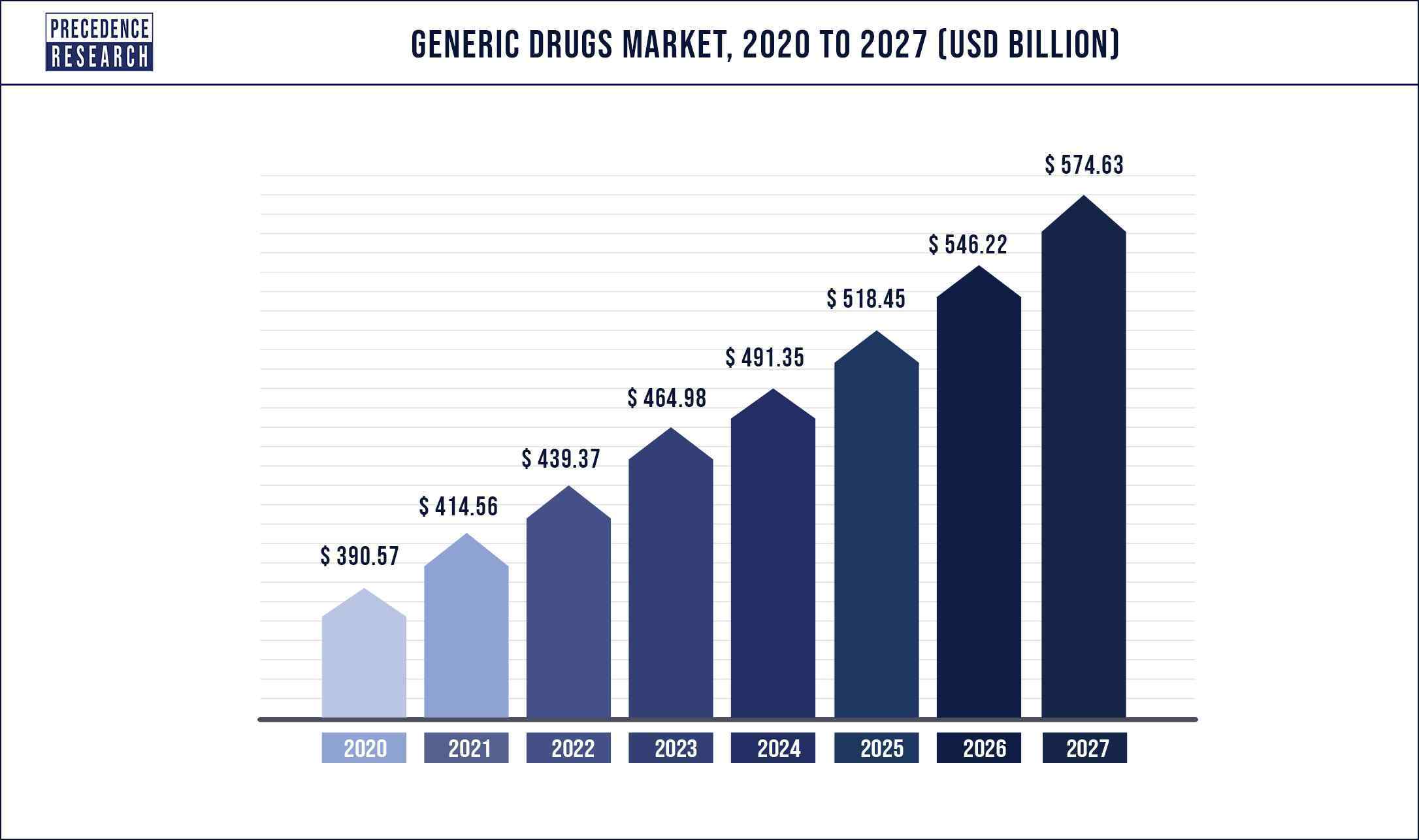

According to Precedence Research, The generic drugs market size garnered US$ 390.57 billion in 2020 and is expected to generate US$ 574.63 billion by 2030, manifesting a CAGR of 5.59% from 2021 to 2030. The report contains 150+ pages with detailed analysis.

The base year for the study has been considered 2021, the historic year 2019 and 2020, the forecast period considered is from 2021 to 2030. The generic drugs market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

A generic drug comprises the same chemical substance as a drug that was previously protected by a chemical patent. After the patents on the original pharmaceuticals expire, generic drugs can be sold. The medical profile of generics is thought to be equal in performance because the active chemical ingredient is the same. Generic medicine contains the same active pharmaceutical ingredient (API) as the brand-name drug, but it may change in terms of manufacturing technique, formulation, excipients, color, taste, and packaging. The cost effectiveness of generic drugs has contributed for a competitive advantage over the branded drugs is the prime factor adding boost to the market growth.

increasing prevalence of chronic diseases especially the cardiovascular disorders have propelled the demand for generic drugs market. Generic Drugs smashes the drug industry market with record growth and sustainable market trend making it a lucrative area to operate in.

