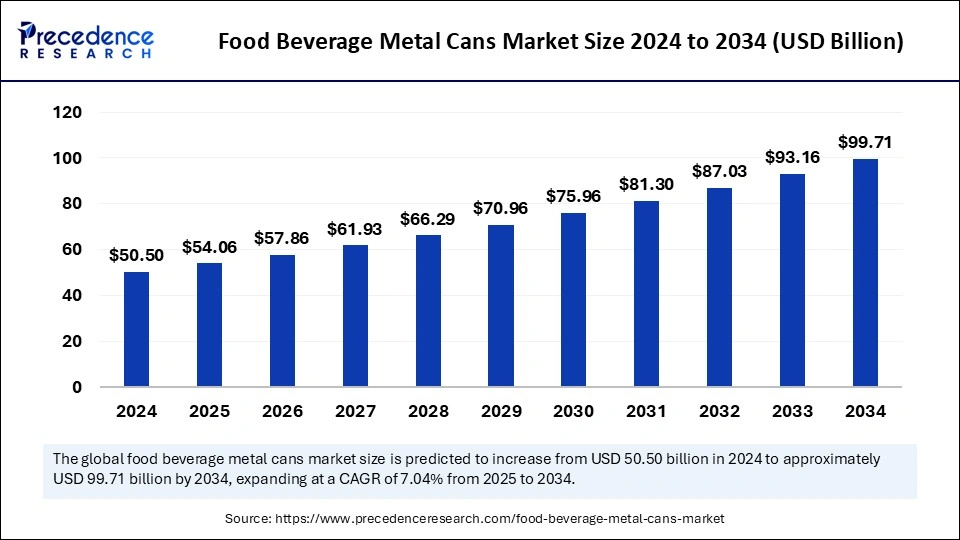

Food and Beverage Metal Cans Industry Valuation Set to Reach USD 99.71 Billion by 2034

The food and beverage metal cans market is set to nearly double, rising from USD 50.50 billion in 2024 to around USD 99.71 billion by 2034, with a 7.04% CAGR.

Food and Beverage Metal Cans Industry Key Insights

- North America accounted for the largest share of the food beverage metal cans market in 2024.

- Asia Pacific is anticipated to witness the fastest growth in the market during the forecasted years.

- Europe is observed to grow at a considerable in the upcoming period.

- By type, the two-piece cans segment contributed the largest share of the market in 2024.

- By type, the three-piece cans segment is expected to show considerable growth over the forecast period.

- By material, the aluminum cans segment accounted for the largest share of the market in 2024.

- By material, the steel cans segment is anticipated to witness significant growth in the studied period.

- By application, the beverages segment contributed the largest share of the market in 2024.

- By application, the food segment is expected to show considerable growth over the forecast period.

The global food and beverage metal cans market is experiencing significant growth, driven by increasing demand for sustainable and eco-friendly packaging solutions. Metal cans, primarily made of aluminum and steel, are widely used in the food and beverage industry due to their durability, recyclability, and ability to preserve product quality for extended periods. The market, valued at approximately USD 50.50 billion in 2024, is projected to reach around USD 99.71 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.04%. The increasing consumer preference for ready-to-eat food products, functional beverages, and carbonated soft drinks has further propelled market expansion. Advancements in can manufacturing, including lightweight designs and improved coatings, have enhanced their appeal, making them an attractive packaging option for manufacturers seeking to maintain freshness while reducing environmental impact.

The surge in demand for sustainable packaging solutions has positioned metal cans as a preferred choice over plastic alternatives. Their ability to be infinitely recycled without loss of quality aligns with global sustainability goals, contributing to the circular economy. With governments and regulatory bodies imposing stricter regulations on plastic usage, many companies in the food and beverage sector are shifting towards metal cans. The rise in urbanization, changing lifestyles, and the growing popularity of convenient, on-the-go food and beverage products have further accelerated the adoption of metal cans. The market is also witnessing technological advancements, such as smart packaging with QR codes and augmented reality labels, enhancing consumer engagement and brand transparency.

Sample Link: https://www.precedenceresearch.com/sample/5674

Market Drivers

Several key factors are driving the growth of the food and beverage metal cans market. One of the primary drivers is the rising consumer demand for sustainable and eco-friendly packaging. Metal cans, being 100% recyclable and reusable, offer an environmentally responsible alternative to plastic, which has been facing increased scrutiny due to its harmful effects on marine life and the environment. As consumers become more environmentally conscious, they are actively seeking products packaged in sustainable materials, boosting the demand for metal cans.

