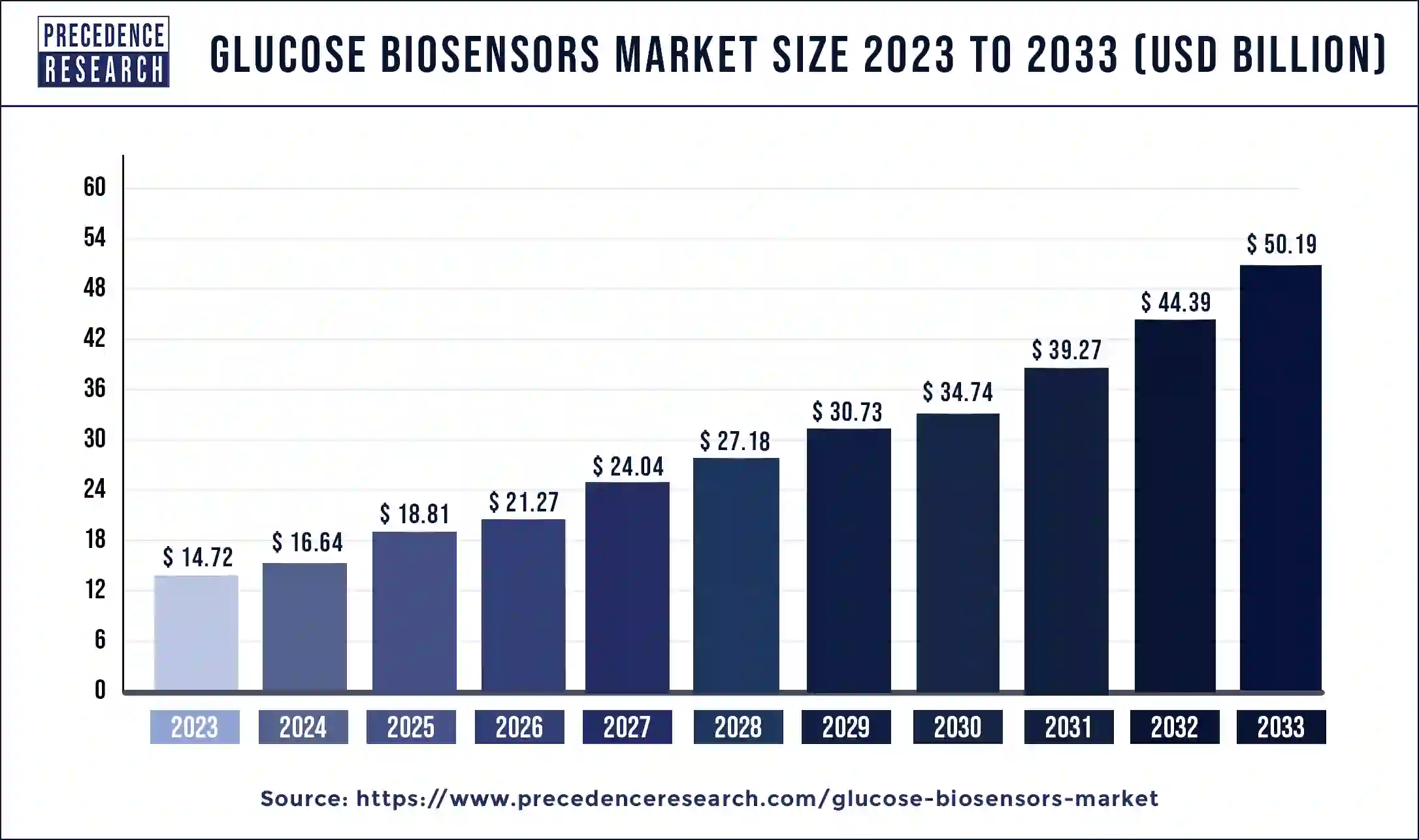

Glucose Biosensors Market Size to Coss USD 50.19 Bn by 2033

The global glucose biosensors market size surpassed USD 14.72 billion in 2023 and is projected to be worth around USD 50.19 billion by 2033, growing at a CAGR of 13.05% from 2024 to 2033.