Download the FREE Sample Report (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1205

A generic drug comprises the same chemical substance as a drug that was previously protected by a chemical patent. After the patents on the original pharmaceuticals expire, generic drugs can be sold. The medical profile of generics is thought to be equal in performance because the active chemical ingredient is the same. Generic medicine contains the same active pharmaceutical ingredient (API) as the brand-name drug, but it may change in terms of manufacturing technique, formulation, excipients, color, taste, and packaging. The cost effectiveness of generic drugs has contributed for a competitive advantage over the branded drugs is the prime factor adding boost to the market growth.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers, novel product introductions and developments, promotion strategies and Research and Development (R&D) activities in the marketplace. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing. The competitive profiling of these players includes business and financial overview, gross margin, production, sales, and recent developments which can aid in assessing competition in the market.

Some of the major players in the global generic drugs market include:

- Mylan N.V.

- Abbott Laboratories

- ALLERGAN

- Teva Pharmaceutical Industries Ltd.

- Eli Lilly and Company

- STADA Arzneimittel AG

- GlaxoSmithKline Plc.

- Baxter International Inc.

- Pfizer Inc.

- Sandoz International GmbH

Generic Drugs Market Scope

This market report studies market dynamics, status and outlook especially in North America, Europe and Asia-Pacific, Latin America, the Middle East and Africa. This research report offers scenario and forecast (revenue/volume), and categorizes the market by key players and various segment. This report also studies global market prominence, competitive landscape, market share, growth rates market dynamics such as drivers, restraints and opportunities, and distributors and sales channels.

This research study also integrates Industry Chain analysis and Porter’s Five Forces Analysis. Further, this report offers a competitive scenario that comprises collaborations, market concentration rate and expansions, mergers & acquisitions undertaken by companies.

Crucial factors accountable for market growth are:

- The low cost of generics as an alternative to branded drugs

- A large number of patents expired branded drugs

- Initiatives by governments and other regulatory bodies across the globe

Browse Healthcare Research Reports @ https://www.marketstatsnews.com/healthcare/

By Drug Type

- Simple Generics

- Super Generics

By Brand

- Pure generic drugs

- Branded generic drugs

By Route of Drug Administration

- Oral

- Topical

- Parental

- Others

By Therapeutic Application

- Central nervous system (CNS)

- Cardiovascular

- Dermatology

- Oncology

- Respiratory

- Others

Key Distribution Channel

- Hospitals Pharmacies

- Retail Pharmacies

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- United Kingdom

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

Research Objective

- To provide a comprehensive analysis of the generic drugs industry and its sub-segments in the global market, thereby providing a detailed structure of the industry

- To provide detailed insights into factors driving and restraining the growth of this global market

- To provide a distribution chain analysis/value chain for the this market

- To estimate the market size of the global generic drugs market where 2019 would be the historical period, 2020 shall be the base year, and 2020 to 2027 will be the forecast period for the study

- To provide strategic profiling of key companies (manufacturers and distributors) present across the globe, and comprehensively analyze their competitiveness/competitive landscape in this market

- To analyze the global market in four main geographies, namely, North America, Europe, Asia-Pacific, and the Rest of the World

- To provide country-wise market value analysis for various segments of the generic drugs

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions& Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Generic Drugs Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

Chapter 5. COVID 19 Impact on Generic Drugs Market

5.1. Covid-19: generic drugs Industry Impact

5.2. generic drugs Business Impact Assessment: Covid-19

5.2.1. Services Challenges/Disruption

5.2.2. Market Trends and generic drugs Opportunities in the COVID-19 Landscape for Major Markets

5.3. Strategic Measures against Covid-19

5.3.1. Government Support and Initiative to Combat Covid-19

5.3.2. Proposal for generic drugs Market Players to deal with Covid-19 Pandemic Scenario

Chapter 6. Generic Drugs Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.1.1. The low cost of generics, as an alternative to branded drugs

6.1.1.2. Large number of patent expired branded drugs

6.1.1.3. Initiatives by governments and other regulatory bodies

6.1.2. Market Restraints

6.1.2.1. Stringent governmental regulations and adverse effects associated with drugs

6.1.3. Market Opportunities

6.1.3.1. Use of RPA to ensure regulatory and standards compliance

Chapter 7. Global Generic Drugs Market: Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.1.1. generic drugs Market Revenue by Market Players (2017 – 2020)

7.1.1.2. generic drugs Market Revenue Market Share by Market Players (2017 – 2020)

