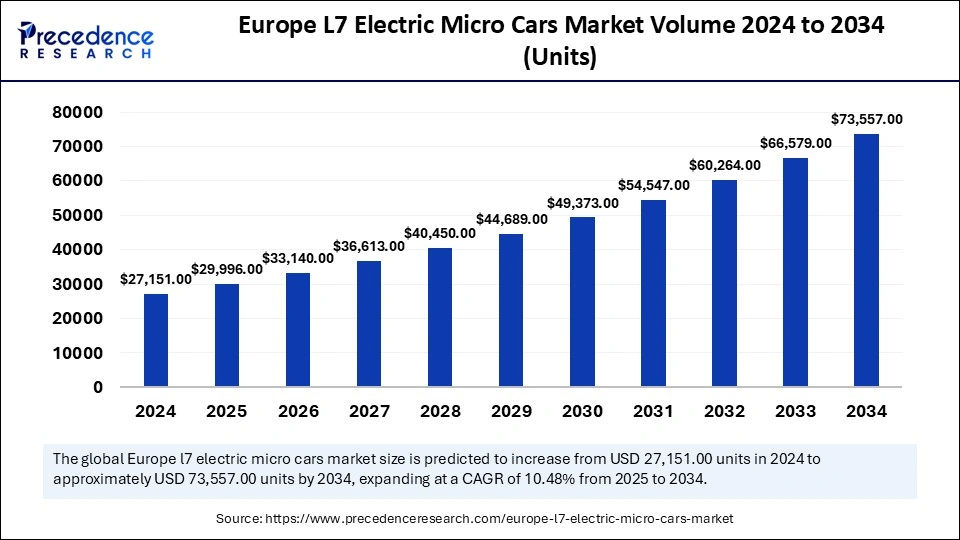

Europes L7 Electric Micro Cars Market is set to expand to 73,556 units by 2034

The Europes L7 electric micro cars market is expected to witness significant growth, increasing from 29,996 units in 2025 to more than 73,556 units by 2034, at a CAGR of 10.48%.

Europe’s L7 Electric Micro Cars Market Key Insights

- Germany dominated the market by holding the largest market share in 2024.

- UK is expected to grow at the fastest CAGR in the foreseeable period.

- By range per charge, the medium range (61-100KM) segment held a major market share of 45.55% in 2024.

- By range per charge, the extended range (Above 100KM) segment is expected to grow at a notable CAGR in the upcoming period.

- By battery type, the lithium-ion battery segment dominated the market with the biggest market share of 72.31% in 2024.

- By seats, the 2 seats segment led the market with the highest market share of 54.34% in 2024.

The L7 electric micro cars market in Europe is experiencing steady growth, driven by increasing urbanization, rising fuel prices, and the push for sustainable transportation. L7 electric micro cars, classified as lightweight quadricycles, offer an eco-friendly alternative to traditional cars, making them ideal for city commuting. With growing concerns over carbon emissions and traffic congestion, many European cities are promoting the adoption of micro electric vehicles through incentives, low-emission zones, and improved charging infrastructure. The market is expected to witness significant expansion in the coming years, supported by advancements in battery technology, affordability, and regulatory support.

Sample Link: https://www.precedenceresearch.com/sample/5700

Market Drivers

Several key factors are fueling the growth of the L7 electric micro cars market in Europe

- Government Policies & Incentives – Many European governments are offering subsidies, tax exemptions, and grants to encourage the adoption of electric micro cars. Additionally, stringent emission regulations are driving consumers toward eco-friendly alternatives.

- Increasing Urbanization & Traffic Congestion – As cities become more crowded, compact and efficient vehicles like L7 electric micro cars provide an ideal solution for short-distance travel, reducing traffic congestion.

- Rising Fuel Prices & Cost Savings – With fluctuating fuel prices and the high cost of car ownership, consumers are turning to electric micro cars, which offer lower operational and maintenance costs.

- Advancements in Battery Technology – Improvements in lithium-ion batteries are enhancing the range and performance of electric micro cars, making them more practical for daily commutes.

- Growth of Car-Sharing & Micro-Mobility Services – The rise of urban mobility services, including car-sharing and subscription-based models, is boosting demand for electric micro cars as cost-effective and sustainable transportation options.

Opportunities

The market presents several promising opportunities

- Expansion of Charging Infrastructure – The increasing deployment of EV charging stations across European cities is making electric micro cars more convenient for urban users.

- Integration of Smart & Connected Features – The adoption of IoT and AI-driven technologies can enhance vehicle safety, navigation, and efficiency, making L7 electric micro cars more attractive to consumers.

- Growing Demand for Fleet & Delivery Vehicles – Companies in the logistics and food delivery sectors are exploring L7 electric micro cars as an affordable and eco-friendly option for last-mile delivery services.

- Development of Affordable Models – Automakers are focusing on cost-effective designs and localized manufacturing to make electric micro cars more accessible to a wider consumer base.

- New Market Entrants & Strategic Partnerships – Increased investments from startups and collaborations between automotive manufacturers and tech companies are driving innovation in this segment.

Challenges

Despite its growth potential, the market faces several challenges

- Limited Driving Range & Speed – L7 electric micro cars typically have a lower range and speed compared to conventional cars, making them less suitable for long-distance travel.

- Consumer Awareness & Adoption Barriers – Many consumers are still unfamiliar with L7 micro cars or hesitant to adopt them due to concerns over safety, charging availability, and perceived limitations.

- Regulatory & Safety Standards – Differences in regulations across European countries can create challenges for manufacturers in terms of compliance and standardization.

- Competition from E-Scooters & Public Transport – Electric scooters, bikes, and well-developed public transportation networks offer alternative mobility options, potentially limiting the adoption of micro electric cars.

- Infrastructure Challenges in Rural Areas – While urban centers are well-equipped for EV adoption, rural areas may lack the necessary charging infrastructure, restricting market expansion.

Regional Insights

- Western Europe – Countries like France, Germany, and the Netherlands are leading the adoption of L7 electric micro cars, driven by strong government incentives, well-developed charging infrastructure, and high environmental awareness.

- Southern Europe – Italy and Spain are witnessing growing demand, particularly in urban areas with congestion-prone city centers. Local automakers are introducing innovative models to cater to city commuters.

- Northern Europe – Scandinavian countries, including Sweden and Norway, have high EV adoption rates and are actively promoting sustainable mobility solutions, creating opportunities for micro electric vehicles.

- Eastern Europe – The market is gradually gaining traction, with increasing government support and rising consumer interest in cost-effective and eco-friendly transportation. However, limited charging infrastructure remains a challenge in some areas.

Read Also: Electric Vehicle Charging Cables Market