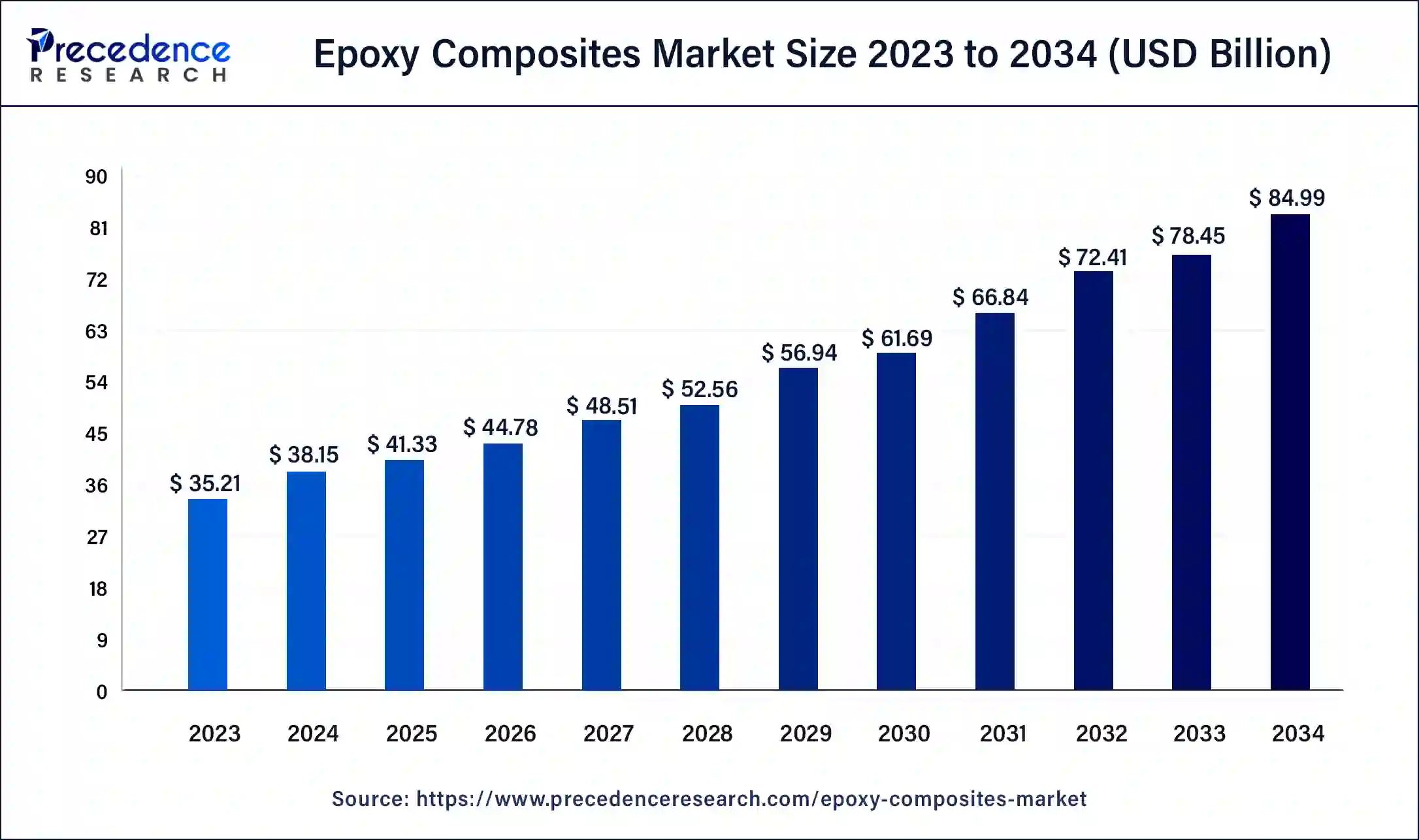

Epoxy Composites Market Size to Hit USD 84.99 Bn by 2034

The global epoxy composites market size reached USD 35.21 billion in 2023 and is predicted to hit around USD 84.99 billion by 2034, expanding at a CAGR of 8.34% from 2024 to 2034.

The epoxy composites market has been witnessing substantial growth owing to the increasing demand from various end-use industries such as aerospace, automotive, electronics, and construction. Epoxy composites are versatile materials known for their high strength, lightweight nature, corrosion resistance, and excellent mechanical properties. These characteristics make them ideal for applications requiring durability and performance under demanding conditions.

Get a Sample: https://www.precedenceresearch.com/sample/4679

Epoxy Composites Market Highlights

- Asia Pacific dominated the epoxy composites market with the largest revenue share of 39% in 2023.

- North America is expected to host the fastest-growing market during the forecast period.

- By fiber type, the glass fiber segment has held a major revenue share of 63% of revenue share in 2023.

