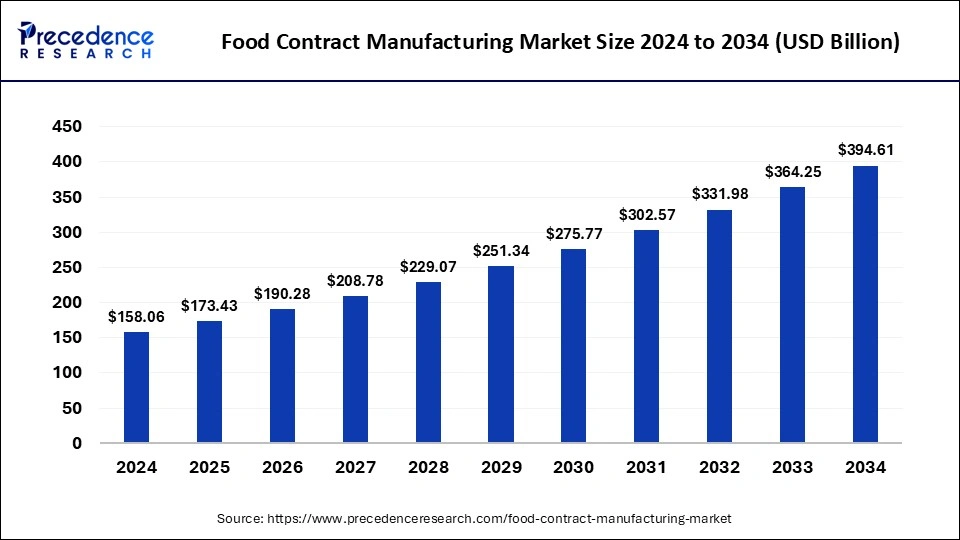

Food Contract Manufacturing Market Size to Worth USD 364.25 Bn by 2033

The global food contract manufacturing market size is expected to increase USD 364.25 billion by 2033 from USD 144.06 billion in 2023 with a CAGR of 9.72% between 2024 and 2033.

Key Points

- Asia Pacific dominated the food contract manufacturing market with the largest revenue share of 54% in 2023.

- North America is expected to grow at the highest CAGR in the market during the forecast period.

- By service, the manufacturing segment has contributed more than 68% of revenue share in 2023.

- By service, the custom formulation and R&D segment is expected to grow at the highest CAGR of 11.46% during the forecast period.

The Food Contract Manufacturing Market encompasses a broad spectrum of services including product development, manufacturing, packaging, and labeling. These services cater to a wide range of food products such as bakery items, snacks, beverages, dairy products, and ready-to-eat meals. The market is characterized by a diverse landscape of players ranging from small-scale regional firms to large multinational corporations. Contract manufacturers provide expertise in various food processing techniques, adherence to stringent food safety regulations, and the ability to scale production based on client requirements.

The market has shown robust growth due to the increasing demand for processed and convenience foods, driven by changing lifestyles and dietary habits. Consumers are seeking high-quality, nutritious, and easy-to-prepare food options, prompting food companies to innovate and expand their product portfolios. This has led to a surge in outsourcing production to specialized contract manufacturers who can offer efficiency and cost-effectiveness.

Get a Sample: https://www.precedenceresearch.com/sample/4606

Growth Factors

Several key factors are contributing to the growth of the Food Contract Manufacturing Market:

1. Rising Demand for Convenience Foods

The fast-paced modern lifestyle has led to a growing demand for convenience foods that are easy to prepare and consume. Busy consumers, particularly in urban areas, prefer ready-to-eat meals, snacks, and beverages that save time without compromising on taste and nutrition. This trend has compelled food companies to develop a wide range of convenience products, thereby driving the demand for contract manufacturing services.

2. Cost Efficiency and Scalability

Outsourcing production to contract manufacturers offers significant cost advantages. Food companies can avoid the high capital expenditures associated with setting up and maintaining production facilities. Contract manufacturers, with their specialized equipment and economies of scale, can produce large quantities of food products more efficiently. This cost-efficiency allows food companies to allocate resources to other strategic areas such as research and development, marketing, and distribution.

3. Focus on Core Competencies

By partnering with contract manufacturers, food companies can concentrate on their core competencies, such as product innovation, branding, and customer engagement. This strategic focus enhances their competitive edge in the market while ensuring that production processes are handled by experts who adhere to high-quality standards and regulatory compliance.

