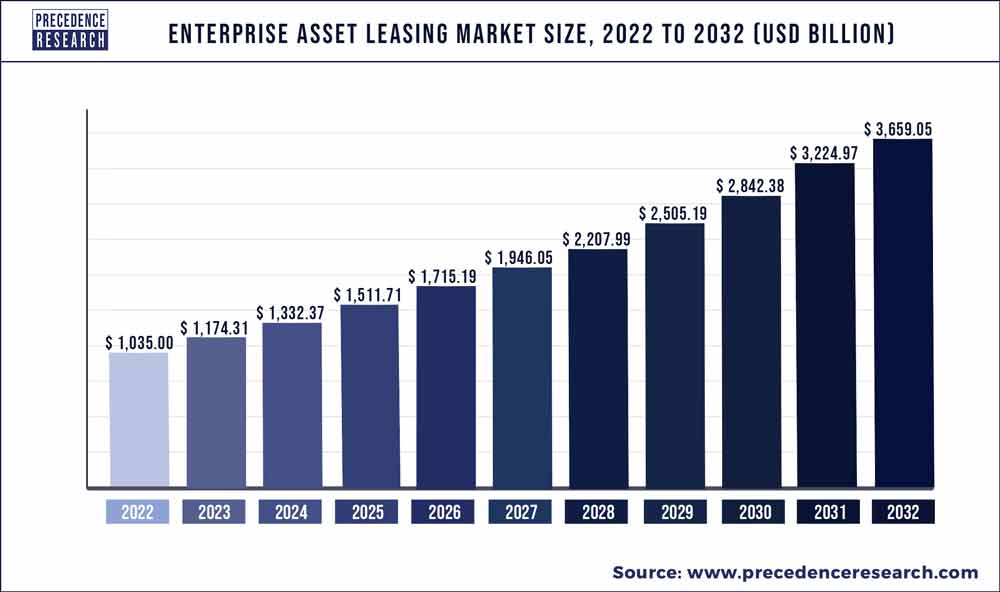

Enterprise Asset Leasing Market Size To Cross USD 3,659.05 Bn By 2032

The global enterprise asset leasing market size accounted for US$ 1,035 Bn in 2022 and is projected to reach around USD 3,659.05 Bn by 2032, growing at a CAGR of 13.46% from 2023 to 2032.

Report Summary

The global enterprise asset leasing market report provides a Point-by-Point and In-Depth analysis of global market size, regional and country-level market size, market share, segmentation market growth, competitive landscape, sales analysis, opportunities analysis, strategic market growth analysis, the impact of domestic and global market key players, value chain optimization, trade regulations, recent developments, product launches, area marketplace expanding, and technological innovations.

The study offers a comprehensive analysis on diverse features, including production capacities, demand, product developments, revenue generation, and sales in the enterprise asset leasing market across the globe.

A comprehensive estimate on the enterprise asset leasing market has been provided through an optimistic scenario as well as a conservative scenario, taking into account the sales of enterprise asset leasing during the forecast period. Price point comparison by region with global average price is also considered in the study.

Download Access to a Free Copy of Our Latest Sample Report@ https://www.precedenceresearch.com/sample/2900

Enterprise Asset Leasing Market Report Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 1,174.31 Billion |

| Market Size by 2032 | USD 3,659.05 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 13.46% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Asset Type, By Leasing Type, By Organization Size, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Key Highlights:

Reports Coverage: It incorporates key market sections, key makers secured, the extent of items offered in the years considered, worldwide containerized enterprise asset leasing market and study goals. Moreover, it contacts the division study gave in the report based on the sort of item and applications.

Market Outline: This area stresses the key investigations, market development rate, serious scene, market drivers, patterns, and issues notwithstanding the naturally visible pointers.

Market Production by Region: The report conveys information identified with import and fare, income, creation, and key players of every single local market contemplated are canvassed right now.

