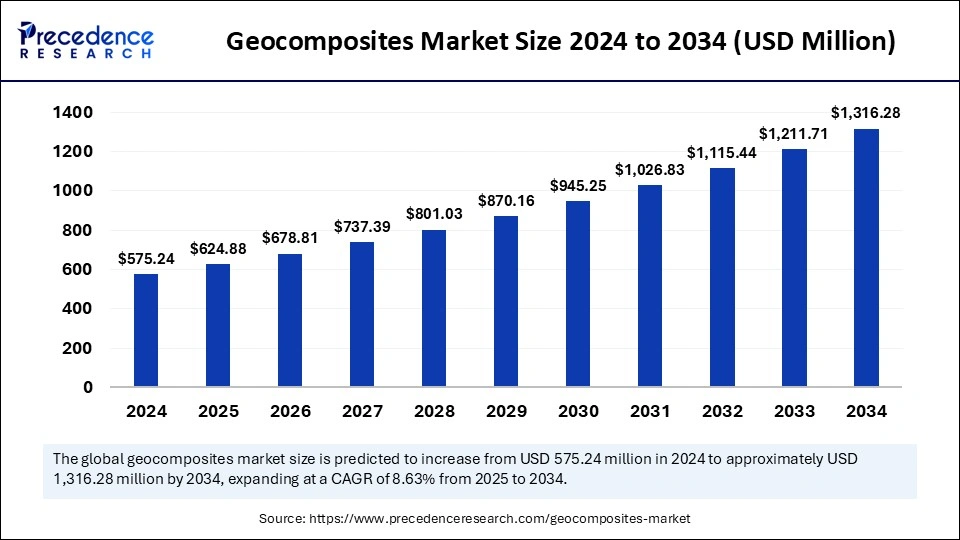

Geocomposites Market Size Projected at USD 1,316.28 Mn by 2034

The global geocomposites market is expected to increase from USD 575.24 million in 2024 to USD 1,316.28 million by 2034, With a CAGR of 8.63%

Geocomposites Market Key Takeaways

In 2024, Asia Pacific emerged as the market leader with a 32% share.

Europe is anticipated to witness the most rapid growth over the forecast timeframe.

The geotextile-geonet segment held the top position in the product category in 2024.

The geotextile-geocore segment is expected to record the highest CAGR from 2025 to 2034.

The drainage segment accounted for the biggest market share of 45% by function in 2024.

The separation segment is projected to grow at the fastest CAGR of 8.73% during the studied years.

The road and highway segment led the application category with a 46% share in 2024.

The water and wastewater management segment is set to grow at a strong CAGR of 9.13% during the forecast period.

Geocomposites Market Overview

The Geocomposites Market is poised for strong growth, driven by increasing construction activities, rising awareness of geosynthetic benefits, and advancements in manufacturing technologies. Geocomposites are gaining popularity as they offer superior performance in soil reinforcement, drainage, and containment applications.

The demand for durable, weather-resistant, and cost-effective infrastructure materials has positioned geocomposites as a preferred choice for engineers and project developers.

Geocomposites Market Drivers

Infrastructure modernization and rehabilitation projects are key drivers of the market, with governments investing in road development, railway expansion, and urban drainage systems. The shift towards green and resilient infrastructure further supports market growth.

The oil & gas and mining industries continue to be significant consumers of geocomposites due to their need for effective containment and land rehabilitation solutions.

Geocomposites Market Opportunities

Manufacturers have the opportunity to expand their product offerings by developing geocomposites with enhanced chemical resistance and load-bearing capabilities. The increasing focus on water conservation and climate adaptation strategies presents new applications for geocomposites in dam reinforcement and erosion control.

Rising Focus on Sustainable Construction

The rising focus on sustainable construction is expected to create immense growth opportunities in the geocomposites market. Geocomposites are suitable for sustainable building construction due to their durability and environmentally friendly nature. The increasing investments in eco-friendly infrastructure projects are projected to propel the market in the coming years.

The rising regulations to reduce carbon emissions are key to boosting the focus on sustainable construction practices. This, in turn, creates the need for sustainable construction materials, including geocomposites, to meet carbon emission targets. The properties of geocomposites, like improved land stabilization and water drainage while protecting against erosion, make them ideal material for sustainable infrastructure.

Geocomposites Market Challenges

High production costs, complex installation requirements, and inconsistent material standards pose challenges to market growth. Additionally, the need for specialized workforce training remains a concern for large-scale geocomposite adoption.

Geocomposites Market Regional Insights & Recent Developments

The market is witnessing strong growth in Asia-Pacific, particularly in China and India, due to extensive infrastructure investments. Companies are focusing on research and development to introduce next-generation geocomposites with improved mechanical properties and environmental compatibility. The industry is also seeing a rise in strategic partnerships between construction firms and geosynthetic manufacturers to drive innovation and market expansion.

- In October 2024, E Squared Technical Textiles announced the launch of its new website focused on geomembranes, www.e2geomembranes.com. This dynamic online platform showcases the company’s extensive range of BABAA-certified geomembrane products designed to meet the needs of various industries, including environmental management, civil engineering, and water management.

- In July 2024, West Midlands-based Wrekin Products launched its new geosynthetics brand, Geoworks. The Geoworks division encompasses the company’s existing geosynthetics product line, which has been in development and expansion since 1995. The product offerings include geotextiles, geogrids, geomembranes, geomats, geocells, and geocellular paving solutions.

- In January 2022, Freudenberg Performance Materials, a leading global supplier of high-performance geosynthetics for the civil engineering market, introduced a new geogrid composite. This innovative product aims to enhance the efficiency of construction projects and consists of a reinforcing grid bonded to a separation and filtration nonwoven geotextile. The new geocomposite, EnkaGrid MAX C, is now available and is part of the Enka Solutions range for civil engineering applications.

Geocomposites Market Companies

- ABG Ltd.

- CLIMAX SYNTHETICS PVT. LTD.

- GSE Environmental

- HUESKER

- Leggett & Platt, Incorporated

- Ocean Global

- Officine Maccaferri Spa

- TenCate Geosynthetics Americas

- Terram

- Thrace Group

Segments Covered in the Report

By Product

- Geotextile-geonet

- Geotextile-geogrid

- Geotextile-geocore

- Geotextile-geomembrane

- Other

By Function

- Containment

- Drainage

- Others

By Application

- Road & Highway

- Land & Mining

- Water& Wastewater Management

- Soil Reinforcement for Civil Construction

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!