7.1.2. Key Organic/Inorganic Strategies Adopted by Players

7.1.2.1. Product Portfolio Expansion, Geographic Expansion, Product Innovation

7.1.2.2. Merger and Acquisition, Collaboration and Partnerships

7.1.3. Market Players Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of End-users

Chapter 8. Global Generic Drugs Market, By Drug Type

8.1. generic drugs Market, by Drug Type, 2017-2027

8.1.1. Simple Generics

8.1.1.1. Market Revenue and Forecast (2017-2027)

8.1.2. Super Generics

8.1.2.1. Market Revenue and Forecast (2017-2027)

Chapter 9. Global Generic Drugs Market, By Brand

9.1. generic drugs Market, by Brand, 2017-2027

9.1.1. Pure generic drugs

9.1.1.1. Market Revenue and Forecast (2017-2027)

9.1.2. Branded generic drugs

9.1.2.1. Market Revenue and Forecast (2017-2027)

Chapter 10. Global Generic Drugs Market, By Route of Drug Administration

10.1. generic drugs Market, by Route of Drug Administration, 2017-2027

10.1.1. Oral

10.1.1.1. Market Revenue and Forecast (2017-2027)

10.1.2. Topical

10.1.2.1. Market Revenue and Forecast (2017-2027)

10.1.3. Parental

10.1.3.1. Market Revenue and Forecast (2017-2027)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2017-2027)

Chapter 11. Global Generic Drugs Market, By Therapeutic Application

11.1. generic drugs Market, by Therapeutic Application, 2017-2027

11.1.1. Central nervous system (CNS)

11.1.1.1. Market Revenue and Forecast (2017-2027)

11.1.2. Cardiovascular

11.1.2.1. Market Revenue and Forecast (2017-2027)

11.1.3. Dermatology

11.1.3.1. Market Revenue and Forecast (2017-2027)

11.1.4. Oncology

11.1.4.1. Market Revenue and Forecast (2017-2027)

11.1.5. Respiratory

11.1.5.1. Market Revenue and Forecast (2017-2027)

11.1.6. Others

11.1.6.1. Market Revenue and Forecast (2017-2027)

Chapter 12. Global Generic Drugs Market, By Distribution Channel

12.1. generic drugs Market, by Distribution Channel, 2017-2027

12.1.1. Hospitals Pharmacies

12.1.1.1. Market Revenue and Forecast (2017-2027)

12.1.2. Retail Pharmacies

12.1.2.1. Market Revenue and Forecast (2017-2027)

12.1.3. Others

12.1.3.1. Market Revenue and Forecast (2017-2027)

Chapter 13. Global Generic Drugs Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue Forecast by Drug Type(2017-2027)

