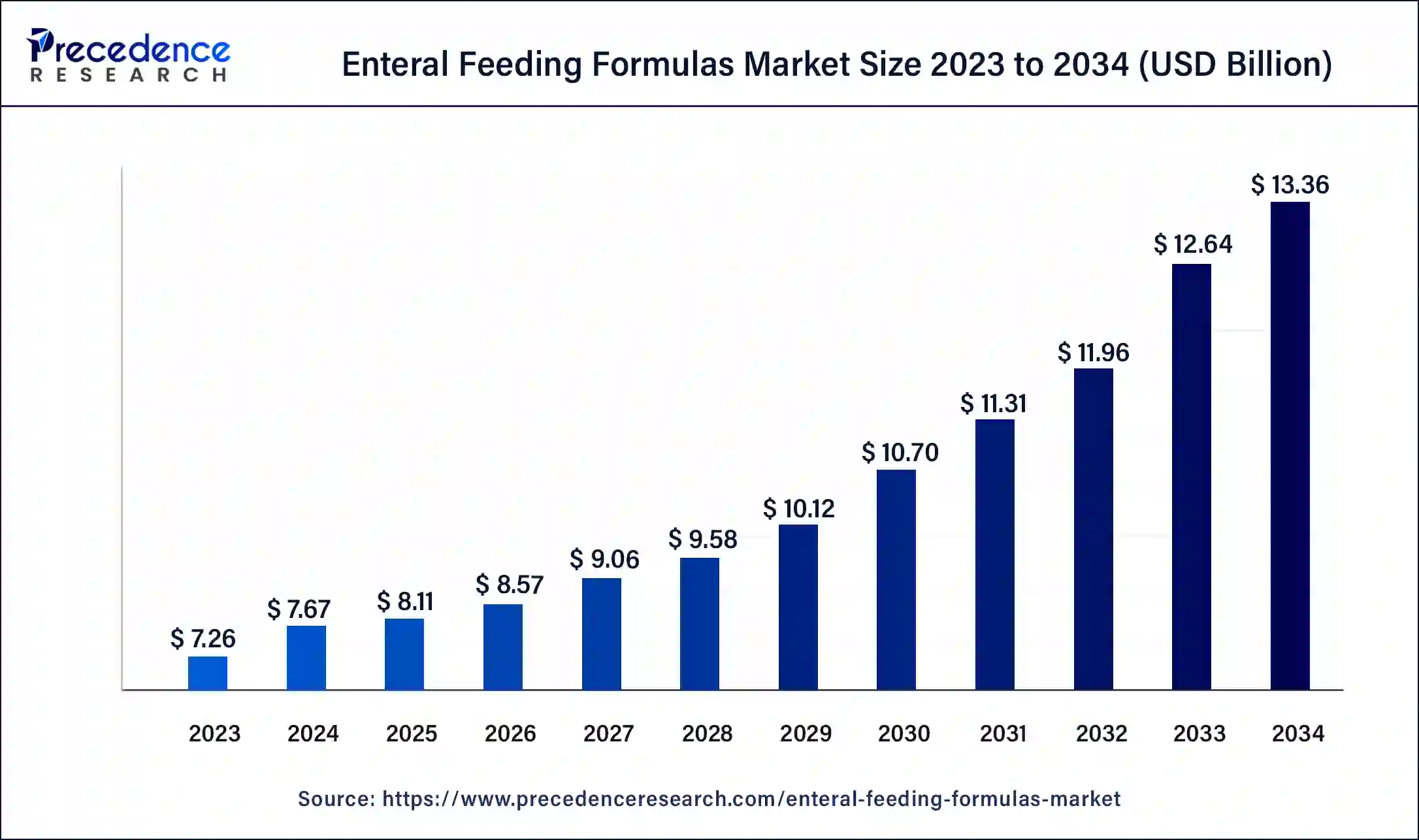

Enteral Feeding Formulas Market Size to Surpass USD 12.51 Bn by 2033

The global enteral feeding formulas market size surpassed USD 7.26 billion in 2023 and is anticipated to be worth around USD 12.51 billion by 2033, growing at a CAGR of 5.59% from 2024 to 2033.

Key Points

- The North America enteral feeding formulas market size was estimated at USD 2.32 billion in 2023 and is expected to surpass around USD 4 billion by 2033.

- North America held the largest market share of 32% in 2023.

- By product, the standard formula segment dominated the market with the largest market share of 58% in 2023.

- By flow type, intermittent feeding flow segment has captured the largest market share of 90% in 2023.

- By stage, the adult segment has accounted for the largest share of 91% in 2023.

- By indication, the cancer care segment held a significant share of the market in 2023.

- By sales channel, the institutional segments dominated the market with the highest market share of 52% in 2023.

- By end use, the home care segment is expected to grow at the fastest CAGR of 5.92% over the forecast period.