4. Technological Advancements

Advancements in food processing and packaging technologies have significantly enhanced the capabilities of contract manufacturers. Innovations such as automation, precision processing, and advanced packaging solutions ensure higher efficiency, consistency, and extended shelf life of food products. These technological advancements attract food companies to collaborate with contract manufacturers to leverage state-of-the-art production techniques.

5. Stringent Regulatory Environment

The food industry is subject to stringent regulations and quality standards to ensure consumer safety. Contract manufacturers are well-versed in complying with these regulations, including Good Manufacturing Practices (GMP), Hazard Analysis Critical Control Point (HACCP), and food safety certifications. This expertise in regulatory compliance reduces the burden on food companies and assures them of high-quality production standards.

Region Insights

The Food Contract Manufacturing Market exhibits varied growth patterns across different regions, influenced by economic, cultural, and regulatory factors.

North America holds a significant share of the Food Contract Manufacturing Market, driven by the presence of a well-established food industry and high consumer demand for processed and convenience foods. The United States and Canada are major contributors, with numerous food companies outsourcing production to contract manufacturers to meet the growing demand. Additionally, the region’s focus on food safety and quality standards further boosts the market.

Europe is another prominent market for food contract manufacturing, characterized by a diverse food culture and stringent regulatory framework. Countries such as Germany, France, and the United Kingdom are key players, with a strong emphasis on innovation and sustainability in food production. The demand for organic and natural food products is also rising in this region, prompting food companies to collaborate with contract manufacturers specializing in these segments . The Asia-Pacific region is witnessing rapid growth in the Food Contract Manufacturing Market, fueled by the expanding middle-class population, urbanization, and changing dietary habits. Countries like China, India, and Japan are experiencing increased demand for processed and packaged foods, driven by busy lifestyles and rising disposable incomes. The region’s large population base presents significant growth opportunities for contract manufacturers.

Trends

Several notable trends are shaping the Food Contract Manufacturing Market:

1. Health and Wellness

The growing awareness of health and wellness is influencing consumer preferences towards healthier food options. This trend has led to an increased demand for contract manufacturing of organic, natural, and functional food products. Contract manufacturers are adapting to this trend by incorporating clean label ingredients, reducing additives, and enhancing the nutritional profiles of food products.

2. Sustainability

Sustainability is becoming a critical consideration in the food industry. Consumers are increasingly seeking environmentally friendly and ethically produced food products. Contract manufacturers are responding by adopting sustainable practices such as using renewable energy, minimizing waste, and sourcing sustainable ingredients. This trend aligns with the broader industry goal of reducing the environmental impact of food production.

3. Customization and Personalization

Customization and personalization of food products are gaining traction as consumers seek unique and tailored food experiences. Contract manufacturers are leveraging advanced technologies to offer customized formulations, flavors, and packaging options. This trend is particularly evident in segments such as snacks, beverages, and dietary supplements, where consumers desire products that cater to their specific preferences and dietary requirements.

4. E-commerce and Direct-to-Consumer

The rise of e-commerce and direct-to-consumer (DTC) sales channels is reshaping the food industry. Contract manufacturers are adapting to this trend by providing flexible production and packaging solutions that cater to the needs of online retailers and DTC brands. The ability to offer small batch production, rapid turnaround times, and innovative packaging designs is crucial for success in the e-commerce landscape.

5. Technological Integration

The integration of advanced technologies such as automation, artificial intelligence, and data analytics is transforming food contract manufacturing. These technologies enhance production efficiency, improve quality control, and enable real-time monitoring of production processes. Contract manufacturers are investing in smart manufacturing solutions to optimize operations and meet the evolving demands of food companies.

Food Contract Manufacturing Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 364.25 Billion |

| Market Size in 2023 | USD 144.06 Billion |

| Market Size in 2024 | USD 158.06 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 9.72% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Food Contract Manufacturing Market Dynamics

Drivers

Several drivers are propelling the growth of the Food Contract Manufacturing Market:

Increasing Demand for Processed Foods

The growing global population and changing dietary habits are driving the demand for processed foods. Consumers are seeking convenient, ready-to-eat, and shelf-stable food products that fit their busy lifestyles. This demand is prompting food companies to collaborate with contract manufacturers to expand their product offerings and meet consumer needs.