Key Points

- North America dominated the market with the largest share of 32% in 2023.

- Asia Pacific is expected to witness the fastest rate of expansion during the forecast period.

- By type, the self-monitoring blood glucose segment dominated the market in 2023.

- By technology, the electrochemical biosensors segment dominated the market in 2023.

- By technology, the optical biosensors segment is expected to grow at a substantial rate in the market during the forecast period.

- By end-use, the home care segment dominated the market with the largest share in 2023.

- By end-use, the hospitals segment is expected to grow as the second largest segment of the market during the forecast period.

The glucose biosensors market is a vital segment within the broader medical diagnostics industry, primarily focused on the development and production of devices capable of accurately measuring glucose levels in biological samples such as blood, saliva, and interstitial fluid. These biosensors play a critical role in the management of diabetes, a chronic metabolic disorder characterized by elevated blood glucose levels. The market encompasses various types of glucose biosensors, including invasive, minimally invasive, and non-invasive devices, each offering distinct advantages in terms of accuracy, convenience, and ease of use.

Get a Sample: https://www.precedenceresearch.com/sample/3962

Growth Factors:

Several key factors are driving the growth of the glucose biosensors market. Firstly, the increasing prevalence of diabetes worldwide is a primary driver, with the World Health Organization (WHO) estimating that over 400 million adults were living with diabetes in 2019, a number expected to rise significantly in the coming years. This growing patient population necessitates the development and adoption of advanced glucose monitoring technologies to effectively manage the disease and prevent associated complications.

Moreover, advancements in sensor technology, including the miniaturization of devices, improvements in sensor accuracy and sensitivity, and the integration of wireless connectivity features, are fueling market growth. These technological innovations have led to the development of more convenient and user-friendly glucose monitoring solutions, enhancing patient compliance and improving overall healthcare outcomes.

Additionally, increasing awareness about the importance of regular glucose monitoring, coupled with rising healthcare expenditure and the growing adoption of point-of-care testing devices, is driving market expansion. The shift towards personalized medicine and the integration of glucose monitoring into wearable devices and mobile health applications further contribute to market growth opportunities.

Region Insights:

The glucose biosensors market exhibits significant regional variation, influenced by factors such as healthcare infrastructure, regulatory environment, prevalence of diabetes, and economic development. North America and Europe currently dominate the market, driven by well-established healthcare systems, high levels of diabetes prevalence, and strong research and development activities in the medical device sector.

In North America, the United States accounts for the largest share of the market, attributed to factors such as the presence of major market players, favorable reimbursement policies, and a large diabetic population. Similarly, in Europe, countries like Germany, the UK, and France are key markets for glucose biosensors, supported by robust healthcare infrastructure and increasing adoption of advanced medical technologies.

Asia-Pacific is poised to witness significant growth in the coming years, driven by rapid urbanization, lifestyle changes, and increasing disposable income levels in countries such as China, India, and Japan. The rising incidence of diabetes in this region, coupled with efforts to improve access to healthcare services and advancements in healthcare technology, will contribute to market expansion.

Latin America, the Middle East, and Africa represent emerging markets for glucose biosensors, albeit with lower penetration rates compared to other regions. However, improving healthcare infrastructure, rising awareness about diabetes management, and increasing investments in healthcare are expected to drive market growth in these regions.

Glucose Biosensors Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 13.05% |

| Global Market Size in 2023 | USD 14.72 Billion |

| Global Market Size by 2033 | USD 50.19 Billion |

| U.S. Market Size in 2023 | USD 3.30 Billion |

| U.S. Market Size by 2033 | USD 11.24 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Technology, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Glucose Biosensors Market Dynamics

Drivers:

Several drivers are propelling the growth of the glucose biosensors market globally. Firstly, the escalating prevalence of diabetes, fueled by factors such as sedentary lifestyles, unhealthy dietary habits, and aging populations, is a significant driver. The need for continuous glucose monitoring to manage the disease effectively is increasing demand for glucose biosensors.

Furthermore, technological advancements in sensor technology, such as the development of continuous glucose monitoring systems (CGMS) and implantable biosensors, are driving market growth. These innovations offer real-time monitoring of glucose levels, providing patients and healthcare providers with valuable insights for better disease management.

