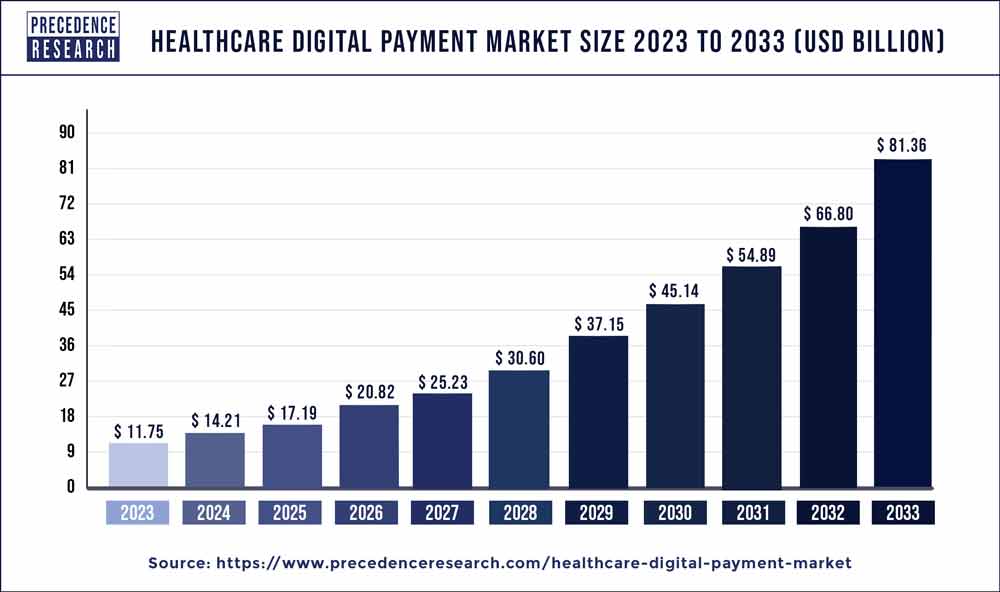

Healthcare Digital Payment Market Size to Worth $81.36 Bn By 2033

The global healthcare digital payment market size was valued at USD 11.75 billion in 2023 and is anticipated to reach around USD 81.36 billion by 2033, expanding at a CAGR of 21.40% from 2024 to 2033.

Key Takeaways

- North America contributed 40% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By solution, the payment processing segment has held the largest market share of 23% in 2023.

- By solution, the payment gateway segment is anticipated to grow at a remarkable CAGR of 23.5% between 2024 and 2033.

- By deployment, the cloud segment generated over 53% of the market share in 2023.

- By deployment, the on-premise segment is expected to expand at the fastest CAGR over the projected period.

- By mode of payment, the bank cards segment generated over 34% of the market share in 2023.

- By mode of payment, the digital wallet segment is expected to expand at the fastest CAGR over the projected period.

Introduction:

The healthcare industry is experiencing a paradigm shift towards digital payment solutions, driven by technological advancements, changing consumer preferences, and the need for greater efficiency and transparency in financial transactions. Digital payment methods, including mobile payments, online portals, and electronic health record (EHR) integrations, are revolutionizing the way healthcare providers and patients handle payments for medical services. This analysis delves into the factors fueling the growth of the healthcare digital payment market, explores key drivers behind its adoption, identifies potential restraints, highlights emerging opportunities, and assesses regional trends influencing the landscape of digital payments in healthcare.

Get a Sample: https://www.precedenceresearch.com/sample/3718

Growth Factors:

The healthcare digital payment market is experiencing robust growth, propelled by several key factors. One primary driver is the increasing demand for convenience and flexibility in healthcare transactions, as patients seek streamlined payment processes akin to those found in other industries. Moreover, the proliferation of smartphones and internet connectivity has facilitated the widespread adoption of mobile payment solutions, enabling patients to make payments securely and conveniently from their mobile devices. Additionally, the COVID-19 pandemic has accelerated the transition towards contactless payment methods, as healthcare providers and patients alike prioritize safety and hygiene concerns. Furthermore, government initiatives aimed at promoting interoperability and standardization of digital health systems have spurred the integration of digital payment functionalities into EHR platforms, further driving market growth.

Healthcare Digital Payment Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 21.40% |

| Global Market Size in 2023 | USD 11.75 Billion |

| Global Market Size by 2033 | USD 81.36 Billion |

| U.S. Market Size in 2023 | USD 3.29 Billion |

| U.S. Market Size by 2033 | USD 23.16 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Solution, By Deployment, and By Mode of Payment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Healthcare Digital Payment Market Dynamics

Drivers:

Several drivers are propelling the adoption of digital payment solutions in the healthcare sector. Foremost among these is the need for greater efficiency and cost-effectiveness in billing and payment processes. Traditional paper-based billing systems are labor-intensive and prone to errors, leading to billing discrepancies and delayed payments. Digital payment solutions streamline these processes, reducing administrative overhead and improving revenue cycle management for healthcare providers. Moreover, digital payments offer greater transparency and visibility into healthcare expenses, empowering patients to make informed decisions about their healthcare spending. Additionally, regulatory mandates such as the Health Insurance Portability and Accountability Act (HIPAA) have spurred the adoption of secure digital payment solutions that comply with stringent data protection and privacy requirements.