Globalization of Food Supply Chains

The globalization of food supply chains is facilitating the growth of food contract manufacturing. Food companies are expanding their operations across regions to tap into new markets and leverage cost advantages. Contract manufacturers play a crucial role in supporting these global supply chains by providing localized production capabilities and ensuring consistent quality across different markets.

Opportunities

The Food Contract Manufacturing Market offers several growth opportunities:

Expansion into Emerging Markets

Emerging markets present significant growth opportunities for food contract manufacturing. Rapid urbanization, rising disposable incomes, and changing dietary habits in regions such as Asia-Pacific, Latin America, and Africa are driving the demand for processed foods. Contract manufacturers can capitalize on these opportunities by establishing production facilities and partnerships in these regions.

Innovative Product Offerings

The demand for innovative and differentiated food products is on the rise. Contract manufacturers can seize this opportunity by investing in research and development to create unique formulations, flavors, and packaging solutions. Collaborating with food companies to develop novel products that cater to specific consumer preferences and dietary trends can drive market growth.

Sustainable and Ethical Practices

The growing consumer focus on sustainability and ethical practices presents an opportunity for contract manufacturers to differentiate themselves. By adopting environmentally friendly production methods, sourcing sustainable ingredients, and ensuring ethical labor practices, contract manufacturers can attract environmentally conscious food companies and consumers.

Challenges

Despite the growth opportunities, the Food Contract Manufacturing Market faces several challenges:

Regulatory Complexity

The food industry is subject to complex and stringent regulations that vary across regions. Navigating these regulatory requirements can be challenging for contract manufacturers, particularly when operating in multiple markets. Ensuring compliance with diverse regulations, including labeling, safety, and quality standards, requires significant resources and expertise.

Quality Control and Consistency

Maintaining consistent quality across large-scale production can be challenging for contract manufacturers. Variability in raw materials, production processes, and equipment can impact product quality. Contract manufacturers must implement robust quality control measures and invest in advanced testing and monitoring technologies to ensure consistent and high-quality output.

Read Also: Electric Vehicle Sensor Market Size to Worth USD 53.75 Bn by 2033

Food Contract Manufacturing Market Companies

- Fibro Foods

- Hindustan Foods Limited

- Hearthside Food Solutions LLC

- Nikken Foods

- Christy Quality Foods (CQF)

- De Banketgroep B.V.

- HACO AG

- SK Food Group

- Pacmoore Products Inc.

- Cremica

- Kilfera Food Manufacturers Ltd

- Nutrascience Labs, Inc

- Thrive Foods LLC.

- Orion Food Co., Ltd

- Omni blend

Recent Developments

- In February 2024, EVERY Company, which developed the technology to produce egg proteins through precise fermentation, announced that, in an effort to satisfy demand, it would be starting this year with major food businesses. Although a very impressive amount, the $233 million raised by the firm Clara Foods, created by Arturo Elizondo and David Anchel in late 2014, is far less than the astounding $840 million raised by Perfect Day to attempt and launch its animal-free dairy business.

- In November 2023, with an initial round of $18 million, Keychain, a new AI-powered platform, was officially launched. It enables consumer brands and merchants to find bespoke production partners more quickly. With participation from Box Group, Afore Capital, SV Angel, and more than twenty CPG specialists, the fundraising round, led by Lightspeed Venture Partners, intends to create the world’s most complete platform for the CPG supply chain via simplicity and clarity.

- In August 2023, PakTech’s current clients in these regions included Hawkers Brewery in Australia, Billson’s of Beechworth, and The Apple Press in New Zealand. The public’s desire for ecologically friendly packaging and practices is growing at the same time as its debut in Australia. American and Australian shopping habits are fairly similar. PakTech has had significant organic growth in the last several years, and it expects this pattern to persist. For PakTech, its clients, and all Australians who care about sustainability and our impact on the environment, establishing a physical local presence in the region is really exciting.

Segment Covered in the Report

By Service

- Manufacturing

- Convenience Foods

- Bakery Products

- Dietary Supplement

- Confectionery

- Dairy Products

- Others

- Packaging

- Convenience Foods

- Bakery Products

- Dietary Supplement

- Confectionery

- Dairy Products

- Others

- Custom Formulation and R&D

- Convenience Foods

- Bakery Products

- Dietary Supplement

- Confectionery

- Dairy Products

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/