 Billion |

| Global Market Size in 2024 | USD 144.16 Billion |

| Global Market Size by 2033 | USD 283.87 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Resin Type and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Engineering Plastics Market Dynamics

Drivers

Several drivers contribute to the growth of the engineering plastics market. The automotive industry is a major driver, with engineering plastics being used extensively in interior, exterior, and under-the-hood applications to reduce vehicle weight and enhance performance. Rapid technological advancements in additive manufacturing (3D printing) are expanding the applications of engineering plastics in prototyping and customized manufacturing. Moreover, increasing demand for electrical and electronic devices with higher performance and miniaturization requirements is boosting the adoption of engineering plastics in these sectors.

Opportunities

The engineering plastics market presents significant opportunities for innovation and product development. Collaborations between material manufacturers, end-users, and research institutions are driving the development of new formulations with enhanced properties such as heat resistance, flame retardancy, and biodegradability. The shift towards sustainable materials and circular economy principles opens doors for bio-based and recycled engineering plastics, addressing environmental concerns and regulatory requirements. Additionally, emerging applications in healthcare, packaging, and consumer goods sectors offer untapped opportunities for market expansion.

Challenges

Despite its growth potential, the engineering plastics market faces challenges. Cost considerations remain a barrier to widespread adoption, particularly for high-performance materials. Ensuring consistent material quality and performance across different production batches is crucial for meeting stringent industry standards. Regulatory requirements related to chemical composition, recycling, and disposal of engineering plastics also pose challenges for manufacturers and end-users. Moreover, competition from alternative materials and fluctuations in raw material prices can impact market dynamics.

Read Also: Invisible Orthodontics Market Size to Worth USD 75.92 Bn by 2033

Engineering Plastics Market Recent Developments

- In April 2024, Nylon Corporation of America (NYCOA), a custom manufacturer of engineered nylon resins, announced the launch of NY-Clear, an amorphous 6I/6T nylon that is targeted for packaging and precision molded applications.

- In October 2023, Polyplastics launched Sarpek polyether ketone (PEK), an advanced material for metal replacement and applications requiring the highest heat resistance of any injection moldable resin without post-curing. Sarpek PEK is an engineering plastic in the upper end of the crystalline super engineering plastic hierarchy, an advancement upon polyetheretherketone (PEEK) that delivers a high crystallization rate and superior molding efficiency.

- In May 2023, Borealis launched Stelora, a new class of sustainable engineering polymer offering increased strength, durability, and a step change in heat-resistance capability. Stelora, which developed in collaboration with TOPAS Advanced Polymers, the world’s leading producer of cyclic olefin copolymer (COC). It is created using a unique process that combines COCs, which are a relatively new class of clear, high-purity polymer, with polypropylene (PP).

Engineering Plastics Market Companies

- Grand Pacific Petrochemical Corporation

- Mitsubishi Engineering-Plastics Corporation

- Wittenburg Group

- Piper Plastics Corp.

- Chevron Phillips Chemical Company LLC

- Daicel Corporation

- Evonik Industries AG

- Nylon Corporation of America (NYCOA)

- Eastman Chemical Company

- Ascend Performance Materials

- Ravago

- Teknor Apex

- Trinseo LLC

- Polyplastics Co., Ltd.

- Ngai Hong Kong Company Ltd.

- Ginar Technology Co., Ltd.

Segment Covered in the Report

By Resin Type

- Styrene Copolymers (ABS and SAN)

- Fluoropolymer

- Ethylene Tetrafluoroethylene (ETFE)

- Fluorinated Ethylene-propylene (FEP)

- Polytetrafluoroethylene (PTFE)

- Polyvinyl Fluoride (PVF)

- Polyvinylidene Fluoride (PVDF)

- Liquid crystal polymer (LCP)

- Polyamide (PA)

- Aramid

- Polyamide (PA) 6

- Polyamide (PA) 66

- Polyphthalamide

- Polybutylene Terephthalate (PBT)

- Polycarbonate (PC)

- Polyether Ether Ketone (PEEK)

- Polyethylene Terephthalate (PET)

- Polyimide (PI)

- Polymethyl Methacrylate (PMMA)

- Polyoxymethylene (POM)

By End-use

- Automotive & Transportation

- Electrical & Electronics

- Building & Construction

- Consumer Goods & Appliances

- Industrial

- Aerospace

- Medical

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/