Restraints:

Despite the benefits, several challenges and restraints hinder the widespread adoption of digital payment solutions in healthcare. One significant restraint is the complexity of healthcare payment systems, characterized by a fragmented landscape of payers, providers, and billing intermediaries. Achieving interoperability and seamless integration between disparate systems remains a challenge, particularly for small and mid-sized healthcare practices with limited resources. Moreover, concerns over data security and privacy present barriers to adoption, as healthcare organizations must ensure compliance with regulatory requirements and safeguard sensitive patient information. Additionally, resistance to change and inertia within the healthcare industry pose challenges to the adoption of digital payment solutions, particularly among established providers accustomed to traditional billing methods.

Opportunity:

Despite the challenges, the healthcare digital payment market presents significant opportunities for innovation and growth. Investments in technology infrastructure, such as electronic health records and payment processing platforms, are driving the development of integrated solutions that streamline billing and payment workflows. Furthermore, the rise of telemedicine and virtual care models amid the COVID-19 pandemic has created new avenues for digital payment solutions, enabling remote consultations and electronic transactions. Moreover, the shift towards value-based care and patient-centered models emphasizes the importance of patient engagement and financial transparency, driving demand for digital payment solutions that enhance the patient experience and promote cost-sharing arrangements. Additionally, partnerships between healthcare providers, fintech companies, and payment processors are fostering collaboration and driving the adoption of innovative payment solutions tailored to the unique needs of the healthcare industry.

Region insight

The adoption of digital payment solutions in healthcare varies across regions, influenced by factors such as regulatory environment, technological infrastructure, and cultural norms. In developed economies, such as the United States and Western Europe, robust healthcare IT infrastructure and regulatory frameworks have paved the way for widespread adoption of digital payment solutions. Healthcare providers in these regions are increasingly leveraging electronic health records and patient portals to facilitate online payments and automate billing processes. Conversely, in emerging markets, such as Asia-Pacific and Latin America, the adoption of digital payment solutions in healthcare is still nascent but growing rapidly. Governments in these regions are investing in digital health initiatives and promoting the digitization of healthcare systems to improve access to care and enhance patient outcomes.

Read Also: U.S. In Vitro Diagnostics Market Size to Worth USD 41.62 Bn By 2033

Recent Developments

- In August 2020, JPMorgan Chase & Co. strategically acquired InstaMed, a healthcare payment solution provider. This move aimed to enhance payment experiences for payers, healthcare providers, and consumers, aligning with the growing trend of digitalization in the healthcare payment sector.

- In July 2023, technology company Zelis partnered with Rectangle Health, a financial technology firm specializing in software solutions for healthcare organizations. This collaboration aimed to leverage technology to improve financial processes within the healthcare industry.

- In June 2023, PayPal Holdings, Inc. and global investment firm KKR entered into an exclusive multi-year agreement, involving a significant replenishing loan commitment of EUR 3 billion. This partnership focused on supporting buy now, pay later (BNPL) services across several European countries, demonstrating the expanding role of digital finance in consumer transactions.

- In February 2023, HDFC Bank initiated a pilot in collaboration with Crunchfish to test offline digital payments for merchants and customers under the RBI’s Regulatory Sandbox Program, known as OfflinePay, showcasing efforts to explore innovative payment solutions.

- In November 2022, Mastercard announced a long-term strategic partnership with the Arab African International Bank (AAIB) to accelerate the digital transformation of Egypt’s financial ecosystem. This collaboration aimed to implement AAIB’s digital transformation strategy and provide advanced payment solutions, meeting the growing consumer demand for secure and straightforward digital payment methods in the region.

Healthcare Digital Payment Market Companies

- JPMorgan Chase & Co.

- InstaMed

- Zelis

- Rectangle Health

- PayPal Holdings, Inc.

- KKR (Kohlberg Kravis Roberts & Co.)

- HDFC Bank

- Crunchfish

- Mastercard

- Arab African International Bank (AAIB)

- Visa Inc.

- Cerner Corporation

- Fiserv, Inc.

- Allscripts Healthcare Solutions, Inc.

- Optum, Inc.

Segments Covered in the Report

By Solution

- Application Program Interface

- Payment Gateway

- Payment Processing

- Payment Security & Fraud Management

- Transaction Risk Management

- Others

By Deployment

- Cloud

- On-premise

By Mode of Payment

- Bank Cards

- Digital Wallets

- Net Banking

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Healthcare Digital Payment Market

5.1. COVID-19 Landscape: Healthcare Digital Payment Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Healthcare Digital Payment Market, By Solution

8.1. Healthcare Digital Payment Market, by Solution, 2024-2033

8.1.1 Application Program Interface

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Payment Gateway

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Payment Processing

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Payment Security & Fraud Management

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Transaction Risk Management

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Healthcare Digital Payment Market, By Deployment

9.1. Healthcare Digital Payment Market, by Deployment, 2024-2033

9.1.1. Cloud

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. On-premise

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Healthcare Digital Payment Market, By Mode of Payment

10.1. Healthcare Digital Payment Market, by Mode of Payment, 2024-2033

10.1.1. Bank Cards

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Digital Wallets

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Net Banking

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

hapter 11. Global Healthcare Digital Payment Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Solution (2021-2033)

11.1.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

Chapter 12. Company Profiles

12.1. JPMorgan Chase & Co.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. InstaMed

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Zelis

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Rectangle Health

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. PayPal Holdings, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. KKR (Kohlberg Kravis Roberts & Co.)

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. HDFC Bank

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Crunchfish

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Mastercard

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Arab African International Bank (AAIB)

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/