Also Read: Online Gaming Market Size To Cross USD 440.89 Bn By 2032

Enterprise Asset Leasing Market Players

The report includes the profiles of key enterprise asset leasing market companies along with their SWOT analysis and market strategies. In addition, the report focuses on leading industry players with information such as company profiles, components and services offered, financial information, key development in past five years.

Major companies operating in this area

- Bohai Leasing Co. Ltd.

- Sumitomo Mitsui Finance and Leasing Co., Ltd.

- BNP Paribas Leasing Solutions

- General Electric Company

- ICBC Financial Leasing Co. Ltd

- ORIX Corporation

- White Oak Financial LLC

- Wells Fargo Bank N.A.

- Enterprise Asset Leasing

- Origa Leasing

- Air Lease Corporation

Market Segmentation

By Asset Type

- Commercial Vehicles

- Real Estate

- Machinery and Industrial Equipment

- Others

By Leasing Type

- Operating Lease

- Financial Lease

By Organization Size

- SMEs

- Large Enterprises

By Industry Vertical

- Manufacturing

- Construction

- Government and Public Sector

- Transportation and Logistics

- Others

Regional Segmentation

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Southeast Asia and Rest of APAC)

- Latin America (Brazil and Rest of Latin America)

- Middle East and Africa (GCC, North Africa, South Africa, Rest of MEA)

Research Methodology

Secondary Research

It involves company databases such as Hoover’s: This assists us to recognize financial information, the structure of the market participants and industry’s competitive landscape.

The secondary research sources referred in the process are as follows:

- Governmental bodies, and organizations creating economic policies

- National and international social welfare institutions

- Company websites, financial reports and SEC filings, broker and investor reports

- Related patent and regulatory databases

- Statistical databases and market reports

- Corporate Presentations, news, press release, and specification sheet of Manufacturers

Primary Research

Primary research includes face-to-face interviews, online surveys, and telephonic interviews.

- Means of primary research: Email interactions, telephonic discussions and Questionnaire-based research etc.

- In order to validate our research findings and analysis, we conduct primary interviews of key industry participants. Insights from primary respondents help in validating the secondary research findings. It also develops Research Team’s expertise and market understanding.

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Enterprise Asset Leasing Market

5.1. COVID-19 Landscape: Enterprise Asset Leasing Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Enterprise Asset Leasing Market, By Asset Type

8.1. Enterprise Asset Leasing Market, by Asset Type, 2023-2032

8.1.1. Commercial Vehicles

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Real Estate

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Machinery and Industrial Equipment

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Enterprise Asset Leasing Market, By Leasing Type

9.1. Enterprise Asset Leasing Market, by Leasing Type, 2023-2032

9.1.1. Operating Lease

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Financial Lease

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Enterprise Asset Leasing Market, By Organization Size

10.1. Enterprise Asset Leasing Market, by March, 2023-2032

10.1.1. SMEs

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Large Enterprises

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Enterprise Asset Leasing Market, By Industry Vertical

11.1. Enterprise Asset Leasing Market, by April, 2023-2032

11.1.1. Manufacturing

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Construction

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Government and Public Sector

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Transportation and Logistics

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Others

11.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Enterprise Asset Leasing Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.1.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.1.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.1.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.1.5.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.1.6.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.2.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.2.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.2.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.2.5.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.2.6.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.2.7.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.2.8.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.3.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.3.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.3.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.3.5.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.3.6.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.3.7.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.3.8.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.4.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.4.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.4.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.4.5.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.4.6.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.4.7.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.4.8.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.5.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.5.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.5.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.5.5.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Asset Type (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Leasing Type (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Organization Size(2020-2032)

12.5.6.4. Market Revenue and Forecast, by Industry Vertical(2020-2032)

Chapter 13. Company Profiles

13.1. Bohai Leasing Co. Ltd.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Sumitomo Mitsui Finance and Leasing Co., Ltd.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. BNP Paribas Leasing Solutions

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. General Electric Company

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. ICBC Financial Leasing Co. Ltd

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. ORIX Corporation

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. White Oak Financial LLC

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Wells Fargo Bank N.A.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Enterprise Asset Leasing

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Origa Leasing

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com