The increasing consumption of beverages, particularly carbonated soft drinks, energy drinks, and alcoholic beverages, has also contributed to market expansion. Metal cans are widely preferred for beverages due to their ability to maintain carbonation, prevent light exposure, and extend product shelf life. The convenience factor associated with canned beverages, particularly among millennials and Gen Z consumers, has further driven market growth. The rising demand for canned food products, including soups, vegetables, and pet food, is another significant factor fueling the market. The ability of metal cans to provide superior protection against contamination and external elements has made them a popular choice for long-term food storage.

Advancements in can manufacturing technologies have also played a crucial role in driving market growth. Lightweight aluminum cans with improved barrier properties and enhanced printing techniques have allowed brands to create visually appealing packaging that stands out on retail shelves. The increasing investment in research and development by leading manufacturers has resulted in innovative can designs that offer both functionality and aesthetic appeal.

Opportunities

The food and beverage metal cans market presents several growth opportunities for manufacturers and stakeholders. One of the most promising opportunities lies in the increasing demand for premium and specialty beverages. With the rise of craft beer, organic juices, and functional drinks, brands are looking for high-quality packaging that reflects their premium positioning. Metal cans, with their ability to maintain freshness and enhance brand visibility through vibrant printing and embossing, offer a lucrative opportunity for manufacturers catering to this segment.

The growing popularity of plant-based and organic food products has also created new avenues for metal can packaging. As consumers become more health-conscious, the demand for organic canned foods, including beans, fruits, and soups, is increasing. This trend provides an opportunity for manufacturers to develop innovative packaging solutions that align with the preferences of health-conscious consumers.

The expansion of e-commerce and direct-to-consumer (DTC) channels is another significant opportunity for the metal cans market. With online grocery shopping becoming increasingly popular, brands are focusing on packaging solutions that can withstand the rigors of shipping while maintaining product integrity. Metal cans offer durability and tamper resistance, making them an ideal choice for online food and beverage sales.

Another emerging opportunity is the incorporation of smart packaging technologies in metal cans. Brands are exploring the use of interactive labels, QR codes, and augmented reality experiences to enhance consumer engagement and provide real-time information about product sourcing, nutritional content, and recycling instructions. The integration of these technologies not only enhances the consumer experience but also allows brands to build stronger connections with their audience.

Challenges

Despite the positive growth trajectory, the food and beverage metal cans market faces several challenges. One of the primary concerns is the fluctuating prices of raw materials, particularly aluminum and steel. The volatility in metal prices can impact production costs, leading to pricing pressures on manufacturers. The reliance on metal as a primary raw material makes the industry susceptible to supply chain disruptions, trade restrictions, and geopolitical tensions affecting the availability of resources.

Another challenge is the competition from alternative packaging materials, such as flexible pouches, cartons, and glass bottles. While metal cans offer several advantages, some brands prefer flexible packaging due to its lightweight nature and cost-effectiveness. The rise of biodegradable and compostable packaging solutions also poses a challenge to the widespread adoption of metal cans.

Recycling infrastructure and consumer awareness about proper recycling practices remain critical challenges for the industry. While metal cans are highly recyclable, not all consumers dispose of them correctly, leading to inefficiencies in the recycling process. Educating consumers and improving collection systems are essential to maximizing the environmental benefits of metal can packaging.

Stringent regulatory requirements related to food contact materials and safety standards also pose a challenge for manufacturers. Compliance with regulations set by organizations such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) requires continuous investment in research and quality control measures.

Regional Insights

The food and beverage metal cans market exhibits strong regional variations, with North America and Europe leading the global market. In North America, the United States and Canada dominate due to high consumption of canned beverages and processed foods. The region’s well-established recycling infrastructure and strong consumer preference for sustainable packaging solutions have contributed to market growth. The presence of key players such as Ball Corporation and Crown Holdings has further strengthened the market in this region.

Europe follows closely, with countries like Germany, the United Kingdom, and France driving demand for metal cans. The European Union’s stringent regulations on plastic packaging and sustainability initiatives have accelerated the adoption of metal cans in the food and beverage sector. The growing popularity of canned craft beer and energy drinks has also contributed to market expansion.

The Asia-Pacific region is witnessing rapid growth, fueled by increasing urbanization, rising disposable incomes, and changing consumer lifestyles. Countries such as China, India, and Japan are experiencing high demand for canned beverages, particularly energy drinks and ready-to-drink coffee. The expansion of organized retail and e-commerce platforms in the region has further boosted the market.

Latin America and the Middle East & Africa are also emerging as potential markets, with growing demand for canned food products and beverages. The rising awareness of sustainable packaging and the expansion of local beverage industries are driving market growth in these regions. However, challenges such as limited recycling infrastructure and price sensitivity among consumers may impact market penetration.

Read Also: End-of-Line Packaging Market