The enteral feeding formulas market involves the production and distribution of specialized nutritional formulas that are administered through a tube directly into the gastrointestinal tract. These formulas are used to provide essential nutrients to patients who cannot consume food orally due to various medical conditions such as chronic illnesses, surgeries, or neurological disorders. The market is expected to grow significantly due to the increasing prevalence of chronic diseases and the aging population.

Get a Sample: https://www.precedenceresearch.com/sample/4123

Growth Factors

Several factors drive the growth of the enteral feeding formulas market. One major factor is the increasing incidence of chronic diseases such as cancer, diabetes, and neurological disorders that affect the ability to eat naturally. The aging population also contributes to market growth as older adults often require enteral nutrition support. Technological advancements in formula composition and delivery systems have improved patient outcomes and convenience, further fueling market expansion. Additionally, the growing awareness among healthcare professionals and patients about the benefits of enteral nutrition is contributing to market growth.

Region Insights

The enteral feeding formulas market varies by region. North America holds a significant share of the market due to the high prevalence of chronic diseases and a well-established healthcare infrastructure. Europe is another prominent market due to a growing aging population and increased healthcare spending. The Asia-Pacific region is expected to witness the highest growth rate due to improving healthcare facilities, increasing awareness, and rising healthcare expenditure. Latin America and the Middle East and Africa are also emerging markets with growth potential as healthcare systems improve.

Enteral Feeding Formulas Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.59% |

| Global Market Size in 2023 | USD 7.26 Billion |

| Global Market Size in 2024 | USD 7.67 Billion |

| Global Market Size by 2033 | USD 12.51 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Flow Type, By Stage, By Indication, By End-use, and By Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Enteral Feeding Formulas Market Dynamics

Drivers

Key drivers of the enteral feeding formulas market include the rising prevalence of chronic illnesses, the growing aging population, and advancements in enteral feeding technology. Increased awareness about the benefits of enteral nutrition among healthcare professionals and patients is another important driver. Additionally, the growing adoption of home-based enteral feeding systems for long-term care is boosting market growth.

Opportunities

The enteral feeding formulas market presents several opportunities for growth. The development of novel formulations tailored to specific patient needs and conditions is a promising area of innovation. Additionally, increasing demand for home-based enteral nutrition offers opportunities for companies to expand their product lines and services. Partnerships and collaborations with healthcare providers and institutions can help companies reach a wider audience and enhance patient care.

Challenges

Despite the growth prospects, the enteral feeding formulas market faces challenges. Regulatory hurdles and strict safety and quality standards can pose challenges for companies in the industry. Additionally, high costs associated with specialized formulas may limit access for some patients. Competition from alternative nutritional products such as parenteral nutrition and other forms of dietary supplements can also impact market growth. Lastly, the need for proper training for healthcare professionals and caregivers on the safe and effective use of enteral feeding systems remains a challenge.

Read Also: Dental Compressors Market Size to SurpassUSD 620.95 Mn by 2033

Enteral Feeding Formulas Market Recent Developments

- In September 2023, Abbott announced the plan to boost the manufacturing of various adult enteral formulas for the retail market to counteract low supply in the institutional sector.

- In February 2023, Nestlé and EraCal Therapeutics initiated a research collaboration to identify novel nutraceuticals for controlling food intake.

- In September 2022, Kate Farms introduced Adult Standard 1.4, a high-calorie medical formula now offered in chocolate. This product is designed to assist in weight gain, weight maintenance, and improved tolerance while providing a delicious taste.

- In September 2022, Kate Farms raised $75 million in a Series C funding round led by life-science investor Novo Holdings. With this, Kate Farms will be able to increase its efforts in developing plant-based clinical nutrition research, product innovation, and development into more channels.

Enteral Feeding Formulas Market Companies

- Nestlé S.A.

- Abbott Laboratories

- Mead Johnson Nutrition Company

- Fresenius Kabi AG

- Danone S.A.

- Victus Inc.

- Hormel Foods, LLC

- B. Braun Melsungen AG

- Global Health Product Inc.

- Aveanna Healthcare

- Meiji Holdings Co., Ltd.

- Nutricia

Segments Covered in the Report

By Product

- Standard Formula

- Disease-specific Formulas

- Alzheimer’s

- Nutrition Deficiency

- Cancer Care

- Diabetes

- Chronic Kidney Diseases

- Orphan Diseases

- Dysphagia

- Pain Management

- Malabsorption/GI Disorder/Diarrhea

- Others

By Flow Type

- Intermittent Feeding Flow

- Continuous Feeding Flow

By Stage

- Adults

- Pediatrics

By Indication

- Alzheimer’s

- Nutrition Deficiency

- Cancer Care

- Diabetes

- Chronic Kidney Diseases

- Orphan Diseases

- Dysphagia

- Pain Management

- Malabsorption/GI Disorder/Diarrhea

- Others

By End-use

- Hospitals

- Cardiology

- Neurology

- Critical Care (ICU)

- Oncology

- Others

- Home Care

- Long-Term Care Facilities

By Sales Channel

- Online Sales

- Retail Sales

- Institutional Sales

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/