Moreover, the growing emphasis on preventive healthcare and early diagnosis of diabetes is driving the adoption of glucose biosensors. These devices enable early detection of glucose abnormalities, allowing for timely intervention and improved patient outcomes.

Additionally, favorable government initiatives and healthcare policies aimed at promoting diabetes awareness, improving access to healthcare services, and facilitating reimbursement for glucose monitoring devices are driving market growth. For instance, several governments offer subsidies or reimbursements for diabetes-related medical expenses, including glucose monitoring devices and supplies, thereby incentivizing adoption.

Opportunities:

The glucose biosensors market presents several opportunities for growth and innovation. Firstly, there is significant potential for the development of novel biosensor technologies with enhanced accuracy, sensitivity, and specificity. Research into new biomarkers and alternative sampling methods could lead to the development of next-generation glucose monitoring devices capable of providing more comprehensive insights into metabolic health.

Moreover, expanding applications of glucose biosensors beyond diabetes management present lucrative opportunities for market players. For example, glucose monitoring technologies are increasingly being integrated into wearable devices for fitness tracking and monitoring of metabolic health in non-diabetic populations.

Additionally, the growing trend towards telemedicine and remote patient monitoring presents opportunities for the development of connected glucose monitoring solutions. These technologies enable real-time data transmission and remote monitoring of patients’ glucose levels, enhancing convenience and accessibility of care, particularly in underserved areas.

Furthermore, partnerships and collaborations between medical device manufacturers, healthcare providers, and technology companies can drive innovation and market expansion. By leveraging synergies and expertise across different sectors, stakeholders can develop integrated healthcare solutions that address the evolving needs of patients and healthcare systems.

Challenges:

Despite the promising growth prospects, the glucose biosensors market faces several challenges that could hinder its expansion. Firstly, regulatory hurdles and stringent approval processes for medical devices pose challenges for market entry and product commercialization. Ensuring compliance with regulatory requirements and obtaining necessary approvals can be time-consuming and resource-intensive, particularly for novel technologies and innovative devices.

Moreover, cost constraints and reimbursement issues present challenges for market penetration, especially in emerging economies where healthcare expenditure is limited, and access to affordable healthcare services is a concern. Addressing cost barriers and establishing sustainable pricing models for glucose monitoring devices are essential for market growth and accessibility.

Additionally, the complexity of managing diabetes and interpreting glucose data poses challenges for both patients and healthcare providers. Ensuring adequate patient education and training on the proper use of glucose monitoring devices and interpretation of results is crucial for effective disease management.

Furthermore, the presence of alternative glucose monitoring methods, such as traditional fingerstick testing and laboratory-based assays, presents competition for glucose biosensors. Overcoming barriers to adoption, such as patient preferences, perceived accuracy, and convenience of use, is essential for market penetration and growth.

Read Also: Diagnostic Ultrasound Market Size to Rise USD 11 Bn by 2033

Recent Developments

- In February 2024, Afon, a UK-based company working on the development of non-invasive glucose sensors using RF (radio frequency) technology planned to launch the devices in early 2024.

- In February 2024, Health Minister Mark Holland announced the long-time awaited details of the federal government’s pharmacare plan with the assurance of covering diabetes contraception and treatment. The government stated that the plan also supports Canadian diabetics for easy access to glucose test strips and syringes for the management of diabetes but struggling to afford them.

- In February 2024, Tandem Diabetes Care, Inc. a leading player in insulin delivery and diabetic technology announced the launch of the new Tandem Mobi, the smallest and durable automated insulin delivery system for diabetic patients.

Glucose Biosensors Market Companies

- Abbott Laboratories

- Dexcom

- Ascenia Diabetes Care

- Nova Diabetes Care

- F. Hoffmann-La Roche Ltd.

- Sanofi

- GlySens Incorporated

- Trividia Health

- Bayer

- Lifescan

Segments Covered in the Report

By Type

- Self-Monitoring Blood Glucose

- Continuous Glucose Monitoring

By Technology

- Electrochemical Biosensors

- Optical Biosensors

By End-Use

- Home Care

- Hospitals

- Diagnostics Centers and Clinics

- Other

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/