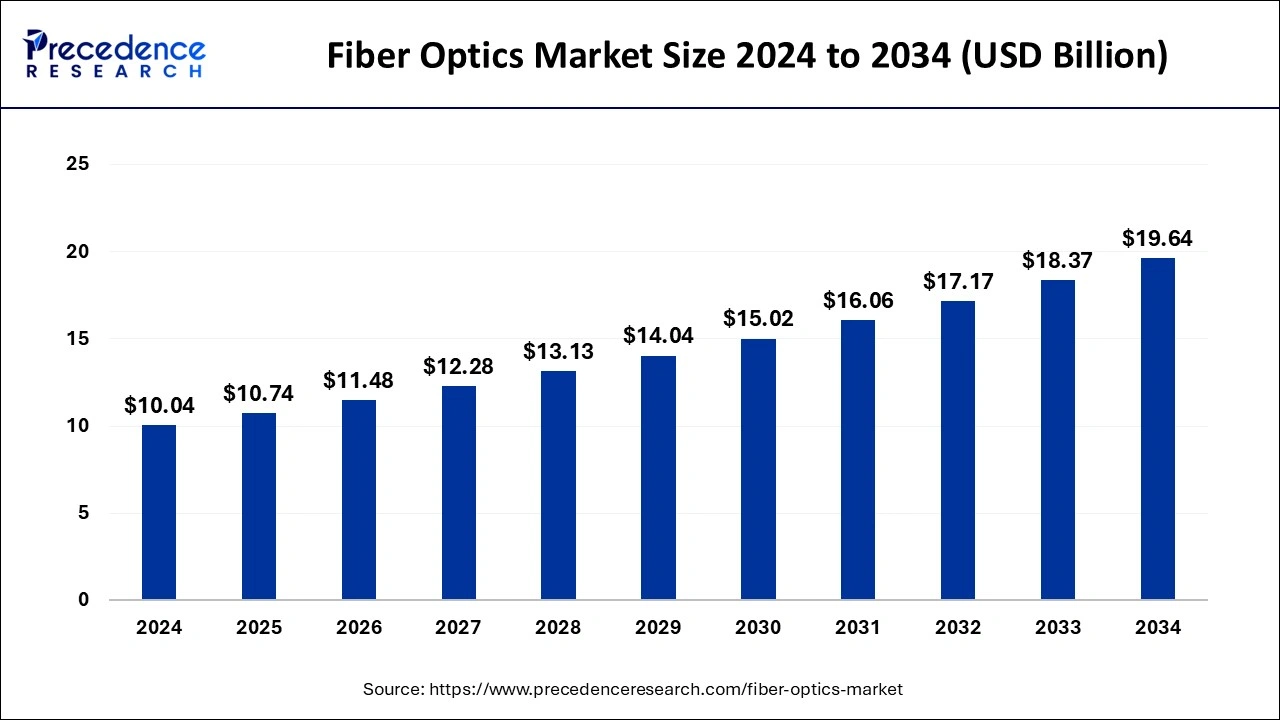

Fiber Optics Market to Reach USD 19.64 Billion by 2034

The global fiber optics market was valued at USD 10.04 billion in 2024 and is expected to reach USD 19.64 billion by 2034, growing at a CAGR of 6.94%.

The global fiber optics market is experiencing significant growth, with Asia Pacific holding the largest share of 29% in 2024, driven by the region’s expanding telecommunications and data infrastructure. The telecom sector remains the dominant application, contributing 42% of the market share due to the increasing demand for high-speed internet and data transmission. Multi-mode fiber optic cables lead in terms of market share, accounting for 54% of the market in 2024, as they are commonly used for short-distance data transmission. Additionally, the glass material type dominates the market, being preferred for its superior transmission properties. These factors collectively support the ongoing growth of the fiber optics market, particularly in regions with expanding telecom networks and data needs.

Fiber Optics Market Key Insights

- Asia Pacific led the global fiber optics market with a 29% share in 2024.

- The telecom segment accounted for the largest market share of 42% in 2024.

- The multi-mode fiber optic segment captured the biggest share at 54% in 2024.

- The glass material type generated the largest market share in 2024.

