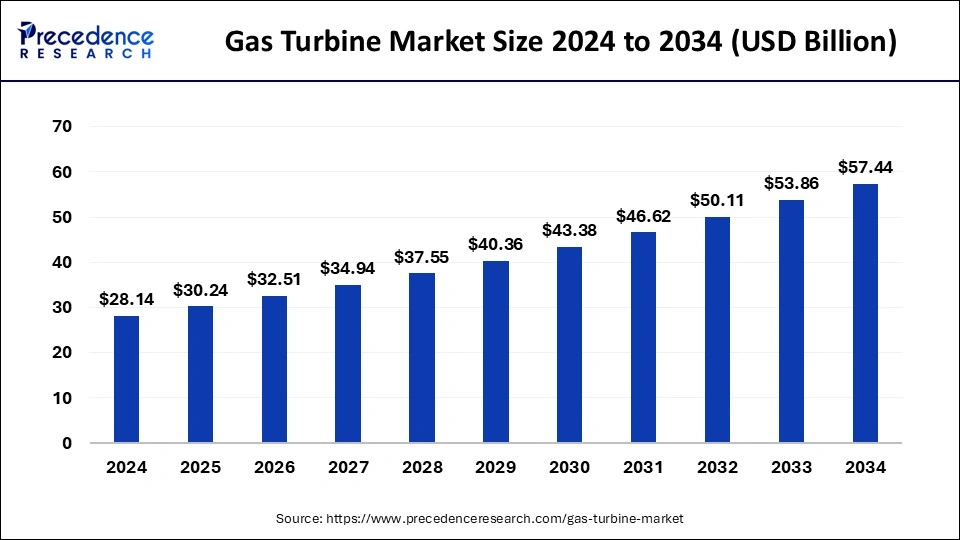

Gas Turbine Market to Reach USD 57.44 Bn by 2034

The global gas turbine market was valued at USD 28.14 billion in 2024 and is expected to reach USD 57.44 billion by 2034, growing at a CAGR of 7.48%.

The global gas turbine market is witnessing steady growth, with Asia Pacific holding a significant portion of the revenue share, approximately 37% in 2023. The market is predominantly driven by the increasing demand for high-capacity turbines, particularly the >200 MW segment, which contributed to 66% of the revenue share in 2023. The combined cycle turbines technology remains the dominant segment, accounting for 74% of the market share in 2023, due to its high efficiency in power generation. The power & utility sector is the largest end user, contributing over 82% of the total revenue in 2023, as gas turbines are essential for electricity generation. Additionally, the aero-derivative segment is experiencing notable growth, with a projected CAGR of 9% from 2024 to 2033, driven by demand for more flexible and efficient turbine solutions in various industries. Overall, the gas turbine market is expanding due to technological advancements, increasing energy needs, and a shift towards more efficient, reliable power generation systems.

Gas Turbine Market Key Insights

Gas Turbine Market Scope

| Report Highlights | Details |

| Market Size in 2023 | USD 26.18 Billion |

| Market Size in 2024 | USD 28.14 Billion |

| Market Size by 2034 | USD 53.67 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.4% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, Technology, Capacity, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

The gas turbine market is primarily driven by several key factors. Increasing global energy demand, particularly in emerging economies in Asia Pacific, is one of the main drivers, as industries seek reliable and efficient power generation solutions. The shift towards cleaner and more efficient energy sources is driving the demand for advanced gas turbines, especially combined cycle turbines, which offer high efficiency and lower emissions compared to traditional power generation methods. Government policies and regulations that focus on reducing carbon emissions are also pushing the adoption of cleaner energy technologies like gas turbines, which can support renewable energy integration into the grid. Furthermore, the growth of the power & utility sector, which accounts for a large share of gas turbine usage, is fueling the market as demand for reliable and continuous power generation rises. Technological advancements, such as improvements in turbine efficiency and flexibility, are also contributing to market growth, as industries look for solutions that reduce fuel consumption and operational costs. Additionally, the growing adoption of aero-derivative gas turbines for industrial and mobile applications is another driver, due to their ability to provide efficient, flexible, and cost-effective power generation solutions.

Opportunities

- Increasing demand for reliable and efficient power generation in emerging markets, particularly in Asia Pacific.

- Growing adoption of combined cycle gas turbines due to their high efficiency and low emissions.

- Rising need for cleaner energy sources, driving the shift towards gas turbines as a more environmentally friendly option compared to coal or oil.

- Development of advanced gas turbine technologies that improve fuel efficiency and reduce operational costs.

- Expanding adoption of aero-derivative turbines in industrial and mobile applications, offering more flexibility and cost-effectiveness.

- Government incentives and regulations favoring clean and sustainable energy solutions, boosting the demand for gas turbines.

Challenges

- High initial capital costs associated with the installation of gas turbines, which may deter some potential buyers.

- Competition from alternative renewable energy sources, such as wind and solar power, which may reduce reliance on gas turbines.

- Volatility in fuel prices, particularly natural gas, which can affect the cost-effectiveness of gas turbines for power generation.

- Technological complexity in designing and maintaining high-efficiency gas turbines, requiring significant expertise and investment.

- Regulatory and environmental concerns related to the continued use of fossil fuels, which could affect long-term market prospects.

Regional Insights

Asia Pacific is the leading region in the global gas turbine market, holding approximately 37% of the revenue share in 2023. This dominance is driven by the rapid industrialization and growing demand for energy in countries such as China, India, and Japan. As these countries continue to expand their energy infrastructure, gas turbines are increasingly used for power generation due to their efficiency and relatively lower emissions compared to coal-based plants. North America, particularly the United States, also plays a significant role in the market, driven by advancements in gas turbine technology and the large power & utility sector.

The region’s growing focus on reducing emissions and increasing energy efficiency has led to the adoption of combined cycle turbines, which offer higher performance and reduced environmental impact. Europe is another key market, where gas turbines are being used to complement renewable energy sources, especially in countries aiming for energy transition and carbon neutrality. The Middle East is witnessing strong growth due to the region’s energy needs and its focus on sustainable energy solutions, while Africa and Latin America are emerging markets where energy infrastructure development is expected to drive future growth in the gas turbine sector.

Read Also: Smart Glass Market to Hit Sales of US$ 18.9 Billion By 2030

Market Companies

- Kawasaki Heavy Industries

- Solar Turbines

- Capstone Turbine

- Vericor Power Systems

- Cryosta

- AnsaldoEnergia

- Opra Turbines

- Zorya-Mashproekt