13.1.2. Market Revenue Forecast by Brand (2017-2027)

13.1.3. Market Revenue Forecast by Route of Drug Administration (2017-2027)

13.1.4. Market Revenue Forecast by Therapeutic Application (2017-2027)

13.1.5. Market Revenue Forecast by Distribution Channel (2017-2027)

13.1.6. U.S

13.1.6.1. Market Revenue Forecast (2017-2027)

13.1.7. Canada

13.1.7.1. Market Revenue Forecast (2017-2027)

13.2. Europe

13.2.1. Market Revenue Forecast by Drug Type (2017-2027)

13.2.2. Market Revenue Forecast by Brand (2017-2027)

13.2.3. Market Revenue Forecast by Route of Drug Administration (2017-2027)

13.2.4. Market Revenue Forecast by Therapeutic Application (2017-2027)

13.2.5. Market Revenue Forecast by Distribution Channel (2017-2027)

13.2.6. UK

13.2.6.1. Market Revenue Forecast (2017-2027)

13.2.7. Germany

13.2.7.1. Market Revenue Forecast (2017-2027)

13.2.8. France

13.2.8.1. Market Revenue Forecast (2017-2027)

13.2.9. Rest of EU

13.2.9.1. Market Revenue Forecast (2017-2027)

13.3. Asia Pacific (APAC)

13.3.1. Market Revenue Forecast by Drug Type (2017-2027)

13.3.2. Market Revenue Forecast by Brand (2017-2027)

13.3.3. Market Revenue Forecast by Route of Drug Administration (2017-2027)

13.3.4. Market Revenue Forecast by Therapeutic Application (2017-2027)

13.3.5. Market Revenue Forecast by Distribution Channel (2017-2027)

13.3.6. China

13.3.6.1. Market Revenue Forecast (2017-2027)

13.3.7. India

13.3.7.1. Market Revenue Forecast (2017-2027)

13.3.8. Japan

13.3.8.1. Market Revenue Forecast (2017-2027)

13.3.9. Rest of APAC

13.3.9.1. Market Revenue Forecast (2017-2027)

13.4. LATAM

13.4.1. Market Revenue Forecast by Drug Type (2017-2027)

13.4.2. Market Revenue Forecast by Brand (2017-2027)

13.4.3. Market Revenue Forecast by Route of Drug Administration (2017-2027)

13.4.4. Market Revenue Forecast by Therapeutic Application (2017-2027)

13.4.5. Market Revenue Forecast by Distribution Channel (2017-2027)

13.4.6. Brazil

13.4.6.1. Market Revenue Forecast (2017-2027)

13.4.7. Rest of LATAM

13.4.7.1. Market Revenue Forecast (2017-2027)

13.5. Middle East and Africa (MEA)

13.5.1. Market Revenue Forecast by Drug Type (2017-2027)

13.5.2. Market Revenue Forecast by Brand (2017-2027)

13.5.3. Market Revenue Forecast by Route of Drug Administration (2017-2027)

13.5.4. Market Revenue Forecast by Therapeutic Application (2017-2027)

13.5.5. Market Revenue Forecast by Distribution Channel (2017-2027)

13.5.6. GCC

13.5.6.1. Market Revenue Forecast (2017-2027)

13.5.7. North Africa

13.5.7.1. Market Revenue Forecast (2017-2027)

13.5.8. South Africa

13.5.8.1. Market Revenue Forecast (2017-2027)

13.5.9. Rest of MEA

13.5.9.1. Market Revenue Forecast (2017-2027)

Chapter 14. Company Profiles

14.1. Abbott Laboratories

14.1.1. Company Overview, Business Information, Regional Presence

14.1.2. Product Portfolio Analysis

14.1.2.1. Product Details, Specification, Application

14.1.3. Revenue, Price, and Gross Margin (2017-2020)

14.1.4. Recent Developments and Strategies

14.2. Teva Pharmaceutical Industries Ltd.

14.2.1. Company Overview, Business Information, Regional Presence

14.2.2. Product Portfolio Analysis

14.2.2.1. Product Details, Specification, Application

14.2.3. Revenue, Price, and Gross Margin (2017-2020)

14.2.4. Recent Developments and Strategies

14.3. ALLERGAN

14.3.1. Company Overview, Business Information, Regional Presence

14.3.2. Product Portfolio Analysis

14.3.2.1. Product Details, Specification, Application

14.3.3. Revenue, Price, and Gross Margin (2017-2020)

14.3.4. Recent Developments and Strategies

14.4. Sandoz International GmbH

14.4.1. Company Overview, Business Information, Regional Presence

14.4.2. Product Portfolio Analysis

14.4.2.1. Product Details, Specification, Application

14.4.3. Revenue, Price, and Gross Margin (2017-2020)

14.4.4. Recent Developments and Strategies

14.5. Mylan N.V.

14.5.1. Company Overview, Business Information, Regional Presence

14.5.2. Product Portfolio Analysis

14.5.2.1. Product Details, Specification, Application

14.5.3. Revenue, Price, and Gross Margin (2017-2020)

14.5.4. Recent Developments and Strategies

14.6. STADA Arzneimittel AG

14.6.1. Company Overview, Business Information, Regional Presence

14.6.2. Product Portfolio Analysis

14.6.2.1. Product Details, Specification, Application

14.6.3. Revenue, Price, and Gross Margin (2017-2020)

14.6.4. Recent Developments and Strategies

14.7. Baxter International Inc.

14.7.1. Company Overview, Business Information, Regional Presence

14.7.2. Product Portfolio Analysis

14.7.2.1. Product Details, Specification, Application

14.7.3. Revenue, Price, and Gross Margin (2017-2020)

14.7.4. Recent Developments and Strategies

14.8. Eli Lilly and Company

14.8.1. Company Overview, Business Information, Regional Presence

14.8.2. Product Portfolio Analysis

14.8.2.1. Product Details, Specification, Application

14.8.3. Revenue, Price, and Gross Margin (2017-2020)

14.8.4. Recent Developments and Strategies

14.9. GlaxoSmithKline Plc.

14.9.1. Company Overview, Business Information, Regional Presence

14.9.2. Product Portfolio Analysis

14.9.2.1. Product Details, Specification, Application

14.9.3. Revenue, Price, and Gross Margin (2017-2020)

14.9.4. Recent Developments and Strategies

14.10. Pfizer Inc.

14.10.1. Company Overview, Business Information, Regional Presence

14.10.2. Product Portfolio Analysis

14.10.2.1. Product Details, Specification, Application

14.10.3. Revenue, Price, and Gross Margin (2017-2020)

14.10.4. Recent Developments and Strategies

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Why Buy this Report?

The purpose of Precedence Research’s generic drugs market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1205

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com