Fiber Optics Market Market Scope

| Report Highlights | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.94% |

| Market Size in 2024 | USD 10.04 Billion |

| Market Size in 2025 | USD 10.74 Billion |

| Market Size by 2034 | USD 19.64 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type, and By Application Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

The fiber optics market is primarily driven by the growing demand for high-speed internet and reliable data transmission, particularly in telecom and data centers. The rapid expansion of 5G networks is also a major driver, as fiber optic cables are essential for supporting the infrastructure required for faster and more efficient mobile networks. The increasing reliance on cloud computing and data storage has further boosted the need for fiber optics in data centers, where high bandwidth and low latency are crucial. Additionally, the demand for advanced technologies such as the Internet of Things (IoT), artificial intelligence, and smart cities has fueled the need for faster communication networks, which in turn drives fiber optics adoption. The shift towards fiber to the home (FTTH) for residential broadband and the expansion of broadband services in developing regions are also contributing factors to market growth. Finally, advancements in fiber optic technologies, such as improvements in material quality and manufacturing techniques, have made fiber optics more cost-effective and accessible, spurring their use across various industries.

Opportunities

- Rapid adoption of 5G networks increases the demand for fiber optic infrastructure.

- Expansion of broadband services in developing regions presents growth potential.

- The rise of cloud computing and data centers boosts the need for fiber optics.

- Advancements in fiber optic technology improve cost-effectiveness and efficiency.

- Increasing reliance on smart city infrastructure and IoT applications enhances fiber optics demand.

Challenges

- High initial installation costs of fiber optic networks can limit adoption, especially in rural areas.

- Competition from alternative technologies like wireless communication may hinder growth.

- Complexity in fiber optic network installation and maintenance can pose challenges.

- Limited skilled labor and expertise in some regions may slow down deployment.

- Regulatory and environmental concerns regarding fiber optic cable installations may affect market growth.

Regional Insights

The fiber optics market is witnessing strong regional dynamics, with Asia Pacific leading the global market, holding the largest share of 29% in 2024. The region’s dominance is driven by the rapid growth of telecommunications and data infrastructure, particularly in countries like China and India, which are heavily investing in expanding their internet connectivity and broadband services.

North America follows closely, with significant demand stemming from the increasing need for high-speed internet, 5G networks, and data centers. The telecom sector’s growth in the U.S. and Canada supports this market expansion. Europe is also experiencing steady growth, with increasing investments in fiber optic networks to support high-speed internet access across urban and rural areas. Meanwhile, the Middle East and Africa, along with Latin America, are expected to grow at a moderate pace, fueled by ongoing digital transformation projects and investments in network infrastructure, although challenges like limited infrastructure in some regions could impact the speed of adoption.

Read Also: Image Guided Surgery Devices Market Size Analysis 2022 To 2030

Market Companies

- AFL

- Prysmian Group

- Finolex Cables Limited

- Birla Furukawa Fiber Optics Limited

- Yangtze Optical Fiber and Cable Co., Ltd. (YOFC)

Recent Developments

Recent developments in the fiber optics market include significant technological advancements and expansion projects aimed at improving global connectivity. The roll-out of 5G networks continues to be a major catalyst, with several telecom companies deploying fiber optic infrastructure to support the high-speed data demands of 5G. In addition, there has been an increase in investments to expand fiber-to-the-home (FTTH) deployments, particularly in North America and Europe, aimed at providing high-speed broadband access to underserved areas. New advancements in fiber optic cables, such as the development of bend-insensitive fibers, have enhanced performance and reliability in dense urban environments and mobile networks. Moreover, companies are focusing on reducing the cost of installation by improving manufacturing techniques, which makes fiber optic technology more accessible to emerging markets. As part of a broader digitalization effort, governments worldwide are increasingly supporting fiber optic network deployment as part of their national infrastructure plans, which is accelerating the adoption of fiber optics in various sectors, including education, healthcare, and business services.

Segments Covered in the Report

By Product Type

- Multimode

- Single Mode

- Plastic Optical Fiber

By Material Type

- Glass

- Plastic

By Application

- Military & Aerospace

- Weapon System

- Secure Communication

- Surveillance System

- UAV

- Optical Computing

- Military Vehicle Sensing

- Oil & Gas

- High Bandwidth Communications

- Material Sensing

- Others

- BFSI

- Railway

- Speed Monitoring

- Railway Maintenance

- Dynamic Load Calculation

- Telecom

- Medical

- Minimal Invasive Surgery

- Biomedical Sensing

- Imaging

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World