- By fiber type, the carbon fiber segment is expected to grow at a fastest CAGR of 8.53% during the forecast period.

- By end use, the automotive & transportation segment has generated more than 28% of revenue share in 2023.

- By end use, the aerospace segment is expected to grow at the fastest rate in the market during the forecast period.

Epoxy Composites Market Trends

A notable trend in the epoxy composites market is the growing preference for sustainable and bio-based raw materials. Manufacturers are increasingly focusing on developing eco-friendly alternatives to traditional epoxy resins, driven by environmental regulations and consumer demand for greener products. Additionally, advancements in manufacturing technologies such as automated lay-up processes and 3D printing are enhancing the efficiency and precision of epoxy composite production.

Regional Insights

Geographically, North America and Europe are significant markets for epoxy composites, driven by robust aerospace and automotive sectors. These regions are characterized by high investments in research and development, fostering innovation in epoxy composite applications. Asia-Pacific is also emerging as a key market, fueled by rapid industrialization, urbanization, and infrastructure development, particularly in countries like China, India, and Japan.

Epoxy Composites Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 84.99 Billion |

| Market Size in 2023 | USD 35.21 Billion |

| Market Size in 2024 | USD 38.15 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.34% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Fiber Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Fiber Type

Epoxy composites leverage a variety of fiber types to enhance their mechanical properties. Carbon fiber stands out for its exceptional strength and stiffness, making it a preferred choice in high-performance applications such as aerospace, automotive, and sports equipment. Glass fibers, known for their cost-effectiveness and electrical insulation properties, find extensive use in construction and electronics industries. Additionally, aramid fibers offer excellent impact resistance, making them suitable for protective applications in military and industrial sectors.

End-use

The versatility of epoxy composites extends across diverse end-use industries. In aerospace, these composites are utilized in aircraft components due to their lightweight nature and high strength-to-weight ratio, contributing to fuel efficiency and performance. In automotive manufacturing, they enable the production of lightweight and fuel-efficient vehicles, reducing emissions and improving sustainability. The construction sector employs epoxy composites for infrastructure projects, benefiting from their durability and corrosion resistance. Moreover, electronics benefit from their thermal stability and electrical insulation properties, ensuring reliable performance in sensitive electronic components.

Epoxy Composites Market Dynamics

Drivers of Growth

Several factors contribute to the growth of the epoxy composites market. Key drivers include the increasing demand for lightweight materials in automotive and aerospace industries to improve fuel efficiency and reduce emissions. Moreover, the expanding wind energy sector, where epoxy composites are used in turbine blades for their strength-to-weight ratio, is bolstering market growth. Technological advancements in epoxy formulations and manufacturing processes further drive adoption across various applications.

Opportunities

Opportunities in the epoxy composites market lie in the development of novel applications in emerging sectors such as marine, sports and leisure, and medical devices. Additionally, the shift towards electric vehicles (EVs) presents opportunities for lightweight materials like epoxy composites in battery enclosures and structural components. Furthermore, investments in infrastructure projects worldwide are expected to create demand for epoxy composites in construction and civil engineering applications.

Challenges

Despite its growth prospects, the epoxy composites market faces challenges such as fluctuating raw material prices, particularly for petroleum-derived resins. Quality control and standardization issues in composite manufacturing processes also pose challenges, impacting product consistency and performance. Moreover, regulatory compliance with environmental standards and disposal of composite waste remain areas of concern for manufacturers and end-users alike.

Read Also: Clinical Documentation Improvement Market Size, Trends, Report by 2034

Epoxy Composites Market Companies

- Axiom Materials.

- Barr day.

- Hexcel Corporation.

- Mitsubishi Chemical Corporation.

- Park Aerospace Corp.

- Sanders Composites.

- SGL Carbon.

Recent Developments

- In July 2024, Solvay launched the epoxy-based CYCOM® EP2190 system, which offers exceptional durability in thick and thin structures together with good in-plane performance in hot/wet and cold/dry situations. The material, which is the company’s new flagship product for aerospace primary structures, competes with existing solutions for wing and fuselage applications in the majority of aviation market segments, from defense and rotorcraft to urban air mobility (UAM) and private and commercial aerospace segments (sub and supersonic).

- In June 2024, With the introduction of its new NE7 low-temperature curing prepreg system, Notus Composites (UAE), the distinguished manufacturer of epoxy prepreg materials, is pleased to announce the newest addition to its high-performance epoxy portfolio. With the completely new Notus NE7 formulation, producers of composites can cure components at as low as 70ËšC, saving energy and opening up more affordable tooling possibilities.

Segment Covered in the Report

By Fiber Type

- Glass Fiber

- Carbon Fiber

- Other Fiber

By End-use

- Automotive & Transportation

- Aerospace & Defense

- Wind Energy

- Electrical & Electronics

- Sporting & Consumer Goods

- Other End-Use (Oil & Gas, Marine, Construction)

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/